Many think a “billionaire tax” could solve the UK's problems — but there are only 156 of them. The real wealth — and the real untaxed income — is spread far wider. In this video, I explain why looking beyond billionaires, to the top 1% and top 10%, is essential if we want a fair tax system.

This is the audio version:

This is the transcript:

There are a couple of quite dangerous tropes going around the tax world at present, and I want to tackle them both.

One of them says, "We should be taxing wealth and not work.", but that's wrong, because the reality is the world is not divided like that.

And the other trope is that "Wealth taxes should only apply to billionaires", and I just want to point out one simple, very straightforward fact, and that is that there are probably no more than 156 billionaires in the UK at present, according to the Sunday Times Rich List, and they are not a sufficient base on which to charge the taxes that are going to transform our economy.

So these two ideas are not right, and I cannot put it more bluntly than that.

Let's deal with the first: tax wealth, not work.

This implies that workers aren't wealthy, and it implies that the wealthy don't work. But that is simply untrue. There are many workers who are wealthy, and there are very many wealthy people who do work, and so this artificial divide, which suggests that somehow or other there is this strict dividing line between the wealth and work, is untrue.

It's as untrue as saying that there is a dividing line that we can draw between millionaires and billionaires, which is also deeply misleading. And just to put this in context, a millionaire has one thousand thousand pounds, but a billionaire has one thousand million pounds, and the difference between a millionaire and a billionaire is therefore quite staggering in scale, and we really shouldn't be ignoring the gap between the two.

So we need to work out what we really need to do.

Wealth and work are not separate worlds. It's time we stop pretending that they are. Humans populate both groups often at the same time, and as a consequence, the boundary between these two is blurred when we get to the top of the wealth and income ranges. And the boundary is always confused at that level and nowhere else.

So to pretend we are not going to be taxing work more or income more, which is the claim being made, because people are saying only wealth taxes are required to put the problems in the UK, right, is just wrong.

The same as it's wrong to say that 156 billionaires can provide all the solutions to all the problems we have when, in practice, the top 1% of households in the UK - 330,000 odd of them, by the way - own more than those billionaires between them. And there are in fact 6 million millionaires in the UK, and so you shouldn't be too surprised if you know one, because you probably do.

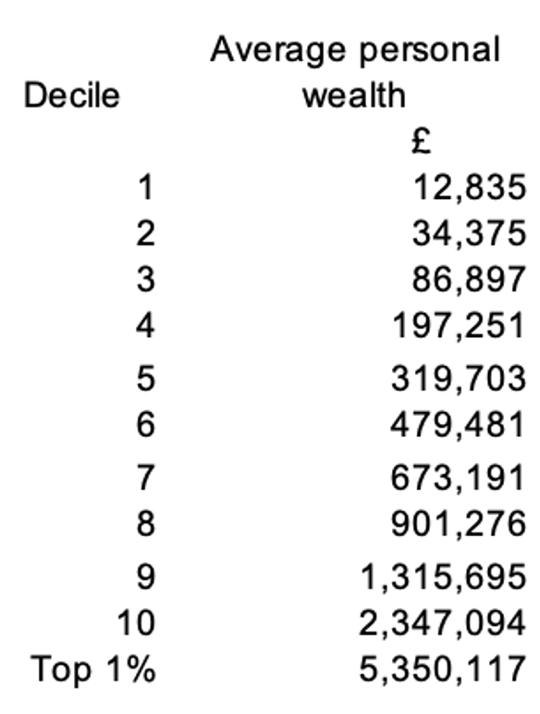

The top 1% are already far removed from the rest of us, though. Even amongst those millionaires, they stand out as exceptional. They're not like the billionaires, and I accept that, of course: they've got much less wealth than the billionaires, but they still are quite different from us. And so we need to look at this because if we look at the wealth distribution in the UK, split into ten equal groups right across the tax-paying population, because that's the way in which most tax data is sorted in this country, with each of those groups having about 3.3 million people each in them, then you will see that the average personal wealth spreads remarkably widely across the population as a whole.

Those in the bottom half of the population from groups one to five have at most, on average, £300,000 of wealth, and some of them have almost none at all.

Those going from groups six to eight who are moderately wealthy have wealth from about £500,000 to £900,000, much of which will be represented either by the equity in their homes or their pension funds, and then we get to groups nine and ten.

