People say higher taxes will drive the rich away. But here's the truth: most wealthy people stay put — and even if some do leave, the UK keeps their houses, pensions and financial assets. This video exposes the hollow threat of ‘rich flight' and makes the case for bold action on tax justice. Let's stop being held hostage by a myth.

This is the audio version:

This is the transcript:

What happens if the wealthy leave the UK?

We've all heard the threat. Time and time again, the wealthy say, "If you tax us more, we'll leave."

It happens whenever there is a mention of wealth tax or increased tax on the wealthy, but is the claim that the wealthy are making credible?

Will they actually leave?

And what if they do?

And how many will go?

And would we notice?

Those are the issues that I'm going to address in this video.

This is the ninth in our series on the wealthy, and to date, we've looked at what wealth is, how people are wealthy, and the fact that the wealthy are petrified of losing their wealth more than anything else, and so they flaunt it, but they're not entrepreneurs.

Now we need to ask the question, what happens if the wealthy leave? And will the wealthy actually go?

The truth is that I've been hearing these claims about the wealthy leaving since the 1980s.

So far, there's very little evidence that anybody goes. In fact, I can think of very many wealthy people who said they'll go, who never did.

So what's this all about?

Or is this all just bluster?

Remember that although the wealthy like to think that they are different to you and me, at core, they're just human beings. And at core, they really don't want to leave their homes, with which they're familiar. Nor do they want to leave their families, who are probably pretty much all around them, because that's true of most of us, and they definitely don't want to leave their culture, whatever that might be, even if it's just defined by the golf club of which they're a member.

And remember that the rich hate change as much as most people do. It's not by chance that most people live in the area where they're born. We all have a natural affinity to a place in the world, and by and large, that's not far from where our parents brought us into this world, and as a result, most people hate having to move, and that's as true of the rich as it is of everybody else. They might like wealth, but they don't like wealth so much that they'll give up being normal human beings completely.

So in truth, if we take this fact that they have strong ties to places, only a small fraction of the wealthy would ever in reality move as a consequence of tax.

Now, let me give you a case study to demonstrate this point.

In June 2025, the Henley Private Wealth Migration Report, which has been produced for years by a one-man band company located somewhere, maybe in Henley, maybe not, said that 16,500 millionaires are expected to leave the UK in 2025, taking £66 billion in investible assets abroad with them. The report said each person would, as a consequence, leave with exactly £4 million, which immediately makes you think that the figures within it are a little spurious.

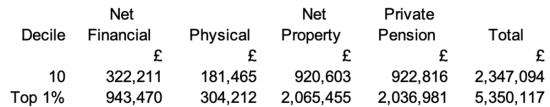

But let's have a look at the ONS data on the wealth of the top 10%, which I've referred to in earlier videos in this series. That data shows this. The average person in the top 10% of UK wealth has just over £2 million of wealth, £2.3 million of wealth in total, of which almost £1 million will be invested in their property.

If a person's in the top 1%, they'll be worth over £5 million, and over £2 million will be invested in their property.

So either the Henley people are saying that it is the ultra wealthy who are leaving, or more likely, because I don't think that many ultra wealthy people are going to leave, they're saying that some people towards the top end of the top 10%, but not necessarily all in the 1% will be going, and if we apportion these numbers, they're saying that maybe 16,500 people might be leaving out of a total population of wealthy people to whom they're referring of, maybe, 2 million.

Let's put it in perspective: that means fewer than one in a hundred will go. In fact, roughly one in 140.

That's at the same time as we're expecting an influx of wealthy people from the USA, who can't stand Donald Trump with good reason, and what they're talking about is what looks like a normal year of movement for the wealthy, when some of them will inevitably retire to the sun, or take jobs abroad, or whatever else it might be, but there will always, of course, be some fluctuation.

There is absolutely no evidence at all in the data that this company put forward, which has been used by those on the right-wing to claim that any idea of a wealth tax is going to send the UK into deep and permanent economic decline, is true. It's simply not the case.

But let's also look at what the wealthy have.

Let's look at that chart again. The top 1% are perhaps the group who are most interesting here, and why not, because they're the ones that everybody seems to want to talk about, and note what they have.

Their wealth can be split, as can most people's, into four broad categories.

They've got physical property, that's the things around their home, and supposedly they're worth, on average, around £300,000 in this respect, because they have very many more expensive cars than we do, and they might have a yacht or something else, but whatever it is, they've got £300,000 worth of that, and I'm not disputing it. If they leave the UK, they can take those things with them, but try living for a long time in a country that drives on the right with a right-hand drive car, as we do, and you'll find you probably don't want to take your cars with you.

You might even find that your yacht isn't very welcome either, because they might charge you VAT on importing it.

So, all things considered, there are problems about taking that physical wealth when you leave the country.

You can't take your house with you.

