There is an article in The Guardian this morning that rather half-heartedly seeks to explain why energy prices are so high in the UK.

As it explains, without adequate analysis being applied to market exploitation, this is because the price of electricity is set on the basis of the highest marginal cost to produce it here in the UK, meaning that the price is almost always determined by the cost of producing electricity from gas, although only forty per cent of electricity is usually produced in that way. The result is that the rest of the electricity consumed in the UK is sold at a massive profit margin. We are ripped off, in other words, as a result of official policy. This is something I have been writing about here for over years now.

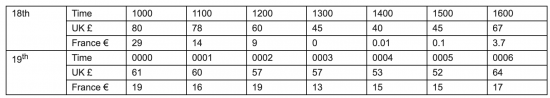

Brussels-based energy expert, Mike Parr, wrote to me about this over the weekend, supplying this table:

As he explained:

This is for the period 18th and 19th April. Selected hours (24hr clock)

The numbers UK and France are £ or € per MWh for day ahead wholsale electricity prices. During the time frames shown, the interconnectors, UK – France were running at close to full capacity (+75%).

Finance companies, such as Goldmans, Morgan Stanley etc with “prop-desks” and with access to interconnector capacity, will have bought in France at – e.g. €29/MWh (18th April @ 1000hrs) and sold in the UK at £80/MWh (a small cost for carrying the elec would be levied). Including the carry cost the margin would be +/- £45 per MWh.

Given the way marginal markets work, it is likely that the traders will bid in French MWh at something less than UK day ahead rates – probably a few £ss below the gate closure price. So if the gate closure looked like £80, the bid would be +/- £75.

There is an argument to be made in that case that the UK gov should have 100% access to the interconnectors and be the only one that can trade. It could then make some decisions as to what is in the best interests of UK citizens.

For example, given the current marginal market structure, this predicates profit maximisation and re-distribution.

Market reform and market split would point to using the French prices to drive down composite wholesale prices.

None of this is on the horizon of the current gov.

Mike is right. None of this, which would be fundamentally in the best interests of the UK consumer, is on the government's agenda. It is not even close to it, probably because none of them would understand it, and their Oxford PPE degrees would defend the status quo.

This is why we're in a mess.

We have dogma-driven policy.

We have governments made up of politicians who do not understand the consequences of the dogma they subscribe to.

People do not come first.

And few journalists have the time to work out what is really going on, or make the case against it.

Meanwhile, we are taken advantage of by a structure that is guaranteed to deliver that outcome and excess profits to traders in the City.

It's all very cosy for a few, and the exact opposite for everyone else.

When will they learn?

My thanks to Mike for the data.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Oh, this hits a nerve — not just because my electricity bill now needs its own GoFundMe, but because it captures that familiar British feeling: being expertly fleeced while a chorus of politicians mutters, “Well, that’s just how the market works,” as though it were a law of physics instead of a human-made scam.

It’s genuinely bonkers that UK electricity prices are set by the cost of gas — even though most of our electricity doesn’t come from gas. It’s like ordering a tap water and being billed for Dom Pérignon because someone else at the table had it. Meanwhile, traders with access to the interconnectors are buying cheap from France and selling high into the UK, raking in profits big enough to keep a yacht in every hemisphere. All perfectly legal. All structurally encouraged. And all defended by a government that confuses economic dogma for divine commandment.

The idea that the UK government could — and should — control interconnector trading is so sensible it almost sounds radical. But that’s only because we’ve been fed the same stale ideology for decades: that the state must step back, and markets must know best, even when they’re clearly rinsing us for every kilowatt-hour they can.

But here’s where a bit of economic realism — call it MMT, call it common sense — could actually light the way.

A currency-sovereign government like the UK’s isn’t some poor pensioner counting pennies in a Tesco Express. It can afford to invest. It can fund infrastructure. It can break up price-setting monopolies and build public systems that don’t treat people like margin fodder.

Instead of letting private traders arbitrage energy across borders for fun and profit, the government could:

Be the primary actor on the interconnectors, using that access to lower prices for UK households, not maximise someone’s bonus in the City.

End marginal cost pricing for electricity, which currently makes every cheap wind and solar watt as expensive as the priciest gas-fired one. It’s rigged. And we all know it.

Publicly invest in domestic renewable capacity, not to “stimulate growth” or hit an abstract target, but because people deserve affordable, sustainable energy.

Treat energy as a public good, not a luxury commodity. Heat, light, and power shouldn’t be a slot machine where everyone loses except the house.

But none of this is on the agenda. Because the people in charge don’t just misunderstand economics — they misunderstand who the economy is supposed to serve.

So yes, it’s warm and cosy… if you’re a hedge fund. For the rest of us, it’s thermal socks and resentment. And the worst part? It doesn’t have to be this way. But until someone in government swaps ideology for reality, it probably will be.

Surely most major UK renewable energy generators are now on Contract for Difference (CfD) payments, and not paid at the highest marginal rate of generators on fossil fuels?

‘market exploitation’ such a good phrase.

The free market: free to exploit us with impunity.

I think you have a typo- i think you mean although only forty per cent of electricity – not gas!

