Andy Burnham says it's time for the UK to stop being in hock to the bond markets. The City is in uproar, but who really calls the shots in Britain—the government we elect, or unelected financiers? In this video, I unpack Burnham's challenge, the myths about debt and borrowing, and why democracy—not markets—must decide our future.

This is the audio version:

This is the transcript:

Andy Burnham has told the media that it's time that the UK got beyond being in hock to the bond market. And he's right, of course, that is obviously true, but let's just put all of this in context.

Andy Burnham was a Labour cabinet minister in Gordon Brown's government in 2009 and onwards, and he was well innovative at the time, but nobody who stood out from the crowd.

A few years ago, he decided to leave Parliament. He became the mayor of Manchester. He's been elected for his third term now, and people think he's been pretty successful in an area which remains hardcore Labour throughout. But, and precisely because he has been successful in Manchester, some Labour members on the supposed left of the party are now viewing him as a successor to Keir Starmer, and what he says is therefore being picked up in the media.

I want to contextualise this. I watched Burnham stand against Jeremy Corbyn in 2015, and his arguments on economics were, to be polite, pretty weak. I think he's come a long way since then because what he's now said shows a much deeper understanding of both the needs of society and the needs of the economy.

But let's go back to that point. Do we need to stop being in hock to the bond markets, because the fact is, the City is panicking about his comments. They're saying that they must increase the price of government borrowing now in case Andy Burnham does, somehow or other, and I very much stress that somehow or other, when he's not even a Labour MP, become leader of the Labour Party and Prime Minister in replacement to Keir Starmer. And others are accusing Andy Burnham of having a cavalier attitude towards the needs of the City of London.

So, let's just unpack all of this.

First of all, the chances of Andy Burnham becoming leader of the Labour Party anytime soon are exceptionally remote. So all of this is a little bit hypothetical. But from the sidelines, Andy Burnham can still influence debate, and in that sense, this is important. What he's saying is that bond markets should not be running the UK economy, and this government clearly thinks that the bond markets do run the UK economy.

Rachel Reeves says she must keep them happy.

Keir Starmer says he has to keep them happy, or we will have a Liz Truss moment, something I will come back to in a few minutes.

Markets nod sagely in agreement, as do all the market commentators who believe that the markets rule, and of course, Rachel Reeves has put in place fiscal rules that confirm all of this.

Any suggestion of a challenge to this status quo convention leads to market tantrums, and that's exactly what Andy Burnham is creating. And what markets want to think is that they hold a veto over democracy, and he's having the temerity to stand up and say maybe they don't.

Let's have a look at what Andy Burnham actually suggested.

He suggested a big council house building programme. As somebody responsible for local government, it's hardly surprising that he knows that this is necessary.

As somebody responsible for what goes on in Manchester, again, it's hardly surprising that he sees the need for this. We have an absolutely critical shortage of social housing in the UK, and council housing, most of all, and therefore what he's proposing is not only necessary, but it's fundamental to ensuring that we head off the threat from the fascist right-wing.

Andy Burnham is also talking about the nationalisation of utilities, starting, obviously, with water, where we have a clear failure of everything that has happened since privatisation, and he knows that the cost of this is relatively low because, first of all, the bonds are just simply issued; nobody has to raise any money to actually pay the price of buying these utilities. And secondly, the price that will be paid will take into consideration the trading of these companies and in many of the utilities that he wants to nationalise, frankly, things are looking pretty commercially poor, and therefore, the price to be offered is low.

And he wants to achieve these two core goals which exactly match with the wishes of Reform voters, let me stress, by taxing the well-off more, which is, of course, easily doable as I show in my Taxing Wealth Report, and he suggests that we might need to raise maybe £40 billion of additional borrowing, or roughly in proportion to the £2,800 billion of government debt currently in issue, about 1.4% of the total.

In other words, what he's saying is nothing very difficult to imagine, and it's entirely possible to believe it would be completely politically popular.

It's also, of course, orthodox social democracy. This is what Labour is all about. What he's saying is true to the core Labour policy.

