As the Office for National Statistics has noted this morning when announcing inflation data for March:

Main points

- The Consumer Prices Index (CPI) rose by 3.2% in the 12 months to March 2024, down from 3.4% in February.

- On a monthly basis, CPI rose by 0.6% in March 2024, compared with a rise of 0.8% in March 2023.

- The largest downward contribution to the monthly change in both CPIH and CPI annual rates came from food, with prices rising by less than a year ago, while the largest, partially offsetting, upward contribution came from motor fuels, with prices rising this year but falling a year ago.

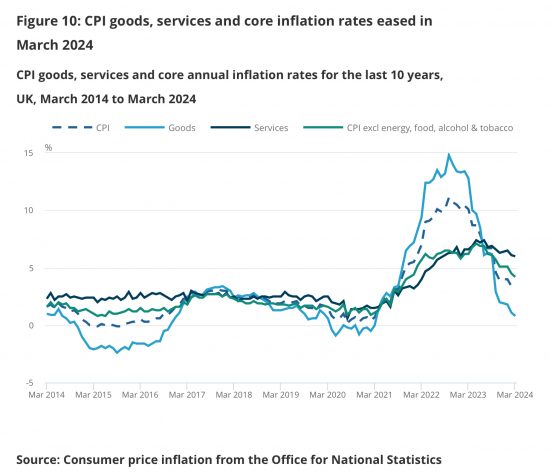

- Core CPI (excluding energy, food, alcohol and tobacco) rose by 4.2% in the 12 months to March 2024, down from 4.5% in February; the CPI goods annual rate slowed from 1.1% to 0.8%, while the CPI services annual rate eased slightly from 6.1% to 6.0%.

The downward trend continues, as expected by everyone but the Bank of England in that case.

In amongst the data I thought this chart most telling:

The inflation rate on goods is heading very markedly into negative territory. As is apparent from the chart, this is not an unknown phenomena, but the rate of descent is, meaning that the level to which it might fall is hard to guess.

What we do know is that deflation is recessionary. I keep predicting that the Bank are determined to keep us in such a state. High interest rates when faced with this data very strongly support that thesis. The Bank is playing a very dangerous game by keeping rates high now, not least for an incoming Labour government that is dependent on growth as the bedrock for all it is planning.

I can almost hear Rachel Reeves echoing Liz Truss on the institutions of power seeking to undermine her, sometime soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Prices have a long way to retrace before we get to the levels before the cost of living crisis. Deflation is a good thing. Corporates can absorb it by reducing their profit margins. Deflation isn’t here but the hard pressed consumer wishes it was.

We do not need those prices back – there have been pay rises since then, and are yu seriously askinmg that people give them up?

Does it really matter if UK consumer prices fall for everything but UK housing?

If the UK “Talking Heads” are to be believed then the cost of housing (rent and/or purchase costs) seems to be the main driver of economic misery. I ask this question as the UK housing market and the US housing market are completely different with respect to reasons for economic misery.

It is a very big factor

And banks cannot afford for property prices to fall as their value is collateral for most loans

When they get in, Labour could just take over the Bank and then make it do what it wants or thinks necessary for the good of the common weal. After all, its independence is only based on a convention, as I understand it. Will they have the guts, though?

Labour introduced it.

It was an Ed Balls idea.

Yvette Cooper is not going to back ending it. Nor is Reeves, yet.

Thank you, Larry.

The Bank of England’s nationalisation act was simply amended to give the institution operational independence. A repeal of that provision would be relatively simple to draft.

There are current and retired Bank officials, including up to deputy governor level, who think the current arrangements are no longer appropriate. 2008 and the rise of macro-prudential policy provoked the first wave of doubt. Covid and global warming have provoked further doubt.

You are right

The 1998 Act could be easily amended

From Bloomberg, today:

What if, they ask, all those interest-rate hikes the past two years are actually boosting the economy? In other words, maybe the economy isn’t booming despite higher rates but rather because of them.

…..This is, the contrarians argue, because the jump in benchmark rates from 0% to over 5% is providing Americans with a significant stream of income from their bond investments and savings accounts for the first time in two decades.

Einhorn notes that US households receive income on more than $13 trillion of short-term interest-bearing assets, almost triple the $5 trillion in consumer debt, excluding mortgages, that they have to pay interest on. At today’s rates, that translates to a net gain for households of some $400 billion a year, he estimates.’

No doubt the same thing is happening here in the UK.

https://www.bloomberg.com/news/articles/2024-04-16/booming-us-economy-inspires-radical-theory-on-wall-street

Excluding mortgages is doing a might lot of work in that claim.

It’s crass, in other words

But it does reveal one thing – and that is high interest rates are welfare for the wealthy

Higher rates certainly transfer wealth to the already wealthy. The question then is “where from?” – In the US this is coming from government as it continues to run large deficits…. so we see the economy humming.

But if you have high rates AND try to reduce deficits (ie. the transfer is from poorer to wealthier people) then that transfer will reduce spending (as wealthy folk won’t spend more, poorer folk with higher rents/mortgages will spend less elsewhere). This is the UK. Then add in other structural headwinds (Brexit, a sick workforce etc) and you have real problems.

