The Bank of England Monetary Policy Committee put out the most extraordinary report yesterday in support of its decision to keep interest rates at 5.25%, where they have, wholly unnecessarily, been for sometime now.

In seeking to justify their decision, the Committee admitted that inflation is going to fall to below 2% quite soon, and is likely to remain thereabouts for some time to come.

They also admitted that the likely impact on prices of current problems in world food and commodity markets has already, probably, been priced to consumer supply chains, and should not have, as a consequence, much further impact on prices.

They also suggested that pressure for wage increases is declining, as anyone could have told them would happen as soon as the lag effect between price and wage increases had worked its way through, as it inevitably does over a relatively short period of time following the peak in inflation rates.

In some other key areas, such as utility bills, prices are falling. They do, however, note that there are other areas, such as rents, where they are still rising, but do not make the obvious association between this fact and their interest rate policy, which has been largely responsible for that increase in rental charges.

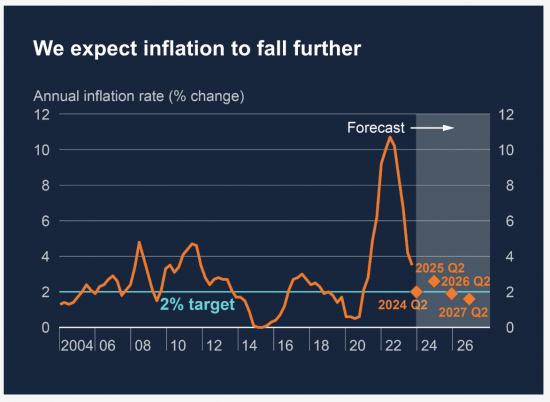

These facts are acknowledged in their inflation forecast (see chart above), which shows that the Bank expects that its 2% target will be met throughout the entire period over which it is making projections.

This then gives to the obvious question as to why we now need to move to a situation not known for most of the last 15 or so years in the UK, where we might have positive real interest rates in this country i.e. the rates payable to depositors of funds might exceed the inflation rate that otherwise reduces the value of the funds that they save. This is what their interest rate forecast - which suggests rates will not fall below 3.75% - implies.

Such a situation always represents an economic environment where the income of those who borrow and have to pay interest is reallocated by the banking system to those who can save because they have no current use for their funds.

I stress when noting this that there is no reason for interest to be paid to depositors excepting bank regulation. The banks themselves have no gainful employment for the funds deposited with them because those funds are never used to fund bank loans, which are always funded by the creation of new money. The payment to depositors is for three reasons:

- Habit. It is presumed that banks need deposits to make loans, even though even the Bank of England has admitted that is not true.

- There is a residual belief, implicit in this practice, that banks are financial intermediaries when that is not true.

- Because banking regulation requires that deposits be held. It does so to provide the banks with capital to cover the risks of default, passing the apparent risk of bank failure to depositors as well as shareholders, from which some of those depositors are protected by government guarantee.

In other words, there are no good reasons for bank deposits to be rewarded as they are, except that it very much suits some in society that they should be, and the Bank of England is intent on rewarding them.

The net consequence of this allocation of resources is reflected in the NIESR forecast for the UK that was published yesterday. They suggested that those on the lowest incomes in the UK are likely, over the coming years, to see the net value of their incomes fall by maybe 2% per annum. Rents will be a big factor in this. In contrast, those with the highest levels of income are likely to see their incomes grow by 7% or more per annum. The coincidence of this outcome, when compared to government policy, which invariably hits those dependent on the government hardest, combined with an interest rate policy of the Bank of England, which is designed to deliver upward redistribution of income and wealth to those who must borrow the hardest, cannot be avoided.

These high interest rates are, therefore, deeply destructive of collective well-being within the UK economy. But are they necessary? For this I turn to IMF analysis, aided by the FT's interpretations of the IMF's charts, which are clearer.