Group nine has wealth of over £1,000,000 on average. As I said, there are a lot of millionaires in the UK now, although most people won't recognise it, and again, that is, in most cases, represented by their houses or their pension funds.

But when we get to the top 10%, that group also has significant financial wealth and quite a lot of personal property as well.

And when we get to the top 1% who are of course, and I stress this point, part of the top 10% as well, then the average wealth is over £5,000,000 of which only £2,000,000 will be in their property, and the rest is some form of financial wealth over which they are most likely to have significant financial control. And I promise you, over £3,000,000 worth of financial assets in some form or other is beyond the imagination of most people in the UK, and I don't blame them because it's rightly beyond the imagination of most people in the UK because they have probably never met somebody who's got that much money because only 1% or less of the population have.

That's the point here. That group, the top 1% are definite outliers, so far out of the ordinary that, of course, they can be subject to extra tax. And that might be true of others in that top 10% group as well.

And when we look at what HM Revenue and Customs say wealthy people are. They reckon that anyone with over £2,000,000 of wealth is wealthy, and that probably means they're looking at 2% or 3% of the UK population as a whole.

Now that's a pretty large number of people. It's coming on for a million households that might be considered to be wealthy. So why are we only going to look at 156 billionaires when we're talking about the taxation of wealth? That makes no sense at all.

We can leave out 95% plus of households. I entirely agree they should not be impacted by the taxation of wealth in all probability, and most of them won't be. But anyone who's got wealth of more than £2,000,000, and in particular, if a lot of that wealth is recorded in financial assets and not in their home, is going to be extremely financially secure. , Outlook on life is going to be fundamentally different from the person in the bottom half or maybe even the bottom 80%, of the wealthiest in the country, because austerity has no impact on them, and there's no bill that's ever going to arrive in their household that is going to cause a panic as to how it's going to be paid.

They are therefore in the scope for more tax, and that's why I'm a little flexible about where this border is, because let's be realistic; those who are living in comfort should be contributing more if we live in a country where there are vast numbers of people, including millions of children who are living in poverty.

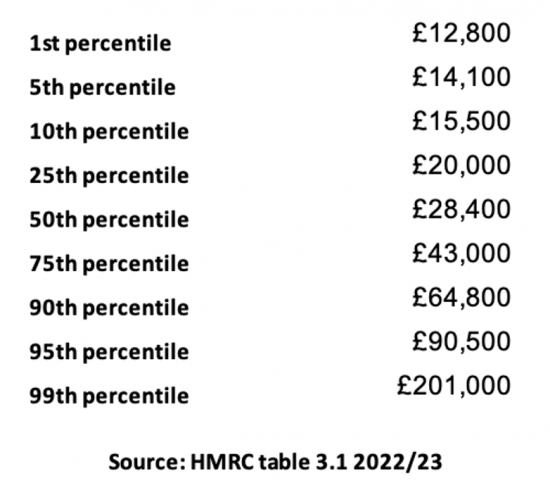

When we look at income, the situation is also remarkably wide.

This data is for the tax year 2022-23, which is the most up-to-date that we've got because the Revenue does take time to pull together all their information, so this is a couple of years out of date now , but even so, it's indicative of where we are.

This is the income of people who are taxpayers in the UK. Again, there are roughly 3.3 million people in each of the ten deciles that are created to represent that income in the UK, but this income is actually presented by percentile. In other words, this represents the income in a 1% band, but you must remember that there are 17 million adults in the UK with no taxable income at all. They're not reflected in that number whatsoever. Just imagine it: 17 million people who have less than £12,800 of income a year, which is what the people in the bottom 1% of income earners who can pay tax get. And when we go right to the top, the people in the 99th percentile, in other words , the highest earning people on average, have income of over £200,000 a year. To give some indication of how far removed they are from the rest of us, the people in the 95th percentile only have an income of £90,000 or so a year: only I say as if that's some remarkably small number, which it is only in comparison with the situation of those who are in the top 1%. But the point is having a high income does also give you a capacity to pay tax, which is real, and let's not deny it.