They did create most of the UK's social housing. Some, of course, happened before World War II, and it was not Labour's responsibility. Liberals had a big role in that in some parts of the country as well. But investment in housing and infrastructure is Labour core policy, and it creates assets for the nation, critical assets for the nation. It improves our wealth.

These things are not a burden. These things are not a liability. The cost - the interest paid - and that's it - is tiny in comparison to the benefits provided.

And what is more, nationalisation can reduce long-term costs, for example, with regard to the benefits paid on housing alone. We could, in fact, pay the costs of new social housing by ensuring that housing benefit was effectively no cost to the government, because people would be living in government-owned houses.

But nonetheless, the City is claiming that this risk is spooking markets. They claim that interest rates will have to rise. They claim that at present, the 4.7% interest rate payable on 10-year government bonds will be too low.

But let's just for a moment, think about that rate of 4.7%. 4% of it is basically determined by the fact that the Bank of England says its bank base rate is 4%, and therefore, why would the gilt rate be less than that? What is more, as we know, the Bank of England is selling £70 billion worth of bonds into financial markets in the next year - a figure way in excess, by the way, of the number that Andy Burnham wants to sell into financial markets for social purposes - and the only reason the Bank of England wants to do that is to simply take liquidity out of financial markets to force the interest rate on government borrowing higher, which is precisely what its policy is. So the figure of 4.7%, which it costs at present to borrow if you are the UK government, is exactly what the Bank of England has set, and has nothing to do with what markets have decided.

Andy Burnham isn't spooking markets. He's making the most marginal change to something which, frankly, is being set by the Bank of England, and which could be cut by them as well.

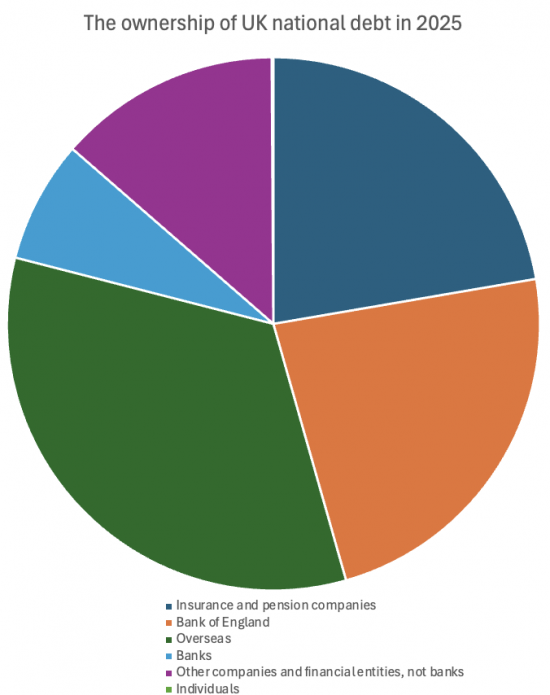

But just to understand this, let's understand who's being spooked, because let's have a quick look at who owns the UK national debt.

And this chart shows the figures, but I'll run through them just in case.

Insurance and pension companies own 22.3% of UK national debt, just under a quarter, in other words.

Just under another quarter is owned by the Bank of England. In other words, that debt doesn't even exist. Let's be clear about it. If the government owns its own debt, this isn't an issue we have to worry about.

So when market commentators - I heard Helia Ebrahimi say this on Channel Four the other night - say that the UK's debt outstanding is £2.8 trillion or £2,800 billion, she was talking total nonsense. The actual figure is only just over £2 trillion because the figure owned by the Bank of England isn't really debt at all, and yet they don't want to acknowledge that.

33.4% - or almost exactly one third of UK national debt - is owned by overseas investors. Now, let's be clear who they are. A large part of that sum is owned by foreign governments who hold UK sterling balances in the ownership of gilts because they want to own sterling because it is still a world reserve currency, and trade with the UK does, in their opinion, require that they hold sterling, and to balance their overall portfolios of foreign currency holdings, especially at a time when the dollar is looking decidedly dubious as to value, they need to hold sterling.

