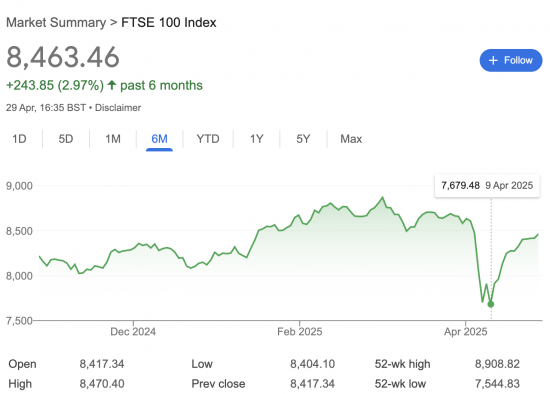

This is the FTSE 100 chart for the last six months:

As brokers, Hargreaves Lansdown, noted in a mail they sent me (and others) last night:

The FTSE 100 has found its mojo to notch up best winning streak since January 2017.

The Trump trade shock has subsided and with tariffs on the back burner for now.

Optimism is pulsing through the markets, helped by a raft of corporate results surprising on the upside.

The top gainers are a mixed bag, demonstrating how the new-found confidence is lifting multiple sectors. The Footsie surged in the last hour of trading, marking the twelth consecutive session of gains.

While some wariness about the future direction of US trade policy remains, for now investors are adopting a glass half full attitude, hopeful that the worst of the tariff fears won't materialise.

Eyes are on negotiations springing up between the US and its trade partners, even though both China and the US seem to be waiting for each other to take the initiative and commence talks.

What to make of this? Try the following.

First, markets are stupid enough to think Trump is not going to return to the tariff issue.

Second, they think that as a result, there will be no more disruptions from Trump.

Third, they think the harm already caused will have little or no further consequence, even though substantial tariffs remain in place.

Fourth, they are presuming the US will survive as an economy despite the assault on its governance structures from Trump.

Fifth, they assume that the collapse of government he is trying to create will have no consequence for markets.

Sixth, they think that the Trump effect will not be contagious, and there will not be similar assaults on government elsewhere, including in the UK.

Seventh, they are ignoring the collapse in consumer and business confidence that suggests consumption and investment will fall sharply.

I could go on, but you get my point. This is a wholly irrational market acting in a wholly irrational way because it appears to focus solely on the news from today. The idea that it might be anything else, and that (as market proponents claim) it takes all market information into account when setting prices, is quite absurd.

The consequences are what worry me. We use this utterly irrational market as the basis for pension provision in the UK. That is the really scary thing. Our politicians are so stupid that they think this is the place where value is both created and determined, when neither is true. Ponzi schemes always fail. This one will.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Is this style of language typical?

Might it be a piece of text with remarkably absent analysis and critical thinking?

Ditto a piece of text more like advertising than serious review?

Does it matter?

The chart is the key data

All the conclusions flow from that

The quote just highlights the stupidity

Fair points, but could it be that you have made a category error (or am I being nit-picking?):

“First, markets are stupid enough………. to think

Second, they think ……………….

Third, they think ……………”

Markets work on emotion, the herd, go with the flow (a favourite of day traders). There is a pretense of analysis and reflection – but in the main it is mostly driven by emotion not thought.

I agree 100% with the final line Apart from this blog, I see no discussions with respect to alternatives to “markets”: for funding companies, places for pensions to invest in etc. There is some ad-hoc stuff but it is mostly very small scale & I rathert dought that the current LINO crew have the time/inclination to engage with such considerations.

I know what they do

I am highlighting the con trick implicit in the claimn that they do otherwise

And thanks…

The real tipping point will come when the world’s population starts to decline, which will probably be significantly sooner than the official UN projections, perhaps even before the middle of the century. Once that happens the market’s Ponzi schemes will collapse because future growth will obviously not be possible.

https://www.healthdata.org/news-events/newsroom/news-releases/lancet-dramatic-declines-global-fertility-rates-set-transform

A good comment, thanks.

Richard is highlighting the absurdity of markets and their inappropriateness for pensions, and I wholeheartedly agree.

It is an interesting question when the Ponzi scheme of the stock market will collapse. Clearly it will not survive more money being taken out than goes in. That will obviously happen before the world population reaches maximum, which, as you say, may be as soon as 2050. But my guess is it will collapse before then. Firstly, the population does not have to reach maximum before collapse happens. There just have to be more people taking money out than paying in and that may happen years before population max. Secondly, the world population may not be a good metric. Not every nation in the world pays in to stock market based pensions. Those that do come more from the “developed” world. In the developed world populations are plummeting. Fertility in S Korea is below 0.8 (with 2.1 being approximately replacement level) In Europe fertility is around 1.5, 1.4 in Norway and Sweden, 1.2 in Italy. Japan’s is about 1.25, the US’s 1.6. So population in the developed world is shrinking much faster than the world population.