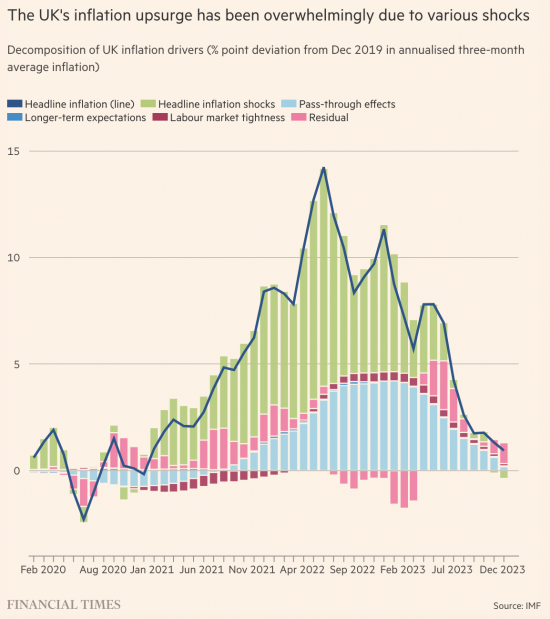

The IMF analysed the causes of inflation in its most recent World Economic Outlook report. The data is around page 5, so important is it. The FT interpreted this in a chart in a recent Martin Wolf article as follows:

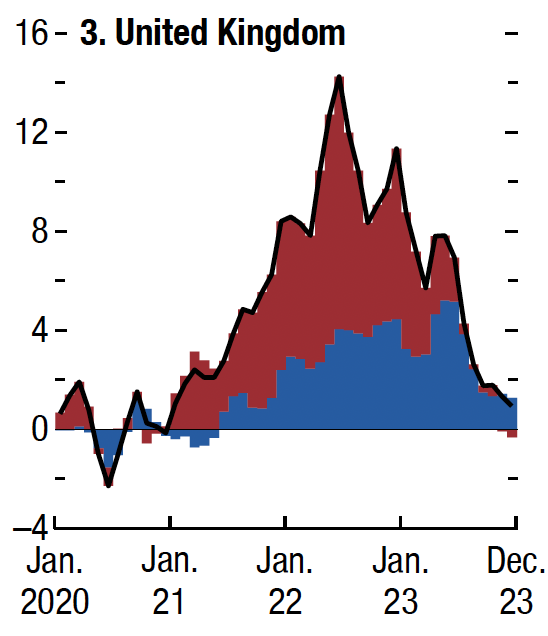

This should be compared with the IMF's chart of headline (red) and core (blue) inflation in the UK:

The overall patterns are, of course, identical.

The reality is that the vast majority of the inflation we suffered was due to shocks. It was always going to go away once markets reacted to shocks. No action was required by anyone to achieve this outcome.

The same is true of pass-through effects. These are as they imply: they are the follow-on price impacts seen in prices not immediately directly affected by the initial shocks, which follow-on price changes maintain price differentials with those things that were impacted. Call these the profit-gouging effect, in other words, although the IMF does not. As will be noted, these explain almost all the rest of inflation in the UK. No action but time was required to tackle them either. They pass through, as the name implies.

The rest is neither here nor there. As is obvious, wage pressure and labour market conditions had almost no impact on inflation at all, despite all that the Bank said.

In other words, as I have always said, inflation was always going to go away. It is now doing so. There never was a reason to raise interest rates. Nor was wage restraint required. But, the government and the Bank took the opportunity to create positive interest rates to increase inequality in the UK, which harms growth whilst also seeking to suppress the wages of most people.

Thye phrase 'never let a crisis go to waste' comes to mind. The Bank has not. It has used the excuse of inflation to boost the upward redistribution of income in the UK at cost to the vast majority of people in this country, and largely by maintaining a myth about the nature of banking that even they have admitted is false.

Economic thuggery is rarely more apparent than this.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This article has been picked up this morning by news aggregator newsnow, it’s one of their top four articles in the Business section! Well done Richard https://www.newsnow.co.uk/h/

Perhaps the Bank of England does understand things such as pass through effects and such like. But, let’s remember that the remit of the rate setting committee is to maintain a 2% inflation rate, +/-1%, and the only tool at their disposal is the sledge hammer called interest rates.

Back when inflation was soaring they had little choice but to raise interest rates; their own remit, politics and political decisions (remember Truss?) required it although there was no real economic need.

But once those decisions had been made there became a very real risk that inflation would turn negative, so now the bank is forced keep interest rates artificially high to prevent this scenario and to remain within it’s remit.

Therefore it is those who make the political decisions to give the BoE this remit, and to keep it so, who must take the blame for the current economic situation.