I hate to tell the wealthy this, but if they leave the UK, they won't be taking their house. It will still be here.

So, as a country, do we need to worry about the wealthy leaving if their property's left behind?

What's the worst that can happen? The price of very expensive properties might fall a bit, and you never know, that might mean that the price of all properties might fall a bit, and there may be no harm in that.

But let's also look at the other assets that they have. Their pension fund will be a UK-based pension fund. Can they take it with them? No, because UK Law won't let them, so that's going to stay here as well.

And what about their cash, all £900,000 of it, or cash plus investments, if it's split into a group of assets. Are they going to take those with them?

Well, they will claim they are, but if they're going to take the money, they've got to find someone to buy it because they're going to need euros or dollars, whichever country's dollars we're talking about, instead of sterling. So actually, the pounds that they have will stay here. They'll have just bought a different currency, and that's it, that's the net outcome. We will not have any fewer pounds in the UK as a consequence.

And if we talk about their investments, if they've invested wisely, they've probably already spread their assets outside the UK, so those that are in the UK, will probably stay here.

In other words, the real point is this. They won't be taking the vast majority of what they own with them because it's based in the UK. It is fixed. So we don't need to worry about the economic consequences of their threat to leave, and that they're going to take their disposable wealth with them, because in most cases, they can't, as a matter of fact. That wealth will stay here in the UK. It will just be under the ownership of other people, and that's not a problem at a macroeconomic level.

In other words, we can dismiss the threat. But let's also just look at something else.

If they go to a tax haven, which is the only place where they might head where they can claim they'll pay less tax than in the UK because, frankly, they get a remarkably good deal in this country at present, they're probably going to find that they're still going to be paying tax on a lot of their income anyway, because, we don't have double tax treaties with most tax havens, and therefore, for example, their pension income is still going to be taxed here.

Now, that's not true if they go to an OECD state, but even so, in that case, they're going to be taxed more than here at their destination.

So why are they going in that case? What's clear is that if they're going, despite paying more tax, they aren't leaving because of tax. They can't be. This then reveals just how nonsensical this claim is that people are moving with regard to tax and tax alone, because quite simply, there's very little to be done in the way of a tax deal that people can get by leaving the UK.

The wealthy might move, but very few of them actually do, and it's no big deal because most of their wealth is not portable.

And what happens if they do go anyway? Let's just consider that for a moment.

House prices, as I've noted, might fall.

The value of the pound might also fall if they sell large quantities of their currency when they leave, although, let's be totally honest, this is very unlikely, and if the pound did fall, that's not a disaster because it means our exports become more competitive and therefore we might get economic growth.

And what is more, and I make this point very loudly and very clearly, entrepreneurs in the UK might get a chance after all, because the wealthy try to keep them out of markets, because it's by maintaining barriers around markets that the wealthy keep themselves wealthy.

So we might have a more vibrant economy as a consequence of the wealthy going. There might be a little bit of disruption, but frankly, the idea that there'll be a collapse is completely ridiculous.

In fact, there's only one part of the UK economy that might be worse off as a consequence of the wealthy leaving , and that's the City of London, and frankly, it needs to shrink. It's too big for the size of the UK economy and is squeezing out everything else, so let's not worry about that.

We gain, in all likelihood, as a consequence of very wealthy people leaving the UK.

There will be less wealth hoarding, but there will be more productive work.

There'll be fewer basement diggers in Kensington, but there will be more people available to build hospitals.

We will free up skills and resources currently dedicated to the whole market of conspicuous consumption, but we will end up with people working on meeting real needs in our society.

And we could see a release of entrepreneurship because people will not be oppressed by the wealth of the already wealthy.

In other words, the chance for people to get on in our country could well rise if the wealthy go.

The wealthy are welcome to leave us, but let's be clear, they can't take their pensions, their houses, and much of their financial wealth with them anyway.

They won't be taking jobs away because if they own businesses in the UK, those businesses won't relocate, and their properties, which are the basis on which so many people claim that they create jobs because the handyman, the builder, the decorator, the taxi driver or whatever else, will still be servicing the new owners of that property.

And they're not entrepreneurs, so we are not at threat as a consequence of them going.

The simple fact is, if the wealthy went, we might get some redistribution that creates more economic activity.

It's only a tiny number of wealthy people who will ever leave the UK. I go back to a point I made earlier in this video. We all like to live in the place that we know, and the wealthy are included in that group, very largely.

So let's be realistic. A tiny number of people might go, but if they do, we won't be worse off. Let's stop worrying about this nonsense. It's a fabrication put forward by the media to try to protect the wealth of the wealthy, and the wealthy own the media that promotes the story.

Let's be clear about that. So it's time to ignore the threats. It's time to get on with the action. We need to tax the income and gains of the wealthy more to redistribute wealth in our society, because then we'd all be better off.

Poll

Will the rich leave in any significant numbers if the UK increases taxes on them?

