The National Audit Office issued a report yesterday on efforts being made by the Department of Work and Pensions (DWP) to tackle benefit fraud, and the rate of errors being made in payments of what I call social security.

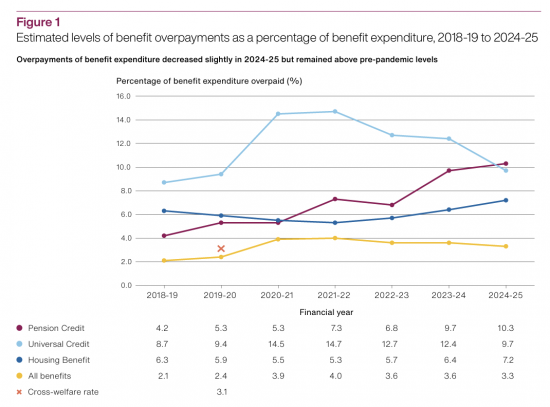

The DWP estimates that it overpaid 3.3% of benefit expenditure in 2024-25 as shown in Figure 1, below. This equated to £9.5 billion of the £292.2 billion that it spent on benefits. Fraud accounted for an estimated £6.5 billion; claimant error, £1.9 billion; and official error, £1.0 billion.

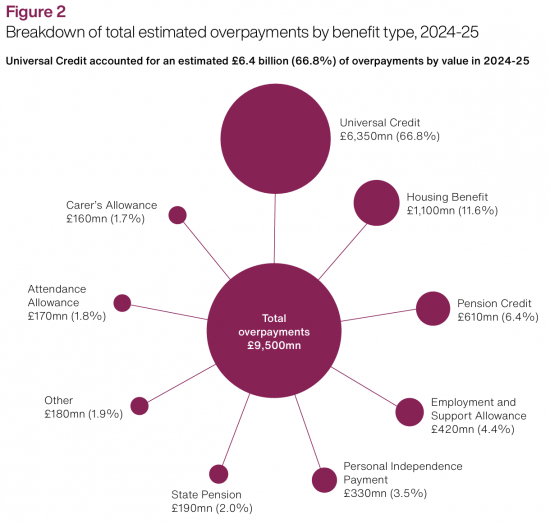

The unpaid figure is broken down as follows:

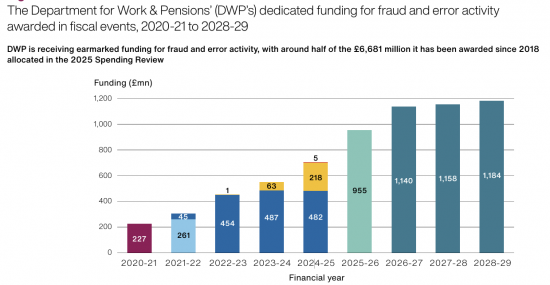

The DWP has, according to the National Audit Office, been provided with considerable financial support to tackle this issue:

£6.7 billion has been provided since 2018, with little overall apparent impact. The estimated value saved by the Department for Work & Pensions (DWP) through counter-fraud activities from April 2022 to March 2025 was £4.5 billion. The rate of return on sums expended is marginal.

What is also very apparent is that the report is partial. It does not show the unpaid benefits to which people were entitled each year, which are rarely the subject of political scrutiny but which are, of course, an indication of a series of policy failures. These are estimated at £19 billion a year, double the amount lost. Imagine the advantage to society if all such sums were paid.

