I was on Sky News last night, supposedly debating the inheritance tax charge on farms.

I say supposedly for a good reason. I went on presuming that we might have a calm discussion, but it became very obvious almost immediately that this was not what my two opponents had in mind. Their intention was to be abusive. The representative of the Country Landowners suggested in the middle of one of her interventions that I was a Marxist, without any justification, whilst the young farmer was the only 23-year-old I have ever come across whose primary concern in life was, apparently, inheritance tax. He was also already obsessing about his desire that his six-month-old must follow him in the life of misery that he had apparently willingly chosen for himself. None of that made any sense at all.

Unsurprisingly, the discussion got heated, largely because these two were utterly unwilling to listen to the suggestions and comments I made and were willing to state for any reason that they could think of that anyone who is not a farmer has no right to offer opinion on this matter.

Sky tweeted out two clips on Twitter, and they are all I have to share. I should add that I overstated my case on business property relief in the first clip, but only in part: that it can apply to activities that are managed on and from farms and can significantly assist the passing of property between generations is being ignored in the debate, and that was the point I was seeking to make:

"No one has to be a farmer" - @RichardJMurphy

"Who's going to feed the nation?" - Farmer Jacob Walker

"Killing off farming is not the answer" - @CLAtweets

A heated exchange takes place on The UK Tonight with @SkySarahJane over the farmers' protesthttps://t.co/hxaeBXLGBE pic.twitter.com/qPXv2uFfnQ

— Sky News (@SkyNews) November 19, 2024

The other is here, but will not embed, so please follow this link.

I don't think this was the most useful debate I have ever been involved in, or my best moment on air, but I think that was always going to be impossible when faced with two opponents who were only interested in promoting data for which there is no evidence and abuse for anyone who wanted to question it.

After the interview, I reflected on this. This issue is obviously attracting passionate interest. Yesterday was the biggest day for blog traffic here for over a year - beating elections and the budget for the scale of interest shown. My video on this issue has attracted 42,000 views so far, with many watching it all the way through the whole 18 minutes. But what is really happening was my question.

The giveaway for me was the verbal abuse from the Country Landowner's rep. She did not drop the claim about me being a Marxist in for nothing. She obviously does not know what a Marxist is. If she did, she would know I am not one, but what she wanted was to politicise this because it is politics that this is very obviously about.

The same was true of the young farmer. His line, that he was being penalised, and that the food supply would fail if he stopped working, and so that he must have the right to inherit and pass on his farm, were all deeply political tropes. So, too, was the accusation that I can know nothing about the countryside because I am not a farmer, even though I live metres from it and have observed its destruction by these farmers, who claim that they love it so dearly and yet have willingly partaken in its environmental degradation for decades.

I also noted the arrogance of the claims made in everything I heard all day. The claim is that poor farmers (and for the record, not all farmers are poor) have a right to farm even though they run what would normally be called failed businesses and that the state must support them to do so because they have an inherited right to pursue this activity that is not only environmentally harmful in many cases, but detrimental to their own well-being and which could in most cases very obviously be done better by others, or those other people would not be queuing up to buy their land. What this comes down to is a demand from farmers that the state should support their lifestyle choices, whatever the cost to the state might be.

What we are actually seeing is a very obvious case of a demand for socialism for the wealthy, with utter indifference and even outright contempt on display for anyone who might question the right of those wealthy people to claim this.

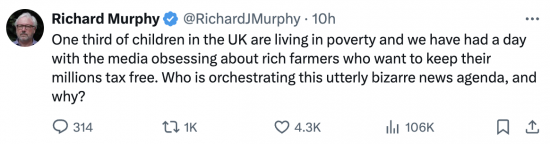

What is more, someone is very carefully rigging the news agenda with blatant misinformation to pursue this agenda, as if this case of the hardship of those who could be immediately very well off if only they sold the family farms that are so burdensome to them was the highest priority in the country. As I tweeted last night:

I admire the ability of these people to mobilise, but my conclusion is that farmers do not deserve a shred of sympathy for all this. Something deeply sinister is going on here, and unlike most people in dire straits in this country, farmers have options available to them and a very comfortable way out of their dilemma. Whatever sympathy I had has evaporated. The politics of privilege are being played here, and I find that extremely distasteful.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

It is surprising that this has become such a hot topic…. with farmers AND non-farmers; I don’t think this a bad thing.

If the “culture warriors” on the right want to nail their colours to this particular mast they will fairly shortly (if not already) look silly.

Perhaps this will embolden the government to tackle other areas of entrenched privilege?

I tbink this is going to backfire heavily on the farmers and Tories

…. I would add that many farmers (tenants) are furious with the protesters. It is really highlighting the divide in the country between landowners and tenanted farmers.

Agreed

“so that he (Mr. 23 Year Old Person) must have the right to inherit and pass on his farm”

This debate has been going on the USA for years. People have a convoluted view of what goes on with the “family farm” and their opinions really make no sense.

Monsanto and ConAgra do not pay inheritances taxes because they are corporation though stock may be taxes on inheritance by an individual. Most Yanks feel that the small 1000 acre family farm, if it is in “active cultivation” should pass tax free to one entity (one heir) to keep it together but the situation with James Herbert Hoover Dyson and his 23,000 acres, which is just an investment with only parts of which may be in active cultivation, is a completely different story.

