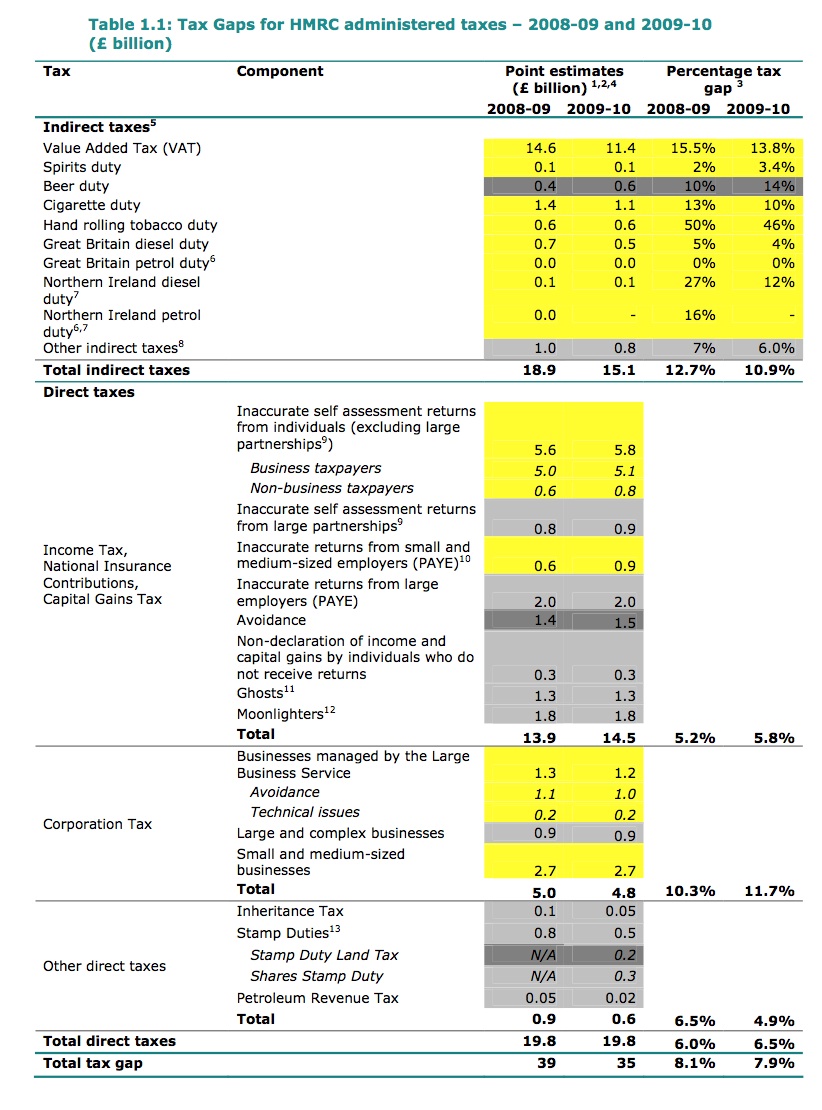

I'm going to repeat the HMRC tax gap table just published:

Let's look at the direct tax gaps - I've already explained that much the VAT gap is down to a change in tax rates.

Now let's look at the direct tax gaps. As is very clear, with the exception of stamp duties these have all risen. And this is despite falling incomes and profits.

This is inevitable. Even given the wholly inadequate basis of calculation the Revenue use for these gaps which ludicrously understates them (to make their performance look better) tax gaps will always rise in recessions: that's because people can't make ends meet and so seek to abuse more. This trend will get much worse.

But despite that the Revenue are cutting staff across the board who can deal with this - meaning money is simply being given away by HMRC. How ludicrous is that?

And how wrong is their message that the tax gap is being dealt with in that case?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!