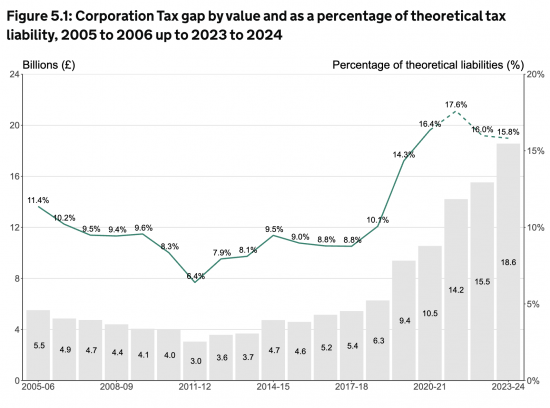

And now let me contextualise this. HM Revenue & Customs has estimated that the unpaid corporation tax in the UK amounts to 15.8% of all liabilities owing:

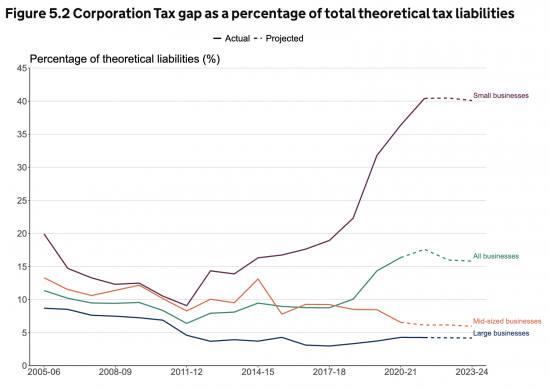

When it comes to small companies, the rate is around 40%:

The cost exceeds £18 billion a year. And what is being done about it? Almost nothing, even though putting necessary laws in place to tackle this by requiring banks to provide data to HMRC to identify companies not paying and then removing limited liability from the people managing the abuse would be easy.

So what is the conclusion? It is that we still have an obsession with attacking benefit cheats and those who simply make innocent errors, who have little overall impact on the economy, and don't give a damn about the fact that maybe 40% of small businesses are operating illegally in the UK. That's what political hypocrisy, backed by class prejudice, now looks like in modern Britain, and the result is terrible decision-making that harms the economy and the well-being of vast numbers of people who are deep in need and who are always subject to suspicion when that is inappropriate.

Taking further action

If you want to write a letter to your MP on the issues raised in this blog post, there is a ChatGPT prompt to assist you in doing so, with full instructions, here.

One word of warning, though: please ensure you have the correct MP. ChatGPT can get it wrong.

Comments

When commenting, please take note of this blog's comment policy, which is available here. Contravening this policy will result in comments being deleted before or after initial publication at the editor's sole discretion and without explanation being required or offered.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Professor Paul Spicker would agree with you wholeheartedly on this I think.

I’m not surprised really. I tried to use Companies House recently to check out a local firm and there was so much different information about one entity I was totally confused about where and how they existed. Companies House is a mess.

As this is an area I work in I will post anonymously

Experience suggests that the DWP is very good at ignoring information handed to it on a plate about a persons income or status resulting in large and avoidable overpayments of benefit.

That might be an obvious place to start

Thank you for a plural perspective article which is widely informative and sets a good example of quality analytical communication.

Might another facet of H. M.G.’s consistent inconsistency be an addiction to attack/diminish the weak and to protect/bolster the strong/powerful, as may beindicated by other decisions such as winter heating and the two child benefit limit?

Might a more valid governmental attitude be to protect the weak and not so powerful from the parasitic behaviours of the powerful?

You would think so…

The official errors of £1bn overspending is a concern, because it appears they aggressively require it paid back by the recipients, who probably have no idea they were in receipt of more than they should get. After all, if the Government who make the rules can’t get it right, how can someone unfortunate enough to need benefits, get it right themselves?

Agreed

Richard Kirby (and Richard Murphy)

It might be useful to read the online Benefit Recovery Guide. No claimant who has been overpaid when they had been *told in writing* that is what they are entitled to can be forced to repay any monies to the DWP. They can only be *requested* to consider repaying it. Receiving money over the amount on the Decision Maker’s letter *is* recoverable.

Any employer works in the same way. Your salary is in your contract. If the contract is wrong, you are entitled to keep any extra money paid by HR error.

https://www.gov.uk/government/publications/benefit-overpayment-recovery-staff-guide/benefit-overpayment-recovery-guide

(HMRC is an agency of the Crown and work to different rules – “the Crown cannot make an error” – so any overpayment is recoverable.)