As it explains, without adequate analysis being applied to market exploitation, this is because the price of electricity is set on the basis of the highest marginal cost to produce it here in the UK, meaning that the price is almost always determined by the cost of producing electricity from gas, although only forty per cent of gas is usually produced in that way. T

Not awake this morning….

You’re still a damn sight more awake than useless torylab politicians Richard.

This makes my blood boil. Having recently spent about £11k of our money to replace our gas boiler with an air source heat pump because, guess what, some of us care about the future of this planet I was looking forward to lower energy bills.

Nope, looks like they’re unchanged, because although our gas use has virtually disappeared, our electricity use has gone up and because electricity here is so ******* expensive thanks to this rip off, we won’t benefit financially.

A great encouragement to the public to go green eh? Thanks a lot thatcher and her Tory morons for giving us this crap. And thanks a lot to the useless labour party for not reversing privatisation under Blair or now.

A very good point….

There is a great free app called Electricity Maps which shows masses of data on this subject. Every country that supplies such data, their production, emissions, Mwh prices. Energy flows from country to country. Very informative and shows we in the UK are being fleeced.

Thanks

Is it correct that the price of electricity was nearly zero (no more than 10 euro cents) for three hours on the afternoon of 18 April, from about 1300 through 1400 and 1500 before tipping up to €3.7 per MWh at 1600? For a day ahead I guess there was little demand on a warm spring Saturday afternoon on the 19th but zero?

The price difference giving an arbitrage for traders may go some way to explaining why about a fifth to a quarter of our electricity has been imported for some time. More from the Netherlands and Belgium and Denmark than France right now today.

I gather it is: base load has to be bit rid of

France has just reduced the cost of our electricity by 16.5%. The fixed charge has risen by 2 euros but the savings are clear,

I’ve got a MCA Basic Sea Survival certificate and I understand it perfectly

Now you might CHOOSE not to understand but thats a very very different matter

Which again begs the questions, do the government know this ? if not why not?

Are they stupid? or are they wicked.

Or do they know but don’t care.

Well regardless it’s only 9.07am and I’m already enraged.

Write to your MP…

He or She wouldn’t understand.

Forgive me but this feels and looks a bit like when Enron fleeced California. Is this arbitrage activity?

The market here is distorting pricing in favour of producers because there is no government intervention. We were told by Thatcher that private utilities would not use price optimisation because of competition (or some other bollix).

This is atrocious – there is no other word for it and should be more widely known.

We have been thrown to the wolves. Except they are not wolves, it is ‘people’ called ‘traders’.

This is arbitrage yes.

The difference is Enron hid it and did it fraudulently.

This is happening in plain sight.

Thank you Richard.

Thanks to Richard for posting this.

To give a feel for number (how many £££). UK – FR sub-sea cables have a capacity of around 4000MW. Let’s just assume 75% use (as is the case right now) then 3000MW x £70/MWh (margin – right now FR Euro25 vs UK £90) ) means £210,000 profit for the prop desks. Looking @ what happened on Easter Sunday, +/- 14 hours of this sort of spread = £3million in the pocket. We can argue the numbers up a bit/down a bit but this is how it looks.

It gets worse, UK has connections to Belgim (1GW), Netherlands (1GW), Norway (1GW) …… Taking it all together – I’d be surprised if profits were much less than £5m/day, every day, 365 – so perhaps £2bn/year. Profit. Nice little earner. BTW: I’m not against x-border elec – just that it is citizens that should get the benefit – not banksters.

I understand that the gov’ is mostly listening to traders (Goldmans, Morgan Stanley etc) on how to “reform” elec markets – gosh what could possibly go wrong?

& the cherry on the cake? There is an org representing those that undertake the cross-border trading of elec – they produced a report for the European Commission showing that “social welfare” (an economics concept) due to such trading was very high. I leave you all to draw your own conclusions.

The trajectory of discussions in the UK tend to be on retail prices – & that fine. But if you want to change things, you need to get down and dirty in the engine room of how electricity prices are formed. Suggestion – write to your MP & ask em’ – what are they going to do about banksters profiting on the backs of UK serfs?

Thanks Mike

The ‘social welfare’ is high for the traders – typical of them not to look at the spread of that social welfare though, eh? The Enron traders made millions.

The only obvious conclusion is that they still believe in ‘trickle down’…………………..

There was another article in the G’ which attempted to divert attention away from how is elec priced. It focused on elec theft:

https://www.theguardian.com/business/2025/apr/22/fight-against-britain-billion-pound-energy-heist

As my previous post shows – the finance sector/traders are, arguably, the biggest theives of all – doing it year in year out – quite legally.

In the case of the network operators. Although they don’t have metering in the HV/LV subs – they do in the primary subs for each 11kV feeder.

And this has existed for ……..since the DNOs were founded in 1949. It would not be difficult to do a bit of number crunching to identify anomalies. Why don’t they? ……..a question for Ofgem (& I expect no answer). 2nd or 3rd year computer student and some python programming would get a result. Won’t happen – DNOs far far too focused on profits.

