Flat taxes are great if you want to increase inequality, crush government services, or leave large numbers of people destitute. Is that why the Tories are so keen on them?

This is the audio version:

This is the transcript:

Who wants a flat tax? It seems that Kemi Badenoch does. And I think that's a truly terrible idea.

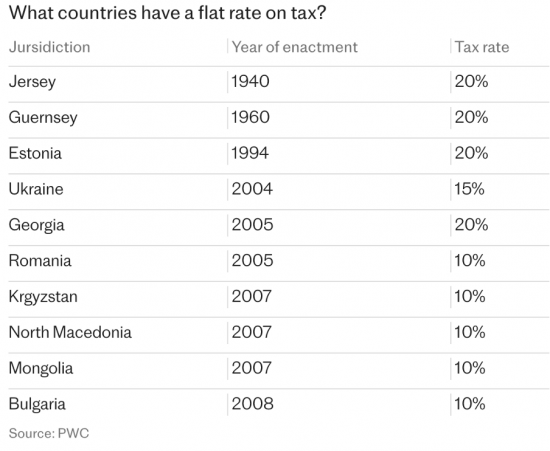

Now, I should put my cards on the table here. I have form with flat taxation. There aren't many flat tax states in the world. In fact, a recent article produced by the Daily Telegraph resulted in this list being produced.

And you will see that there are on that list not many countries shown.

Right at the top of the list are Jersey and Guernsey, in the Channel Islands, which are part of Great Britain but which are not part of the United Kingdom. And they have had a flat tax since 1940.

What happened in 1940 in Jersey and Guernsey? They were occupied by the Nazis. This is the legacy of Nazi rule in those places. They still have a flat tax of 20%, which was even the rate that was introduced in 1940.

Then look further down that list, and what you will notice is that, with the exception of Estonia, which got a flat tax in 1994, most of the others are Eastern European states who got flat taxes between 2004 and 2008, at which point, I was doing a lot of work around flat taxes, sometimes cooperating with international organizations on doing so, including the International Monetary Fund.

Frankly, my aim at that time was simply stated. I was trying to prevent the spread of flat taxes. So let me explain what's wrong with these things.

Flat taxes sound simple and people love the idea of flat taxes. What they say is we should have a single income tax rate.

Call it 20 per cent if you like because that's the standard rate of income tax in the UK at present.

And then they say, we should have a standard rate of VAT, which should be 20%, which happens to be the standard rate of VAT in the UK at present. It looks as though we're heading in the right direction.

And then they would say, let's have a standard rate of capital gains tax. Make it 20%, they'd say, even though they have to date been terribly reluctant to make the rate of capital gains tax the same as the rate of income tax.

And they would want to make the rate of corporation tax 20%.

Do you get my idea now? Now let me start to explain the problems.

If we had a 20% rate of income tax in the UK, there would be no higher rate tax paid. That's a simple, straightforward statement of fact, but as a consequence, £100 billion of tax revenues would disappear.

If we had a 20 per cent rate of corporation tax, I think maybe 20 per cent of all corporation tax revenues would disappear. That's another £15 to £20 billion, depending on how things go in the next couple of years that might disappear.

If we had a 20 per cent rate of capital gains tax, given that the rate has just increased, then we would lose some revenue there as well. £4 or £5 billion a year.

Make inheritance tax 20 per cent and we would halve the recovery on that. Chuck away another £4 billion a year.

Can you see how things are beginning to look expensive when it comes to this tax.

Now there are ways around that, the people who promote flat tax would say.

For example, they could say on VAT, well there are lots of exemptions and allowances now, and they include zero rate VAT, and the VAT. exempt rate.

Zero per cent VAT is the rate of tax that is charged on food.

There's a 5% rate of VAT, which is charged on the fuel and energy that we supply for use in our houses.

There's an exempt rate of VAT on rents and quite a lot of other things, funerals, for example.

The point is the flat tax exponents would say no, there should be one rate of VAT. It should be 20% on everything, and that would maybe recover £100 billion of VAT.

But who would benefit? And who would lose from these changes?

£100 billion of income tax would not be paid by those who are earning over £50,000 a year, and most especially by those who are earning well over £100,000 a year. The wealthy would, in other words, win hands down with a flat tax.

Who would pay that extra VAT? That would be paid by those on the lowest incomes. How do I know? Because they have the highest proportion of their expenditure incurred on things like food, and domestic energy, and rent. So they would lose out badly to compensate the rich.