FYI: Any farm under a 1000 acres is consider a small farm in the USA and Canada. When I lived in the Midwest I went to high school with several people from farming families where each family was actively farming over 10,000 acres. Some of the acreage they owned and some they rented but they were still farming over 10,000 acres. For comparison, Jeremy Clarkson only actively farms 300-400 acres at the most though his Diddly Squat Farm is reputed to be around a 1000 acres.

“I don’t think this was the most useful debate I have ever been involved in..”

Key word: debate. It wasn’t & it was never intended to be – it was not intended to discuss the core issues, it was intended to entertain, to inflame sensibilities and to get the kids cheering on punch or judy or the policeman. Job done.

Pretty much the only place where you will see half way informed discussion and questioning is HoC select committees and even there one has to be careful. Telly = punch n judy for the populace, ditto Twitter, Facebook etc.

Last comment: “What is more, someone is very carefully rigging the news agenda with blatant misinformation to pursue this agenda”.

I offer two words: Gaza, Lebanon.

I no longer watch TV news (or indeed the TV). For the most part most “journalists” are simply well paid prostitutes (natch – some exceptions).

“(or indeed the TV)”

Can one really survive without binge watching old reruns of Midsomer Murders and Escape to the Country?

FYI: I learned all about Ely from watching Escape to the Country.

🙂

There was a very good programme repeated last weekend on a year in the fens on the BBC – all about the patch where I live

It is interesting that there is so much focus on farming and APR. Perhaps it plays better in the media.

The changes to BPR also affect estates with over £1m of qualifying assets (or £1.325m or £1.5m counting the nil rate bands). Most estates claiming APR on agricultural value are also claiming BPR. But it also includes other non-farming family owned businesses.

That said we are taking about around 1000 estates a year making claims for over £1m of tax relief. And the tax free uplift in CGT base cost can still deliver a tax saving.

Some stats on the distribution of claims in 2021/22 here: https://www.gov.uk/government/publications/agricultural-property-relief-and-business-property-relief-reforms/summary-of-reforms-to-agricultural-property-relief-and-business-property-relief

This is what I sought to draw attentio9n to

All I can think of in this ‘debate’ is not accepting the world as I find it and remind myself that taxation is not actually required for the NHS, adult social care or childrens’ services at all.

I am worried that when Labour ministers start talking about the taxation issue and relating it to funding public services that are tangibly not working, another nail is being slammed into the public sector coffin.

What a farce. This whole thing is propelled forward by ignorance.

The broadest shoulders are those of the government, whom you have noticed yourself simply want everyone – anyone- to pay for things but itself.

‘Post-truth world’?

Oh yes.

Farmers have long been extraordinarily cosseted compared to other sectors, whilst recognising that for small farmers, dairy or hill, its a tough life. Its been a standing joke with small farmer mates about what gets put through the farm account.

Farmers are also the biggest sources of water pollution, hiding behind the water companies who get most of the blame. Not to mention carbon emissions.

We need to take a dispassionate view of farming. Tackling tax abuse and ludicrous concentrations of land ownership at the top end. Winding down unsustainable farming at the bottom end. And working to make the rest both economically and environmentally sustainable. That might also mean paying more for their produce.

Much to agree with

“That might also mean paying more for their produce.”

That is one thing that has been hammered home on Clarkson’s Farm yet the local council complains about the farm shop and farm-to-table restaurant where said farmer can sell his produce and reap all the benefits what they may be.

Farming and the food industrial food complex, both in the USA and UK, is very complicated piece of work.

Based on only limited experience of antagonistic arguments in local politics, might it help, when being accused of being a «Lefty », a « friend of commies » etc., to ask the accusing person for a definition of their term of attack/distraction/abuse?

They would have ignored it

Do you think they could have even given an incorrect definition?

Yes

The romantic idea of faming being some sort of rural idyl whose role is to feed us no longer applies. It is over 100 years since a farmer last sat on a three legged stool squirting milk into a butter churn.

Farming is not a lifestyle that benefits society, it is an industrial, capital and chemical intensive enterprise that exploits land and livestock in the pursuit of profit.

Just as the bulk of the food we eat is imported, the bulk of the product they create is exported. So there is no justification for any tax breaks for farmers. They should not have the new £1million tax exemption and the lower rate of inheritance tax. They should pay the same tax as the rest of us.

But the enemy of the U.K. farmer is not the taxman or the environmentalist. It is the supermarkets and the multinational companies that control the markets, distribution and price of farm products. That is the enemy farming should be battling.

The Sky segment:

1. You debunked their facts, so they used emotion and defamation to counter you. They nearly gished you, it was their only defence. Take it as a compliment.

2. I think they got at you with the Marxist comment – my advice FWIW? – just smile it off. We know what they are like when they stoop that low.

3. The Sky studio person was weak – as they often are. Why not refer defamation back to the studio bod, treat them as ‘the chair’ and ask for them to intervene and restore the discussion back to facts? It’s their show.

4. Watch your language when using refutation. Using a word like ‘nonsense’ for an opponent who may actually believe in their reality sort of closes down discussion when the discussion is sort of being opened up. Coat your contrary points in empathy perhaps, if only to avoid the reaction we saw in (1) above?

