As the FT notes this morning:

Sir Keir Starmer has vowed to slash spending on Britain's “broken” and “indefensible” health-related welfare system, which is costing the government £65bn a year and is on track to hit £100bn by 2030.

As on so much else, Starmer is wrong. Let me offer four reasons why.

First, he is ignoring the cost of Covid and ultra-processed food poisoning, which are the primary causes of the increase in costs. What is indefensible is his refusal to tackle the causes of these issues. It is the government that is broken in that case, not the benefits system.

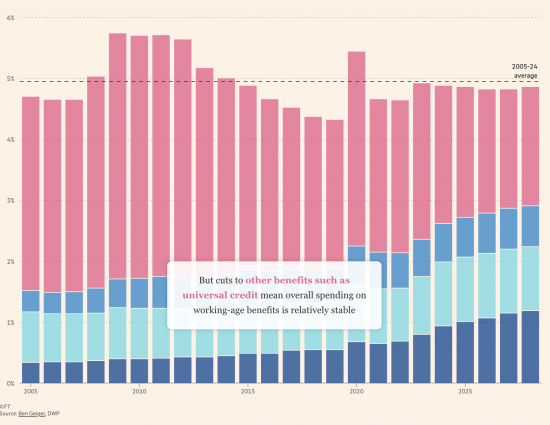

Second, overall benefit costs are in fact stable as a percentage of GDP, because of pre-existing punishing cuts to universal credit. Starmer is wrong to say costs are out of control. They are becoming increasingly mean:

The pink sector is universal credit. The dark blue is disability benefits, the lightest blue incapacity benefits and the intermediate blue care allowances.

Third, it is now estimated that at least one third of benefits due in the UK go unclaimed each year or more than £22 billion. That is what a broken benefits system looks like.

Fourth, as I noted on this blog very recently, but which I will repeat, none of this is necessary.

The FT notes that the 'broken' benefits system that protects the most vulnerable in the UK from harm costs £65 billion a year. They fail to note that this is less than the cost of the subsidy to the savings of the wealthy that Labour is happy to provide to them each year, without fuss being raised.

£5 billion of that subsidy goes to ISAs and £65 billion to pensions.

As I note in the Taxing Wealth Report (page 67):

In total tax and national insurance contribution relief on pension contributions made by the highest tem per cent earners in the UK are likely to amount to £38.6 billion per annum (£13 billion of national insurance and £25.6 billion of tax per annum). The remainder of the population enjoy a subsidy of £28.7 million between them.

In other words, the wealthiest enjoy a subsidy of more than £8,750 per annum on average towards their pension savings each year and the rest of the population enjoy a subsidy of almost exactly £1,050 per annum each based on the number of taxpayers in 2020/21.

To put these figures in context, the basic universal credit allowance a year is £4,416 per annumin 2023/24 for a person over the age of 25 and the basic old age pension in that year is £10,600 per annum, or not much more than the subsidy given each year to increase the value of the pension of the top income earners in the country, on average.

If there is in that case a group in society who need to forego their state benefits, it is the wealthy. Labour is choosing to make the poorest and most vulnerable do so. The question that needs to be asked is why that is the case.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

It’s good to see the TWR being used again.

You are right. This position is totally indefensible.

It is measuring people by their net worth of their money and saying that because they have more, they are entitled to keep it because somehow they are superior to others. These people it seems save the state money – can look after themselves – and not rely on the state who increasingly does not want to look after any one below a certain monetary threshold. This is social Darwinism – based on money – gone mad. In effect, the state is rewarding these people through the tax system for being ‘self sufficient’. That is a perversion typical of libertarianism and Neo-liberalism.

Not only that, this is essentially the monetisation of democracy. Policy here favours the rich. The cutting of benefits is also the worse case scenario of ‘nudge’ policy. But nudged into what?

Talk about ‘virtue signalling’ accusations aimed at people who are called ‘woke’.

The TWR reveals the virtue signalling too really isn’t it, through the tax system?

Thanks PSR

Thanks Richard extremely useful information to help counter the everything is out of control line on benefits.

All LINO is capable of, is parroting the “system is broken and more austerity is the only way forward.”

LINO is too scared to do anything else but hold the neoliberal line of cutting the state.

Even Germany is spending now.

As usual it is down to the vested interests.

Most pension contributions go into funds that put money into investments via the City of London. These funds apply fees and charges to the fund holder, and the trading also attracts fees and charges to City institutions. This ensures the city will not allow any reduction in the pensions subsidy as it will reduce their revenue of fees and charges.

On the other hand, very little of the benefits budget finds it’s way into the City and so, from the City’s point of view ( and where they apply political pressure and contributions ) demonise them to keep the gravy train running.

