LabourList published an article last week under the headline “Bond markets explained: How in hock are we – and can we break free?”

The article began with a question that should trouble anyone who cares about democracy: Who governs Britain?

The suggestion made was that the bond markets have become so powerful that even elected politicians must now fear their displeasure.

LabourList then noted that Labour MPs are, reportedly, being warned that rebelling against cuts or tax rises risks incurring market displeasure, whilst Keir Starmer now loves nothing more than invoking Liz Truss as the exemplar of what happens when a government crosses the markets, as though her own incompetence was not the real problem.

They then set out to explain this supposed power. But in doing so, they simply reinforced the neoliberal, antisocial economic mythology that has crippled progressive politics for more than a generation. And this matters, because if the Left continues to accept the framing of market power, it will continue to fail the very people it supposedly exists to serve.

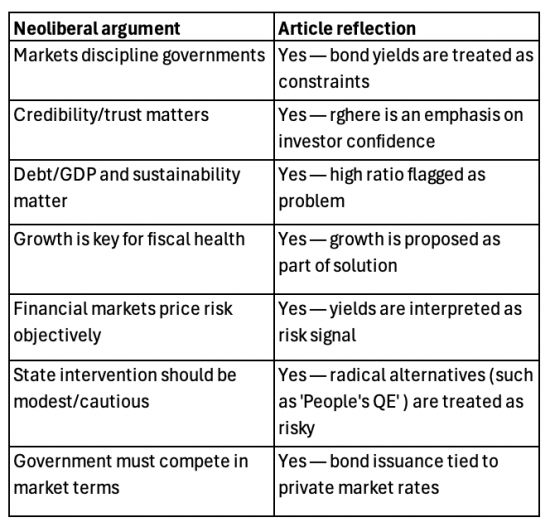

To examine this, I summarised the article's core arguments. They are that:

- Markets discipline governments

- Market credibility/trust matters

- Debt/GDP and sustainability matter

- Growth is key to fiscal health

- Financial markets price risk objectively

- State intervention should be modest/cautious

- Government must compete in market terms

The trouble is that these are all neoliberal/antisocial to their core, as this table shows:

LabourList tried to conclude its article with this sentence:

Whatever the approach, Labour politicians are more united in trying to get beyond being in hock to bondholders than recent rows suggest.

What this means, and how it relates to what was written before, is very hard to work out because I cannot make the link, but what is clear is that LabourList gave up the argument long before it reached any form of conclusion by:

- Deciding to frame its entire argument within the neoliberal/antisocial economics framework.

- Failing to explore any real alternative options. My 'People's QE' is mentioned, but I long ago moved on from that to modern monetary theory, which this article pointedly ignored, and it did anyway reject People's QE as too risky, in the process basically conceding that governments cannot take initiatives, undermining any suggestion that left of centre government has a purpose.

- Failing to challenge the myth that governments are dependent on bond investors for survival, in the process, actually reinforcing the ideology that has stalled progressive politics for decades.

It really is time for the Left to rediscover its courage and its economics, which I think is impossible until it embraces modern monetary theory, which it appears far too frightened to do. The reason for saying that is simple: the Left needs to embrace the power of the state, and only MMT lets it do so.

If we are serious about funding the future, the Left must stop treating the bond markets as our masters and start building institutions that put people, and not traders, at the centre of economic decision-making.

That begins with telling the truth, which is that Britain is not in hock to the markets unless its politicians choose to be, but much of the Left seems entirely sure that the government not only is in hock in that way, but that it should be. No wonder it is not delivering in that case.

Comments

When commenting, please take note of this blog's comment policy, which is available here. Contravening this policy will result in comments being deleted before or after initial publication at the editor's sole discretion and without explanation being required or offered.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

A very brief comment. Labour List is a mouthpiece for Labour, which cannot, by any stretch of the imagination, now be considered ‘Left’.

Agreed

Wholly agree. Sadly, it is not surprising. I sent myself into a minor rage this morning having read the Guardian article by Richard Partington. https://www.theguardian.com/uk-news/2025/nov/24/bond-market-power-rachel-reeves-budget?CMP=Share_iOSApp_Other

The following gives a flavour: “For the first time on the London trading floor of Deutsche Bank, a custom-built artificial intelligence tool will tune in to the chancellor’s speech. It will transcribe her words, spot shifts in tone and spit out alerts when the numbers deviate from expectations.