At the end of the day the lesson is surely that fiscal policy trumps monetary policy in virtually all situations… and that this means that the government (whoever they are) cannot abdicate responsibility by passing it off to a Central Bank.

Monthly unemployment figures were published yesterday.

Both headline unemployment and the figures for economically inactive persons are rising.

Unemployment is now over 4% and more job cuts are forecast.

The level of economic inactivity now stands at 22.2%.

Both trends ought to make the BoE very happy indeed, being their stated goal.

The day to day struggles of people trying to make a living do not affect the BoE, whose collective transactional mindset merely feeds MPC groupthink.

Apparently, the MPC logic, as discussed by economics correspondents on BBC and ITN last night, is that with pay rises at 6.1 %, – so well above headline inflation – the MPC has every reason to maintain high interest rates to try to drive down inflation further, regardless of other metrics including increasing unemployment, static economic growth and the risks of recession.

So instead of removing the inflationary pressure on income growth that higher interest rates present, we are to believe the opposite, that driving unemployment higher is absolutely necessary to, allegedly, at some future and unspecified time, definitely maybe to eventually drive income growth downwards, as the labour market becomes more insecure, and that criterion alone means the MPC will think the inflation risk is reduced. You couldn’t make it up.

This is beginning to look like hunting the Snark, with a real insane banker in control.

That the BoE evidently want the general population of the UK to be poorer, with lower standards of living, and with more people out of work, simply so they can reach an arbitrary 2% inflation rate ought to be shouted from the rooftops.

This was the subject of a video yesterday, here – now watched more than 11,000 times on vatrious platforms, and rising

Thank you, both.

Ever since I started working with the Bank in the spring of 2008, it has been obsessed with internal devaluations. It made me wonder if the Bank would be happy for us to return to subsistence farming.

Last night I made some progress with an old friend , he gave me a start.

“Listen to this” he said as we sat down to sup our first pint after the river walk , we had experienced in quick succession cold, sun, hail, drizzle and thunder which left us surprisingly chilled after an hour.

“When I got my first job , I was paid a £1 an hour , but that meant I could buy four pints of beer with it. Now with the minimum wage , I’d only be able to get 2 pints. What happened? “

“Ahaaa “, I responded , “I know!”

So , I explained how productivity has been forced up over the decades, increasing the profits multifold but wages didn’t go up accordingly. Even if they went up nominally. Inflation has hidden the fact that we have had our real wages cut in half since the 80’s.

The gap between rich and poor has been increased back towards the prewar (ww2) era. They don’t want us to be independent and wealthy, they want us as herded into the new parishes and stay in them.. they want us to own nothing and be happy , paying rent and to do that they load us up with debt at a younger age.

He seemed to understand.

“That is why my kids will never be able to afford to get a house as I did back in the 80’s , with one job and girlfriend as a full time student and still had enough for beers, car and holidays and save as well – all without a credit card or hp “

“Yup, I remember, I was there. We could get council housing at an affordable rent!, if we earned enough and saved a deposit we could buy a property for not much more than that rent.”

He nodded in agreement so I carried on.

“Your girlfriend could be a student on a grant as I was. We could sign-on in the term breaks or get a casual job, we had an overdraft at most as borrowing’s – now barely out of teenage-hood , they come out with tens of thousands in debt! Can’t even get into a decent permanent job with a degree. Have to work zero hours and shitty paid jobs that make money for the employers and keep the kids poor.”

He concurred with my explanation, we had been deliberately ripped off by not increasing our real wages and loading us up with debts that have made houses a lot more expensive so anybody in their mid 20’s couldn’t even consider purchasing their first property now , even if they were earning double of what we were in our days, just a few decades ago. That’s why we can only buy two pints at minimum wage now compared to four then.

I said it’s because Money is a con. He looked quizzical. So I went on.

“Can you answer this question do you think taxes pay for government spending?”

“Well they must” he said.

After establishing that he didn’t really know why he thought that , having gone past the , ‘it is common sense’ and that’s ‘what everyone believes’ and having agreed he would let me explain it , I said great I’ll get a round in and we’ll chat about it!

Good luck and thanks for sharing

The argument about pay inflation is a complete red herring, given pay increases lag price increases. Increases in pay taking effect this month will be based on CPI (or whichever) figures 6 months or more ago.

There might be a point if pay was rising faster than prices over the long term, but that isn’t the case except for a few lucky individuals (FTSE Chief Executives the main example).

However as an ordinary citizen I am experiencing April bringing a number of increases in price, and it isn’t clear to me the drop in the energy price cap will compensate for those when the next figures come out. While you have argued persuasively in this blog that current inflation figures only look high because they include the April 2023 rises and have been running at around 1-2% for the last 9-10 months, there may be a risk that they don’t drop as low as that over any 12 month period.

(Though having said that, sensible policy would see interest rates moving to be roughly aligned with inflation figures, i.e. a drop).

Spot on