Fire and flooding are making houses uninsurable. Will this crash the housing market? There are strong signs it will unless the government takes action.

Note: this a revised version from that originally posted.

This is the audio version

This is the transcript:

Is the future uninsurable? It's a question that Ann Pettifor asked on her Substack recently, and Ann and I have been friends and Green New Deal colleagues for a long time and I think the question is a good one.

What she's referring to is the current crisis in Los Angeles, where there are still four fires raging, and what we know is that very large numbers of properties in that city are now uninsurable.

What that means is that householders are going to both lose the entire value of the properties if they are burned down now because this has been the case for a year or two. And in the future, they're not going to be able to get insurance on properties if they rebuild them.

Now, there is a condition in the USA, which is also imposed in practice in the UK, that if you have a mortgage on a property, you have to insure it to cover the risk to the person who has the mortgage on your property that they might not be repaid if the property burns down.

So, if you can't get property insurance, can you actually afford to buy a property in LA or very soon anywhere around the world?

Now, I raise that second point very deliberately because the problem in LA might be fire, but the problem elsewhere, including in the UK, tends to be flood. Large parts of the UK are at risk of flooding.

Some are already at the point where getting property insurance is really difficult. In areas around the River Humber and the River Ouse, which flows into the River Humber, it is already very difficult to get property insurance because of the high risk of flooding of your property, which is happening on a recurring basis. Other parts of the country are now beginning to see the same risk.

Properties that were once insurable in the market are now only insurable in reserve markets, which the government has been trying to organise. And at some time, they may simply become uninsurable altogether.

Now, that is going to create a bigger housing crisis than just about anything else. anything that we have seen before in the UK.

We've had all sorts of housing crises in this country, from slums at one time, which we've solved, to a shortage of properties, or so we think at present, although actually, that might be slightly artificial. There's a shortage of properties available for people to be able to live in affordably, which is slightly different from there being a shortage of properties.

But in the future, there might be absolute obstacles to people owning properties because they cannot get insurance on that property if they require a mortgage to buy it. And this is going to hit two parts of the market.

One is, of course, the owner occupier, who actually is only an owner because they have a mortgage loan.

And the other one is the buy-to-let landlord who buys with a mortgage to let.

Both of those are going to be hit by this requirement for there to be insurance on the property, which they won't be able to get. And therefore they will no longer be able to own the properties in question. And that is going to cause a crisis.

It is going to mean that many more people are either not going to be able to buy their own homes, and there might be a shortage of supply of rental property as well. And that is not something I take lightly. This is a major issue.

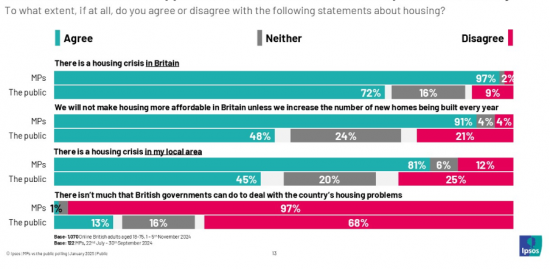

Let me put an Ipsos Mori survey up on the screen. This one came out in late January, and this is about the scale of the housing crisis in the UK.

What you'll notice that 97% of MPs in the UK think there is a housing crisis in this country.

Obviously, there are things that MPs can do to solve the housing crisis in the UK. Two glaringly obvious requirements stand out as a consequence of this risk of uninsurability, which we know is going to arise in the UK because sea waters are rising and the risk of flooding as a consequence is going to grow significantly.

The first is that the government could become the insurer of housing property in the UK. There is no reason why it shouldn't. It is big enough to bear the risk. If it did bear the risk, it would, in fact, be concerned enough to take action to stop the flooding. That's glaringly obvious, and therefore, it may be advantageous for the government to take this risk on and become, at the very least, the insurer of last resort in the UK market for those properties that will otherwise have difficulties securing it.

And I believe that is going to be a growing trend, and therefore, this is something that is inevitably going to happen. It's time we recognised that and got on with managing an insurance market around this idea.

But secondly, there's something else as well. And that is that the government has to become the owner of more property.