Alternatively, if this levelling up of all rates to one level, with the rich gaining enormously and the poorest in our society losing badly, did not take place, we would instead have to do something quite radically different. And that would be to cut out well over £100 billion of government expenditure if Kemi Badenoch remained dedicated to the idea of balancing the books, which I presume she will because she's as thoroughly neoliberal as Rachel Reeves. And in that case, something big has got to go.

Something as big as education, for example.

Something as big as all of social care and quite a bit of housing policy.

You could throw out quite a lot of defence and that wouldn't actually cover the saving that is required.

This is the sort of scale things that would have to disappear to save over £100 billion a year, which would be necessary to make this work.

And let's be clear, the claim by those who promote flat taxes is that if we just allow the wealthy to have more of their money, first of all, they spend more into the economy, and therefore, that wealth will trickle down to those who are on lower incomes because they will have more to spend, and therefore stimulate the economy to provide work for all those who haven't got the initiative to create it for themselves. So goes the story of trickle-down economics.

And that is nonsense. The people with wealth in this country save already, despite the tax rates that they're paying. If they have more income, they won't necessarily consume more, because they've already got enough. They will instead save more. The chance that there will be trickle-down is incredibly remote, and history has shown that trickle-down simply doesn't happen.

Secondly, it's argued that there will be a boost in employment because there will be lower taxes, but the differences with regard to corporation tax are very small - insignificant - and will make no net impact at all on whether or not people want to start businesses or otherwise. In other words, nothing much would change there.

And those who argue that the flat tax states on that list that I showed earlier, the Eastern European states, all flourish as a result of flat taxes, miss something quite fundamental, which is that basically all the Eastern European states who adopted flat taxes early this century did so either when they were coming out of the Soviet bloc and were establishing their own independent economies for the first time, or were recovering from war in the Balkans, which had been pretty devastating.

Yes, they enjoyed growth at that period, but that wasn't because of flat taxes. That was because their economies finally had a period of stability in which they had a chance to do something when previously they'd either been on war footings, or simply oppressed. So, the fact is that flat taxes have never boosted the economies of everywhere, including, by the way, Guernsey and Jersey, where local people suffer really badly from poverty in those economies, because the flat taxes are designed to boost their use as tax havens.

Flat taxes are a simple, straightforward way of achieving two goals.

One is to crush the size of government, to reduce the services it supplies to people who really need them.

And the other is to make the wealthiest in our society richer at cost to those who haven't got the funds, spare to provide to those with wealth, but who will have to do so if they wish to enjoy the services they've had in the past.

Flat taxes are designed to be penal.

They are penal.

They're destructive.

They harm the economy.

They will harm the nature of society itself.

They're even anti-democratic, because the assumption behind them is that actually, not everybody does have an equal voice because the idea of progressive taxation, which is the alternative to flat taxation, is that everybody should pay equally according to their means. And the opposite is flat tax, which does not assume people pay equally according to their means, but that everybody should have the opportunity to put aside more for themselves as they get wealthier - the complete opposite.

This is a disastrous policy idea, but exactly the sort of thing you'd expect the Conservatives to flirt with.

It could happen, but if it did, it would be a disaster for the UK.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Good straightforward reasoning, thank you.

We SHOULD simplify tax – but in areas that are unnecessarily complicated. For example losing your personal allowance if you earn over £100k; if you need to tax these folk more then be honest and raise the tax rate rather than mess with this. On the other hand, having simple tax thresholds where the marginal rate changes is NOT complicated; keep them.

We SHOULD harmonise tax rates…. but only to prevent tax arbitrage. Eg. employed v self-employed or income tax/NI v CGT v dividends etc.. There is no reason that VAT and income tax should be at the same rate and you can’t arbitrage income tax thresholds away.

We SHOULD eliminate reliefs where they are not delivering beneficial results (eg. higher rate tax relief on pensions – these folk would save without this incentive).

It is the standard trick – “simplify, rationalise the system” sounds good….. indeed IS good – but not if the goal is merely self-serving.

Much to agree with

Compassion and understanding how your country’s monetary works are inseparable! Greed and ignorance tear them apart!

I think I read on your blog you favour CGT on valuable first properties in the South East of England. Was that covered in the taxing wealth report?

I address cut on properties in that in there.

Can I ask you?

How does classical economic theory understand poverty?

If the invisible hand of the market sorts everything out, in the best of all possible worlds.

Should people simply choose to work in a job that pays more?

Why are there jobs that don’t pay enough?

The conservatives (and LINO) seem to think that (we) poor people are lazy, or stupid, or too fat.

Whatever the reason, it’s obviously their fault.