None of this is easy – I could not do it, so my comments are my reaction to what I watched and are aimed at nothing more than being useful.

You are absolutely right about an agenda here. But farmers and wealth have a nice little feudalistic side line going don’t they? You only have to think about fox hunting and the like to realise that.

I think that what has kicked this off though is as you suggest – long standing other issues in farming that have been left too long to fester added to what seems like a land grab by the rich and the rich populising THEIR version of freedom by pretending that their concerns are the concerns of working people.

Thanks

As I admit, not my best. I gut the anticipated approach wrong. My mistake.

Guy SIngh-Watson’s (Riverford Organics) take on this:

“For those who are pushing the hardest against this change to inheritance tax, don’t be fooled: they don’t represent farmers, they represent the super-rich who don’t want to contribute their fair due, and are simply buying up our country to keep more money and assets for themselves.”

(He doesn’t get the ‘spend then tax’ of MMT – but, well, probably has a lot else to which to give his time and attention!)

https://www.theguardian.com/commentisfree/2024/nov/08/farmer-glad-tax-loopholes-investor-landowners-inheritance

(It was also in his newsletter to subscribers/customers.)

He is spot on with that comment.

The impact assessment has been far short of what we should expect Richard. They haven’t engaged with their own organisations appropriately. If the government apply a problem solving approach in other industries in the same manner as they have here, we should all have concerns for the outcomes.

There were many better ways to approach this depending on what the government actually want to achieve.

I’m happy to engage with you as someone from the other side. Currently I have 2 jobs. One in farming and one in HE. I can relay some real

life examples without resorting to Marxist denigrations

For someone in HE your comment is extraordinarily free of any indication of an argument

So, no thank you

What is “HE”??? Higher Education????

Yes

The blatant media bias has been stunning, not to say sickening.

When protesters have marched in thousands on foot against climate destruction (Extinction Rebellion, Just Stop Oil, etc), or against the slaughter of innocent Palestinians, the media has either castigated them, and talked nonsense about “blocking ambulances”, or completely ignored them. Never do the protesters cases get given serious airing, it’s just talk of disruption, inconvenience, and police arrests.

But when a few dozen farmers block up central London with their £100k tractors, the media are all over them, talking about their “legitimate concerns”, and not a word about the trouble they’re causing. The case in favour of the tax change gets a few cursory words as a footnote.

Why is even so-called impartial media so biased? Are the journalists totally blind to their own prejudices? I’m sure if the public were polled on the importance they attach to climate change, Palestine, and farmers’ taxes, I can’t imagine farmers would be at the top.

Much to agree with, not least in the buss on protesting.

Very, very good point this – again rather underlines that the source of the outpouring of grief is much more sinister than believed.

This seems like Establishment backed protest therefore.

A capitalist agrees:-

https://morningporridge.com/blog/nations/uk/uk-farmers-trigger-the-revolution-politely/?utm_source=MorningPorridge&utm_campaign=4784bda922-EMAIL_CAMPAIGN_2021_03_08_08_41_COPY_1148&utm_medium=email&utm_term=0_247c74c193-4784bda922-457935270

Very good

Judging by this phone in to LBC, we should not expect a high quality level of debate on this issue.

https://fb.watch/vZq1DKRL3C/

This ‘debate’ is getting rather ridiculous. Most farmers are not privileged. You cannot compare their situation with those who do inherit large estates often after another job and take over probably employing a manager to run the estate. They are privileged. I gather that many large estates are owned by family trusts so will probably NOT be paying IHT. The likes of those like Clarkson and Dyson are also a problem – people with high earnings and wealth buying up farms and pushing up values.

We need to address those issues – a limit on who can buy land and how much anyone can own. Over that limit it should be taxed in a way to substantially reduce the amount owned. IHT is not the answer.

I am a little surprised that you have fallen for the government line you are usually more aware of the issues.

Peter

You’re quite good at making quite strong statements here, but you also reveal on occasion that you have very little understanding of some of the issues about which you talk. For example, trusts are quite heavily taxed in the UK. They are not the tax panacea they once were.

I have also not fallen for the government line, as you assert. That is about as inappropriate a claim as that of the person who suggested that I was a Marxist last night. If you had read the Taxing Wealth Report 2024 you would know that I suggested the withdrawal of agricultural property relief in that report. I am pursuing my own line.

You are one of those who might need to think a little harder before they comment. In particular, your line on land ownership is becoming repetitious, and that is a reason for deleting comments. We have heard it.

Richard

There was a hilarious exchange between James O’brien and a very heated farmer on LBC radio yesterday (it’s on video) in which the prospect of the farmer having to cover his farm with solar panels was mentioned. A commentator picked up on this and pointed out that if, as the the farmer suggested, his farm will have a £150K inheritance bill, then this would be payable over 10 years and could be repaid by renting just 15 acres of his land at the going rate of £1000 per annum to a solar energy company for 10 years. The tax would then be repaid painlessly at a nett benefit to the environment. I have no idea how feasible this is, however it does illustrate that farmers are sitting on potentially vast assets some of which, with a bit of ingenuity might be utilised more profitably.