- Yes to 2, 3 and 4 (43%, 117 Votes)

- No (32%, 87 Votes)

- We'd be better off if they did (13%, 34 Votes)

- I'd pay for their tax to the airport (8%, 21 Votes)

- Yes (4%, 11 Votes)

- I don't know (1%, 2 Votes)

Total Voters: 272

Previous videos in this series:

The Wealth Series introduction: Do we need the wealthy?

Wealth Series 1: What is wealth?

Wealth Series 2: Who are the wealthy?

Wealth Series 3: Why are the wealthy so wealthy?

Wealth Series 4: Why are the very wealthy so very wealthy?

Wealth Series 5: What are the wealthy worth?

Wealth series 6: Wealthy, or worried?

Taking further action

If you want to write a letter to your MP on the issues raised in this blog post, there is a ChatGPT prompt to assist you in doing so, with full instructions, here.

One word of warning, though: please ensure you have the correct MP. ChatGPT can get it wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

If we did start to get a significant net loss in high net worth individuals from the UK, I suggest that the potential impact on the prices of Nice Hices in Haslemere might be such as to discourage some of those remaining as there UK property assets decline in value.

I’ve seen those hices. Not for me, thank you!

Well said.

In truth, the rich need the UK more than we need them because the state currently looks after them better that it does the rest of us.

“I’d pay for their tax to the airport”

At first I thought that was a typo. Then I thought a Freudian Slip. Maybe it was intentional

In any case – what would be least expensive?

🙂

We have been pursuing a policy of recruiting the rich to these shores for decades now. If that was such a good idea, why are things so bad now?

Dan Neidle says different to you and many wealthy will leave and are able to take the entirety of their wealth with them. Maybe you dont know as much as you think you do.

Politely, you are making a crass comment, and Dan is taking ultra microeconomics and I am doing macro. But you obviously can’t spot the difference. As is the case with most people, Dan seems to not even know macro exists.

Peter,

Consider this: people can only become rich by accumulating a share of other people’s wealth so surely the more rich people leave the better off the rest will be? We might lose some money now but getting rid of the parasites at the top of society seems like a beneficial move in the long term.

Of course removing them would be pointless if we continued to allow unrestricted private wealth accumulation because another layer of parasitism would soon form over society. So it seems to me that some sort of wealth restriction mechanism would be needed as well…

I find it ironic that some owners of the MSM, whilst apparently based in the UK, are, for tax purposes domiciled overseas. Yet they are amongst some of the loudest promoters of the notion that the wealthy will leave in drones. Perhaps we should turn the mantra heard at the time of the war of American independence on its head and campaign for “No Representation Without Taxation”?

I agree with most of what you say, Richard, but it is possible to export a pension scheme at any age, to a “Qualifying Recognised Overseas Pension Scheme” or QROPS, see https://www.gov.uk/guidance/check-the-recognised-overseas-pension-schemes-notification-list

Also once someone is over 55 and has lived outside the UK for four tax years, it is possible to get an NT tax code then close the UK scheme. What to do with the fund depends on the country of residence, as it may or may not tax the scheme closure. I have dealt with two such cases, transferring the pension assets to personal accounts. It is a bit messy.

Ok. I stand partly corrected, but also note all your caveats

We saw during the pandemic who was vital and who was not. It wasn’t millionaires and billionaires and the idle rich and for the most part useless politicians issuing contradictory and confusing statements and ballsing things up, it was the supermarket workers, delivery drivers, Drs and nurses, care workers, fire men, the police and all kinds of ordinary people caring about others. If the rich had left then would we have noticed?

It makes me angry that the people who benefit most from Britain’s wealth and infrastructure give back the least. Yet if there’s a fire, that tax dodger wants fire engines, if there is a burglary, the millionaire wants police, if there’s an accident on the motorway that rich person wants an ambulance and all those conveniences and necessities that make civilisation and modern society rather safe and pleasant. They are hypocrites the lot of them! Tax reform and wealth redistribution now has to be on the agenda of the UK and the rest of the Anglophone world. It may just save society.

I am tired of living in a divided society where a majority of people cannot get a dentist or hospital appointment, bills rise and we get less and less and our politicians and political parties seem hell bent on doing the very things most of us don’t want, things we never voted for and which they have lied again and again.

Again, I fear it is not too late and wiser heads in power or behind the scenes may change course, because if they don’t I think we are heading for some kind of collapse or a number of collapses. If we don’t I will stand corrected but the way they are all doubling down and ignoring the army of elephants in the drawing room does not give me hope. Like an Old Testament prophet pleading with society and the king and the rulers of society I would plead and beg them to step back from the brink and the discredited economic neoliberalism that is destroying the fabric of UK society. Heed this warning.

Succinctly put!

[…] Wealth series 9: What happens if the wealthy go? (video) […]