It would help if I wasn’t charged a double daily standing fee ; one for gas and one for electricity which means I pay about £35 monthly before I’ve even used any power.As regards producing enough electricity I understand about a third of it is wasted because of poor infrastructure etc.Is that so?

Mark

Mike?

There are two aspects to electricity “loss”

One is loss due to the resistance of the conductors (& transformers). Circa 5% – 8% is about right (it depends where a load (households) is located relative to a generator, if you are next to a wind farm or solar & it is sunny or windy then losses with be perhaps 3%.

The other loss is due to constraint = too much (usually) wind energy, infrastructure can’t carry it and so output is reduced.

Does all this come to 30% – not. I would not be surprised by perhaps 12%.

If you want to see what UKPN. a network operator says: https://www.ukpowernetworks.co.uk/distribution-network-energy-losses

Thanks

I confess to being a little conflicted on this issue. While so much of our electricity is produced from gas, discouraging energy use seems good for the planet, and high prices encourage investment in renewables. On the other hand, energy poverty, cost of living, etc.

Clearly part of the correct answer is to fix our generation infrastructure (and demand management), which should be a high priority for the Government.

This is a source of continual frustration to me. I was lobbying Government at the time that smart meters were first being specified, asking politicians be more ambitious and build something world-leading, capable of proper demand management.

Living in the Republic of Ireland and just to upset every one, my last electricity bill was about 300 euro for 2 months. That covers lighting and cooking.

That is more than mine here, to be candid

According to Ofgem –

“Under the current regulatory framework, there are two general routes for interconnector investment:

A regulated route under our ‘cap and floor’ regime. This allows developers to identify, propose and build interconnectors, subject to Ofgem approval.

A cap and floor mechanism regulates how much money a developer can earn once in operation, providing developers with a minimum return (floor) and a limit on the potential upside (cap) for a 25-year period.

As an alternative to the cap and floor model, developers can seek exemptions from regulatory requirements. Under this route developers would face the full upside and downside of the investment and would usually apply for an exemption from certain regulatory requirements to better enable the business case of their investment.”

https://www.ofgem.gov.uk/energy-policy-and-regulation/policy-and-regulatory-programmes/interconnectors

This is all about regulating what the ‘developers’ of interconnectors are allowed to charge.

Could Mike Parr, or anyone, explain to me how the above relates to “prop desk” activities?

Ofgem has a list of licensed companies at https://www.ofgem.gov.uk/energy-policy-and-regulation/companies?company_status=6272&sort=title

Should I expect the Ofgem list of licensed companies to include the “prop desk” companies that trade across the interconnectors?

I did stumble upon one oddity – Morgan Credit Ltd, a currently licensed electricity generator in the Isle of Man. It was licensed in 2007, but according to Companies House only registered as a company in 2022 as an ‘overseas entity’. It has no officers and one beneficial owner.

I digress, but I do wonder what Richard thinks with his Companies House hat on?

Part X of the Companies Act relating to overseas companies is absurdly under-regularted. It seems no one cares.

Doesn’t surprise me that nobody cares. Does anyone care about the spider’s webs of companies, groups of companies, Jersey/Cayman Island companies, special purpose vehicles, companies with LLP’s as sole shareholder, Topco’s, Midco’s and Bidco’s that one often encounters when trying to find out who is really in charge of an activity of public interest.

No doubt many of those are said to have ‘legitimate uses’, but I can’t help thinking they have other uses.

But to cut to the chase, who are those “prop desks” – names?

Major banks, in the main

Hi,

Two ‘interesting’, linked, interviews this am on ‘Today’. First with Dale Vince (founder of Ecotricity) in which he pointed out that our overall electricity prices are set by the price of gas, and being very critical of the fact that gas is expensive to us as we have to buy it on the world market. Second, with Ed Miliband, who was about as disappointing as you might expect and who misrepresented Mr. Vince’s position when it was raised with him. He was adamant to the point of gaslighting that Vince had said something other than what I heard him say.

The issue of this thread – the market in electricity – was not mentioned at all, so I have written to Today and the rest of Radio 4’s news programmes with a link to this thread, to prod them into including it in a programme later today. Fat chance, but at least I have tried.

The interviews are at 54 mins and 2h 15 mins into today’s programme, should you wish or have time to check it out (https://www.bbc.co.uk/sounds/play/m002b6zx). Personally, I’m sure you’ve got a lot of much better things to do – like getting on with that book!

I heard him

You are right, Miliband was dire

And as a result the point was missed. and of coruse the BBC interviewers missed the relavnce of that

From the Times Political Editor on X today –

“Ed Miliband signals he is opposed plans for zonal pricing of electricity, which could see people in the north paying less than people in the south

‘My test for any reform is will it cut bills and will it do it across the country in a fair way. I’m not in favour of a postcode lottery on bills. What I do not want to do is somehow jack up bills in one part of the country in favour of another’”

Does Ed not understand that our current system leaves various ‘zones’ paying more than the average?

Also says something when the National Energy System Operator (NESO) is apparently in conflict with Labour policy.

He is happy for Scotland to pay more, of course….