This morning, the business media is obsessed with the fact that Thames Water has failed to make a payment due on debt owed by its parent company, with intense speculation about what this might mean for the company's future.

The discussion focuses on how that company's debt might be repaid and whether temporary nationalisation might be required to reorganise it so that it might be preserved within the private sector.

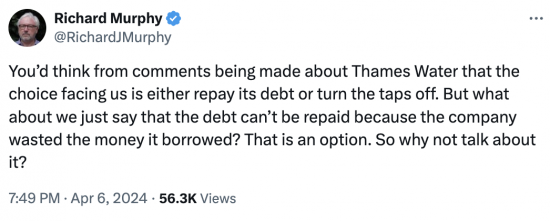

However, as I noted on Twitter, last night:

I put the option forward in all seriousness. As I demonstrated in the report that I wrote on the water industry last year, quite literally every penny that this sector has borrowed this century has been used to make payment of dividends to shareholders. Even more money was used to pay interest to those from whom funds had been borrowed to finance these dividends. The sector's own net investment in new capital to provide water to the people of this country over the period that I reviewed was precisely nothing.

My point is a quite straightforward one. If I could work this out, then so could anyone. In that case, any institution lending money to these companies or providing them with their capital clearly knew the risk that they were taking, which was that the industry that they were providing with funds was not using those for gainful purposes but was instead exercised in undertaking financial engineering for the benefit of financiers, but not for the country as a whole.

Given that this risk was always apparent, known about, and widely talked about, the fact that loans have now failed can come as a surprise to nobody. This whole industry is environmentally insolvent, as I have described it, but is also now tottering on the brink of financial insolvency as well.

In that case, obsessing about how debt might be repaid is absurd. That debt never funded useful activity. As a result, the means to make its repayment do not exist. It is not repayable, as a matter of fact. That is why insolvency happens, and these companies are bust.

The pro-market extremists in the Tories will try to avoid this issue, desperate to make sure that renationalisation of this company takes place on Labour's watch, for which they will then give it the blame.

Labour's own pro-market extremists will refuse to recognise that they will have renationalised this company when they will, inevitably, be forced to do so. Instead, they will say that it is quite impossible for the state to take on the debts of Thames Water and that the company must be returned to the private sector for these debts to be repaid, which can only happen at cost to consumers who will not see any benefit from the charges that they will have imposed upon them to ensure that such repayment can be made.

Both parties are pursuing policies that are extreme. Both want to impose the cost of failed financial engineering on the people of this country when the reality is that they have a duty to acknowledge that this company has failed, that water privatisation has failed, that the sector can only work in the future under state control, In that case, they should be organising planned insolvencies under laws that recognise the economic reality of the financial failure that has happened, which those in place at present do not do because they are inherently biased in favour of the owners of capital in this sector.

Thames Water is bust. Its shareholders need to accept that they have lost their money. Most, if not all, of its debt financiers need to do the same thing. They took the risk of losing their money. They have done so. That's how markets work, unless you are a pro-market extremist, of course, when the idea that the market might fail cannot be tolerated.

It is only because we have pro-market extremists in charge of this country that we are debating whether the debts of Thames Water should be repaid or not. It should be obvious to anyone with the slightest sense that doing so is impossible. What we should be doing now is working out how to deliver clean water, rivers and beaches. Instead, our politicians are obsessing about how to save financiers who were stupid with their funds from embarrassment. You cannot get a clearer indication of the failed priorities of all those at the top of our political system than that.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

When a company cannot pay its creditors, the creditors get to take over the assets. You don’t get to confiscate the assets to fulfill your fantasy of nationalisation.

You clearly do not understand corporate insolvency. I suggest you should before commenting here

Part of the reason I continue to read your blog, Richard, is your unerring honesty.

Top marks and, thank you

According to the Government’s own website, under ‘Technical Guidance to Official Receivers’ : “Generally speaking, a creditor is prohibited from taking a debtor’s property once they have gone into formal insolvency.” (Section 12).

I only add to Richard’s polite reply (and he is informed on these matters); in order, helpfullyI trust, to point out that your problem is, if you are going to comment on Richard’s Blog by offering a rude and contemptuous sneer, may I suggest you first come adequately informed and prepared? You do not merely undermine your argument, but make yourself (and your ilk), look crude and ridiculous. Why is it that neoliberalism seems to attract quite so many foolish trolls?