I don’t agree with the reasoning in your third para but do with your conclusion

“Therefore it is those who make the political decisions to give the BoE this remit, and to keep it so, who must take the blame for the current economic situation”.

As far as I could see the increasingly complacent, plummy-toned Andrew Bailey seemed to be taking credit for reducing inflation. A claim that appears to me to be false in conception; and unprovable by the BoE. At the same time Rishi Sunak is taking credit for the Government redusing inflation; even though he insists that the BoE is “independent”.

We are supposed to make sense out of these statements; and even more absurdly; believe they are all true, and consistent. We are not just being manipulated and misinformed; we are being insulted. We are paying them to insult us and mislead us.

More deep frustration at the impoverished standard of business/economics interviews. One would have thought it stark-ravingly obvious to ask the question, ‘Mr Governor, increases in home rentals are material in sustaining inflation at these levels. What component of Bank of England interest rate policy is responsible for this in an otherwise downward trend in inflation?’

I must calm down. My GP wants to talk about my blood pressure at 2pm!

A few quiet moments – longer than the average Anglican minister provides for reflection during a service – might be required. I think it might have been 15 seconds at my late-uncle’s funeral this week.

[…] The Bank of England used the inflation crisis to boost the wealth of the wealthy, but did nothing at… Funding the Future […]

Brilliant post. And on the money. (Sorry; couldn’t resist.). When Bailey was interviewed last night (iirc) for Channel 4 News by Cathy Newman, he couldn’t keep from smirking for almost the entire time of the interview. Had I been the interviewer, it would have taken all my self-control to not smack him across the face. The arrogance was palpable. Indeed, she asked him good questions which he dodged. It would be salutary were Starmer to summarily sack him , though I don’t expect that to take place.

I agree

He was sickening

I’ve filed that away to be used when next I’m at one of those “BoE talks down to the public & pretends to answer their questions” sessions.

I’m thinking about drafting a question something like “Hi. Huw, can you provide any evidence to show that increasing interest rates over the last couple of years has actually had any effect at all on inflation, given that the IMF say that the UK’s inflation was entirely due to shocks from the world economy & consequent pass-through effects & that means that this bout of inflation was always going to be temporary? The only effect increasing interest rates had was to increase inequality, moving money from those who pay rent & those on low incomes almost directly to the better off.

Probably won’t get called, obviously. But it would make me feel better!

Keep trying

I gave up on those sessions after one go

Huw Pill yesterday:

“We shouldn’t be seduced into drawing too much comfort from developments in inflation that are largely driven by factors that are external to us.”

That didn’t seem to matter for the last 2 years.

Quite so

Richard,

Please can you confirm whether rising rates or falling rates benefit the wealthy (and why), as you’ve previously argued for both outcomes.

You do know that both can, don’t you?

If you don’t, you don’t understand how markets work to the advantage of wealth.

This is fine as long as one is also willing to admit that the corollary is that long period of negative real interest rates in the 2010s managed to redistribute income from the wealthy to the vast majority of people. I don’t recall anyone ever making that kind of argument then.

No, that is not what they did. As is apparent that did not happen. Asset prices were inflated then. Now we have inflated asset prices and high rates. You are assuming a zero sum game. It isn’t. This is about how power relationships are used to exploit opportunities. Your simple little models seem unable to comprehend the range of variables that ensure that happens.

It isn’t my model but yours. Positive real interest rates = redistribution to the wealthy. The corollary has to be negative real interest rates = redistribution to the rest. If the corollary didn’t happen because of asset inflation as you said, then it means that the wealthy win no matter if the real interest rates are positive or negative. In that case, discussion of interest rate policy can leave out distributional concerns.

That is crass.

Your argument is that because the system of interest changing as we do it now can be rigged means that we should not worry about the rigging

The terms small minded indiffernce, incompetence or callousess come to mind. Don’t call again.

You fail to acknowledge the impact of higher rates on the value of many assets, which have fallen significantly.

Hence why your ‘analysis’ is fundamentally flawed. Of course there is no actual analysis, it’s just a series of politically-biased claims with no facts to support them.

I failed to notice the stock market hitting a record high on Friday, of course.

Do you trolls always talk such drivel?

Sure, bonds are down. But not everything is, by a long way.