Correct

Re solar rental. And if the rental was for raised panels the growth in the shelter is often better so grazing or harvesting beneath is better and less prone to weather damage. So profits from farming activities could be expected to rise….

I had conversations with some people yesterday and their arguments were along the lines of “who is going to feed the country” if these farmers are forced to sell up.

The BBC’s Victoria Darbyshire caught out Jeremy Clarkson on the 10pm news last night, challenging him over his Sunday Times article a few years ago in which he admitted buying his farm to avoid paying inheritance tax. He didn’t have an answer, only to blame the interviewer -“typical BBC” – for asking the question!

The answer is that the people who buy the land off the farmers will feed the country. If anybody buys farmland, it is because they want to make a use of it, and if they want inheritance tax relief, they have no choice but farm it.

There is also a lot of nonsense being talked about the fact that some farmland might in the future be sold for property development. This has always been true. It is having no impact on this debate, in my opinion. The gradual spread of urban areas into farmland is a process that’s been going on for a couple of centuries, and what Labour is proposing is very unlikely to make very little difference to the rate of progress. It is, therefore, irrelevant to discussion.

Richard

Pls get in touch with Mehdi Hasan as soon as possible to organize an interview/debate/discussion on this topic through his platform.

Also you are not alone – James O’Brien on LBC and many others are also facing the same vitriol, accusations and condemnation. Its part of the

I am strongly of the view that you and others need to come together and work much more effectively together and mobilize in person and on-line in order to smash the myths, untruths and uncover the blatant lies, misinformation that is being touted and promoted by those that have deep vested interest in distraction, privilege, inequality, austerity, injustice and essentially promoting neoliberalism.

These types of battles and many others that will come up must be won. Those on the opposing side of the arguments have to be defeated. Their absurd arguments and deep rooted beliefs have to be outed and made crystal clear to the public and masses.

Even Dan Neidle has posted about it:

https://www.linkedin.com/posts/danneidle_the-country-land-and-business-association-activity-7257830226498310144-QCS2?utm_source=share&utm_medium=member_desktop

‘That could mean as few as 100 farms per year are affected. And the 20% tax is only on the excess over the threshold, so for most of the 100, the additional tax will be reasonably small. Insure against it when you’re young(ish). Give some/all to your kids when you get older.

And the data shows that most of the cost of the tax increase will be borne by a few very large estates. In 2022 2% of agricultural estates – just 37 – claimed an average of £6m.

That’s what this is really about – not 70,000 farms. So let’s drop the hyperbolic fake stats’

Dan is right

I could contact Mehdi…

Richard – keep going and never give up.

https://www.linkedin.com/posts/tim-mallon-10188214_farmers-protesting-about-inheritance-tax-activity-7264535979766558720-3LOx?utm_source=share&utm_medium=member_desktop

‘Rarely agree with much of what Richard Murphy says, but he has an interesting take on the farmers protest which, if you are genuinely interested in it (rather than interested in jumping on a bandwagon hitched to a tractor) is well worth a read.’

I also recommend ‘The Lie of The Land’ Who Really Cares for the Countryside – Guy Shrubsole

A few quotes from his book:

‘The environmental campaigner George Monbiot concurred: ‘It’s bad enough that the extreme concentration of landing in the UK means an extreme concentration of daily decision-making…….It’s worse still when they insist on being treated as the ‘guardians of the countryside’.

‘You and I, as members of the public, have vey little say over how land is used and abuse by its owners’.

‘In England, just 1% of the population own half the land’

‘And the groups that claim to represent the sector – the NFU, The Moorland Association, the Countryside Alliance and others – continue to lobby vociferously for what are evidently ecologically destructive practices, for profit over people and planet, and for the defence of private property rights at all costs. All whilst blithely assuring us that all is well, and that their members can be trusted to care for the countryside’.

‘We have lost half of all farmland birds since 1970’.

‘97% of lowland hay meadows, once bursting with wildflowers, have been destroyed since the 19030s’.

‘50% of our ancient woodland was cut down in just 3 decades in the middle of the 20th century, lost to modern plantation forestry and intensive agriculture’

Thanks

The Marxist jibe is pathetic and a sure sign of not having any substantive argument. It’s a deflection and the only thing worse, pace Donald Trump in his debate with Kamala Harris, is being the offspring of a Marxist.

However, that debate reminds me of another hot button that has remarkable salience with the British public: animal welfare.

I watched a video on YouTube recently of a British couple restoring an abandoned farmhouse in Co. Leitrim in Ireland (first year, on fast forward, racing to complete enough to get a €70,000 grant). Lots of Irish comments giving credit for the work. And the British? Overjoyed over the adoption and housing of a rather abandoned donkey.

Kindness to animals is creditable, of course, but kindness to taxpayers and the children of the poorest ought to take precedence over the preferences of wealthy landowners (for many of whom farming is a hobby with financial and tax benefits).

I closely know farmers (in the EU). They constantly struggle with profitability. They manage the land and animals respectfully (probably part of the reason they struggle). I doubt their land holdings come anywhere near millions of euros in value. That’s the kind of farmer (i imagine representative of the majority of individually owned farms) that struggles in order to ‘feed the nation’. They’re not the ones being targeted by this legislation. Good on you for standing your ground.

