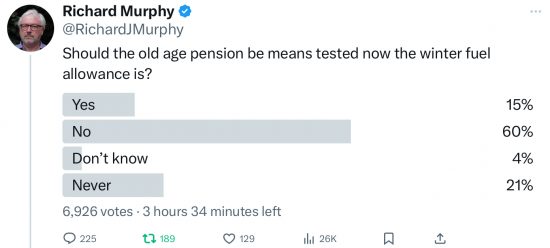

I put up a Twitter poll yesterday, asking whether the state pension should be means tested. After 20 hours this was the result:

Roughly one in six people say yes, it should be. That is a bit more than the proportion who pay higher rate tax, but without any evidence to support this assertion at all, I would strongly suspect some overlap.

Roughly one in six people say yes, it should be. That is a bit more than the proportion who pay higher rate tax, but without any evidence to support this assertion at all, I would strongly suspect some overlap.

The vast majority are opposed.

Of course, this is not scientific, but I have a suspicion that this is quite likely to be representative of opinion: people do feel strongly on this issue, as the comments suggest.

I have little doubt that Labour will look to move in this directiin at some time, preferring to do so instead of taxing those with the means to pay in our society, and who are at present seriously undertaxed, as the Taxing Wealth Report 2024 (see right hand column) makes clear. Doing so will, however, be incredibly unpopular.

But would that be enough to stop the Single Transferable Political Party now in power in the UK, which guarantees that any government in office exists to serve the interests of the wealthy taking such action? After all, is there any serious opposition to whatever it does now?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

The problem with means testing is that not everyone is in a position to be tested.

My mother (aged 94) does not own a computer, nor a mobile phone. Is the State going to find her?

I bet people with their own private pension aren’t being considered for means testing.

@ Ian Tresman:-

“I bet people with their own private pension aren’t being considered for means testing.”

Where is the evidence that the Labour Party under Starmer will not try to scam the bulk of the British people (not just pensioners) in income terms with the exception of the rich? I would suggest the farce of the House of Lords inquiry into the sustainability of the National Debt gives us strong evidence they are attempting the scam:-

https://billmitchell.org/blog/?p=61999#view_comments

See Neil Wilson’s comment in particular.

No scamming of the far from rich by this so-called Labour government?

https://www.theguardian.com/politics/2024/sep/17/women-uk-public-spending-labour-wbg

And what should we expect from this Labour government in respect of the following argument?

https://www.theguardian.com/business/2024/sep/16/a-golden-solution-to-tackling-poverty-in-britain

A side show

My understanding, not sure of my source, is that a means-tested pension discourages those over the pension age from working. Probably not desirable in ageing societies.

Example is Australia vs NZ. Oz has an extremely complex means testing system and Kiwi pension is universal, but taxed normally. As a result, more older Kiwis are in productive employment than in Oz.

Means testing costs excessively in administration and allows a rather unproductive financial planning industry to flourish.

Professor Paul Spicker (a social security guru) has always said that means testing just adds to the cost of provision and this has been a constant problem in the housing benefit system etc. This could be at the forefront of AI – but as we know, AI bears the hallmarks of any human creator.

Additionally, with means testing you open up another can of worms – the probability of error and even fraud.

Better to make these things universal and more generous. The money gets saved and used, or saved to be used – for goodness sake, there is a return that even helps the returns for markets.

Agreed

Worth comparing that:

“China will “gradually raise” its retirement age for the first time since the 1950s [..] raising the statutory retirement age from 50 to 55 for women in blue-collar jobs, and from 55 to 58 for females in white-collar jobs.” BBC News (13 Sep 2024). https://www.bbc.co.uk/news/articles/c62421le4j6o

But before you get excited:

“The average monthly pension payment in China in 2020 was around 170 yuan (£18.15), according to the U.N.’s International Labour Organization.

In the U.S., the government-funded social security programme paid an average of $1,907 (£1440) per month as of January 2024.” Reuters (January 2024) https://www.reuters.com/world/china/why-are-there-concerns-about-chinas-pension-system-its-population-ages-2024-01-18/

But then again, here is a general comparison of monthly pensions (not taking into account cost of living):

1 £5,201 Luxembourg

2 £2,709 Spain

3 £2,698 Belgium

4 £2,148 Liechtenstein

5 £2,148 Switzerland

6 £1,564 France

7 £1,507 Cyprus

8 £1,486 Bulgaria

9 £1,893 Iceland

10 £1,651 Denmark

11 £1,245 Netherlands

12 £1,412 Norway

13 £1,022 Bosnia and Herzegovina

14 £958 United Kingdom

15 £886 Sweden

16 £946 Ireland

17 £696 Czech Republic

Source: 2024 Pension breakeven index: How does the UK state pension compare to the rest of Europe?

https://www.almondfinancial.co.uk/pension-breakeven-index-how-does-the-uk-state-pension-compare-to-the-rest-of-europe/

Thanks

A word of warning! These ‘comparisons’ are (IMO) highly misleading and effectively worthless.

Pension systems very greatly between countries and individual pensions may depend not only on number of years worked (as in UK), but also (in many other countries) on income earned in some or all of those years. As a result, the figures cited (revealed by a check on the site linked to indicate the MAXIMUM pension paid) are not at all comparable. While in the UK (if I’m not mistaken) anyone will the full number of qualifying years will get the same pension, that is not the case in many of the other countries cited, with the quoted maximum being paid only to those with the highest incomes, with no indication of the range or the minimum received after a full working life.