This is something that has to be taken into account, and if we take HM Revenue and Customs view that anybody with not just £2,000,000 of wealth, but also with income of £200,000 a year is wealthy, then clearly we have a cutoff at around the 1%, but in practice I think that's slightly wrong, and I think the figure should be lower because these bands are actually about after tax allowance income, and so if we were looking at these bands, I'd be putting the cutoff at around £150,000 to allow for all the allowances and reliefs that the wealthy can claim, and that would therefore suggest that again, maybe 2% to 3% of people in the population might be subject to this consideration of being not just wealthy, but also being exceptionally high earners and therefore potentially subject to additional tax.

So should we be raising tax on work, which is what the trope is all about, and by and large, I'd say, well, actually no, we shouldn't. By and large, I'd say that work is being fairly taxed at present in the UK, and indeed, on some of the lowest earners, might be being overtaxed. There is a case for saying, for example, that we should have a 10% tax rate again for those at the very lowest level of earnings, but with a guarantee that the benefit could not be passed on to those on high levels of income. That would be possible. It could be done, and I think it needs to be looked at because we take people into tax at very low levels of overall income at a relatively high rate of 20%, which, when combined with national insurance, is quite penal.

So there are arguments for reforming tax downwards at the lower level. And maybe there's some argument for extending tax by increasing national insurance paid throughout the employment income range, but I'm going to leave that aside for a minute, because what I'm really talking about is the fact that those figures for income combine income from work, and income from wealth, and at the top of the range, there will be significant amounts of income from wealth in there, and not all of that will necessarily be taxed at appropriate tax rates.

In fact, the point is that if we look at this chart, which shows effective tax rates, you will see there's an enormous bias inside the tax system.

If we look at what most people think to be work, because it's taxed on income, we will see that orange line, and this is data split by those 10% groups again, 3.3 million people roughly in each group.

If we leave the bottom 10% out for consideration, because they have very little income, so their tax rate looks to be very high, you will see that we have a slightly, and I stress slightly progressive tax system where the wealthiest - the people in the top 10% - get to an overall effective tax rate of less than 40%, which is why I'm slightly annoyed to hear people talking about the wealthy paying tax rates of 50% and 60%, because they aren't.

The only people who regularly pay tax rates of 50% and 60% in the UK are those in the lowest group of earners when they come off benefits and back into work, and then the marginal rates of tax are very high, but there are few such rates on the wealthy, so we should be ignoring that.

But what we should be noticing is that, of course, the money that we have available to us is not just made up of what we get from work. There's also an increase in our financial well-being made up from the increase in the value of our homes, the increase in the value of our investments, the increase in the value of our savings, and the increase in the value of our pension funds as a result of them accumulating money tax-free on our behalf.

When we take all those factors into account, and the incredibly low overall rate of tax on those increases in financial well-being, enjoyed by those who benefit from them, you will see the blue line, and the blue line drags down the overall effective rate of tax right across the tax spectrum so that the wealthy are paying little more than 20% in real terms on their income, plus their increase in financial well-being in a year, meaning that they are incredibly well off in the UK when it comes to tax and in fact, massively under contribute to the tax revenue of this country.

So what we need is to look at income as well as wealth when we are talking about how we are going to transform the taxation of this country to tackle the inequality that we face.

This idea that there's wealth and there's work, and one is income and one is wealth, and that income does not need to be considered, is wrong because there's under-taxation of income from wealth in the UK, and we need to increase the tax on dividends, and rents, and interest, and capital gains, and we also need to look at how we can prevent the penalisation of ordinary earned income.

So we must be much more flexible.

Not only can we just look at the 156 billionaires, we actually need to look at most definitely everyone in the top 1% and consider how they can pay more tax overall, and perhaps we need to look even further down the scale, well into the top 10% of wealth earners, because many of them also enjoy very high levels of unearned income, and that means that they're underpaying tax, and this group should therefore be contributing significantly more to the UK economy.

So what do we need to do?

We need to change our narrative. We need to reject simple tropes like "let's tax wealth, not work" because that is confusing, because work is confused with the income from wealth when it comes to taxation, and if we don't change income taxes and other taxes to make sure that we're picking up sufficient from investment income, we are not going to solve the problems we face. And wealth taxes by themselves will never raise anything like the amount of money that we require to transform the UK economy if we are to genuinely meet needs and redistribute income and wealth.

It's a simple, straightforward fact that is not possible by charging wealth alone.