Because it was created and promoted by people of that ilk?

Maybe it’s time to change the game.

If lenders lend without understanding their moral and market responsibilities (in this case, providing fresh water – their moral responsibility, and making sure investment took place – their market responsibility) maybe they should lose lose access to ‘their’ assets in the event of default.

It would concentrate the minds of lenders in the future.

What is actually happening is that the solution for water is being manipulated toward the same fix as the solution for the financial crash (and we are still paying through the nose for that mess, because it was fudged to save the miscreants, not solve it). I suspect the idea is to assume the miscreants in water are ‘too-big-to-fail’ (or in this case perhaps we have moved on to), or too embarrassing to confess, and thus ‘too-important-for-free-market-credibility-to-fail’; and rescue them with public money. No doubt we will find a way to hand them cheap debt, and then cut public services even more to pay for it all; and point to the impossible levels of national debt that are holding up all these ‘free market’ banks and utilities. And allow big executive bonuses to return because the water companies are doing so well; allowing themselves to be rescued.

Alternatively, we could just allow a collapse, and nationalise the carcass. No ‘bail-outs’, no ‘haircuts’; just execution of the miscreant company. And no more fake ‘free markets’.

Of course like the private sector banks in the GFC having potable water and and no sewage born diseases is a “too big to fail” situation and for all the Neoliberal monetary illiterates “polluting” this country this is why we have governments that can create money from thin air! No excuses for my strength of feeling on these issues!

Couldn’t agree more John. The Banks should have been allowed to fail like Iceland did and the whole sorry state of affairs we are in now would be a distant memory

Fail yes

But the customers should not have been failed

Totally agree John, well said. The lenders and shareholders and useless millionaire managers of Thames Water deserve no sympathy and no money of any sort.

Agree with the final para. The only thing to discuss now is the details of how gov pulls Thames (& the others) back into state ownership.

Anything else is deckchair rearranging.

Tories & LINO don’t want to do this – thus a good reason to ensure both have a minimal number of seats in the next parliament. Time to elect realists not market fetishists.

In the case of Mrs Flowers, I predict an attitude change if nothing comes out of her tap (or it comes out a nice brown colour).

The symbolism is huge as the nation gets pissed off with the outcomes of the Tories “market perfectionism” their leaving will be accompanied by sewage stenches! Market perfectionism stinks but Starmer wants more of it!!! What a clown!!!

It would be interesting to know what a realistic valuation of the debt is: pence in the pound, no doubt – but is it 10p or 90p?

As things stand the parent company appears to be insolvent m, at least on a cashflow basis. It seems the operating subsidiary isn’t yet, but what does its balance sheet look like?

At some point the directors will have to do a deal with the lenders, or get the insolvency practitioners in, or both. I can’t see that the lenders would have much interest in taking over the subsidiary – more of a liability than an asset. They will just be looking for a deal that gets them as much back as possible. Someone to buy the debt, or to buy the company or its assets. And if they are not paid off in full then the shareholders should be getting nothing.

No doubt the special administration regime for utilities will kick in at some point to maintain services, but at the moment it seems to me the only realistic purchaser of Thames Water is the UK state. And there is no reason for the state to repay the debt in full if no other person would. Just make the lenders a realistic offer and arrange a prepack administration and sale to a state-owned company.

I suspect that there is a small value – largely to get rid of nuisance claims. If it exceeded 25p in the pound I would be amazed. I suspect less than 10p would be counter productive in terms of the cost of resolving this.

This is complicated and I don’t understand all the “ins and outs”. However, I think we need to distinguish between the regulated company and its debts (Thames Water and associated borrowings typically secured against assets) and the holding company structure and its debts (Kemble).

Kemble can’t pay its debts because its only income is dividends from Thames Water. At the outset, this seems odd – why have this “bond” structure? Either it is to get more leverage or it is to minimize tax… and either way, they took the gamble and should lose everything.

Kemble creditors might take control of Thames Water as part of the insolvency but that does not give them the right to plunder the assets of Thames Water – that is a regulated entity. But would creditors want to do this? They are banks not suited to run a water company… they will want to sell asap. However, as Richard has observed, the regulated entity is insolvent because it cannot sort out its sewage issues and service debts at current regulated prices. So, clearly all equity should be wiped out.

But consider the “Enterprise Value” of Thames Water – that is the value of its Equity (zero) and its debt (£15bn ish at face value). The question is “what is this worth?”

