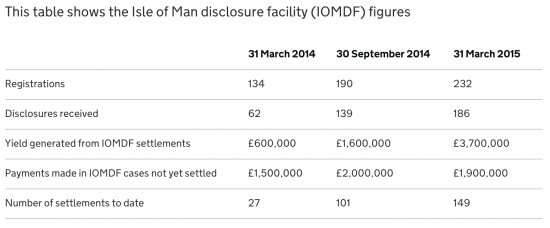

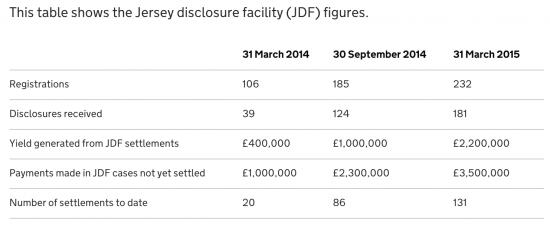

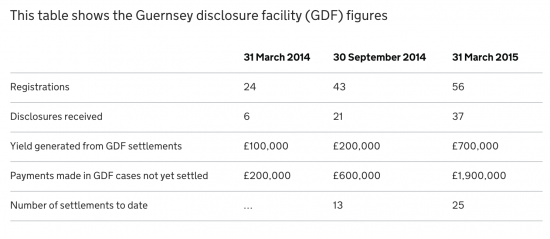

The government has today announced new figures for settlements made under tax disclosure arrangements created for Jersey, Guernsey and the Isle of Man. The data is as follows, with in all cases data being cumulative excepting the figures in cases not yet settled:

Which means that, by a short head, Jersey looks to be paying up most at present.

Do not be confused by the small sums however: HM Treasury says they know that many are using the Liechtenstein Disclosure Facility with its extraordinarily light touch terms instead. I suspect settlements will come nowhere near the sums forecast by the Treasury, but they will be more than indicated here.

What I can say for certain, however, is that the claim there was no tax evasion in these islands is just false.

That's another long term issue settled in that case, with the islands in the wrong, as usual.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!