Aside: I also wonder how militant the farmers are going to be about this, and what the reaction will be. In the EU whenever there’s a negative change in the status quo, farmers are some of the quickest to react. Protests are often amusingly accompanies by tractorloads of manure being dumped in front of key political offices. I wonder if they would go that far in the UK. And I wonder, if they did, whether the establishment would consider that disrupting the peace and deserving of jail time (a la extinction rebellion) or a brave act of defiance.

Corks on in the dock? Now there’s something to think about.

Clarkson?

Can you please make your question clear?

When I moderate comments I cannot see what you are replying to.

Upwards of hundred thousand people can turn out to protest against austerity or for more NHS funding and those protests get scarcely a mention in the media.

Some farmers turn out to protest IHT changes and the media dedicate hundredanof column inches to it for days.

I think that says all we need to know about the framing of this debate and what is really happening here.

The efficacy of lobbying by the NFU and Country Landowners Association, 30 years ago was such that the Tory Party adopted it as a model. Right down to the seasonality of harvests which means that the smaller farm does not have available staff to influence the drafting or voting on policy advising government.

Various alternatives to the NFU/CLA, like FARM have been set up over the years to counter this but effective organisations take enormous effort to maintain over the decades that are needed to shift government farming policy.

A persistent claim, by the lobby, is to paint small, family farms as ‘inefficient’ and ‘hobby’ farmers. The creep of agribusiness has meant that the rich tapestry of wildlife habitats has gone alongside the social fabric of the rural economy.

Thanks

“A persistent claim, by the lobby, is to paint small, family farms as ‘inefficient’ and ‘hobby’ farmers”

Regenesis by Monbiot. Chapter 4:

8 hectares producing 125 tonnes of fruit and veg per year for 500 familes. With no fertiliser input of any sort, on poor agricultural ground but with yields equal to some of the best one can get from farms on high quality land. (& the 8 hectares of land is packed to the rafters with insects etc).

It would seem one quality required of lobbyists is to be mendacious.

my previous comment seems to have disappeared / deleted, but Richard, if you want to talk through with someone with a foot in 2 different camps, let me know and I’ll reach out privately.

It was posted

I replied and declined your invitation.

Maybe posting as more than m might help

I was in Westminster yesterday so saw things first hand, and then watched the reporting. It struck me that it was worryingly like Countryside Alliance meets UKIP, with even a bit of anti net zero and anti vax. Not a good look, especially when the celebrities are Clarkson and Farage.

There are sections of farming that really struggle, and important issues to tackle around sustainability and food production. We heard none of that yesterday.

Most online comments report on the £1,000 coats that were on prominent display everywhere, paid for, apparently, out of £20,000 pa incomnes….

No doubt those coats went through the farm account!

I am sure they did

Protective clothing account…

It’s too easy to see

“Not a good look, especially when the celebrities are Clarkson and Farage.”

@Robin Stafford

Clarkson and Farage are not the same species by any stretch of the imagination.

However, I cannot decide to which dude person you may owe an apology! LOL!

I have to disagree with you

I think they are near enough twins and both thoroughly obnoxious

Correct!

Both Clarkson and Farage are VERY obnoxious!

I see a quiz show question coming up here! Spot the differences…

Apart from one being an ex-City trader and the other being a TV celebrity, they share some depressing similarities in their politics and regular bigoted outbursts. And the Cotswolds where Clarckson hangs out has almost become a suburb of Chelsea and Kensington!

Sorry Richard, I missed your reply. No problem if you don’t want to talk.

I’m not being elusive with the “M” by the way I just prefer to keep my data footprint low.

I know you’ll all let me know if this is a rubbish idea. I am fairly receptive to the idea of keeping smaller family farms together (accepting that the IHT changes proposed will not affect many). But it’s beginning to seem the wrong way round to me. I can see nothing in the current IHT exemption rules for farms that says the beneficiaries must farm the land bequeathed. So, tax the beneficiaries not the estate, but defer payment whilst they farm the land bequeathed, and reduce the liability by 5% a year over a 20 year period or similar. The Rural Payment Agency already hold comprehensive data on who farms what where, so it should be possible to keep track.

I have a small farm which will not reach the IHT threshold. My neighbours have much larger holdings and are long established farming families in the main, but none have children or other relatives that are farming. Why on earth should there be any farm IHT exemption for them.

Whilst I agree farmers are looking very entitled, it is a shame, given the need to move to a much more sustainable way of farming, that the Govt has now lost any hope of support from the majority of the farming community.

That is a constructive suggestion

I am not sure I agree entirely, but it’s definitely constructive

Thank you John for what seems like a sensible suggestion that I can map onto the two good friends I have with small farms, neither on the best of land. Both in their different ways are effectively small business people with buildings converted and let out and most of the land too. One of them looks like being taken over by his daughter but I cannot see the other being handed down. For a younger generation it is not an attractive option. Which makes me wonder just how many really do get handed down. I’m talking about the small farms, not the large estates.