Now, that depends on how much money needs to be spent sorting out the infrastructure versus income for bills under the current pricing regime…. and it is here that the real discussion begin!!

The answer will decide what secured lenders to Thames Water should expect to receive. A look at dividend payouts since privatisation would suggest about 75% (can’t recall the details but The Guardian had a list of all the dividend payouts and if you assumed they had not been paid and used to reduce debt you get to something like 75%).

Would any private company want to take this on? Probably not… so nationalisation it is. Kemble equity and bond holders get zero. Secured lenders to Thames Water get 75% of face value. The Nation gets Thames Water for about £11 or 12bn (which gets financed by gilts).

Kemble Creditors might, instead, offer forbearance

I think that would represent a massive over valuation….

But these things are always subjective

I accept there will be a price

We are angry with TW because they extracted excessive dividends and did not invest in infrastructure. So, imagine all those dividends were not taken; Imagine investors had made NO return over 30 years. Would we then be demanding that they lose money because they were greedy? Probably not.

Total dividends extracted = £7bn; current debt = £14bn …. so I think 50% represents a floor for payout to secured operating company debt.

Holding company debt? Zero…. or maybe 5% to stop them causing trouble.

You are ignoring interest payments in that calculation – often to parties related to the shareholders.

Yes, some of the loans are to related parties and may be at “above fair market” rates (ie. disguised dividends) – although that would be difficult to determine and HMRC might need to have a word if it were true. Equally, I have assumed zero returns (give or take some time value of money)

Sure, this is a very rough/ready estimate but my point is that operating company debt should not be compensated at 10 or 20 pence in the pound; 50 to 75p is more realistic.

Market prices are a bit opaque but the TW 5.125% 2037 trades at about 80; Kemble trades at about 10-15.

In my view Kemble bonds are close to worthless – that they are 10 bid is the hope that the Government throws them some money.

TW operating company debt pricing suggests that the market still thinks there is a reasonable chance that they will keep paying but that if there is a default then they will recover somewhere between 50 and 75.

I think the throw them a bit of money option is the only viable one – but I mean, a bit

Before 75% of face value is paid, it is worth asking what options the secured creditors have, if the Government (under public pressure, for example) resisted paying £12Bn, when the public has been ripped-off in their bills, and services provided; for decades. The Government should be taking a very, very tough line; because it is the public that is picking up a private sector mess, again.

My question remains; who else can the secured creditors turn to, to pay 75%. Why, specifically is it not a fire sale, with limited wriggle room?

I agree, there is no private buyer at 75 (although the debt still trades at about 80 today) and the government could drive a hard bargain. But equally, the owners could say – “build your own reservoirs, I will turn ours into swimming pools… because you could not do it for less that £14bn”

Extreme, I know….. but you get my point

You forget planning law….

Refuse a change of use and they are stuffed

And, anyway, the special administration rules prevent this, but overly compensate the creditors

Clive,

Joint stock companies can bounce around structures simply to be tax efficient. It is too easy, because it is indulged. The fact is we are facing another outrageous plundering of the public sphere (paid for by everyone) by the private; and because water services mustn’t fail, it seems to me you are trying to allow that pressure to provide room for the willing participants in this private sector irresponsible financial carnage (when they thought they couldn’t lose), to fillet the public sector (and the public), and save the bacon of the wantonly irresponsible private sector; yet again. This is simply regularising a variant of ‘too big too fail’ in order to save a system that does not work. What you are doing is encouraging the easy way out for unacceptable activity. You are establishing ‘to big too fail’ as a generalisable private sector, free market rule. And that isn’t a ‘free market’. We are just privatising profit, and transferring losses to the public sector as standard procedure.

I ask again. Take out the fail-safe bail-out by Government from the available assumptions. Given that whatever happens, water services will be required under a seriously regulated structure, with massive penalties for failure, and suspicious if not hostile consumers; what are the secured debts worth? Who will buy them – without some grace and favour from the State?

Responding to Mr Parry:

“the value of its Equity (zero) and its debt (£15bn ish at face value).”

what did they spend it on – the debt? & why(why was it raised) & what is the cost of the debt? and and and … (rinse & repeat for all the other companies).

https://www.thameswater.co.uk/media-library/home/about-us/investors/our-results/2023-reports/thames-water-annual-report-2022-23.pdf

Page 122

But, it’s more complex than that

I may be over-simplifying here, but let us stick with Kemble for now.

