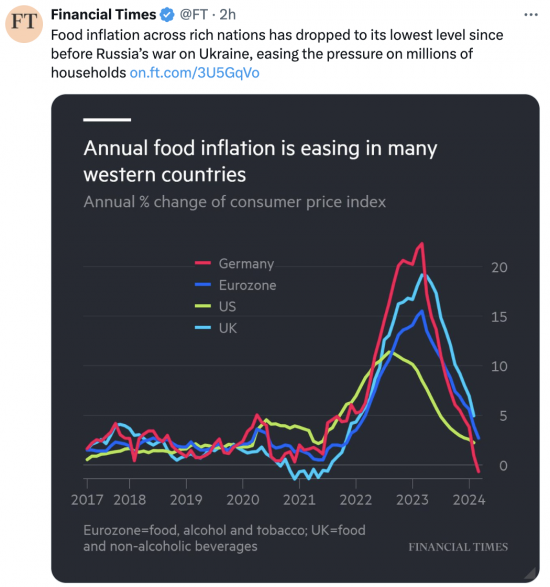

The FT posted this on Twitter this morning:

The data they used comes from the OECD, which either leaked it or is subject to a leak as it is not due out until later today.

The data shows that food inflation is falling to levels last seen before the Ukraine war. This is also true of raw material prices. In other words, the shocks that caused an unnecessary market reaction that hiked international prices, largely as a result of the onset of that war but also in reaction to the reopening after COVID-19, have now all gone away or will cease to have much impact very soon.

This is, of course, exactly as a few of us predicted and which was denied as being a possibility by the likes of the Bank of England.

Did their increasing interest rates have any effect on this? No, not at all, although Brexit did have an impact in leaving our inflation higher than anyone else's.

Did anyone else's interest rate rises affect this? Again, no, because the lag effect on any impact from such changes is usually reckoned to be two years, and the downturn came long before they could have had an impact.

So what did happen? Simply, what always happens when an exogenous shock to markets occurs. Markets return to normal once they have absorbed the shock and, in most cases, realise that they had overreacted, as they did on a massive scale in this case. Again, this is exactly as predicted by me, Danny Blanchflower and others.

So was there any real role for monetary policy in this crisis? As far as I can see, there was none: we would have all been vastly better off if only the Bank of England had done precisely nothing with interest rates at any time since 2021.

As it is, they acted and now will not return rates to the level they need to be at - which is below 2% - for a long time to come. We will all be paying a significant price for that for a long time to come.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

City economists are increasingly convinced that inflation is falling more sharply than the Bank of England expects and could even hit zero within months.

That would open the path to much faster interest cuts than the market expects, a boost to family finances and to the Conservative Party ahead of a looming general election.

https://www.standard.co.uk/business/inflation-economists-may-zero-interest-rates-bank-of-england-mortgage-b1149566.html

Inflation would need to go negative for quite some time to redress the historic price rises it has inflicted on us. It appears that many people don’t appreciate the ratcheting effect it has: once prices have risen, they seldom drop by anything like as much.

We really do not need that defaltion – it would be deeply recessionary

‘Many large international companies were able to comfortably increase prices during the global inflation period, protecting or even driving up their profit margins, while ordinary families saw their real incomes wither away, according to a new report from IPPR and Common Wealth’ –

https://www.ippr.org/media-office/revealed-how-powerful-companies-are-amplifying-inflation-through-their-profit-margins

If large companies were able to make a step change in their prices, unless wages increase to allow for it, then a higher level of profitability has been locked in for years. Falling inflation would do nothing to address such price gouging.

This is what monopolies do when enabled by government and the Bank of England

2000hrs – Sunak on the telly – July – political broadcast:

Sunak – gurns/smiles at the camera

“I am pleased to announce today that this government has instructed the Bank of England to cut interest rates to 2%. This will make everybody better off, those with bank loans, those with mortgages, all will benefit from this government action. This government is committed making life better for everybody in the UK which is why we told the bank to cut rates. A better Britain for all .”