So most of that balance is foreign central banks , just by the way, as we own balances in other currencies as well, because that's part of our overseas holdings. So there's nothing unusual about this overseas holding. Some of the rest, by the way, is people who run trade surpluses basically with the UK: they sell more into the UK than we buy from them, and this is the balance left over, and they leave that in deposits as well. But there's nothing frightening about that figure, despite everything that people say.

Our banks only own 7.4% of UK government debt, a surprisingly low figure, but you do to some extent have to combine that with that figure for other financial institutions and large companies who own 13.5%, because between the two, depending on the time of the day, around 20% is owned for the purposes of what is called the repo market, which is the overnight London deposit market with regard to borrowing, which does not depend upon the deposit of cash, but depends upon large companies buying bonds from banks, which they hold overnight and sell back to them the following morning. I know it sounds daft- it sounds crazy- and it is - but that's because they don't trust the banks to go bust overnight. So they want to own these assets for the sake of that market.

So 20% of all government bonds are basically owned for the purposes of making sure that our large financial institutions in the UK can actually deposit money overnight when they aren't using it.

And at the bottom of that list, there's just 0.1% of all UK government bonds are owned by individuals, which is quite extraordinary.

So who wants to panic if we look at those market sectors?

Insurance and pension companies don't, because they want to hold bonds for the long term.

The Bank of England doesn't because it is the government.

Overseas investors aren't worried by this. They're getting a better rate of interest in the UK than they are elsewhere. They're not going to be going anywhere if a minor change in the level of borrowing takes place.

And the other players basically need this money for purely practical purposes. So all of this talk about markets panicking is complete and utter nonsense.

But two things I stress. This talk about the fact that markets are, in some way, the people who are driving the process is not true. Markets aren't driving this process.

The markets, the people behind, the financial institutions in the City of London, the people who entrust money to their care, are not panicking.

What we are hearing is political talk by some people who are claiming that taxpayers are going to be taken for a ride by people like Andy Burnham. But all of that is false. The people who are talking are those who want to protect the elite privileges of those who trade in bonds in the City of London and who see great advantage by creating market turmoil because they tend to make a lot of money out of it, and, who believe, they act in the interests of the wealthier part of the British public, because, of course, they do dominate the ownership of pensions and life assurance funds behind the scenes.

But, these bond traders who are sending out these messages about how terrible Andy Burnham is are not elected. They're trying to claim a veto over power. They might oppose social housing and the nationalisation of utilities, and the expansion of public investment. They might be fearful about the fact that Andy Burnham might want to reduce their speculative profit opportunities, but they're only concerned about themselves. They're not concerned about society.

And the reason why they're spooked is that there's a politician on the horizon who's calling them out.

Now, let's be clear, markets can move in unexpected ways. We did see that with Liz Truss in 2022, but that was a complex story, much more complex than I've got time to explain now. And most of the reaction to what Liz Truss did was because of the simultaneous action of the Bank of England to announce that it was going to massively expand its bond sales, and that's what caused the crash, Liz Truss didn't. I'm not letting her off on the grounds of competence or anything else; she was clearly absurd, hopelessly out of her depth; her budget with Kwasi Kwarteng was utterly incoherent, and markets did react adversely. But all I'm saying is they reacted adversely to the Bank of England just as much as they reacted adversely to her.

But if somebody explains what they're doing, and that was the fundamental problem of what happened in September 2022, when Truss was around, because she didn't explain what she was doing - if somebody does explain they're using borrowing to fund assets and that this is not a tax giveaway, then there is very little prospect of a real bad market reaction, because of course, financial markets are totally used to people borrowing to fund asset investment. That's what they're meant to be doing all the time, day in, day out. So if truth be told, the City is talking nonsense now, and if this actually happened, there would be no market reaction.

In other words, Andy Burnham is right. The UK must move beyond being in hock to financial markets, and it can move beyond being in hock to financial markets.

The fact is that, as modern monetary theory shows, we don't even need to borrow as an issuer of our own sovereign currency. We issue bonds because the City of London, and pension funds, and life assurance funds, and overseas governments, and overseas individuals, or more likely institutions who want to save in the UK, need these to facilitate their own financial portfolios, but not because the government does, because it can never run out of money, and it can always borrow from the Bank of England.