“As we get it, in real time, we’ll be able to decipher it,” says Sanjay Raja, the bank’s chief UK economist. The natural language model has been trained on the entirety of Reeves’s recent public appearances: media interviews, conference speeches, the spring Office for Budget Responsibility (OBR) forecasts and last year’s budget. All with the aim of giving the bank an edge in one of the most heavily anticipated budgets in recent history.

“There are some high, high, high, expectations going into 26 November, for the budget to deliver on the part of the City,” says Raja.

This is the age of the bond market budget. After an explosion in government borrowing over the past decade; a sharp rise in debt interest costs, and with the scars of the Brexit vote and Liz Truss’s mini-budget still fresh, how the market reacts is critically important.”

It is clear that when a supposedly left(ish) newspaper spouts neoliberal claptrap as above we need to change the narrative.

Regarding your earlier blog about a replacement for neoliberal. My tuppence-worth: Elite Extraction Economics or Feudal Extraction Economics (FEE). The latter simply because we literally have a feudal system based on extraction and extortion (tax dodging, etc.) and treating the vast majority of people as chattels.

Even worse, we know in advance that it is not going to be “Cometh the hour, cometh the (sic) chancellor”.

Thanks

Thank you.

I worked for Deutsche for 5 years, including on their (old) trading floor, the blonde stone building on London Wall. The new trading floor sits on top of Moorgate station, courtesy of a move managed by Mister Kemi Badenoch, the admin and ops manager.

DB was not bailed out directly in 2008, but was indirectly. Without government intervention and tolerance it would and should not exist.

No currency issuing government needs a bank, least of all that basket case, to fund it.

To hell with the bond markets Richard, and you showed yesterday they can be solved by capital controls, easy. Next question?

The LabourList author still seems to be assuming that the govt ‘borrows’ in order to get spending money which it would otherwise run out of. In which case the “in hock” story would be true. The full funding rule needs to go – as I think people would call for if it were widely understood.

As you may have noticed, I believe, that on the omnibus, this translates, however inaccurately, into the “Liz Truss” question (yes, I realise it is a flawed analysis, but when did that ever get in the way of extractive economics/Mammonism?). The “Liz Truss” question sits up there in the top 2 economic arguments dealt with on the omnibus – the other being the “householder analogy”.

(in Reeves’s case, a budget worked out by her mum around the kitchen table).

Dislodging and discrediting these 2 arguments, both in the minds of omnibus passengers AND the pronouncements of politicians and media pundits (who should know better) is an uphill task with a destructive phase, but also a constructive one – what to put in its place? – to prevent fascism dominating the ruins of our politics.

My fear is that we may succeed in destroying Reeves/Starmer quite soon, but leave the fallacies that drove them, relatively unscathed. I don’t have answer for that.

I think Tony Benn once said something to the effect that we had to toughen up and keep going – I can’t remember the quote well enough to find it.

Tony Benn:

‘There is no final victory, as there is no final defeat. There is just the same battle. To be fought over and over again. So toughen up, bloody toughen up.’

🙂

That’s the one!! 🙂

Thank you, Richard.

From my years as a bankster lobbyist, 2007 – 16 and the autumn of 2023 and spring of 2024, I can help answer the question.

Many of the types who gather at the likes of Labour List, Left Foot Forward, Novara Media, IPPR, Resolution etc. would like a gig in Whitehall and, eventually a safe seat. They won’t commit heresy.

Many of the same are comfortably off and would feel equally at home in a Cameroon Tory Party and SDP past and present. They have lived, grown up and worked in centrist log roller circles.

There’s also laziness. Thinking about the economy is too much hard work, especially when cheap and easy slogans earn likes in their echo chamber.

Even when insider sympathisers offer help, they are rebuffed. So often, the likes of the TUC and ETUC were urged to attend events, use talking points and put candidates forward, but there was no interest. In the years above, I think I only met one trade union representative. I did come across many Labour politicians, in London and Brussels, offering services, including votes, to finance.

The left should seize the moment offered by Zack Polanski. The Overton window won’t stay open forever, so time is of the essence. How about a shadow monetary policy committee with the likes of you and Steve Keen. If it’s good enough for City AM and EY(‘s ITEM Club), it’s good enough for the left. Get the vuvuzela out!

A great deal to agree with.

The situation you describe only exists because the Left seeks power for the sake of power. To get it, it will ape the liars who have it now.

It is because of the Left’s very narrow definition of success?

If the ‘left’ seeks power for the sake of power, then they are not the Left!