I think that’s a really good question, to which there is no answer, except those wh9 cannot survive won’t – that is what the market dictates.

How does classical economic theory understand poverty?

Wow! That is a really good question,,,, I would love to see that addressed to a “true believer” of neoliberalism.

I think it is a really good question.

Chat GPT had this, which seems a fair summary to me:

Neoclassical economics explains poverty primarily in terms of individual choices, resource allocation, and market dynamics. From this perspective, poverty arises due to inefficiencies or constraints that prevent individuals from maximizing their utility or productivity in competitive markets. Key points include:

1. Human Capital Deficiency

• Poverty is often attributed to a lack of education, skills, or training that reduces an individual’s productivity and earning potential.

• Investment in human capital (education, skills training) is seen as a way to escape poverty, assuming access to these resources.

2. Market Outcomes

• Neoclassical economics assumes that markets are generally efficient. Poverty may arise due to unequal initial endowments of resources (e.g., land, capital, skills).

• Inequality in resource ownership or access leads to unequal income distribution, leaving some individuals in poverty.

3. Rational Choice and Incentives

• Individuals are assumed to make rational decisions to maximize their utility. Poverty may occur if individuals face poor choices due to lack of information, short-term thinking, or adverse incentives (e.g., dependency on welfare systems).

4. Barriers to Participation in Markets

• Poverty can result from structural barriers like lack of access to credit, property rights, or functioning labor markets. These barriers prevent individuals from fully participating in and benefiting from the economy.

5. External Shocks

• Temporary poverty can arise due to external factors such as economic downturns, natural disasters, or health crises. In the absence of robust social safety nets, individuals may fall into long-term poverty.

6. Policy Implications

• Neoclassical economists advocate for policies that enhance market efficiency, such as reducing barriers to education, fostering entrepreneurship, and ensuring property rights.

• They often favor targeted interventions to address specific market failures rather than broad redistribution, emphasizing economic growth as the primary mechanism to reduce poverty.

Critiques

• Critics argue that neoclassical economics may oversimplify poverty by focusing on individual responsibility while underemphasizing systemic issues such as power imbalances, institutional failures, and structural inequalities.

Neoclassical explanations of poverty hinge on the belief that poverty is a result of inefficiencies and constraints within otherwise self-correcting markets, with solutions rooted in addressing these inefficiencies.

Thank you. I’ve copied it to return to.

just one of the points:

“Inequality in resource ownership or access leads to unequal income distribution, leaving some individuals in poverty.” Yes, that would do it.

Marginal utility of income (which basically just codifies common sense) is useful in arguing against flat taxes, to my mind.

The common sense idea can be expressed as a simple progression (and, indeed, was even used in a political ad not so long ago).

If you give, say, £100 to someone at the lower end of the income distribution then all of that money is immediately useful; someone in the middle won’t necessarily have immediate use for the whole amount, and someone at the top might not even notice.

So far, so obvious.

I think Thaler & Sunstein worked out a sine-based equation for it which appeals to me, I admit. It gives a nice, progressive curve to calculate percentages from, and that immediately makes me think of tax rates (although I’m pretty sure that wasn’t Thaler’s intention).

The other thing that I think is useful from the behavioural economics realm is loss aversion & the endowment effect.

If you already have something in your possession, you tend to value it more than something you don’t yet have. Similarly, having something taken away is more painful (same neurology at play here) than it is pleasurable to receive.

It’s a weird construction, but you get the idea. If I give you £100, the pleasure you feel will be roughly half the intensity of the pain you would feel were I to take £100 away.

Between those two principles it’s surely not all that hard to work out that a smoothly progressive tax system, which doesn’t go above an *overall* rate of 50%, would be the fair way to go. At least, it seems so to me. YMMV.

I do often use that argument

I also point out they really are not simple

But I chose different arguments on this occasion – I think a reasonable limit dictated some choice was required.

There is very little to add to what is comprehensive debunking of yet another rather bad idea emanating from the funders of our political system – the rich.

I do ask myself – why this need for doubling down on bad ideas at what seems to be a critical time in our world ? It’s as if Capital has decided to have one last hurrah before the end and then it is everyone for themselves.

I do think that there is evidence of a form of organisation in this all – Tufton Street, the Mont Pelerin Society, our universities (perversely), the political lobbying system all blowing the horn of Neo-liberalism.

But then there is this concept of autopoiesis – a sort of self organising trait in societies and organisations which seems to be built on same mindsets which themselves are created by contexts, organisational and societal conditions. Autopoiesis can even be created by marketing . It is a strong force, hard to pin down but it does have a relationship I feel with information provision by vested interests – public relations knows this well – read about Edward Bernays who to me honed in on the inherent human weakness within its power to self organise and survive.

