I have a sense that Bitcoin is the canary in the coal mine of the crash to come.

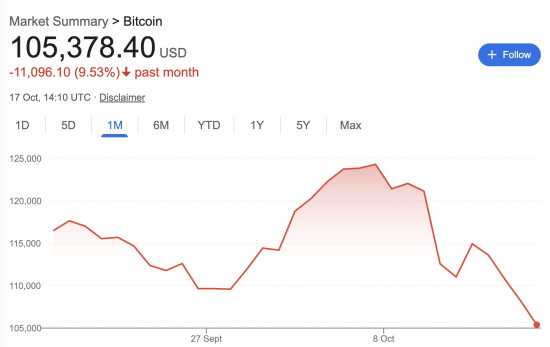

This is the chart of the Bitcoin price/exchange rate (if you can call it that) at around 3 pm today, showing the movement for the last month, using data from Google:

For a couple of Fridays in a row now, the value has fallen.

Now, I admit that it still has a long way to fall, given its rise over the last year:

However, given all the warnings now being sounded by just about everyone who has now joined my previous solo act of predicting the forthcoming crash, this all feels ominous.

Watch this over the weekend. The significant fall was on Saturday last weekend. It could happen again. And what is clear is that the cracks are beginning to show.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

would I be right to assume the other cryptos are weaker? Bitcoin has been around fora bit.

Yes, I checked.

At the risk of pedantry, the fall in Bitcoin was late on Friday last week (NY afternoon session) from 127,000 to 117,000 and it coincided with a fall in the S+P from 6,790 to 6,600 (Dec future). It was due to the announcement of more tariffs on China.

Over the week end and during the first part of the week we saw the TACO trade kick-in (TACO = Trump always chickens out) so stocks bounced back only to be hurt again by the potential exposure to the First Brand fiasco in some US Regional Banks. That story has ebbed and flowed today but…. and I am getting to the point.

From Friday close to now S+P futures are UP at 6,680 while BTC is DOWN at 107,000…… ie. the drop in Bitcoin is not just related to the general ebb/flow of “risk on / risk off” trading, there is something specifically crypto going on and in fact, most Crypto is doing worse than Bitcoin.

So, in short, there IS trouble in Crypto world but the detail is slightly different than you describe.

I would also add that we saw a gold “melt up” late yesterday and overnight in Asia (since reversed in our trading hours). No idea what that spike was about….. but the gold bubble is gathering pace.

I think this is a bit nitpicking, but we actually come to the same conclusion, and I still think bitcoin is the canary in the mine.

Nitpicking? Yes….. but, when trying to understand what is driving what, it matters. The point I was trying to emphasize was that looking through all the noise of Trump – as demonstrated by the gyrations of the S+P – we see, imposed on those same gyrations in Bitcoin, an underlying weakness.

There are several companies (principally Strategy) that have been issuing shares (well above NAV) to buy Bitcoin; they have even issued preferred stock that pays a dividend/coupon. Paying that interest/dividend requires an ever rising Bitcoin price as they have no income… so this will not end well. Now, technically, as a preferred or subordinated instrument they can decline to pay the interest/dividend but we all know what happens when they do that.

I will be most interested to see how liquid and deep the market really is once they are sellers.

That I get…

Thanks

Bitcoin’s value isn’t based on what it produces or represents, but on the belief that someone else will later buy it for more — a classic case of the “greater fool” principle.