That careerism is true of the RW Labour politicians currently emulating Cameron and George Osborne and certainly politicians like Tony Blair but it is not true of the grassroots left or socialist MPs like Jon Trickett, Ian Lavery and more.

I can’t remember how long ago it was (maybe PSR might recall), but some while ago in one of your blogs on MMT we had an exchange of comments on what a better (i.e. more accurate and attractive) term might be for modern monetary theory. If my memory serves me correctly you asked that question – and most commentors agreed that it’s actually a pig of a name (or even abbreviation).

First, it’s not accurate: at it’s core MMT describes reality not a theory (the nature of contemporary money). That’s a fundamental point: calling something a theory – that it may or may not be factual – immediately allows opponents a line of attack, which, in this case is entirely unjustified.

Second, “modern” is a misnomer. It’s not modern – as in, just discovered in the past few years, or the opposite of “old” or “ancient”. If it’s modern then we may as well claim that a Ford Capri and Morris Minor are modern cars. Of course they’re not. And we wouldn’t describe them as such. But they are certainly cars. And money now is certainly money – as it’s been created for decades.

Third, both the full term (modern monetary theory) and the abbreviation are clunky in the extreme. No wonder very few people want to drop them into any conversation. And, worse still, the abbreviation sounds much too much like MMR, MRI and so on. In short, it sounds like some kind of medical procedure.

So, the question is, can this factually incorrect misnomer of a term be changed for the better? Probably. But in the meantime (and as a compromise) I’d suggest that it would be an improvement if we simply dropped the ‘theory’ bit and talked about “modern money”. At least then we’re recognising that a car’s a car even if we might argue about exactly if one’s modern or not.

MME

Modern money explanation?

You made me revisit the glossary entry on this – thwre will be a revised one soon

Could proponents of MMT (or critics of Mammonism) see how this question fares, on a trial run or two?

Q: “What changed in the UK’s economy and how the government finances its spending, when we came off the gold standard in 1931?”

A follow-up might be:

“What changed in how we talked about this, in 1980?”

It might need tweaking to make it more bombproof on MSM.

My problem is I think very few people will understand that question or the history.

“MMT describes reality not a theory”

This seems to come up time and time again. To say that “theory” means something that “may or may not be factual” is, I think, to misunderstand the way it’s used in MMT. The OED’s basic definition of theory is “The conceptual basis of a subject or area of study. Contrasted with practice”, and a further one is “An explanation of a phenomenon arrived at through examination and contemplation of the relevant facts; a statement of one or more laws or principles which are generally held as describing an essential property of something.” I believe that’s how we should understand the term here.

Think, for example, of all those people who take music theory exams or driving theory tests. Nobody suggests they’re dealing with something that “may not be factual”, so I don’t really know why MMT is seen in that way.

Going back to the OED’s first definition, I’ve sometimes thought we should start talking about MMP – Modern Monetary Practice – instead, because as Richard has frequently pointed out, the principles of MMT are in fact being put into practice every day. So maybe it’s time to articulate that.

See a post coming tomorrow (budget or not, MMT goes on)

Therese, I accept what you say but the trouble is that the vast majority of people don’t know what MMT is, much less, the specifics of the use of ‘theory’ in it. So, the point I was making is, in common parlance most people regard use of ‘theory’ as referring to something that isn’t proven. As in the expression, ‘It’s only a theory, but….’

Anyway, ‘practice’ is certainly much better than ‘theory’ – so maybe just MP – monetary practice. But then we arrive at another set of issues 🙂

I never liked it being said I was in practise. I always thought I was doing it for real.

Yes Ivan, I do remember those sort of episodes on this blog.

I have mulled over the MMT issue for some, somewhat unsuccessfully.

But if MMT is the reality of money creation, then whatever we call it has to reflect the reality of it.

How about ‘Sovereign Investment Money/Funding’?

Or ‘Democratic Maintenance Funding’?

Or ‘Mixed Market Input Funding’?

‘Sovereign Equality Support Financing’ anyone?

All of these could be preceded by the time ‘long term’.

And no taxes needed for anything except to take the edge out of inflation.

Starmer is absolutely stupid or absolutely corrupt to believe that only licenced banks can create money and even further not to understand the necessity of having an agency capable of creating it debt-free!

Zack is doing his best to challenge the orthodoxy isn’t he ?

Successful theories explain available evidence, but their worth lies largely in their predictive value. Neoliberal economics has failed on both counts, repeatedly since it was promulgated.