According to the FT this morning:

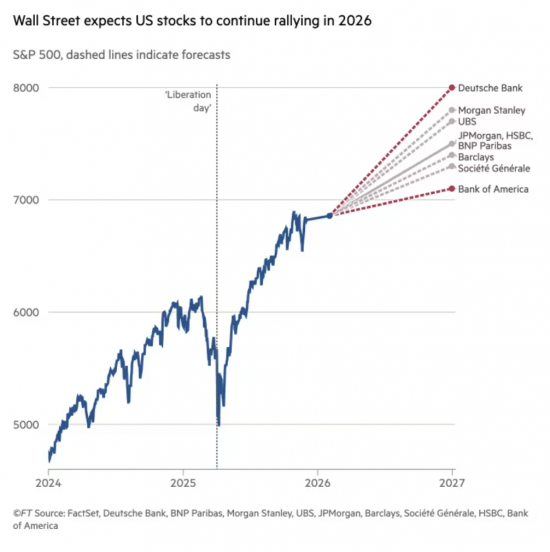

The blue-chip S&P 500 index will rise to more than 7,500 points by the end of 2026, a roughly 10 per cent increase from its current level, according to the average forecast of nine major investment banks surveyed by the Financial Times.

They back this up with a chart:

They add:

The predictions indicate a belief on Wall Street that markets have put last month's pullback — sparked by concerns over high AI valuations — behind them, helped by US President Donald Trump's tax cuts and the prospect of interest rate cuts.

So, let me offer my interpretation, with which I think the Bank of England would agree in its latest Financial Stability Report (on which there will be a video tomorrow). This is that:

- These people have massive stocks of useless products to sell.

- They know they are overpriced.

- They know they will be rumbled soon.

- They are talking up the price for as long as they can.

- They want to flog this stuff whilst it is still possible.

- That will not prevent a crash.

- The technical description of these forecasts is that they are either:

- Snake oil, or

- Bullshit

- Markets will crash because:

- US valuations match 2000.

- UK valuations match 2008.

- AI is horribly overhyped.

- There is massive debt leverage to buy AI stock.

- There will, then, be contagion into banking when values fall, as they will in my opinion.

- Banks might look stable, but they are only half the story now: private equity and hedge funds are the rest. They are overleveraged and could easily create massive market contagion.

- Private equity and hedge funds have never been tested on the scale they might be by a crash: they may fail very badly, bringing the whole edifice down with them.

- Sovereign debt markets are stressed right now (albeit unnecessarily) and as a result are subject to highly speculative betting and so could also be at risk.

- Massive opacity in lending and poor credit ratings are making matters very much worse, as they did pre-2008.

To put it another way, there is no evidence at all to support these bank forecasts for growth in share valuations.

And remember, they said the same thing in early 2008.

This is economic commentary, not financial advice. But markets look very vulnerable right now.

Comments

When commenting, please take note of this blog's comment policy, which is available here. Contravening this policy will result in comments being deleted before or after initial publication at the editor's sole discretion and without explanation being required or offered.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Another observation…

I’ve noticed the workplace is losing older wealthy people, who can afford to escape the toxic workplace of KPIs, micro management and grubby hot-desking. leaving behind stressed over mortgaged, in debted younger people.

Once retired those older people cut back their spending, and younger people are simply treading water.

Fewer and fewer people feel secure, wealth has been literally siphoned off.

And as for AI it’s useful but boy does it tell whoppers, you can’t trust it, not even on a single transcript annotated into key points. Needs careful supervision, which takes time. Agree overhyped and people are realising it lies, confabulates because its intellect is fast but limited.

As my father said if you want to get a return go to the bookies, at least in 10 minutes you will either have your winnings or lost your money.

At least with a house you can live in it even if you lose money on the deal – in the short term at least

What else happening?

What is the state of the container index?

Other markets for raw materials?

Is demand slowing or going up? I used to know what these were and dip into them but I understood that they were key indicators of market confidence.

The Baltic Dry is strangely high and even jumping. I have no idea why. It looks irrational. That happened in 2008.

For those unfamiliar with the Baltic Exchange

https://en.wikipedia.org/wiki/Baltic_Dry_Index

If we are in for a crash – maybe the only possible comment is an irrelevant one.

Composer John Rutter who is composer of the week on radio 3 said he will be going to Ely Cathedral on Christmas Day. Its his local cathedral.

He lives near here, yes. His music makes Advent special.

Richard, I have two questions for you,

1. What are the United States bond market? That seems pretty rickety to me as well part because I think yields will jump if Trump really does take over the federal reserve; also it seems that other countries are looking for options other than buying our bonds. So I don’t think it’s just stocks that are at risk. I think treasures can fall as well.

2. Why aren’t you on substack? I follow Paul Krugman and others on substack and I really like it. I’m not saying that your site sucks, but I’m a fan of substack anyway just curious why you don’t do that?

1. True

2. I am finite. We just do not have time as yet. They don’t have a blog and a daily YouTube channel.