They are currently insolvent and have no likelihood of getting any income. So they are now insolvent. Their only assets, I believe, are shares in Thames Water. Call in the liquidator who will try to realise those assets. No-one will buy them as Thames Water is not an interesting proposition, so Kemble goes bust and the shareholders get nothing.

Then move on from there.

What have I missed?

Not a lot

Correct – all (I think) agree that Kemble investors get nothing.

The trickier question is what do lenders to the operating company get?

Yet another case of attempting to privatise the profits whilst socialising the losses. As you say, the creditors are going to have to take a hefty haircut and the shareholders may well lose out. They should have known what they have been investing in. Somewhere between a Ponzi scheme and a scam.

The only question is how it is made to happen and what form the resulting organisation should take. A public benefit company seems like and attractive option. At the same time, the regulator, along with all the other regulators in different sectors, needs to be massively beefed up with real teeth and consequences for failing organisations and their directors.

I’ve just read the Telegraph comments on the article about Thames Water, and I can only conclude that there has been a rip in the fabric of the space-time continuum.

Almost every comment is in favour of nationalisation and allowing Thames Water to fail. They blame the shareholders entirely for ripping out the money and giving nothing back, without one penny* going towards improving the infrastructure.

They say that privatisation of public utilities was a scam and should never again be allowed.

I feel faint.

*Should have been one guinea. I forgot it was the Telegraph.

🙂

Isn’t the the major benefit of our extreme Neo-liberal Brexit that we are supposed to be able to say to the owners of companies like the Water industry, you gambled and lost. The debts are all yours.

The ‘regulators’ seem to have failed massively.

There must be questions over their failure to take action

and who appointed them and failed to monitor their performance.

Those questions need to be asked about other ‘regulated’ sectors.

Mr Stevenson, failure of various regulators to regulate is not failure per se but is built into/designed into the system.

Under resourced (envo agency), failure to stop looting (Ofwat,), failure to regulate money extraction/overcharging (Ofgem). Ofcom, Of-this-n that the list goes on & on – the outcomes in all cases are the same: UK serfs paying over the odds for crumbling services/poor services/negative services (shit in rivers).

The Thatcherite “experiment” undertaken by Tories & LINO I and with continued support from LINO II has to come to an end.

It will come to an end if a parliament is elected that recognises this reality (& it is a reality) and acts.

In an ideal world, there would be a written constitution – & gov ownership and control of critical infra would be part of that – thus preventing a fresh set of imbeciles in the future deciding to have yet another “experiment”.

We can live in hope

I’d put it as a failure of regulation rather than the regulators as persons. Given the current model, they are pretty much doomed to fail, if we think that the objective is to deliver good service to the public and the environment.

More cynically, one could could argue that regulation has succeeded given the intentions of those who set it up. If your objective was in practice to interfere as little as possible with those businesses being regulated, then regulation has succeeded. Looking more closely, across different areas, we have regulators with limited resources (compared to those they are up against), narrow remits, and no teeth whatsoever. If regulation was set up to prioritise delivery to the public and the environment (or the wider economy in the case of finance), PE and other such speculators (I don’t flatter them with the term investor) would run a mile.

Whilst the discussion about value/cost is interesting, to me the bigger question is what do we do about the directors and auditors.

Those two groups never seem to suffer in these circumstances. I would suggest that directors of any insolvent company with debts in excess of £1m is barred from directorship asap. And if it appears that previous directors set up the circumstances then they took are barred. As for the auditors, unless they issued warnings to shareholders about the financial risks the directors were running, all the partners of the firm should be fined the value of the remuneration they have ever received from the insolvent company.

If the one of the big five goes bust as a result so be it. Time for auditors to be reminded of their duty to shareholders, to check on the directors behaviour.

The auditors of Thames did give a warning

Yes Prof, in this case, but in other major insolvencies they haven’t! In this case they did their duty to shareholders so no punishment due. But again in this case having been warned the shareholders need to be cleaned out, as for the directors ….

The Insolvency Service only disqualify about a third of the Directors reported to them by official insolvency practitioners for malpractice. And they take up to two years to investigate.

Of course not all failures ever are scrutinised by insolvency practitioners anyway.

The trick used by cowboy builders is to leave insufficient funds.

Company directorship seems to be all carrots and no sticks in practice.