Now, that doesn't mean to say people shouldn't be able to buy their own properties. Obviously, I see merit in that. I see merit in the security that property ownership provides to people and their families, and perhaps most especially to their children, who need that security of knowing where their home is, knowing where their friends are, knowing where they live when they are young.

It is vital to their development, in my opinion, but the government can also do that in the rental property sector simply by beginning to buy out the buy-to-let landlord.

Now, there are various measures that can be taken to make sure that the buy-to-let landlord would find it attractive to sell to the government and this may be the biggest, the quickest and easiest way in which the social rental landscape can be expanded. I want that to happen, and the government should become the landlord of choice for one very simple reason.

Unlike the private landlord, who tends to be small with a relatively limited number of properties, the government is big and it can, therefore, spread its risk over a massive portfolio of properties, meaning that even though there will be risk in some parts of its portfolio from flooding or other natural hazards, in the overall context of the portfolio as a whole, that risk will be small and therefore it will not inflate the cost of renting properties unduly in any one part of the country because the risk should be spread evenly over the portfolio as a whole.

Now, this would massively change the way in which we look at property in the UK and would make what is at present uninsurable property insurable, and deliver both the opportunity for buying for ownership and letting with long-term security.

Those two things are critical to the well-being of this country, to families within it, to children within it, and to our development as communities.

Those MPs who think that there is nothing they can do about the housing crisis in the UK are plain straightforwardly wrong. They can, they could, and they should. And they should start by looking at how they change the insurance market on properties to ensure that we have effective insurance available in the UK into the future.

And then they should look at how they can take current buy-to-let properties into the ownership of the government to guarantee that people have the opportunity to live for the long term in secure tenancy properties for the security of their families and, most especially, of their children.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

My understanding of council owned schools and houses is that their portfolios are so large that there is no point in taking insurance. The risk is spread widely. It does change incentives though compared to individual ownership where complete loss of one house is a catastrophe if it’s your house.

Except where legally required to do so, a lot of large organisations eg Shipping Companies and dear old British Rail ‘self insured’ ie carried the risks themselves.

You write “ What you’ll notice when you go to the bottom line is that 1% of those MPs think that there is anything they can do about the housing crisis.”

I think you’ve got that the wrong way round. Only 1% believe “there isn’t much that the British Government can do to deal with the country’s housing problems”.

Is there a difference? What am I missing?

A small correction:

“What you’ll notice when you go to the bottom line is that 1% of those MPs think that there is anything they can do about the housing crisis.”

The statement given was that “there isn’t much the government can do” and 97% of MPs disagreed with that, which means they think that something can be done.

OK, but that is not how I read it

Richard,

I am sure that @Pilgrim Sight Return will have more to say about it, BUT

1. Would you want a lot of the current ‘buy to lets’ there are issues about build quality with new homes and older properties are in poor repair, energy inefficient etc

2. The big saving you get with an old fashioned council estate is economies of scale, when I worked in a Housing Office there was the ‘paint programme’ all the houses in an area were inspected, any necessary work done then they were painted. This went on over a 5 year cycle. By comparison the acquired properties, individual houses in otherwise ‘owner occupied’ areas were much more expensive to maintain as they had to be dealt with individually

I suppose of course that if you start buying up large blocks of property in ‘high risk’ areas it might be different

>This went on over a 5 year cycle. By comparison the acquired properties, individual houses in otherwise ‘owner occupied’ areas were much more expensive to maintain as they had to be dealt with individually<. As long as this is truly done as needed rather than every 5 years whether needed or not. Recently a whole row of housing association houses were retiled apart from the ones that had bought their houses under right to buy. Some may have needed it but pretty sure most didn't. Also important imv is the right for the tenant of the house to have a choice in paint colours, floor coverings etc or the right to do it themselves, providing it is not structural without permission,so that they "own" and feel invested in the house. Think there was too much job lot painting and maintenance with too little tenant input in the past.

Is this really true still?

John Boxall – thank you for the respect – I hope that I live up to it.

In terms of dealing with risk I agree with Richard that an expansion of social rented housing (through building or acquisition) would make sense because the government could afford it by virtue of the fact that essentially they are owners and users of their own sovereign currency (we and others know that, but it is not as well accepted elsewhere).