CUT.

Sunak – “Jesus what’s that terrible smell”,

lackey “Thames water have had a problem & the river is a rather strange colour – pedestrians are passing out walking over Westminster bridge”.

Isn’t yet another example of how the DSGE models in which the BofE places total faith, are incapable of reflecting how the real economy and society function? Certainly in times of sharp change, as in the financial crash and recent events. They might as well be looking at a chicken’s entrails.

The weird thing about DSGE mocels is they assume that there is no money in use and all transactions involve arbitrage…

I looked through the details of my personal tax liability and public spending for 2022/23 (see below).

Its shocking to learn that Debt Interest ranked No. 3 and composed 12% of the total amount. This amount is higher than Education, Transport, Environment and many others categories by a huge amount. I can only assume that a large chunk of this is due to the increase in interest rates which is total and utter madness, especially given that the rate increase was unnecessary in the first place.

If the majority of UK individuals/businesses were to do a similar exercise for their own private consumption/spending I am confident in saying that it would show that Debt Interest also appears at the top and in some cases could even rank as high as No.1 or 2. Again this could well be all because of the spike in interest rates.

Your blog posts/articles/tweets/reports/analysis and others have all point to the fact that the increase in rates is and always was unnecessary and that it has caused a massive detrimental impact on public and private finances and the cost of living.

Make no mistake this is/was a choice made by those in power.

As a slight aside I know that there is an ongoing so called ‘No tax for genocide’ (https://www.probityco.com/ and https://notaxforgenocide.uk/ only including for reference here for sake of completeness, not advocating anything). I know that the claims and arguments being put forward are are very dubious and questionable at best and downright dishonest/misleading at worst (see rebuttable by Dan at Tax Policy Associates -https://taxpolicy.org.uk/2024/03/19/fake-anti-war/)

However, it got me thinking about the possibility of anything to claw back taxes or seek compensation that arises from and is due to the mismanagement of monetary and fiscal policy by those that are in power and make the choices and decisions that we have no choice but to live with and abide by.

Could we bring criminal charges against those involved? If so, when and how?

I know it may come across as a bit silly or naïve to ask and people will say that’s what democratic elections are there for and that we have public enquiries, governing bodies etc all designed to achieve this. It is true to a certain extent that we already have lots of checks and balances in place, scrutiny, governance and procedures but none of the existing measures is even remotely effective, or working. No measures currently in place are the slightest bit helpful, useful, functional, effective to prevent the mismanagement of finances across the board.

For me its just not good enough. For example, I think there are unlikely to be any meaningful criminal charges bought against those that are responsible for the deaths of many as a result of the Covid enquiry. For years politicians and others have got away with so much and there has been little to no effective accountability, punishment, heavy price, sanctions etc at all whatsoever.

I reckon we all should be able to hold to account the governor of the bank of England, Chancellor, politicians and others that are directly involved in the economic management of public finances during their term in office/parliament and over the tenure of their stewardship. We must be able to pull them up and pass judgement, enforce criminal sentences/punishment (if necessary) before they create even more chaos and madness. On what grounds can the governor of BoE be charged/prosecuted for criminal offence to do with his role?

At present I don’t think its a criminal offence for BoE to increase rates which cause so much hardship and then in the fullness of time proves to have been the wrong thing to have done – so all the pain was inflicted unnecessarily and at huge cost to a whole generation. Surely this cant be right.

As you have presented above if in the future there is proof/evidence which can establish beyond any reasonable doubt (and perhaps if the vast majority of economists, politicians, knowledgeable/respected commentators, specialists etc all agree so a consensus of opinion) that the decisions made were completely and utterly wrong and led to disaster/financial ruin for many of the population, then it appears there is very little or no repercussions/consequences at all for those individuals/organisations concerned in making these fatal choices and decisions. So something they did and which immediately led to huge misery difficulties for millions of people all of which is/was based on flawed thinking/policy/analysis and personal dogma/political will/persuasions goes unpunished.