I have been struck by the amount of appeals I have seen on TV this Christmas – from cats to Gaza.

And I’m thinking:

A lot of governments advocate low taxes and less government – even ignoring the impacts of their actions and polices, home and abroad.

Our societies worship money.

Our societies seem to denigrate the poor and needy.

Have turned self-realisation through consumption into a way of life – hyper-individualised it.

We have turned state fiscal policy into a cash point for the rich it seems with no credit limit whilst funding the social good less and less.

And now ordinary people are still being asked to cough up money to solve our problems. But that is OK because it is not taxation.

It occurs to me that the way we are being set up is nothing but to be exploited. Telling people that you are cutting their taxes and then seeing them being asked by the voluntary sector for money over and over again to solve problems that the people’s own government has created through poor domestic and foreign policy?!! What the fuck is going on here? Whilst the government stands off, presiding over a drop in wages and public service standards?

Why not just tax in the first place and take out the middleman investor who creams off more and more and leaves us with less?

And there you have the cui bono question answered? Who benefits? The investor class, the banks who set it up, capital, the corrupted government who let the private sector use its CBRA to use its OWN MONEY to underwrite the buying of – at artificially low prices – its own assets that it created to look after all of us! People like Laboured’s Peter Mandelson think that this is an achievement!

All I see is a world where the rich have grabbed the world. And mark my words, they have inherited nothing by consent (and they have bought the consent from governments) and won’t be satisfied until they have everything.

Flat rates taxes will quash social mobility and are just another symptom, another redoubt for the forces of capital accumulation to dig themselves in forever. The brave new world being terra-formed for the rich is still a live project it seems no matter how much evidence is amassed to the contrary.

Much to agree with

A flat tax is one of the most reactionary ideas around. For that reason I fully expect to see the reactionary multi-billionaire who is already calling the shots in the US to enthusiastically endorse it soon.

It’s clear that the Tories are charging to the right in a (probably vain) attempt to shore up their defences against Farage. Badenoch has made a poor start as leader and there are already mutterings that she was the wrong choice. But she will fight hard to hang on and no reactionary policy can be ruled out. Net zero looks like it will be her next target.

Much to agree with

Same thinking as the Poll Tax – and look what happened to that

The call for flat tax does indeed seem to be just another excuse for smaller government and yet further transfer of money to the wealthy.

Unfortunately we don’t currently have a very progressive income tax system. Above the tax threshold income tax and NI are 28%, increasing to 42% above about £50000 income and finally to 47% above about £125000. Above that there is no progression, it is a flat tax. I’d like to see a more progressive system.

Unfortunately, as @Kaal Rosser points out, there is a lot of psychological, and therefore political, resistance to higher progressive tax rates. Even though it is IMO fair, many people regard it as tantamount to theft.

And yet, and yet, there is something alluring (to many, if not this blog readership) about the superficial simplicity and fairness of flat tax. It is, perhaps, better to try to go with the flow than to rail ineffectively against it.

So perhaps there is a way to harness the psychological political advantages of an apparently flat tax. It has been suggested that we should have a much higher income tax threshold, say £20000 (when I say income tax I mean NI too). I can’t see why someone earning less than £20k should pay tax. If you did this, but raised tax (including NI) too, from 28% to, say, 34% then no one earning less than about £50k, the current higher rate threshold, would pay more. Furthermore in this income range it would be more progressive than existing arrangements. But, of course, it would, as Richard points out, lose revenue, particularly above the current upper tax threshold. Richard has written extensively about alternate ways to raise revenue. My favourites are reducing the lifetime limit for pensions and introducing a limit for ISA holdings.

But a higher tax threshold, whilst progressive for lower earnings, is still not progressive for higher earnings. I suggest this could be effectively addressed by a progressive employers tax, such as employers NI. By increasing to his significantly for higher earners (whilst low for low earners) it would be possible to achieve the same thing as progressive income tax. The benefit is that it means that the direct income tax rate does not have to be progressive, avoiding psychological and political resistance.

A straight flat tax is regressive and pernicious. But by raising the tax threshold, and having much more progressive employers tax, you could achieve an overall progressive tax system, whilst harnessing the psychological and political benefits of an apparently flat tax.

Politely – that is total nonsense

Sorry Tim, but pelaase don’t post ridiculous comments here if you want to continue

Your last para has not a shred of evidential support – or the plausibility of ever delivering fair tax

How, for example, is fair tax delivered on invetsment income, gaibns and inheritances when you rely on employer taxation?