Mr Bray, you post triggered a thought: in energy there is a thing called a Sankey diagram which shows engergy flows usually for a country showing energy inputs (gas, oil, coal, renewables, nuclear) and outputs – industry, energy industry, end users. Perhaps a Sankey for money and wealth. Just a thought. It would not make for “pretty” viewing.

A map of political economy….

Thank you for enlightening me on the material interest in demonising the benefits system. I had thought it was solely about the wealthy not wanting to pay more tax.

If Richard agrees I wont use my name as what I am about to say relates to my middle son.

He is Autistic and gets middle rate care and high rate mobility for PIP

He rarely goes out due to anxiety & hasn’t been in school for over two years

BUT its only now that he’s getting minimal treatment for his anxiety and there is finally the possibility of him getting back into education after a long fight for an EHCP. His younger brother got one but only because he wasnt ‘expensive’

We also hear some of the treatment he might be offered is not of a high quality.

There is obviously no guarantee that treatment or an EHCP would have prevented the situation we are now in, BUT it might have done in at least a percentage of cases.

So instead of being able to contribute to Society he isnt. Thats before we talk about his welfare and that of my family

And we wonder why the benefits bill is rising……….

I am so sorry to hear this.

All parents worry. You have more than your fair share of reasons to do so.

Go well – and your sons as well

And yet Streeting has just gone on record this morning as saying there is an over diagnosis of mental health conditions.

Perhaps we should trust the mental health professionals to make medical diagnoses.

I hope he would not second guess a cancer diagnosis, or tell someone with MS or Parkinson’s to just get on with it, yet somehow feels able to imply that a significant number of people with a mental health diagnosis (not an easy thing to obtain by the way) are not really suffering as much as they claim, just lazy and malingering. Odious.

Dunning Kruger has definitely met We Streeting

“And yet Streeting has just gone on record this morning as saying there is an over diagnosis of mental health conditions.”

Yes! Jaw-dropping arrogance. He called giving people government benefits “writing them off”. They are doing the disabled a favour by cutting their money.

On that, it’s the doing “them” a favour that’s the problem. He’s got no understanding that he or we might need it. It’s them over there. Truly nasty politics.

Streeting claims mental health problems are over-diagnosed the very week it’s revealed that social media and screen technology is literally wrecking young brains

https://www.youtube.com/watch?v=FWsHgylP0Hk

Something like 40% of Universal Credit recipients are in work, sometimes not that badly paid either

BUT its Housing Costs in particular which are far above the ‘cost of production’ and low pay that are driving this.

Where is the will to tackle that?

There is none

Plus of course, who is in actual receipt of housing benefits? Mostly private landlords of course. What most people don’t realise is that the benefits system has, like healthcare, become yet another way to funnel money to the haves rather than a way to help the have nots.

Presumably tax relief on pension contributions can be reduced rather than being eliminated. Income tax is also payable on subsequent pension drawings, which must be taken into account The right to take up to 25% of the pension pot tax free could also be reduced or eliminated.

Any changes in the legislation will require a tricky balancing act to ensure that the very wealthy aren’t simply using private pension solely for tax avoidance whilst leaving an incentive for more ordinary mortals to save for old age, given that the state pension is inadequate.

From personal experience I’ve found pension legislation to be a complete morass and a feeding ground for greedy banks, insurance companies and personal financial advisors. This is really a tough one.

Worth reading what I actually proposed. Might you do so?

No intention to offend. I clearly need to read the ground you have already covered. Could direct me to it please?

https://taxingwealth.uk/

Look at the chapters on ISAs and pensions.

Oh goody! I’ve bookmarked that for the next omnibus (or meter reader) conversation.

I love it when there are direct comparison figures like those for the OAP cf. the pension tax relief subsidy p.a. or the total “welfare bill” c.f. the total pension tax relief subsidy for the wealthy.

And that “welfare expenditure” graph is gold dust! It brings a whole new meaning to the phrase “out of control”!

If Starmer took a ride on a Blackpool tram, he’d probably come away thinking he’d been on the Big Dipper.

That makes me pleased

Glad to be of use

Thank you for this, and skewering what is a Big Lie.

Thank you for the post, it is a good perspective. I wouldn’t call being allowed to defer taxation on pension contributions until old age a subsidy. For it to be a subsidy the money would have to be the government’s to start with.

I entirely agree that the poorest in society should not have to suffer due to the terrible budget and self imposed fiscal rule, but removing pension contribution relief and expecting middle class people to pay tax at a rate originally intended for the super rich is doesn’t seem fair either.

The last person to overhaul the tax system was Nigel Lawson 40 years ago, maybe it’s time for another review?