The stock market Ponzi scheme seems likely to collapse well before 2050. 2040? As the Hemingway quote goes, this will happen gradually, then suddenly.

This is very difficult for the younger generation who are in the first part of their working lives. They want a pension but the only ones available are stock market based. They have no choice, but they will be in big trouble if the collapse happens before they retire (or even before they die), which is likely.

I have warned my children about this.

Big changes are coming.

Thanks

Population decline is something that isn’t spoken about enough. Having children can be unaffordable for many families. The fact that “the system” now requires both parents to work means they are subject to IMO unfair practices from many childcare providers. For example, on paper the government offer 30 free hours of childcare per week – but what isn’t mentioned is that this is term time only (38 weeks out of 52) – why is this the case? For those lucky enough to work in a school, they are often forced to pay for care during the school holidays even though they don’t usually need it. Many providers split the 30 hours thinly forcing parents to pay supplementary fees per day.

Maybe this is required to keep these businesses afloat – I don’t know but what I do know is, if governments have enabled circumstances that forces society to work as much as possible, then they need to do more to support parents to actually go to work.

Even after nursery, children are required to go to school if they’re not home schooled but then the provisions before school starts and after it finishes are also very costly and sadly for many families, can put them into difficult financial situations.

The short sightedness of successive western governments is what is causing low birth rates IMO. I know may people will argue that society shouldn’t pay for peoples’ children but then it is the continuation of the human species that is beneficial for all.

Much to agree with

If you want to know about population decline read: The Human Tide by Paul Moreland. Fascinating and frightening.

On Al Jazeera I have just seen David Lubin of Chatham House say that Vance and others are arguing the reserve role of the dollar has created a form of Dutch disease where the success of one part of he economy drives up the value of a currency. This has a negative effect on other exports and this is why Trump may be acting as though he wants to end that role. That might make American manufacturing more competitive and rebuild US industry. The implication is that Trump only seems to think in terms of trading goods, not services.

The other analysts thought the role was too useful.

I have argued that in the military field the US has made poor strategic decisions despite having effective forces and well informed analysts.

It seems to me their economic strategy is going the same way. Incoherent and even contradictory.

They are right re the problems caused – there are some, but they are the sort politicians elsewhere would love to have.

Agree ntirely, Richard, and thanks to Mike for adding his valuable insight, because in fact we (the public) are supposed to believe that the people behind all this are actually very, very, intelligent.

But just to add an actual example of what’s really going on on the ground. Yesterday evening I was catching up on the OSINT people I follow (open source intelligence), several of whom are in the US and as well as collecting data on Ukraine also publish other interesting stuff they come across, and saw reports of what’s happening in US ports now tariffs have stifled trade from China.

As the report pointed out, hundreds/thousands of dock workers jobs are now under threat; as are those of haulage firms, and delivery firms (UPS in the US announced plans to lay off up to 20,000 (twenty thousand!) driver due to the collapse in deliveries – particularly from Amazon); and warehouse workers in distribution centres; and finally, staff who work in retail.

So not such a happy picture, is it. What we can be sure is that by Trumps 150 day in office, the situation in the US is going to be whole lot worse than it is now – and you don’t need to be an analyst working for Hargreaves Lansdown, or any other trading company to understand that. Just use some brain cells and spend 20 minutes thinking about how the SYSTEMS that underpin our economies and societies actually interlink and operate.

Agreed

I have read the Reuters report on UPS. This is complex, but it seems to be driven by a fall in demand for Amazon deliveries than anything else. The Teamsters are not happy.

From what I read yesterday on US news sites/OSINT, Amazon was UPS’s biggest customer.

On a related point, you’ll no doubt have also spotted the story that Amazon were intending to add a number to the price of what they sell so that customers could see how much was down to tariffs. After calling Amazon and Bezos all manner of names Trump eventually rang him and Amazon then denied that the proposal was anything but ‘an idea’ and Trump went back to calling Bezos a nice chap. This is how industry and commerce is run in the US now – and the markets still think this is all positive? Bonkers!

Agreed, and thanks

UPS are closing 73 depots

“Trump eventually rang him and Amazon then denied that the proposal was anything but ‘an idea’ and Trump went back to calling Bezos a nice chap.”

I have no clue why Jeff Bezos would fear Trump. If anyone has any ideas, please chime in!

So markets’ response to an immediate and catastrophic event is…ignore it and carry on as normal.

No wonder markets fail to price in imminent climate collapse given the collapse is catastrophic and (in their minds) distant.

Is this chart demonstrating that collectively big investors don’t have a better place to invest? If they could they would.

Suggest that too big a proportion of wealth being invested by a few rather, rather than in the hands of the many – and spent. Assets classes can all end up historically ‘overvalued’. I’m concluding that there is latent demand that would enable Governments to borrow more from savers and investors, but don’t.

