There is a report in the International Accounting Bulletin this morning that suggests:

The UK's HM Revenue and Customs (HMRC) has reported that US companies may have underpaid taxes amounting to £8.8bn ($11.8bn) in the previous financial year, according to UHY Hacker Young, a national accountancy firm.

This figure marks a 57% increase from the estimated £5.6bn underpayment recorded the year before.

US corporations represent the largest share of tax underpayment among foreign entities, contributing to 46% of the total £19bn in tax underpaid by all international companies operating in the UK.

This data is fascinating because it directly contradicts a great deal of data in HM Revenue & Customs' own tax gap information on the corporation tax gap.

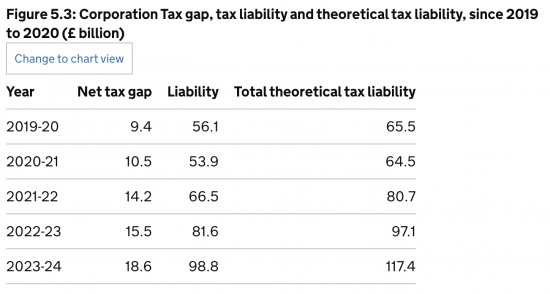

With regard to corporation tax, they say this gap is as follows:

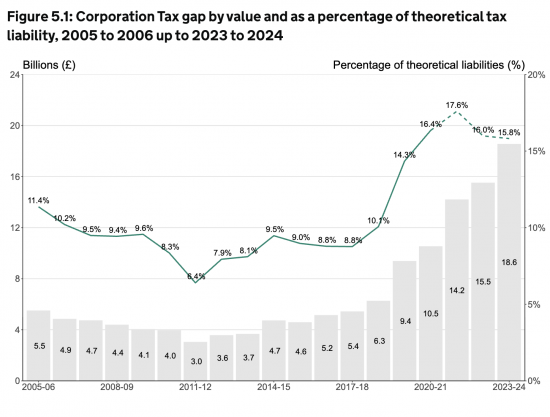

They then admit it is at record levels:

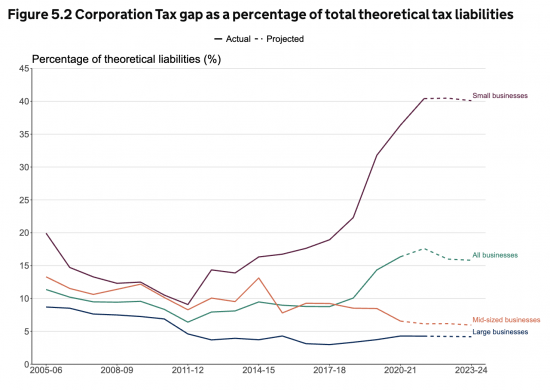

And they explain the gap by type of entity as follows:

But if the Hacker Young data is right, and they have a long history of extracting data from HMRC via Freedom of Information requests, then all this corporation tax gap data is nonsense.

If, as is reported, US companies have underpaid by £8.8 billion, and they represent 46% of the loss to transfer pricing abuse, this means that the total loss to this case is most likely £19.1 billion.

As the International Accounting Bulletin report notes:

Some analysts have suggested that these companies are minimising their tax obligations in the UK by reallocating profits to jurisdictions with lower tax rates, such as Dublin.

UHY Hacker Young pointed out that a prevalent strategy used by these firms is known as ‘transfer pricing'.

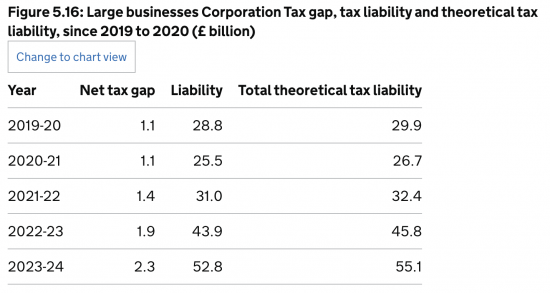

In their tax gap report, HMRC suggest that the value of the large business tax gap (and large businesses are the type of entity that almost invariably are part of multinational corporations, and so undertake transfer pricing) is as follows:

I think it is safe to assume that no more than half of that stated gap is due to transfer mispricing, so let me value that at, say, £1.1 billion, and then note that the obvious conclusion to draw is that the large business tax gap is understated by £18 billion as a result.

This increases the large business tax gap to £20.3 billion, or 36.8% of theoretical liabilities, as stated above. If, however, we assume HMRC also understates theoretical liabilities, as I think this implies they must, the loss becomes 27.7% of theoretical liabilities.

Importantly, this makes the large business corporation tax gap bigger than the small business corporation tax gap, which is £14.7 billion. They have placed much emphasis on that small company figure in their recent reports on this issue. They appear to have ignored, or misstated, the bigger issue.

Correcting for this misstatement then means the total corporation tax gap becomes £36.6 billion, or 27% of total corporation tax owing.