And the fact is that this is shown by that 0.1% of bonds that are in individual ownership. There is no reason for the government to issue bonds. It does so because the City - but no one else - needs them.

So Labour must choose: is it going to be the City's messenger? Or is it going to promote a politics of care, which is what Andy Burnham seems to be talking about to me?

The politics of care demands truth-telling. That requires that we say the state has the power to invest responsibly. It has got the power to fund its own activities if it wishes. It has got the option of cooperating with the City if the City wishes to place funds with it, which we call borrowing, but which is really deposit-taking. And the truth is, bond markets are a threat to democracy in the way we treat them now, and they need to be put in their place.

It's time to stop bowing to the City of London.

It's time to declare that democracy must win.

It's time to declare that people are the priority and financiers aren't.

That's what Andy Burnham is doing. What do you think?

We've got a poll below.

Do you think that the City of London should be put back in its box?

Do you think that the government should treat it as someone who deposits funds with it rather than someone it borrows from?

Do you think the priorities of people should come first?

Let us know.

Poll

Taking further action

If you want to write a letter to your MP on the issues raised in this blog post, there is a ChatGPT prompt to assist you in doing so, with full instructions, here.

One word of warning, though: please ensure you have the correct MP. ChatGPT can get it wrong.

Comments

When commenting, please take note of this blog's comment policy, which is available here. Contravening this policy will result in comments being deleted before or after initial publication at the editor's sole discretion and without explanation being required or offered.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Are you sure that you’ve got the definition of social democracy right? Nationalisation of utilities, planning, house building, price controls on the houses built – that’s democratic socialism in most economics text books and I’ve been here for a while.

Define the difference if you want to go further.

I think it is perfectly fair to call it social democracy.

But, the nub of the issue is you can play semmatics if you wish, and I don’t really care: semantics are the excuse pedants use to prevent progress. I am interested in progress

[…] Credit: Source link […]

It’s more correct I think to say that the human use of money requires morality rather than democracy although it’s the latter that can ensure the former happens. Why should I say this? Because of Keynes’s Paradox of Thrift first stated in his book “The General Theory of Employment, Interest, and Money” published in 1936, nearly ninety years ago. Keynes, however, credited the Paradox of Thrift concept to Bernard Mandeville in his work “The Fable of the Bees” published in 1714, over 300 years ago.

In modern day terms these works are pointing out that the use of government bonds is saving that withdraws demand from an economy and therefore reduces the possibility of optimising growth. It’s only moral therefore that a government should be able to use its power to create money to run a deficit to replace this lost demand.

An additional argument to augument this is of course another concept of Keynes which is market capitalism rarely optimises the use of real resources because of profit uncertainty.

There’s yet a further one involving global trade in which countries that suppress demand for public goods and services in their country are able to maintain downward pressure on their currency value and therefore better able to maintain price point in global markets for their exports.

I like this….

Correction “augment” not “augument”

Of course if some commentators insist that the Government is beholden to the bond markets they may well achieve power over the Government or The Government could decide that only they are in power and throw their rivals into the Tower of London

Harold Macmillan a Conservative prime minister presiding over house building, NHS and nationalised utilities would now be regarded as far left.

Obvs agree with all. What follows is not a niggle – an observation:

“I heard Helia Ebrahimi say this on Channel Four the other night – say that the UK’s debt outstanding is £2.8 trillion or £2,800 billion”

Just guessing but, was she challenged on this along the lines of, given gov’ owns BoE how can you owe yourself money?

My guess is not – because (as a recent BBC survey noted); jorunalists know very little about the political economy.

In terms of the City – need to salami-slice it down to size – more rules here, there, everywhere & turf out the Americans (who only came over in bulk post 1987).

Related: Have a map from the late 1950s showing “new factory building” in the UK (Atlas of Britain Clarendon Press 1963). London dominates – the seeds of centralisation were even then being sewn.

There was no challenge.

Richard.

In the section where you discuss ownership of the debt the figures in the script and those on the diagram in the video seem to differ. Am I missing something or does it need an edit?

Let me check. The chart is right.

