I posted this video on YouTube this morning:

This is the transcript:

Who are the wealthy? That's a really important question, especially when I've written something called the Taxing Wealth Report, because very obviously that is targeted at those who are wealthy.

There are two definitions that we can use of those who are wealthy in the UK. One is to simply look at the money and other assets that they own, because that is the clearest indication of wealth in common parlance, or in normal plain speak.

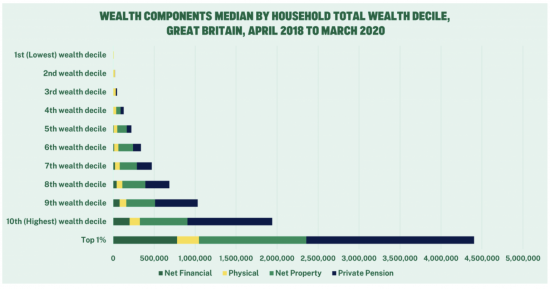

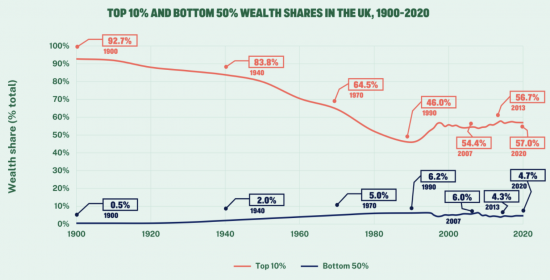

And if we do that, we can see, from information provided by the Office for National Statistics, that there are charts that show, the wealth of the UK is concentrated very heavily in the hands of relatively few people. The top 10 per cent own the vast majority of wealth in the UK. Inside the top 10%, the top 1 per cent own a lot more than anybody else.

Source: Equality Trust https://equalitytrust.org.uk/scale-economic-inequality-uk

If we look across the rest of the population - that's frankly, the bottom half of the population – they own a tiny proportion of the whole of the UK's wealth. That is obviously a clear indication that we do have really wealthy people in the UK and people who are not wealthy.

Source: Equality Trust https://equalitytrust.org.uk/scale-economic-inequality-uk

But the Taxing Wealth Report does not seek to tax wealth directly. What it seeks to tax are the incomes that are derived from wealth and the capital gains that also come from wealth - the profits on the sale of assets.

So what is the pinch point there? Where do we move over from being ordinarily comfortable to being wealthy? My definition is that that point is reached where you can afford to make a number of quite sensitive choices. You've got discretion over your well-being.

One is that you can save a lot. Your proportion of voluntary savings goes up as a part of your earnings. You put more into your pension, you put more into your ISA, you put more into whatever else it is that you want to store value in for your future. That is one measure of well-being.

The other one is that you can actually afford to make choices about what you do in life. In other words, you can afford to not work. You can retire early. Or you can afford to work less, or you can actually choose to do what you wish rather than what you have to, to put food on the table, pay the bills and everything else. Now, that's a pretty critical distinction, but it's really important because that point does arrive in some people's lives.

It is a point where we can recognize that people have real wealth because wealth represents choice and the opportunity to take it, and that opportunity to decide where you save more or where you work less is critical. This is a point where you cross over from being ordinarily well-off to being wealthy.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thank you, Richard.

Richard and readers may be interested in what John Burn Murdoch has been writing on this, https://twitter.com/jburnmurdoch/status/1689950429403037697?lang=en.

He is right

Eurostat published a graphic showing the top ten richest and poorest areas in northern Europe. Inner London was the richest. The next 9 richest were all outside of the UK. Conversely, all but 1 of the poorest were inside the UK (9th poorest was Hainaut in Belgium).

Says it all really.

Yes….

And yet I sat in a small meeting with a deputy governor of the BofE a couple of months ago as he told us that inequality is not an issue in the UK.

Clueless, and care-less.

That is unbelieveable ignorance, smacks of confirmation bias.. and sheer callousness..

The centralised concentration of power serving corporate and financial elites really does just reinforce hegemony with attitudes like that. Not me, guv…

Where we’re at in terms of democratic deficits requires a serious reduction of social and economic inequality.

An unanswerable BoE with no democratic controls really does harm the body politic, and needs bringing back under full parliamentary control to serve public policy, and not merely act as maid servant to the finance sector.

Mind you, as reducing inequality is not prominent in the stated policy agenda of any of the neoliberal political parties… he has a point.

It represents that economic view that to put it crudely, is still wedded to trickledown economics, however discredited that might be. There is evidence out there that unequal economies tend to be less successful. Bet they don’t teach that on PPE courses.

I am sure you are right

Thank you, Robin.

From 2012 – 14, I compiled credit data, quantitative and qualitative, from my trade body employer’s members for the Bank of England’s monetary policy committee. The chief economist, Andy Haldane, was happy to take whatever was produced, but the newly appointed governor Mark Carney often got an underling to contact me and dilute messaging, especially about the increase in cost of living.

That made me chuckle. Carney had non dom status even though he worked at Threadneedle Street and lived in Hampstead and was paid twice his predecessor’s rations as he and his wife complained London was more expensive than Ottawa and Toronto.

Sorry, I’ve missed something somewhere. “The top 10% own the majority of wealth”? Wouldn’t the top 10% own 10% of wealth? Otherwise, that “10%” makes no sense. 10% of what? Can you explain?

10% of the population

Hi Richard, I see some parallels between your views and Gary Stevenson’s views (I’m sure you’re aware of him but if not check out @garyseconomics on Youtube and Twitter). It would be much more powerful if you fellow advocates of taxing the wealthy worked together. I appreciate that you have different views of which levels you would tax but if two advocates of taxing wealth and reducing inequality can’t agree amongst yourselves then there’s no hope!

Thoughts?

I’d be happy to work with him

I have no iodea how to get in touch though in a way he would notice

Thank you, both.

@ Richard: Please try a Twitter DM.

Another channel would be Novara with Gary and your good self.

It’s great to see more of you on Naked Capitalism.

I have made contact….

Most problems in life can be solved with a little thought

Might be worth a try?

https://www.wealtheconomics.org/contact/

Another route has been found

His book is a cracking read and for those who have had first hand experiences of dealing rooms, rings true.

I’ve read Gary Stevenson’s explanation (https://www.wealtheconomics.org/) of why wealth inequality is very harmful: it’s clear and convincing.

But his suggested solution of a time limit on wealth is much less convincing: I find it hard to see how it could work in practice.

Richard’s portfolio of ways of taxing wealth seems much more realistic, including his analysis of how they can be phased in.

But I’m sure it’d be good if Richard talks to him.

Yes but what about people who have made the choice to live apart from society and pursue a more creative personal lifestyle, Are they the same as those who may have made the choice to gather as much material wealth around them as possible in order to do a similar thing but on a much larger material scale.

Let us not forget the acid heads, musicians, actors, vinyl collectors and hobbyists and others who make the choice to trade the wealth of cash for the wealth of time. They might have less material wealth but according to your definition they would also be wealthy .

What about them?

yours

vinyl collecting

mark

I see no reason not to define that as wealth – but in a wholly untaxable form.

I explore such issues in my book ‘The Courageous State’.