The letting standards requirements for social landlords are onerous (much more so than home buyers who really are at risk, and private social land lords who are very good at avoiding their responsibilities – talk to any housing standards team at a local council) and they too rely on the private insurance market to insure their homes. So, they too are faced with the prospect of really high premiums to not getting insurance at all.

The housing revenue accounts (HRA) of these council and housing association landlords are the sole responsibility of the landlords; there is no top up from government; government will intervene in rent rises sometime suppressing much needed income; government grants for maintenance have basically withered away and grants for new build are very low; registered social landlords (RSLs) used have regular programmes of component renewal based on life-time costing but because of the withdrawal of capital investment and maintenance & management investment from central government, RSLs are extending the lives of a lot of components which does not bode well for insurance purposes (a new roof is better than an old one in a hurricane). So, as insurance costs go up, the HRA will be bled more to the point where one day we might see the whole sale or part sale of council housing stock into the private sector that makes Right To Buy look like a birthday present.

So more money is needed somewhere – for RSLs/Councils or the government to take the insurance strain.

What we have now is a cluster fuck of momentous proportions. but that is housing policy as it is now.

Thanks

“1% of those MPs think that there is anything they can do about the housing crisis.”

Shouldn’t you learn how to read charts before commenting on them? The 1% are MPs who AGREE that there isn’t much the government can do. 97% think they CAN do something.

Doesn’t half make you look silly, making mistakes like that.

No, it shows that you’re a pompus prig who believes that making a mistake shows someone is silly, when all it actually provces is that they are human.

The video is being corrected right now, because one sentence apart it all makes sense.

When large numbers of houses get flooded and become uninhabitable, we need to start talking about land reform and reallocation, imo.

I don’t have even a smidgeon of an idea, just a question:

If buy-to-let and other property portfolios become “unaffordable”, what happens to the pensions of the people who are in that market because “my pension”?

The housing market isn’t a stand-alone problem.

Agreed

Just to echo what others have said above, I saw the statement and initially thought, like you, oh, only 1% of MPs think there is much the government can do, how pathetic.

But the statement they were asked to agree or disagree with is the negative one. Do you agree that there is *not* much that the government can do? Only 1% agree with that negative statement (just one negative).

Most disagree. They think there are things the government can do.

But there is a sizeable section of the public who despair of the government doing anything to help. (That said, as things stand, with governments that just set ambitious targets, wait for private developers to jump, and then look disappointed when less is done than hoped, they may have a point that in practice the government actually does little to help. Simply relaxing local planning controls and allowing free rein to house-builders is not the answer either.)

The video is being corrected right now.

I made the video too quickly.

[…] morning's video, as first posted, included a mistake. I misinterpreted a question on an Ipsos Mori poll. I misread […]

As others have pointed out and you are rectifying, the chart does suggest that the vast majority of MPs disagree that Government can do anything about the housing crisis.

However, just as you made a mistake in misreading the chart, it is an awkwardly phrased one, and it is likely that some of the MPs who answered misunderstood the question asked.

Otherwise it is fair to ask why if MPs nearly all think Government can help with the housing crisis, is it doing nowt!

Thanks

When houses in an area become uninsurable, and abandoned, it would make sense to see the return of squatting. It’s not ideal, in terms of security and housing condition, but it’s got to be better for families living in one room in a hotel, or people sleeping rough.

In 1947, my Army family were supplied with a bungalow in an abandoned Army camp in a Birkenhead park. We were the only legitimate tenants; all the other properties were occupied by squatters and their families. And there’s no doubt that it was better for them than the alternative. I know the legal situation has changed since then; it could change back, especially if the property owners have abandoned it.

Its difficult because without insurance a lot of the properties will be worthless but presumably rather than sold to The Government for cash they could be exchanged for a pension instead?

Maybe…

There are two additional issues here. One is that developers like to build on flood risk areas. It’s more cost effective for them as they tend to be cheeper and close to amenities. The fact that they are called “flood plains” used to put people off building on them. This means too much housing stock is being built at an already high risk.

The second is that the “value” of housing is often driven by the largest loan that can be offered for it. People will say that fundamentals cost as well, but land and raw materials also get inflated values due to what a house can sell for. The winners in this are the land owners and banks. The distortion shows up when a home is uninsurable. As you see what a home without a loan is worth.