I’m not sure who runs Britain, but it definitely isn’t Starmer.

I’ve had a quick read of the Guardian articles online this morning. Nowadays, at a time of turmoil at the top of the Labour Party, I pay attention to the authors as much of the content, trying to work out who is batting for whom, and when an article has been written to an editorial line, and who the editorial team might be batting for (it’s always interesting when Polly Toynbee gets wheeled out).

What struck me today was Pippa Crerar’s lengthy exposition of Starmer’s latest attempt to survive as PM.

https://www.theguardian.com/politics/2025/sep/26/keir-starmer-warn-labour-battle-reform-fight-soul-nation

All the usual strained attempts to please everyone, and do nothing. The vacuous drivel about the soul of the nation. “Patriotic national renewal”. Tokenism, with a couple of whip restorations which apparently will keep lefties happy with his lurch to the right. An inexplicable pitch for the “Palantir” vote with digital ID cards by 2029 (to be hacked within a year?). The claim to be fighting Reform when he’s spent over a year pitching to the right of them with racist rhetoric and actions.

But what struck me most was the absolute total lack of ANYTHING concrete that dealt with the issues uppermost in the lives of my neighbours – the harsh economic reality of poverty, inequality, the NHS, the cost of living, climate change, employment, education, housing, public transport, failed public utilities. Nothing. Not a thing. The whole thing was spin, not substance. Headlines but no Help. Posturing but no Policies. Moaning but no Money. Oh yes, and as usual, genocide was too trivial to mention. The Tony Blair Institute have all that in hand nowadays.

As for Reeves, even less than nothing. No change. More tough decisions for tough times, the danger of “siren calls” (like Oliver, -please can I have some more? NO! FISCAL RULES). Labour even resurrected Liz Truss, the 49 day bogeywoman PM from under the bed, to shut us up in case we demanded relief from 15 years of selfish austerity. Tough decisions. And those ****** fiscal rules again!

This isn’t a pre-conference reset – it’s a Reform victory handed to Fa***e on a plate aided and abetted by the Guardian.

So much to agree with.

And he thinks the Brit Card will win for him. Stupidity takes many forms. Starmer tries to embrace as many as he can.

The UK should not be “in hock” to the City… it IS “in hock” only because the political class doesn’t understand economics and has no backbone.

The UK does not have a debt problem (well, not a sovereign debt problem – corporate/individual debt IS an issue… but that is another story). It does have an inflation problem and a (lack of) investment problem.

If a government tackles these two issues – and they are not new and have dogged the UK for decades – then everyone, including gilt traders, who ARE human (sort of) and have families/friends, would be delighted.

So, we need to unpick what “the City says” means. Gilt traders are (nearly all) wealthy and, at a personal level, they realise that improving public services will mean spending… which will need to be drained either by higher taxes or more gilt sales in order to prevent inflation – and, yes, every gilt trader knows MMT to be true.

In reality it will be both…. and rich people know that the increases in tax will be borne by them…. and most don’t want that to happen. So, they appeal to the “markets won’t take it”… knowing full well that markets CAN take it – indeed, more gilt supply and volatility would deliver greater trading profits.

Where they do have a point is that there is a real fear that greater investment spending (health, housing, transport education) will not, due to political difficulty, be drained by higher taxes. If it is not there are more gilt sales and rates will rise with a negative impact on a debt-laden private sector.

Of course, the BoE could control interest rates though interest rate policy and gilt buying….. but this could easily lead to an FX crisis.

In short, we need a government with vision and the willingness to tax.

So much to agree with.

And thank you

On reading the negative/cautious/fearful responses by various Labour functionaries to Burnham’s comments about bond markets, I wondered whether it would dawn on any of them that they were rather proving his point.

Unlikeky

The ‘morality bit’ about money was that I’m sure I read in one of Michael Hudson’s historic books that money was once issued from the temple (pp. 56-59 ‘….and forgive them their debts’ (2018).

If so we need a new form of temple then – not banks.

Even better if we let the ‘fiscal rules’ of that money temple be written by someone like Jesus.

After all, we are a ‘Christian country’ – are we not?