As for auditors, I think the big 4 cost their regular fines into their business plans.

Company law is wide open to abuse, is poorly scrutinised and the sanctions for dishonesty, negligence or other malpractice are virtually invisible.

Much to agree with

Even the Economist runs articles these days about why privatisation has been an expensive failure –

https://archive.ph/3nb9o

It’s not as if it’s something that’s came out of the blue – ‘warning to ministers over privatised water kept secret since 2002’.

‘Chris Goodall, who wrote the report for the Competition Commission investigation into a proposed takeover of Southern Water, said: “My real concern was about the financial structure of the proposed deal. In my view the transaction created an entity which would prove impossible to regulate. Large external private equity shareholders would load the company with debt and Ofwat inevitably would lose any regulatory control. For example, it would prove extremely difficult to ensure that water companies invested enough in sewage control. This report should be published in full now because it helps to show why the last 20 years of increasing private equity dominance of the water industry has proved so disastrous”’

https://archive.ph/GdVU3

I wonder how many MP’s have financial links with water companies. As always, follow the money.

1) “I agree, there is no private buyer at 75 (although the debt still trades at about 80 today)”.

I suggest it is trading at 80, because the market assumes, at worst the British State (the mug) will bail them out; ant that can’t fail. Because they know the politics of government.

2) “But equally, the owners could say – ‘build your own reservoirs, I will turn ours into swimming pools… because you could not do it for less that £14bn'”.

Richard made the point about planning and administrators. however, there is a wider point, too. The Government represents sovereign power. It has lots and lots of prerogative powers to use if they explore their capacities, to make life difficult for failed investors who want a soft bail out; indeed nowadays, expect it. Ripping off the public sector is mainstream. The fact that government hasn’t explored its capacities to make life difficult for private sector business scroungers (a phrase that fits the facts much better on scale of money waste than ‘benefit scroungers’), for decades; but rather – has lavishly indulged them.

Agreed

There is another deduction that can be applied to the final price for which the company is bought.

Environmental crimes that remain within time limits, and have not been discharged, with even failure being brought to a special court with day and night sessions.

I believe that Thames Water maintain a running list of these events. Possibly the only maintenance they do on a regular basis, so the self-evidence is there for the using.

What am I missing?

We can create money for QE, bailing out failed banks a la 2008, & failed privatised industries (examples: rail franchises, hived off health care that is too difficult to run and/or doesn’t make enough money and/or quickly enough for “shareholders”), & we all know that government will almost certainly do the same with Thames Water as another example. I cannot claim to know precisely how the TW “rescue” will be done, just that it will be, dressed up by neoliberal politicians with their aides in the media, in the form of an elaborate lie.

Desite massive public support for bringing this outsourcing, privatising, almost piratical nightmare to an end, this government will not do it, & as far as I can see, neither will the next one. Any form of public ownership will be temporary & transient – just as long as it takes, & no more, to get it back into private hands asap! So much for democracy!

Taxation does not fund anything & collected taxation is not recycled, so if we can create money for all the nonsensical schemes (scams!) mentioned above, why can’t we , without beating about the bush, create money for badly needed investment, infrastructure & to bring the privatisation nightmare to that end referred to?

The only caveat is to revamp the tax system & the savings systems (irrationally & erroneously called National Debt) a la Murphy.

What indeed am I missing?

Nothing…

You are right

The bottom line I suggest that Thames is worth nothing.

Its clearly insolvent by any standards

Because its a regulated business you cant simply sell off the assetts

So the creditors get nothing

Except the law has been rigged to protect them

Lord Prem Sikka has echoed Ian’s comments above. “Private equity has its tentacles in England’s water companies. Thames, Yorkshire and Southern Water are all inflicted by private equity and have higher leverage than other water companies. Profits are made by dumping sewage in rivers, not plugging leaks and low investment. Since 2020, Thames Water is has dumped 72bn litres of sewage into rivers and has not built any new reservoirs since 1989. It is now struggling for survival and has hiked customer bills by 12.1%, well above the rate of inflation.”

Sikka’s article on Private Equity is worth a read.

“Private equity is predatory capitalism with a long trail of destruction”, Left Foot Forwards, 5 Apr 2024

https://leftfootforward.org/2024/04/private-equity-is-predatory-capitalism-with-a-long-trail-of-destruction/

Various good points made by John Warren, Mike Parr, Richard and others – as usual.