It’s a shame that by being seen demonstrate all together, smaller farmers with legitimate concerns allow themselves to be lumped together with undeserving tax dodgers. Given the problems of food supply, sustainability and water, agriculture is going to have to change

Much to agree with

I find most tv debate is not in any way designed to illuminate the truth or get anywhere near any understanding. If it were the interviewer would be all across the detail and certainly wouldn’t permit ad hominen attacks. On the contrary it is all about confrontation and raised emotions so that the masses can vicariously enjoy the fight, satisfying, presumably, some primitive urge and the tv stations play to this.

With the latest ‘Gladiator’ on general release now it pretty much dovetails with how short a distance we’ve come.

I think Sky liked it – or they would not have sent out two tweets so quickly

People in the US watched TV debates for the same reason they watch UK PM Question time, NASCAR races and Formula1 races on TV.

They want to see an epic crash.

Thank you, all.

@ Bay Tampa Bay: A year ago, Dyson said he owned 36,000 acres in Lincolnshire and the Cotswolds. I have since heard he has sights on another 20,000 acres.

@Colonel Smithers

At one time Ted Turner was the largest private landowner in the USA totaling Totaling 1,910,585 acres (7,731.86 km2) per Wikipedia so who know what Dyson might do.

Also there is Scotland’s largest landowner one Anders Povlsen person, the Danish Asos mail order billionaire, who owns 88,296 hectares spread across 12 estates; his Highland empire has grown by 37% since 2012. This Danish dude owns more than land than the Buccleuch Estate, aka Richard Scott, 10th Duke of Buccleuch.

Who knows??????????

Thank you.

Bill Gates, by way of his Cascade investment vehicle, has emerged as a big landowner in the US, Ukraine and south America and is looking at the UK and Netherlands.

That’s correct about Povlsen.

Scott, an illegitimate descendant of Charles II, is advised by a bankster. The bankster has suggested Scott reduce his estates to 60,000 acres. This would be an eighth of what the Scott family owned in the late 19th century.

I have seen some figures doing the rounds online and note that the dukes detailed at the bottom end of the scale own a lot more than credited. Even one of the higher end dukes has more.

The Treasury and government bodies dealing with infrastructure have a good idea of the scale of aristocratic estates, but do not divulge. I note local authorities removing online references to such estates. Most figures cited by researchers are an underestimate.

Like so many of the people ranting about this issue in defence of farmers, I am not familiar with all of the available tax exemptions. However, I think that perhaps it might be possible for the Government to make a clearer outline of exactly what exemptions are available, to include the ones you have raised as they are significant. There should be a Labour commitment to insure that farmers are fairly compensated for their produce by limiting the exploitation of supply companies. Beyond that, a further review of the new policy could try to sweeten the deal by possibly offering grants to farmers. I’m not sure what that should target, but essentially giving the genuinely committed farmers the overwhelming impression that they have won more protections and concessions from the Labour government.

This should be balanced out and funded by the inheritance tax levy being raised from 20% to the full amount of 40%, to fully equalize it with the amount paid by non-farmers. This would effectively single out the tax dodgers who are exploiting this inheritance tax loophole: people the general public do not support. If this is not done then the wealthy land bankers like Dyson will still pay significantly less inheritance tax by hanging onto farmland. This might well defeat the important objective of freeing up land and reducing the cost of land. If the Inheritance tax change fails to accomplish this goal there will be nothing to show after the bitter fight.

If new farming entrepreneurs have the opportunity to enter this challenging market, perhaps with the help of one of those grants, this will improve food security. We need to encourage different types of farming, ones that make better use of the land and enshrine environmental protections, farming grants should be conditional on this commitment. I think you also feel that this half hearted policy, 20% rather than 40%, should be revised. There is the opportunity to do this by revising the proposal to better target those who are using our farmland to avoid inheritance tax; this would get farmers and the public back on-side.

Much to agree with

“This might well defeat the important objective of freeing up land and reducing the cost of land.”

As a Yank, what I do not understand is this: What is the point of freeing up land if one cannot get planning permission to build housing and the concurrent social amenities required? Let us call it a “housing village” as it called something else in the US would that confuse UK readers.

If Dyson sells me 5,000 acres, can I get planning permission to build my “housing village”?

No

No way

If King Charles can develop and construct an ‘eco-village’ in the Dumfries Grounds grounds, a planned community called Knockroon, then I do not understand why I cannot construct a “housing village” in Lincolnshire provide I can pay for and/or finance it myself.

Of course, my “housing village” will showcase houses with proper and complete Yank Bathrooms and Yank Kitchens. There will be a utility room. No clothes washer/dryers in the kitchen food prep area! LOL!LOL!

Richard,

What I dont understand is why farmers have this obsession with inheritance.

You ran business(s) but have never expressed any desire for your sons to become accountants, even if your father wanted you to become an engineer.

Yes there are some business’s that remain in families for several generations but as a for example someone I heard of wasnt allowed to join the family firm until he had spent some time out in other business’s. Most I suggest are either wound up on the death or retirement of the owner or sold on.

As a child my family holidayed on a farm in Wales, the farmer had served in the Army and bought his farm when discharged at the end of WW2. I cant see any retiring Veterans doing that today. He only had one child, a son and while he did inherit the farm I dont think that it was a foregone conclusion, he was asked if he wanted to ‘join the business’ when he left school as clearly that would affect Dads business plans (new back of envelope needed!)