Explain that, if you can.

I’m disappointed you feel it is ridiculous. 🙁

I’m sure we’re both on the same page in that we want a fair and progressive tax system, even if you don’t like my ideas.

You are, of course right, that I didn’t include unearned income and that certainly has to be addressed in a fair system. Unless addressed we would have a system, as we do at present, which advantages, and therefore encourages, rentierism. Neither of us want that.

I left it out to try to avoid an inordinately long comment; I certainly have considered it.

My approach to unearned income would be first to apply the standard income tax rate, and only allow a single tax relief. This is not what we have at the moment. If I recall you a favour to this too. Then, in addition, I would charge a surcharge on unearned income equivalent to the employers tax. Again this is something that is not currently done and which I think we should do, even in the current system.

I most certainly do not think, as both you and @Clive Parry say, that there should be a unified, single rate of VAT. That’s nonsense and would undermine some of the fundamental reason for tax. So very strongly “no” to a single rate of VAT.

I think we probably agree on many aspects of this. I hope so. Where, perhaps, we part company a little is in how to achieve a progressive tax system. In my view, to be sufficiently progressive, it would have to have very high tax rates at the top end. I don’t have a problem with this; we’ve had it in the past. But I think it is a difficult sell, for the reasons @Kaal Rosser mentioned. So if something similar could be achieved through a progressive employers tax that seems something worth to consider.

The other advantage of employers tax is that it plays to the fundamental strength of the tax system, that of discouraging socially undesirable activities. In this case the undesirable activity is employers paying excessive wages (I’m thinking CEOs and “city” employees here). Does anyone really believe that the skills and abilities of a CEOs are vastly better than say a senior surgeon? And yet they are paid vastly more. I would like to see such socially undesirable pay discouraged through the tax system. I think you can do so through employers tax, but that it is much less easy through income tax.

I hope that, having now posted many more words, it is clearer what I am thinking. I’m certainly not trying to in anyway support the pernicious neoliberal trope of a simplistic flat tax.

Tim

Politely, before you say I have said something, check I have.

I have never argued for a a single tax relief. I argued for a single rate of tax relief for everyone. That is utterly different.

And don’t say I argued for a single VAT rate – when the piece you are responding to makes it very clear I am not. Clive Parry did not argue for it either.

And then you say we are on the same side, when candidly almost nothing you say makes sense. I spent 126,000 words explaining what might.

I am not amused.

I wouldn’t bother replying. I haven’t got the time to deal with more of this.

Richard

Interesting take on taxation, I was only thinking this week labour will need a new tax victim next budget, which I think will be a hit on VAT, maybe books and printed material not for educational use, or a general rise to say 22.5%.

As for flat taxes, ok, but not on low earners, a tax exemption for earnings below £20,000, but with the usual threshold for earners above £20,000. Coupled with 50% on bonuses over say £10000, including equity and shares.

Maybe even considering lowering corporation tax and do an Ireland, to say 12% to encourage foreign companies to base themselves here, especially if Trump completes his hostile acquisition of the UK through a trade deal.

Finally just for the fun of it, remove the upper cap on National insurance contributions from employees and self employed.

Sorry, but none of this makes any sense. Please either learn about tax, or not make random comments about it.

Or just try reading the Taxing Wealth Report 2024.

Your comment was a bit dismissive, I might be an ‘ignorant’ when it comes to the nuances of taxation, but to be barred from a conversation on the grounds of ‘qualification’ does narrow the field of conversation and debate to only those ‘in the know’, small wonder change and progress is difficult to achieve.

OK, now see things from my perspective.

I bothered to spend 9 months writing the Taxing Wealth Report, after more than 40 years in tax.

You appear not to have read it but on a Sunday afternoon want me to spend my time telling you why I disagree with your back of the envelope theory that has no basis to it at all.

Then you get upset.

Don’t you think it is you being arrogant here?

Reeves made small steps on Capital Gains Tax in the budget by increasing the lower rate from 10% to 18%, the higher rate from 20% to 24% and the rate on hedge fund carried interest gains from 18% to 32%. Those were progressive changes, even if she failed to equalise the CGT rates with income tax rates which would have been 20% for basic rate and 40% for higher rate.

Whoever succeeds her as Labour chancellor will have to grasp that nettle. Apart from the obvious unfairness, it distorts the tax system by taxing earnings from work at higher rates than earnings from investment and speculation.

Why not take big steps then?

Has she not read ‘The Prince’?