Thanks

Noted

Gov’s tackling benefit fraud generates positive headlines in the gutter press.

Gov’ tackling under payment by companies generates negative headlines in the fascist press.

Thus the choice is based on political cowardice. (“what will the Daily Mail say???”)

Using numbers & rationality is good – but won’t work wrt the political imbeciles running the country or the even greater imbeciles that hope to do so.

I agree with you wholeheartedly. Also, thanks for bringing back into use the term “social security” because that reinforces the true purpose behind benefits. Let’s keep referring to them as “Social Security support payments” and restrict references to benefits fraud etc to the likes of those who helped themselves to PPE contracts via their political chums and those that hide their wealth in tax havens. I might also extend it to those wealthy individuals who claim that they are paying the largest share of income tax but neatly avoid any reference to the amount of tax that they paid as a proportion of their overall income.

Thanks, and agreed.

We are still influenced by the Victorian concept of the deserving and the undeserving poor -as decided by those who have probably never been poor.

The ‘benefits fraudster, skiver’ nomenclature is a propagated narrative. Propagated by those in whose interest it is shore up the ‘hey, look over there’ trope.

Whilst benefit fraud obviously does occur I would wager that the majority are vulnerable, desperate people using what nous they have towards redirecting a few quid.

For the people demonising these benefit claimants many will be using their nous to happily bathe in HMRC’s burgeoning tax gap, more still employing ‘illegal immigrants’ at slavery rates others dubiously lobbying government for ‘big bucks’ contracts.

There are many and varied iterations of Michelle Mone in our country doing far, far more damage, not just financial, to the fabric of society.

All DWP Benefit overpayments are recoverable.

Under the Housing Benefit Regulations, administred by Local Authoritiesoverpayments are not recoverable if

They are caused by official error and

The Claimant did not cause or contribute to the overpayment AND could not reasonably have been aware that he was being overpaid

So why not apply that to the DWP as well………..

I’d add a note of caution to these evaluations of the ‘efficiency’ of DWP’s anti-fraud efforts. We should include the effects of discouraging potential fraud that might otherwise occur if the prospect of being detected was lower. It’s very hard to estimate how much that actually saves, let alone measure it.

Accepted

But what we know is HMRC is not working in comparision, and that was my point.

Akala coins it well in one sentences.

” Rich man crime good, poor man crime bad”

Associations and division.

people not paying corporation tax, or vat over, aligning them to those that benefit the most from scrutiny being elsewhere.

Large business owner.

Corporations

those that are also very asset rich and financially rich . The biggest avoiders of tax as the law for them is different and they have the means to pay for those with the required knowledge to set up the systems to achieve it.

The creation of the ” bad people ” to blame for all societies ills is mostly created.

If they were truly bad people.

They would not be so easily caught.

Ie The average cost for a prison place per year 53k. Gov sources show that 30% of prisoners have special educational and learning needs, it is recognised likely have unidentified need.

Consider the requirement for many jobs now.

5 GCSE.

Many jobs do not have a perpetual learning curve, which is something that is expected of students.

Gcse for many roles is not essential. Nor required for most of human existence.

a social construct excludes the children that learn differently than the ever narrowing school curriculum.

It includes the creation of fining for absense, a current century “crime”, only really an issue the last 12 years,

As the law we are held to is very different to those in corporation and business, government , public service, asset rich.

if the social construct was, putting prison money at the frontline.

Health, education, social care, housing Ect.. it would be a different outcome.

What we have instead is the continuation of mismanagement of public funds to meet political ideology.

the situations are created so there will always be those that are poor and not supported, to identify as the criminals in society.

The subclass.

The lack of interest of chasing for tax fraud and evasion and avoidance is because those that are the most proficient at it do not want people really understanding more about this area, as then the focus might be where it should be.

Starmer is a real benefit fraudster… er…sorry, .. maker of administrative errors.. . He received £16000 in personal benefits in kind and portrayed them as donations to the running of his office.