So we have to look at how we redistribute through the income tax system as well. And that means we must look at people outside the billionaire class because they, too, have to pay tax and some people who even think of themselves as middle class are really very wealthy indeed, because there's a lot of evidence to show that people think that they earn much less in relative terms than they actually do.

Many of those people who are earning £200,000 a year will think they're really not very well paid. They'll think they are not particularly high up the income spectrum. They'll probably say they're only earning a little bit more than somebody on average earnings in the UK. This is commonplace, but they're talking nonsense.

We have to stop talking nonsense about tax. We have to change the system. We have to close the loopholes. We have to make sure that high incomes and wealth are fairly taxed. And we can't only look at billionaires because that's an excuse to not tax those who are extraordinarily wealthy just below that group, including lots of people who think themselves to be middle class, but who are in fact exceptionally wealthy.

Why would anybody want to create excuses to let these people off the tax that they should really be paying? I don't know, but I want it to stop, because I want tax justice and tax justice demands that we create a genuinely progressive tax system in the UK, and we're a long way from having that now.

What do you think?

Do you want a progressive tax system for the UK?

Do you want the wealthy and those on high incomes to make a fair contribution to the UK economy when at present it looks like they're not?

Are you willing to pay more if you are in that category?

Do you think that this matters?

Or do you think, let the wealthy have their money and leave them in peace?

Let us know. There's a poll. We are looking for your opinions, and we do notice what you say because it impacts the way in which we create future videos.

Poll

Do you want a progressive tax system for the UK?

- Yes, and taxing billionaires is not enough (37%, 231 Votes)

- I think the top 1% to 2% might need to pay more as well (33%, 206 Votes)

- Would you be willing to pay more if you were that wealthy? (28%, 173 Votes)

- Leave the wealthy alone - let them have their money (2%, 14 Votes)

Total Voters: 279

Comments

When commenting, please take note of this blog's comment policy, which is available here. Contravening this policy will result in comments being deleted before or after initial publication at the editor's sole discretion and without explanation being required or offered.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

One point worth making is that a large chunk of most peoples wealth is in property so there is bound to be a significant ‘North – South’ divide

Clearly if you are a Teacher or Doctor in – say Scunthorpe your ‘property wealth’ may well be a lot less than in = say Cambridge although you may well have a much better house

Agreed

[…] have seen comments of late, most especially on YouTube, that imply that videos of the type that I have posted this morning are created solely because my only interest in life is in winning arguments. It is claimed that […]

“there are in fact 6 million millionaires in the UK, and so you shouldn’t be too surprised if you know one, because you probably do”

At first I thought this overstated; I couldn’t think of any I might know. But now I considering the remuneration packages of senior managers at our university (many of whom I talk with from time to time) and doing the maths and assuming they invest their ‘surplus to lifestyle tournament’s and … Well, probably they are by now.

Look at the data

Do they have a nice house? Worth say 500k, perhaps more? Do they have a well funded private pension? 10% of 100k for 20 years is already 200k. With some growth and more salary and years it can easily be over 500k, perhaps more. How about ISAs for 20 or 30 years? And so on.

Before we forget, the actuarial valuation of a full state pension is around 150k to 200k. I dread to think what the cost of NHS benefits would be (and the lump sum valuation of whole of life cover, at retirement age) if you had to buy them in the private health insurance market.

This is the basis for my suggestion.

Just a thought – although it might not be very valid – in this index of earnings/wealth, where do most of our politicians figure? I am of course talking about rampant self-interest.

On earnings – at around the 95th per centile

Wealth varies

Very valid PSR. MP’s might be considered to be averse into taxing their incomes and wealth more.

Looking at the income distribution without taking account of the age distribution is pointless, and ignores the inevitable (and essential) life stages.

Someone just turned 18 has spent the majority of their life studying and probably earning very little, if anything – of course we’d expect them to have very little wealth.

In contrast, someone who has just retired has probably been working for 40 years, and had a lifetime of earning to save and invest to accumulate money with which to live on in retirement. savings of £1m isn’t that much to buy an annuity if you can’t work for the rest of your life. Indeed the value of the pensions ‘earned by most public sector workers will be well over £1m when they retire.

An 18-years old with £0.5m in wealth is tremendously rich. A retiree with £0.5m in wealth (and no other savings etc) is not rich in the slightest.

And you think that this does not have implications in itself?

Let me guess three things.