Like reparations for slavery (the application of the concept of reparations to victims of slavery and/or their descendants). I call for a similar action and concepts to be considered and embedded in law for matters relating to managements/decision making to do with public finances, interest rates etc.

How is it possible that Boris Johnson, George Osborne and David Cameron, Andrew Bailey have not faced any serious criminal charges over their the decisions that they made and presided over whilst in office? I know that there is a long list of other names to be added including advisors, corporations and so called experts. But if some of these individuals faced punishment it would send a clear message throughout.

Tax year: April 6 2022 to April 5 2023

Your taxes and public spending

This shows a breakdown of how your taxes have been, or will be spent by government.

Description:

Health (19.8%)

Welfare (19.6%)

National Debt Interest (12%)

State Pensions (10.3%)

Education (9.9%)

Business and Industry (7.6%)

Defence (5.2%)

Public Order and Safety (4.1%)

Transport (4.1%)

Government Administration (2%)

Housing and Utilities, like street lighting (1.7%)

Culture, like sports, libraries, museums (1.3%)

Environment (1.3%)

Outstanding payments to the EU (0.6%)

Overseas Aid (0.5%)

That figure for debt interest is bogus

Maybe half was actually paid. The rest might be paid, on average, in 15 years time. The accounting, as has been discussed here, is shoddy, and that matters because it is deeply misleading.

I think food prices may well go back up this year. Farmers in the uk have had their winter wheat fail and are still not able to get back onto the fields to plant spring crops, potatoes are failing, heat in Asia is impacting on rice and other crops, price of coffee and cocoa/ chocolate already rising. Expect a heat wave impacting on EU crops this spring/ summer.

A rise, or continuation of the current interest rates will of course have absolutely no impact on the actual cause of the price rises. They will ensure the poor continue to go hungry.

I enmtriely accept that there are many real risks

Corruption and mismanagement is rife in the UK but many people keep voting for it. It can only end badly!

If a Tory minister is saying individuals should go to jail over the sub-postmaster scandal why should the Bank of England be immune most right-wingers constantly tell us it isn’t part of government! Should this ever get traction as a civil suit suddenly we’ll be told the BoE is part of government and therefore immune! The hypocrisy will be chilling!

I feel similarly about interest rates after my study here:

https://medium.com/@eddyojb/do-interest-rates-tackle-inflation-af4bfce45b88

I actually think the lag rate might be generally longer than 2 years if you look at my graphs.

I agree about external factors far beyond interest rates explaining falls in raw commodity prices. However, can you point me to summary data that shows this falling over the last few years?

Ed

I feel similarly about interest rates after my study on medium, which I have linked.

I actually think the lag rate might be generally longer than 2 years if you look at my graphs.

I agree about external factors far beyond interest rates explaining falls in raw commodity prices. However, can you point me to summary data that shows this falling over the last few years?

Ed

I just look at trade prices on the web. For example, https://tradingeconomics.com/commodity/crude-oil

Link here:

https://medium.com/@eddyojb/do-interest-rates-tackle-inflation-af4bfce45b88

It amazes me that in the modern day with so much wealth that the only tool to tackle inflation is interest rates. Most of my retired relatives have carried on living life as usual, actually feeling better off and spending more as they’re making more on their savings.

I saw one article recently after saying it for over a year now. Interest rates hit less than 30% of people at most directly so less than 30% are directly targeted to control inflation.

The interest rate hike wasn’t done to keep the inflation in check. It was done so the big banks can make an buck. The big question was : why do they increse the rates so fast? The only answer for this is to get as many people as possible on 5 years or more tight up in the mortgage.

Agreed, but savers have had a welcome boost.

Which has fuelled both inflation and inequality

Great…