There is a video coming on this

Remember, most of this is pension fund money

Thank you and well said, Richard.

There are skeptics in finance. One notices they tend to be at small firms, often owned by themselves.

Some giants, too. Two former employers began distancing themselves from the US years ago, not just because of their inability to compete with the US giants, but their client bases and foot prints made association with the US a liability. That distancing began under Trump’s first presidency, but the causes go back many years, i.e. precede Trump.

This comment my be born out of ignorance…

Is it the case that those that work within the stock market system are happy primarily with movement. Up or down, buying or selling presenting opportunities for cashing in?

Yes

Arbitrage of movement is what suits them

Thank you.

Banking, not trading, is what I tend to support.

Trading thrives on volatility.

It was noticeable that in the years leading to the Brexit referendum and even some years after, some investment firms hired political strategists. That was a cover. These strategists had been leading Brexiteers and had media and /or political connections. The firms knew in advance and even encouraged market moving news so as to profit.

There are rules to prevent market abuse, but, using proxies, one can evade them. In any case, remainers and the authorities weren’t bothered. They may even have been asleep.

Years later, some of the above hosted Kwasi Kwarteng to celebrate his budget. That was the evening of the budget. One even said the budget had not gone far enough and looked forward to celebrating more Kwarteng budgets.

I will spare Richard the libel risks by not naming the firms and individuals.

Personally I take it as a sign greedflation/profiteering/rentierism is alive and well. Hence the raft of good corporate results buoying the market.

How long that bubble can last I don’t know, given the growing number of families in temporary accommodation – many of whom have been failed by our economy.

The economy is not working for the common people as it should be.

Agreed

With regards to the seventh comment above;

“Seventh, they are ignoring the collapse in consumer and business confidence that suggests consumption and investment will fall sharply.”

From Insider:

Several tech billionaires attended or donated to Trump’s inauguration in January.

Four of the richest have lost a collective $194 billion in wealth since Trump took office.

Tech leaders who attend Trump’s inauguration have also seen declines in their company’s share price.

Elon Musk

Net worth on January 20: $449 billion

Net worth on April 28: $335 billion

Loss: $114 billion

Musk, the tech billionaire who’s gotten closer to Trump more than any other as an advisor, has seen the greatest decline in wealth, though he remains the world’s richest person.

Musk’s work with the White House DOGE office led to swift backlash and a wave of protests against Tesla. The electric-vehicle maker has been struggling, with its stock price down nearly 25% this year.

After Tesla reported lackluster quarterly earnings last week, Musk announced he would be stepping back from DOGE in May, spending just one or two days a week on government matters. He has consistently defended his work with the White House to eliminate waste and fraud in government.

Jeff Bezos

Net worth on January 20: $245 billion

Net worth on April 28: $209 billion

Loss: $36 billion

Bezos’s wealth, most of which is tied to stock in Amazon, the company he founded, has declined sharply since February.

Analysts have said Amazon is especially at risk of being negatively impacted by Trump’s trade war, including the 145% tariff on China, due to the number of products sold on the site, either directly or through third-parties, that come from the country.

Some Amazon sellers have been raising prices on goods like appliances, snacks, and electronics, though the company has said it represents a small fraction of the total amount of goods sold on the site.

Mark Zuckerberg

Net worth on January 20: $217 billion

Net worth on April 28: $195 billion

Loss: $22 billion

Zuckerberg may have had the worst relationship with Trump compared to any other tech billionaire prior to the election. Trump had repeatedly lashed out against the Meta CEO on Truth Social and suggested he should be investigated or jailed after Facebook temporarily banned Trump’s account following the January 6 Capitol riot.

Meta, the primary source of Zuckerberg’s wealth, has been fighting an anti-trust lawsuit brought by the government that has not gone away under Trump. Zuckerberg earlier this month sat for three days of testimony after the antitrust trial opened.

The Meta CEO testified for more than 10 hours and was grilled by the FTC’s lead attorney.

Jensen Huang

Net worth on January 20: $117 billion

Net worth on April 28: $95.4 billion

Loss: $21.6 billion

While Huang did not attend the inauguration, Nvidia donated $1 million to the inaugural fund�. Huang’s wealth, a majority of which is tied to Nvidia stock, has also dropped since January, when he attended the inauguration.

Nvidia stock has fallen over 21% year to date, with the company facing several setbacks that include Trump’s tariffs, as the company sources a majority of its chips from overseas, primarily Taiwan.

The company also said earlier this month it expected to take a $5.5 billion hit on its first-quarter earnings as a result of the Trump administration’s restrictions on its chip exports to China.

The USA consumers and USA businessmen have already lost confidence.

Thanks

[…] There is a footnote to add, building on a theme noted yesterday on the stupidity of markets. […]