You’re probably retired.

You’re probably well off.

And you think the young are snowflakes.

And as a result you use what you say do because you are indifferent to their precarious state.

I am not.

And that’s why we differ. I care.

Many in my generation won’t even have £0.5M when, sorry, if we retire. Yes we have compulsory private pensions but I’ll be blunt, many of us think it will be pillaged at some point, no doubt by another once in a lifetime economic event. With rent, water, electricity, student loan tax/scam, travel, insurance and council tax (which mostly goes on adult social care and children) being so high, in order to save for retirement you wouldn’t be able to enjoy being young or even middle aged.

While off topic, it is why younger voters are increasingly looking outside of Labour and Conservatives, thankfully mostly to the greens.

Let’s be clear, the data shows that, and that is why redistribution is essential.

I am reading “Failed State” by Sam Freedman. Page 53. John Kingman (2nd perm sec@ Treasury under Osborne)

“..the Treasury’s agenda on HMRC has usually been to reduce its budget. & yet we know that marginal additional spend on HMRC pays for itself many times over”.

Rich people can afford cleaver tax lawyers. UK gov’ trajectory/Finance Ministry is to reduce the capacity of the UK gov to collect taxes. Any new UK gov’ needs to break up the treasury and have all staff re-apply for their jobs – whilst also implementing decimation (every tenth person sacked).

As is, the Treasury is useless & brainless, it is an enemy of the british people and stands in the way of a tax collection system that works – without which all the ideas and data in the blog cannot be implemented.

(The book is ok from a wezzi gossip PoV – but never gest to grip with e.g. how the UK gov is financed – thus criticisms are somewhat one dimensional).

Thank you and well said, Mike.

It’s good of Mike to highlight Kingman, who I came across during the 2008 crisis.

Kingman and his peer, Tom Scholar, have been well looked by the City since leaving Whitehall. That needs to stop.

Taxation rhetoric (and policy) can be regressive, progressive but it can also be performative and even covert.

Taxation is political as well as economic, especially when politicians talk about it, thinking about elections rather than economics. Unfortunately journalists rarely challenge them on either their arithmetic or their opportunism.

Starmer – ” those with the broadest shoulders…” (followed by refusal to remove 2 child cap, further benefit cuts and fiscal drag on income tax thresholds)

The left – “a wealth (asset) tax” (but no idea how to collect it)

The wealthy – “IHT is a DEATH tax” (to scare the unaffected 96% into opposing it)

Reeves – “we might think about considering a feasibility survey on the possibility of one day talking about exploring some potential changes to IHT – and a bit more fiscal drag with frozen allowances.” (to appease those restless backbenchers tempted by YourParty’s 750,000 signups while still increasing the tax take from those with the lowest incomes,).

Reform – “£20k personal allowance, abolish IHT, couples transferable allowance up to £5k” (please can I have more exposure on BBCQT, but don’t ask me about the maths)

I think there is something to be said for messaging. “Tax wealth, not work” is a catchy slogan that captures the general feeling an increasingly large number of people have that wealth is taxed much less than work (whether or not this is factually accurate or a complete account). It is a “catch-all” slogan for a fairer tax system. So, you provide a closer and enlightening examination of the data and distributions of wealth and income, for which I say “thanks” and for all the work you do. Certainly, taxing those who you describe as wealthy is desirable. But I think you do a disservice to a general movement for redistribution by casting this slogan in particular in such a negative light and urging people to stop using it.

We will have to disagree in that – precisely bevaused the way in. which it is being used – and I explain this – justifies what I am saying.

“if we look at this chart,” What chart?

It might be in the video.

I thohght I had added it – there should be two.

It is a table, not a chart

“if we look at this chart, which shows effective tax rates, you will see there’s an enormous bias inside the tax system.

If we look at what most people think to be work, because it’s taxed on income, we will see that orange line, and this is data split by those 10% groups again, 3.3 million people roughly in each group.”

I think this is definitely missing.

Sorry – I now see the mistake. But on an iPad tonight probably can’t change it. Apologies

https://www.theguardian.com/business/2025/aug/17/record-salaries-for-uk-chief-executives-as-pay-rises-for-third-year-in-a-row

They have no shame. If Reeves had the slightest intelligence she would reverse her NI changes and instead of lowering the start point lift the ceiling entirely so that there would be a very slight deterrent to continually increasing the pay of the already excessively rewarded employees.