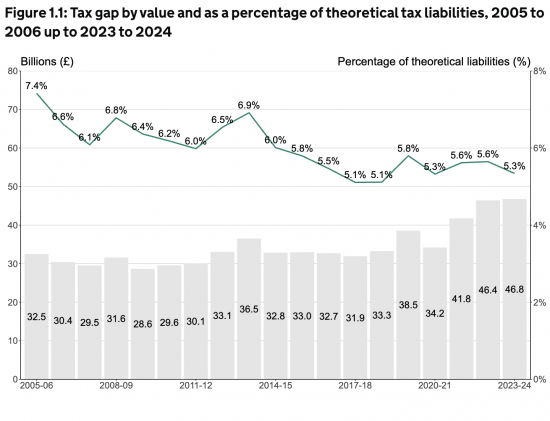

It also increases the overall tax gap from £46.8 billion to maybe £64.8 billion, because this claim by HMRC is obviously wrong:

That means the revenue lost is not 5.3%, but something like 7.3%, which somewhat blows apart their claim of continuing compliance improvement. But, to put it another way, it also means HMRC understate the tax gap by 28%. I think they might be unamused if a company did that with regard to its profit reporting.

But what it also means is that:

- We have good reason to doubt the validity of HMRC's claim about tax gap data, as I have always suggested.

- We also have very good reason to doubt whether HMRC has got the management of transfer pricing under control, for which there is now no excuse when it has country-by-country reporting data to assist it with this task. I should add that this is a subject I know something about: I created country-by-country reporting.

- We should have serious doubts about a public authority that chooses the information to include in its public reporting to suit its own agenda.

This last point is, perhaps, the most important. I have, for many years, pointed out that the definitions of tax loss included in HMRC's tax gap data have been open to question. In particular, HMRC has used a spectacularly inappropriate definition of tax avoidance to limit the scale of recognised losses attributed to this cause. Basically, they claim that unless an activity is considered to be tax avoidance under the Disclosure of Tax Avoidance Schemes (DOTAS) rules of 2004, they can ignore it for the purposes of calculating the tax gap. This will be their excuse for ignoring this transfer pricing abuse, because transfer pricing is not required to be disclosed under the DOTAS rules, and so, rather conveniently, falls out of the disclosure requirement for tax gap reporting purposes.

So, too, incidentally, does the incorporation of companies with the purpose of avoiding national insurance charges fall out of tax gap reporting rules because that, too, does not require disclosure under the DOTAS rules.

Likewise, the use of umbrella companies to avoid tax also falls outside the scope of reporting for this purpose.

In other words, tax gap reporting rules are created in a way that is designed to ensure that the tax gap is seriously, and very obviously, understated, giving a false impression of the result of tax loss as a consequence of tax avoidance activity.

This is precisely why I have said, over many years, that HMRC have published what I consider to be misleading information, and I continue to hold that view.

So, the question is, when will HMRC tell us the truth about the true scale of the tax gap, and when will the government, as a result:

- Invest appropriately in tax enforcement and collection in the UK.

- Properly regulate companies in the UK.

- Close the real black hole in their finances, which is not created by people claiming disability benefits, or by families having a third child without state consent, or even by local authority librarians stocking too many books on their shelves and schools spending too much on pencils, but is instead caused by the UK-based business community not making payments of the tax that they owe?

These are questions requiring answers.

I will be sharing this post with parliamentarians.

Taking further action

If you want to write a letter to your MP on the issues raised in this blog post, there is a ChatGPT prompt to assist you in doing so, with full instructions, here.

One word of warning, though: please do make sure you have got the correct MP. ChatGPT can get it wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

American-owned companies earn from the UK the equivalent of a third of our total GDP, mostly through extractive, rentier capitalism. Almost every commercial transaction in this country is facilitated by an American company, such as eBay, Amazon, PayPal, or Oracle, to name a few, which takes its cut of that transaction. Brexit was American-backed, not Russian, as some suspected, and it was likely because American companies didn’t want the scrutiny of the EU to contend with. Look at the fine they issued to Apple in Ireland. The UK seems desperate to attract this foreign investment, but what value are we getting from it, if not tax revenue?

Might you show how you think they earn a third of our GDP?

I suggest that is impossible.

They might manage a third of our GDP – but I also think that impossible.

Your data would be interesting then.

It was from a book called Vassal State by Angus Hanton. I was remembering off the top of my head, but upon going back to check, the author says that the information he got from the American Inland Revenue Service records $800billion in sales per year from businesses operating in the UK. Our GDP is £2.5trillion, so a large chunk of that is American companies, but not quite the third of GDP my hyperbolic brain conjured up. Part of an American takeover also involves a lowering of tax liabilities. Many of these companies are also digital platforms, which are essentially rent-seeking businesses. As for the US backing of Brexit, it wasn’t overt, but the Heritage Foundation was all for it, which says a lot.

Thanks

I think the data is seriously overstated.

And remember gross sales are not comparable to GDP, as all steps in a supply chain contrbiute to gross sales but only net consumtpion does to GDP.

HMRC has always been too timid to tackle transfer pricing effectively. The unwillingness to litigate in order to establish where boundaries lie has meant that business (ably assisted by its incredibly well-rewarded professional advisors) has continuously moved those boundaries in its favour. My experience is that American big business is always reluctant to pay tax, but if it does have to pay it, it prefers Uncle Sam to be the recipient.

My recollection is that IR/HMRC used to be quite well resourced to tackle transfer pricing abuse, with very capable teams of international tax specialists as well as special investigations offices of one sort or another. Other large business and network inspectors had regular refresher training delivered by the same specialists. I rather doubt if this is the case now.

It has always been under resourced in this area

I suspect it still is despite having CBCR

There is no excuse for that. Disabled people are made to suffer as a result