The money was the government’s

Tax belongs to the government, not you

And why should wealth be subsidy by a return of tax belonging to the government?

Sure we need to overhaul tax – to beat inequality

Income tax is not due on pension contributions until these are received by the recipient post retirement, if it never was due it never was the Governments.

I think I agree with you on the disparity on taxation of wealth vs income.

Wrong

Sorry – but tax saved is by concession from full rate granted by parliament.

The gov’t chooses to allow a higher proportion of earnings to be tax free to the wealthy than it does to the poor. The figures and percentages are mind-bogglingly unjust.

When we consider marginal rates of withdrawal for benefits once people start earning, the rates are so high that most people who have never claimed benefits don’t actually believe it when they are told.

If you clear the decks, and start by taking away ALL tax reliefs, then ask people to devise NEW tax reliefs/allowances and benefit withdrawal rates, and justify each penny of relief to a panel made up of the bottom two deciles of earners, perhaps we might see things differently? For example, get a rich person to argue their case for an upper earnings limit on NI, or even for why NI should not just be merged into income tax, or why they deserve huge exemptions on enormous pension contributions. See if they can persuade the bottom 20% of earners to accept why rich people should have an upper earnings threshold!

We can all think of ways to justify our privilege (to ourselves). But can we justify it to people who don’t share it?

Why SHOULD I as an OAP, be exempt from NI on my income even if working? I can’t justify it except as a historical quirk.

Great idea

RobertJ :Totally agree with you about NI on earnings for people over pension age. My employer pays it so no reason at all in 2025 for me not to pay it.

30 years ago, people died younger and it made more sense. Now it is unfair.

Thanks for drawing attention to this

today and in the TWR.

l explained

that tax relief on pension contributions made by the top earners in the UK are 10s of billions per annum to my

hairdresser yesterday – a lady in receipt of PIP without which I doubt sne could do her job. She was shocked by this as she had not heard this mentioned before.

Her understandable responses were 1 why take money from people like me rather than them, and

2 why don’t MSM journos mention this?

Why indeed?

Agreed

I feel a video coming on ….

Richard, thank you so much for this post. It’s brilliant, succinct and extremely useful. May I quote parts of it? I’ll give the appropriate attributions.

I had (yet another!) burst on LBC yesterday, this time to Natasha Devon, about disability benefits. My points were quite simple:

– I have submitted an FOI to see the Impact Assessment for Disability Benefit cuts

– The benefits system may well be broken, but it is not the recipients of that system who broke it. They should not, therefore, be the people who are punished

– There is an obvious correlation between the large rise in spending on disability benefits and the significant reduction in spending on healthcare.

– 10 years of slashing the annual uplift to the NHS from approximately 4% to approximately 1.9% has meant that short term, minor conditions turn into major, chronic conditions because people cannot get rapid healthcare.

– The growth the Government seeks requires a productive workforce. A productive workforce, it must be fit to work. To be fit to work, there must be speedy and effective healthcare.

– Without a healthy workforce, the economy will not only stagnate, it will eventually collapse.

– Instead of saying “we must get sick people back into work” we should be saying “we must get sick people healthy again”

Thanks

And quote away….

A much needed critique of the government and their adherence to the neo-liberal consensus. Over a decade of limited investment into Capital NHS infrastructure, flat funding of Primary Care which given the ageing population has equated to a significant cut, active cut is Public Health and the repeated underfunding of Social Care have come together to fuel the current crisis in Healthcare. The relative fall in the number of qualified full-time GPs even BEFORE the COVID-19 pandemic added to reduced access to Family doctors.

The very basic (by 21st C standards) IT infrastructure means that outside of the big Metropolises there is a huge technological shortfall. When I returned to “the country” having trained to be a Consultant in London, I was surprised to find a computer system still in use that we had when I was in Medical School… We were still not able to prescribe electronically or request CT scans or MRI scans electronically. We could not look into the Primary Care records of our patients. So, we have been trying to increase productivity with incredible amounts of duplication, omission and only basic Interoperability between IT systems. These drive inefficiencies in Health and Social Care which increase delays in accessing treatment and also increases costs.

The absurd creation of that gargantuan Arms Length Body, NHS England by Andrew Lansley’s reforms was signed off by large parts of the media as being necessary and reasonable when it was always a huge scam; just a way of shielding ministers and Senior NHS leaders from any accountability. Good riddance! However, the proof will be in the pudding.

The vast majority of these issues pre-date the current UK government by a decade, so I find it fairly pointless and disingenuous for us to criticise Wes Streeting. However, he is clearly a Bambi in headlights who needs to learn and develop some humility!

Thanks

What’s the evidence behind ultra-processed food being one of two major factors? You don’t have to convince me around covid.

Just go and read the evidence