Richard,

I think it might help to convince better off people that they should pay more tax if it was put to them that they would in fact be better off if they did so. My husband and I are fortunate in that we have had long working lives, own our own property and both have final salary pensions. We have also benefitted from inheritance. I do not think we are in the highest percentile in your chart but we would certainly regard ourselves as financially secure. And yet.. I need a knee operation. On the NHS there are long waiting lists and I am in pain. I learn that I can have my operation done more quickly if I pay £17000 at my local private hospital.

Perhaps if the NHS had shorter waiting lists because of better funding I would not have to pay such an eye watering sum. My annual tax bill would have to go up and awful lot for it still to be cheaper to use the private hospital. Both hips are dodgy too. In short you have to be very wealthy or very healthy indeed before a privatised system makes sense for you as an individual.

That is what is being concealed from us with the “Private good, state bad” mantra we have had shoved down our throats since 2010. Collective, state insurance is better for everyone and even the super rich would end up in an NHS hospital if their car ( or their helicopter ) crashed.

Noted

And good luck

Just because I wanted to look at the available data, and I went on a bit of a detour to find it, I will post the links here, for any others who might be interested.

“Personal Incomes Statistics 2022 to 2023: Commentary

Published 12 March 2025”

https://www.gov.uk/government/statistics/personal-incomes-statistics-for-the-tax-year-2022-to-2023/personal-incomes-statistics-2022-to-2023-commentary#table-31-and-31a—percentile-points-for-total-income-before-and-after-tax-for-tax-year-ending-1993-to-tax-year-ending-2023

“Table 3.1 Percentile points for total income before and after tax”

https://www.gov.uk/government/statistics/percentile-points-for-total-income-before-and-after-tax-1992-to-2011

Thanks

Hi Richard

Firstly I have a great admiration and respect for your tireless efforts and watch your short videos almost religiously. there is something uncomfortable about this one though. I think it comes down to the difference between “Wealth” and “The wealthy”. The later individualises the problems with wealth inequality, personalises the growing wealth divide and in effect “Others” wealthy individuals. I have a deep fear of “Othering” as mainly I see it used against minority groups, not least the disabled, unemployed, Muslims and immigrants as the source of all our woes.

Wealth resides in several places and should not be laid down at individual feet, if say an individual is extremely wealth then they may well be caught up in taxing wealth but not singled out for a “Wealth tax”. Most wealth is held in assets that often appreciate in value, especially at the moment with investments in domestic property. Most wealth is held by corporate interests, Blackstone just “Invested” £1.4bn in rental housing and affordable schemes, (Which are unaffordable to most working people). The capital gains of which are realised only on the sale of said housing, which will not be sold but rented. The income gained from rent is spirited out the country and very little tax is paid at source.

Taxing wealth could well mean bringing in legislation that stops corporations parking their wealth in domestic properties and funnel their wealth into commercial or industrial productive purposes.

Taxing wealth could mean closing down tax loopholes that avoid tax in this country.

It could mean changing capital gains tax law or international corporate tax rates.

It could mean limiting asset purchases by foreign investors.

In effect in could mean a lot of things not just a tax on wealth itself.

I feel we need to move away from personalising inequality and realise that the economic system run by the western world is at fault and it needs to be changed, ie Neolibreral driven capitalism. (Very similar to laissez faire liberalism pre 1930’s).

…And don’t get me started on “Foundations, “Institutions” and “Think tanks”.

Ps I have had to correct Google spell check multiple times to stop the corporate take over of English. I mean “Realize” with a “Z”, come on, if that’s not subtle corporate take over I don’t know what is.

Quite a number of claims in here e.g. rent being sprited out of the country, are just wrong.

Can we discuss what is likely to be true please?

I agree rent it self does not leave the country, but I stated “income gained from rent” ie profit does, and little tax is paid on that.

I refer to the work of Angus Hanton “Vassal State”,

Small parts leave, I am sure.

But let’s not make sweeping generalisations that are not true.

I applaud your sentiments regarding ‘othering’ but the wealthy are, in effect, already ‘othered’ currently. It is precisely this ‘othering’ that a just and progressive tax system would correct. A wealthy person that had paid their dues, as determined by a fair tax system, would be able to rub shoulders with the poorest of us in the knowledge that they were contributing to, and are an essential part of, a cohesive society.