So what exactly is driving this obsession about inheritance amongst farmers

I honestly think this obsession amongst farmers about their children following in their footsteps is profoundly unhealthy and deeply unfair to those children. The objective of good parenting is to set your children free. They seem to have a very different belief.

Cheap flexible labour

Richard

You made the point that many farmers are actually not good custodians of their land. I have lived in a rural area for 40 years and can confirm this. My friends know I have ranted about this for many years!

Nobody spares a thought for the farm workers who actually get up in the early hours , earn little better than the minimum wage and retire with nothing.

But having lived in france for the last few years the recent debate is very english. In france farm land is cheap and farming is effectively subsidised to keep small farmers going and they have a problem in that children do not want to follow in their parents way of life.

I suspect that many of the children of farmers on our tv screens only want to inherit millionaire status rather than enjoy farming. Although i know of a few examples of english people moving to france ( when we were in the EU ) because no one can buy farm land in the uk unless you are already a millionaire.

Perhaps Starmer in his negotiations with the EU can suggest we export our farmers looking to exit farming to France to help keep French farming going.

In the Vendee Riverfood the box veg people own farms and export their produce freely back to UK at the moment. I suspect that is what Starmer is negotiating over.

People say farming is complicated but its not that complicated.

I commend the book on the oyster industry

The English The French and the Oyster by Robert Neild. The french believe in planning and they effectively nationalised the foreshore and parcelled plots of it to family sized plots , large enough to have a good living , which is often supplemented with a bit of cattle breeding. It survives with heavy regulation of water quality and support to r&d and innovation.

In england we believe in laissez faire and the oyster industry has died out despite it being part of the english diet up until the middle of the nineteenth century and untreated sewage wiped it out.

But an analogy is clear to uk farming.

If you are prepared to think the unthinkable.

May I suggest that the difference between UK and French farmland has a lot to do with the differing inheritance laws. As I understand it a parent in France may not choose to leave their estate to one child, but it must be shared between all children. So, over time, farms become smaller and smaller as they sub-divide. In the UK a parent may leave their entire estate to one child, indeed many of the huge estates include provisions that the estate must be left to the eldest male heir. None of those UK estates are small family farms.

The very few real small family farms, most small farms are tenanted, although the tenant may leave the tenancy to their child.

Why did the French manage to achieve the French Revolution, when we failed? (sigh)

Much to agree with

In the Vendee the revolution was achieved by a genocide in the countryside.Wiki vendee wars. Bourgeois interests trumped land owners, small farmers and tenants of the church on lowish rents.

In the Uk Bourgeois interests are buying up the farms. What we are witnessing are the death agonies of some of the remaining biggish small farmers who are having their mouths stuffed with gold to go quietly into the night.

They should take it before the government takes away agricultural land relief entirely .

Which is the only logical policy and would yield the greatest returns for the government . The argument then becomes how best to regulate land use as big business will exploit nature , farm animals, labour and food quality. As they do now.

I

I’ve been following this as a complete layman, and I was impressed with your interview on sky. I’d like your opinion though: if, in the unlikely case,, loads of farmers suddenly sell up, isn’t it likely that foreign hedge funds and the likes of Bill Gates, would likely buy it all up? What impact would this have do you think ? Surely this would, at the very least, intensify farming and create even more monoculture ?

Why are they going to sell?

That would increase their tax bills and deny their families the chance to inherit which is what they say they want, so why would they do that?

A Suffolk small farmer comments:

I haven’t got time to reply in detail – but I think there will always be upset when the government takes away or reduces a tax exemption. If the intention was to try and catch those who invest in farmland as a tax management tool, I am not sure this will succeed. Many large farms are companies (eg Troston Farms, several thousand acres in West Suffolk, owned by the German company Claas – not sure if this will touch them).

Is there a special case for farming? I would argue yes, we need food to be produced and the land to be managed. However we are dealing with a manifestly dysfunctional system of food production where supermarkets keep the price of some foods artificially low as they have stranglehold on the retail side of the operation, and farmers often earn very little.

Someone once said that we pay for food three times – once when we buy it, a second time through the subsidy and support system for farmers, and a third time to clean up the mess (eg removing pesticides from drinking water).

What I think is really winding up the farmers is the poor signalling by Labour. This change wasn’t in the manifesto, in fact their shadow environment minister ruled it out before the election. So it has come as a shock – and people are having to make different arrangements suddenly. As for the exemption if you give the farm away 7 years before you die – can anyone tell me when they are going to die? My grandfather dropped dead at 62 and his entire herd of pedigree aberdeen angus cattle had to be sold to pay the death duties, as they were known at that time.

This change also comes on top of lots of change in the support system for farmers. EU area payments transitioning to Environmental Land Management (ELMS) and the sustainable farming incentive (SFI) scheme. I agree that change was needed – the government was writing big support cheques to some of the country’s richest people just because they owned large areas of land. But I’m not clear – they might still be doing that under the new system as well.

What remains is that the barriers to entry are still there – land is expensive, capital requirements are high unless you start on a very small scale doing a market garden type operation – and that’s hard work – I’ve done it! If the government wants to make it easier for new entrants, the new IHT regime might help more land come onto the market – but that could result just in more consolidation into bigger and bigger farms.