While no expert in this field, I can cite from my experience as someone receiving pensions from both UK & France (each for about 20 working years). In France, individual pensions are calculated on the basis of both number of years worked and income earned over the best 25 of those years, with an overall maximum currently set at 1932 euros (about £1600), which looks to conform with the figure given in the table. But as someone who was well paid in France, I get nowhere near that (after allowing for the reduced number of years I worked in France). I stress I have no complaints with what I get (with a mortgage fully paid, I have never been better off!), but I am aware that many poorly-paid people in France get far less and really struggle.

I agree and I posted the following back in July:

“ There are several well researched articles about the difficulty of comparing different pension schemes. On basic pension the UK does poorly. But once you take other state transfers, private pensions and savings income into account the difference isn’t quite so great. Plus there are other benefits UK pensioners receive such as free prescriptions. And a full pension entitlement can be built up in fewer years in the UK than some other places.

That doesn’t make it “world beating” but neither is it as dire as it would seem from comparing the flat rate amounts.

Another interesting stat is a comparison of pensioner poverty. An OECD table quoted in the Parliament briefing places the UK 12th worst. A more recent table shows some improvement.

https://researchbriefings.files.parliament.uk/documents/SN00290/SN00290.pdf

https://fullfact.org/online/uk-france-germany-pension-comparison/ “

Certainly if you have no other income than the basic State Pension plus any other entitlements you are definitely not well off.

@ Geejay:

“Certainly if you have no other income than the basic State Pension plus any other entitlements you are definitely not well off. ”

Indeed. And that is also true in France, especially for poorer people, also least likely to have other entitlements.

I should have said that I only feel well off because I do have excellent additional pensions from work-related pension schemes in both UK (final salary scheme) and in France (salary-related).

The current pension is a partial proof that Universal Basic Income works. For some people that is reason enough to change it to a means-tested system.

What is the difference, in effects, between means testng and taxes on income? We have a system in place for the latter, and the former adds more costs to the the admin bill.

So why are we imposing taxes on the poorest, is the obvious question?

Hi Richard; Robin McAlpine wrote an excellent article on this subject recently. First published in September by Common Weal ‘The fight for universalism’.

Link:- https://robinmcalpine.org/the-fight-for-universalism/.

Quote from RMcA & referencing PSR’s comment @ 08:15 today “Also you can’t really defraud a universal system because it just does what it does… equally and to all. You can’t double-claim, you can’t falsely claim. Rates of fraud in means tested benefits are about 50 times higher than in universal benefits.” Technically, means-testing is hopelessly inefficient.

Thanks

And, according to Spicker, some of this ‘fraud’ is actually genuine mistakes made by applicants or those applying on their behalf. The belief is that fraud rates are over-stated.

Once you start doing a few internet searches on how many people don’t get the support to which they are entitled it throws up all sorts of issues: tens of thousands don’t claim a state pension (and not because they have deferred it), more thousands don’t get the right amount and then have to battle with obstructive bureaucracy to get what they’re owed, many don’t apply for pension credit (as has recently been publicised), there’s the WASPI women scandal, there’s women in their “ 60s or 70s who stayed at home to care for children before 2010, [who] may be missing out on £1,000s in state pension payments due to errors in [their] national insurance record” (MoneySavingExpert 07/2023). And so on.

Not to mention the horrendous forms you have to fill in to qualify for certain entitlements. When my wife volunteered at CA she frequently had to help people form fill because they could not make head nor tail of it, or they didn’t have access to a computer for those applications which had to be done online.

You’d think the Government wanted to put people off.

They do….

Agree about the horrendous forms!

I recently printed of a Maternity Allowance form for my sister…. 129 boxes to fill in!!

Apologies for the lack of paragraphs in the above post. I had prepared it in my word processor and failed to notice that the paragraphing disappeared when I copied it here.

They survive

They just don’t show on the draft

The state pension is taxable income. To the extent that pensioners have income that takes them above the personal allowance they will be paying tax. So in a sense there is already a means test that claws back up to 45% of the state pension.

Correct

The payment of tax is sufficient means testing. Should the state rise over the point at which basic rate tax is paid HMG gets 20% + back. The mechanism is as yet untested but it seems reasonable and we can all understand it. Most of all we know what our NI contributions will give us.

What needs looking at is the rate we pay in.

I fear this Labour government, if they go ahead with means-testing the state pension, will be playing with money that isn’t theirs.

The state pension is funded via National Insurance payments that are intended to be used to pay all subscribers their state pensions after retirement. National Insurance is not included in the rest of the UK’s tax revenues, which the government has the power—and the responsibility—to allot to where it is needed. National Insurance is a separate fund, created for a specific purpose.

Taking away a person’s entitlement to the state pension without prior notice is similar to an insurance company taking payment for a home insurance policy—after agreeing contract terms—and then suddenly refusing to insure the person who paid the premium. “Sorry, folks, but we just decided to use your premium payment for something else entirely. So you’re not insured after all. No, you’re not getting a refund; you’re not poor enough. You’ll just have to pay for your house repairs yourself—we decided you can afford it.”

An insurance company wouldn’t get away with this kind of behavior (I would hope.) Our government shouldn’t either.

The national insurance fund has long ceased to have any meaning, I am afraid. NI is just a part of general taxation now.

Means testing is a way of eroding support for a universal benefit and supporting the policy promoted by all right wing governments of individual responsibility for pensions, provided by the market.

It will impoverish the poor in the long run.