It is this ‘we are all in this together’ aspect that is dangerously and corrosively missing from society currently.

Also let’s not forget that a wealthy person that has paid their dues is still wealthy and any that feel hard-done-by need a mental realignment not a financial one.

The wealthy other themselves in most cases. That is precisely what conspicuous consumption is all about.

I agree entirely Richard but I would add that once any individual has fully contributed the dues that society deems fair and reasonable(which they are far from doing at the moment) then, as I said, it will still leave most as very wealthy and, I believe, it is not for any of us then to make moral judgement regarding what they spend their money on….we really are in danger of straying into the politics of envy in that case and the myopia of envy is as socially destructive as the hoarding of wealth.

So, if they spent it on human trafficking you would have no problem?

Are you sure about that?

Really?

Your generalisation is far too sweeping, I suggest.

Maybe my expression was inadequate.

I wasn’t talking of the ethics of spending more the principle.

Of course there are things that should not be available to be bought…ever….but that is a different, though not unrelated, argument to having a surfeit of funds accessible to spend.

Few people, myself included, would advocate funding human trafficking but I can’t imagine (without doing the research) that many people that can afford, and buy, a boat, of any size, purchase it for the purpose of transporting vulnerable people across the Channel.

I was making a philosophical living. I did not agree that anyone can always spend as they wish. I still don’t. Regulation is required on many issues. That was the only point I was making.

Just free associating as a result of this thread….it might be useful to expand this thinking at some point – what we can/can’t or should/shouldn’t be able to spend disposable income on in a responsible society.

If I can afford a private jet should I be able to buy one? If I could afford punitive carbon taxes as a result and it is fully net-zero compliant should the purchase still be possible? If all the multiplier effects of the supply chain are factored in does that in any way legitimise the exercise?

In effect should this highly ‘conspicuous consumption’ ever be permitted and, by extension, should anyone ever be permitted to be that rich?

I’ll leave it there .

Fair questions.

Tax can help solve them.

Progressive consumption taxes are possible….

Reading thru, I am conscious that many folk (and newsreaders!) don’t seem to have an appreciation of the difference in scale of 1M cf 1Bn.

1M seconds is about 10 days duration. 1Bn is about 30 years.

Agreed

It is staggering that this awareness does not exist

Tom Scott did a YouTube video ‘A Million Dollars vs A Billion Dollars, Visualised: A Road Trip’ (at https://www.youtube.com/watch?v=8YUWDrLazCg – you’re probably going to want to skip most of it).

Or by weight: a £1 coin weighs 8.75g, so £1,000 8.75kg – you can put in your shopping bag; for a million, almost 9 tons – you need a medium sized lorry; for a billion, that’s approaching 9000 tons – perhaps 300 juggernauts, a heavy haul train (not something we have in the UK) or a ship.

Thanks

Over recent years I’ve felt that the tax system is demonstrably unfair. You could easily prove this if people declared voluntarily how much tax they’ve actually paid, certified by an accountant and/or HM

Collector of taxes. Most people have a good idea how much they’ve paid.

Many will object, for various reasons and it would be difficult to enforce if it was ever mandatory.

For example, a millionaire business person might declare that they’ve paid £100,000 in the tax year and a teacher might declare £10,000 over the same period. A pensioner, perhaps £1000, and many people zero tax.

It would create a lot of public interest, I’m sure.

You are ignoring the need to also disclose income and personal circumstances in that case. I can’t see it happening.

Everyone pays tax.

Taxes on spending are impossible for either the HMRC or the individual to calculate on an individual basis.

I make the point just to emphasise that everyone participates in taxation, rich or poor.

Some pay a higher proportion of their income and wealth than others.

Some taxes are more regressive in principle, or in distribution than others.

Reply to Rob C

According to recent Oxfam research the top 1% of the world’s population contribute more to global warming than the poorest 5 billion people. I would not therefore have any ethical problem with taxing that section of the population to the hilt. They are a danger to us all. The difficulty is not ethical but practical. How do we curtail their income and their activities, especially given that they have so much power.