To conclude – not sure the government has got this right – the threshold is probably a bit low and they perhaps could have put in more transitional arrangements. But in comms terms it’s a mess – and the Tories are making hay with it (excuse the pun)

Noted

Once again the political messaging is awful.

That seems a fair summary and fits with what I’ve learnt from farming friends. Glad you raised the point about the prices that farmers get which end up driving the need for subsidies.

The phrase small farm gets bandied about a lot. 100 …300 … 1000…? And whats the land that its on? Cumbrian hill farmers (where I grew up) on rough ground with some sheep? Lincolnshire barley barons on top quality soil? At the bottom end it is debatable whether it can ever be sustainable in any financial sense – it is subsistence farming. At the other end it is a business like any other and highly profitable. And not known for ethical standards in treatment of workers or environment. Is there an optimum size..?

It needs careful thought to balance environmental requirements, food supplies, and economic viability for the farmers. The Treasury are the last people that you would want to be doing this as they will have as much understanding of agriculture as they do of any other business. Zilch.

Correction To ERIC:

The water companies only use run off because the water table has been so polluted they cannot use it. It’s the main reason the country has water shortages : that and the fact that agricultural water is free. It helps to keep someone I know’s Moat topped up.

I’m astonished the woman did not know the details of what she was arguing against. The sums are even on their website if she cared to look. I’m convinced, that if the Labour Party explained about those wealthy farmland buyers, and gave examples, the public would go along with them. I’m told many avoid huge amounts of IHT by doing this. The current government must explain this, and then this will all die down.

The “Marxist” accusation is also a constant refrain from supporters of Ben Habib, Farrage & Reform – & it NEVER matters what the discussion topic is or what you are trying to tell them. I have to resort to humour & admit to being a Marxist – a Groucho Marxist. Some times humour is all I have left!

Agreed

Of COURSE they are angry.

You’re winning! 🙂

So you agree your figures were incorrect. As was the statement of both APR AND BPR not being combined. While at the present time they are not combined they are due to be combined.

then instead you decide to act as if I was the issue in the debate.

Yes had you asked more information on my life you would understand that our farm has skipped a generation. So yes at my young age of 23 I am dealing with inheritance much younger than most. That doesn’t mean I should be accused as the only 23 year old to be worried on concerned farming is a tradition. A generational business model.

Politely Jacob, I have explained that I overstated my case, and accept that fact and would not have voluntarily said so otherwise. My aim for mentioning both reliefs was to answer a point made in the VT that preceded the interview. BPR is available to farmers, and many split businesses to make sure multiple ways to get relief are available.

As for your situation, it would seem you are an incredibly fortunate person. I would get some good financial advice if I was you. You could get incredibly cheap life assurance to cover any risk you have. Whinging on television has harmed your cause, as have all farmers by acting as they have. Wealthy people demanding subsidies does not go down well with people at large.

I find the “marxist” accusation particularly baffling, because there are very good and very capitalist and neoliberal argument against the selective treatment of farming property on inheritance tax. To quote the Fawlty Towers series: “This is socialism, isn’t it?” “No, it’s the free market”.

First, it is presented as a subsidy on a specific industry, farming, demanding a special bespoke tax arrangement (a sort of subsidy) so that they can remain in business at low profits. We are being exposed to the awful spectacle of small farmers telling us “our farm produces so little profit”, as if parading their incompetence should earn any public sympathy. If your company has a lower yield on capital than the UK Gilt (the risk-free rate), and unless they pay themselves large salaries (doubt it), that is financial incompetence. In other words: they would earn more by buying bonds and sitting on the couch.

Second, It is a subsidy or tax advantage that promotes one industry, farming, as a use of a natural resource (the land) to the detriment of others. What would the land yield if they planted new forests for “carbon capture” and future sales of wood, at maybe a lower effort or expense? How much would the land yield if they installed photovoltaic panels in it? Should the energy provider pay more IHT than the food provider, when there is a lot of cheap food and high energy bills?

Third, it benefits a specific governance model, the “family farm”, the idea that (like that bloke you debated to) a farm going through history tied to a bloodline, a deeply feudal ideal, is the best way to govern an enterprise. If the sons and daughters of Jobs, Gates, Ellison, or Musk were appointed tomorrow as CEOs of Apple, Microsoft, Oracle, or Tesla, respectively, the share prices would collapse because for every investor it would stink of nepotism and sell fast. No one in his right mind holds the medieval idea that skills and virtues are inherited in the blood.

Fourth, It is a subsidy on a specific form of capital ownership, namely, personal property over corporate. Let us suppose one person can own ten million pounds in “farming equity” in two ways: one is as personal property in a small farm; and the other is as shares in a large farming corporation owning hectares. Under present rules your estate is exempt of any inheritance tax in the first case, but charged 40% on the second. Even if we one wanted to promote farming investment, I doubt that promoting small companies is a capitalist notion to increase efficiency.

IMHO This is not a marxist revolution, this looks like a remnant of feudalism left over from England’s unfinished liberal revolution. Although, it would be good to find out more about it: when was this tax exemption introduced? Which government or prime minister brought it about? What constituencies was it meant to serve?

Much to agree with