Sorry for the sardonicism so early in the morning.

Actually, no, I retract the apology.

No ptoblem 🙂

I do not understand why the Bank of England is planning to sell the bonds they hold. I assume that these bonds will be sold into the market so it is unlikely that they will get face value. Also they will have to pay interest over the remaining life and face value at the end. Why do they not put all in a drawer until they expire and just play pass the parcel inside the government with the money.

Also on the interest being offered, Bonds issued by National Savings only pay about 3.8%. Should the government not actively sell bonds to the public and save money.

Much to agree with.

But, best of all, just cancel them. It only requires some double entry.

Andy Burnham seems to understand the crisis facing ordinary people far better than the Labour government does, perhaps because he is closer to where the problems are being experienced daily. The single biggest fault with our economy is its failure to provide people with decent homes and Burnham puts that at the front of his pitch to voters, whilst Keir Starmer makes a speech about digital ID. The one man has some political antennae and the other doesn’t. The one man seems to have grasped the scale of the challenge brought about by the failed neo liberal philosophy which has dominated our politics since 1979. The other one seems to think that a bit of tinkering under the bonnet will get the old banger running smoothly if people are a bit more patient. I don’t know whether Andy Burnham will become PM. What I am sure of is that IF Keir Starmer was the pragmatic politician he claims to be he would facilitate Burnham’s return to Westminster, bring him into government and work with him to unite the Labour party and develop a much more radical approach to economic renewal. I am not holding my breath.

It’s a simple enough sum to do treasury bonds subtract from demand and the only player in town who can add it back is the government by running a deficit. How to do this simple sum eludes most UK politicians and voters due to the decades of brain-washing from a mainstream media owned predominantly by the rich. Mathematical illiteracy a very good example of class war in action!

Politicians are always talking about money. Or so they want us to think. In fact they NEVER really talk about it at all.

But three questions they NEVER want to answer…

1. Where IS the money?

2. Where did the money COME from?

3. Where is it GOING?

Whether discussing banks, bonds or benefits, those three questions are so very important, and no politician in the Single Transferable Party can answer them truthfully.

Maybe it’s because the questions are too simple?

Or perhaps it’s because the STP politicians are too simple?

Both

It’s the economic aspects of this article that interest me rather than the personalities. And its an Editorial not an Op-Ed.

https://www.theguardian.com/commentisfree/2025/sep/26/the-guardian-view-on-labour-conference-a-clash-of-visions-and-direction-not-egos-and-personnel

“Capital behind the wheel, social policy just along for the ride” vs “European style interventionism” – “Abundance” (nicked from the supply side liberals).

There is also a strong demolition of digital ID as a control on immigration – the reminder that in the UK, immigrants ALREADY have to produce digital proof of their legal status. Digital ID simply extends that to UK citizens thus further empowering the authoritarian state.

The Guardian seems to have taken against both Starmer and his US-influenced economics of “abundance” repackaged as social democracy (which it isn’t).

I think that this represents a significant shift for those in charge at the Guardian. A U turn in fact, economically speaking. They’ve been backing Starmer, Reeves and their deadening, destructive American-sourced neoliberalism since before he became Labour leader. But now are they dumping, not just him, but his neoliberal economics too??

What will fill the gap? Just a new face and better rhetoric? Or real “CHANGE”?

Maybe I’m reading too much into it, but it looks like Katherine Viner has changed her mind both on Starmer and on the needs of the economy.

And he was the “forensic” future once…

See blog just posted.

Thanks for drawing this to my attention.

Presentation given by Steve Keen at Jeremy Corbyn’s Peace and Justice Project conference last Sunday (September 21st) clearly explaining MMT and double entry book keeping and also explains why the financial sector needs government bonds and will always buy them.

Available on YouTube:

https://www.youtube.com/live/Mng2Fr3TXmU?si=nr0EWRDetc3486mK

Apologies if this has been posted previously

No problem.

Thanks.

I’ve just read that De Gaulle, told that the markets would not stand for a proposed action, replied to the effect that the policies of France were not made on the floor of the Bourse. On this point, I agree, and would wish the current UK government would show similar resolve.