I am inclined to agree

I have three problems with wealth:

1. It denies political representation to people who ought to have it.

2. Through denial of political representation, it ensures its own security and growth at the expense of society and limits upward economic mobility. Working harder and contributing to society should be correlated with prosperity and security, but as of now, people can work three jobs and still struggle.

3. Wealth is used to dely and deny justice, and it corrodes rule of law.

If I could pay more tax and know all these problems would be solved, I would do it in a heartbeat. But realistically, I doubt it would happen, and I doubt you could convince me it would have a meaningful impact on dismantling this system.

Would would happen is this: billionaires and corporations would suck up this extra tax revenue through government contracts, harming the possibility of political rivalry from a united upstart movement funded by millionaires (1); the papers would simultaneously claim austerity is necessary; and billionaires and corporations would set their legion of paid professionals to finding tax loopholes, or writing such tax loopholes intoo law, or underfunding your tax collection agency. In reality, you would not be able to collect taxes from these individuals if you tried. Furthermore, the national security interests of potentially every nation on Earth would oppose you if you tried to, because billionaires and corporations are foundational to state power. (Hence the race to the bottom re: minimum tax.)

I’m not saying that taxing millionaires doesn’t have the potential to help fund social programs. It does. But whether that potential is realized is out of our hands, and that is a big problem. Saying “tax the wealthy” is like slapping a band aid on a gushing artery. More is necessary.

But like it or not, billionaires are an exceptional class, and they should be treated like one financially.

(1) Readers of the FT might have seen an article about the political leanings of Silicon Valley. Published a while ago, it said that a large majority of the employees leaned left. I saw that, and I thought to myself, “someone is looking at this, and thinking it’s a problem which needs to be solved.” It was too much cash flow to a bunch of liberals. And sure enough, thousands were laid off.

I don’t share your pessimism.

Nor do I agree with the problems wealth creates.

The problem with wealth is it sucks energy out of people, the economy and society to meet its demands.

That’s what’s so utterly destructive about it.

Then you don’t think the wealthy have better political representation than the average taxpayer? You don’t think they have more chances to acquit themselves in court? More money to afford lawyers and fees? You haven’t seen how many impoverished non-white defendants have settled with the state because they can’t afford to do anything else?

I think we will have to agree to disagree on this subject. A great deal of structural inequality is built into our systems, and it’s not by accident.

Also note: many high income liberals in the U.S., are already paying more tax because of changes to SALT. Did we see more spent on SNAP or other social programs? No we did not. Instead, we were told these social programs were ridden with waste and fraud, and we needed a multibillion dollar budget leap to harass fruit vendors and veterans in LA. (Fascism didn’t need to be our future. The wealthiest people in America have made it our future.)

I was not arguing with your points 1, 2 and 3, but with where you went next, which I felt too pessimistic about our opportunities to address the issues, hence my comment.

And how you can think I do not see the problems with wealth defeats me, when I point out the problems so often. It’s always irritating to be accused of having opinions I don’t hold.

Well when you said “nor do I agree with the problems wealth creates,” which was points 1, 2, and 3, I didn’t know how else to interpret it as anything other than disagreement with points 1,2, and 3. I apologize if I misunderstood. Indeed, I was a bit taken aback to hear your reply, given the other content I have read on this blog. But I will point out that other media personalities have accused critics of being pessimists and doomsayers, particularly with regards to issues like the rights of women, LGBTQ, and non-white citizens, and as it happens, those critics have proven to be correct. (How often were we told that Roe v Wade was established and unassailable?) So it is not simply enough to say someone is a pessimist. You must engage in facts and ideas on their merits.

That said, I am aware I might be too pessimistic. I think I have a right to some pessimism given how many experts have tried to gaslight the public into being okay with impending fascism. Fascism is alarming. It should be alarming. We should have judges, for example, confronting the executive branch. But they are all too afraid to “provoke a constitutional crisis.” We are already in a constitutional crisis! The crisis is here! But no, we must relax, and let it happen. Look at Russia; all neat and orderly, the citizenry contained, no meaningful elections. This is the model our leaders want right now.

As for opportunities to address these issues, I am always looking for them. That’s what drew me here in the first place.

Apologies for the confusion.

I moderate a lot of comments.

Some I let through when I would love to have time to comment. Others, I comment on, but not in enough depth to be clear what I mean. That was obviously the case here. Apologies. But, I think we are on the same side, even if we are exploring from very slightly different perspectives.