Where do we agree?

a) Kemble bonds are worthless and they should be nothing for the holders of these bonds or any other equity.

b) The government has the power to do whatever it wants – it is sovereign. However, it should act “fairly” to all stakeholders…… and that includes bondholders and the public.

c) The end result has to be public ownership.

The only issue is what happens to secured lenders to the operating company. “Only” is doing quite a bit of work here – it is, after all, a £14bn question! Not only that, it sets a precedent that has implications for other water companies and also other entities that ought to be in public ownership.

The easy solution is to take control and honour existing debts. This has been the case in similar situations (Railtrack, Bulb) to this point. It is easy because there would be no serious industry/market opposition. Easy but unjust… and it also gives the greenlight to everyone to leverage up as much as you can as the precedent is set.

The “feelgood” solution is to nationalise and pay out secured lenders at (say) 10p in the £. The “feelgood” comes from seeing the bad/greedy punished… but unfortunately the bad/greedy folk have run off with the money and we are just punishing the stupid. This solution would be bitterly contested in the courts and could look like nationalisation without fair compensation which would also have implications for all investors in the UK. Richard has made powerful case that the present value of the obligation to provide clean water through leak free pipes and not discharge sewage into our rivers exceeds the present value of future revenues (under the current pricing regime); this would mean that even the secured operating company debt is worthless. However, this could ( and would be) contested – the argument being that the license gives flexibility in future pricing to reflect changing circumstances. Messy!

The “real world” solution needs to be generous enough to win in court (or, better, stay out of court) and harsh enough to “encourage les autres” and quell public anger.

My starting point is that lenders financed the excess dividends and should lose that amount of money £7bn out of £14bn… or 50p on the £. You could argue that excessive leverage raised debt costs but on the other hand what dividend would have been fair over the last 30 years? Mike Parr asks “where did the other £7bn not paid as dividends go?” and I have no idea invested in infrastructure, I presume.

So, “if I ruled the world” I would start out offering 50p in the £ and settle as high as 75p. A 25p hit to lenders on what should have been low risk debt will certainly have the desired effect of curtailing leverage elsewhere and, in the big scheme of things a billion or two here of there is worth it in order to regain ownership.

Thanks Clive, I appreciate your willingness to develop the discussion. It airs some big issues.

First, I note we are already down in your estimate to £7Bn, from £12Bn. The issue remains, however – what are the bonds actually worth? You are looking at the infrastructure, and think somewhere under the sewage there is actually £14Bn-£18Bn of saleable, realisable assets (the latter figure from TW accounts fixed assets). There is; but nevertheless – what is it actually worth in a sale, not a set of books? We know from the TW accounts that there is a massive investment in infrastructure required, and that must be made (see Chairman’s statement 2023, but it was titled ‘Strong shareholder support’). What you have is a large amount of infrastructure that doesn’t work without eye-watering amounts of money; and the private sector is not, as I understand it forming an orderly queue to buy at book price or other proposed price (?), and invest the vast amounts required, in what will almost certainly be a far more heavily regulated future. If I am wrong, I am happy to be corrected.

Second, I submit the assets are inaccessible; and cannot even mount a fire sale. They have no viable alternative use. They come with massive investment commitments attached. They are not free, at point of sale. The private sector is unlikely to buy them, unless the government is going to give them a large monetary gift in exchange, given the scale of investment required, and a tougher regulatory framework, to boot. The government, however is not actually in the gift of the bondholders. If the Government refuses to buy, what is a Court going to do? Compel the Government to buy? I would argue that de facto the assets are in economic, saleable terms, literally worthless. It seems to me that you are saying the government is under some compulsion to pay a price for the bonds; a price that on one hand you cannot verify independently, and second compels the Government to commit to vast investment in infrastructure directly, or by subsidising a private third party that has so far failed to come forward; presumably because the prospect is very unattractive, without heavy public inducement. Trade off the disincentive of the future investment commitment required, the assets become unsaleable; the bonds are worthless. That is my hypothesis. I may be wrong, happy to be rebutted.

What you are really doing, I submit is rehearsing the ‘too-important-to-fail’ argument; generalising it now by arguing that privatisation does not really apply the rules of private enterprise risk; the enterprise sinks or swims. Privatisation means the profits are private, but serious losses must be largely transferred back to the state to fix (with some losses – but mainly to the small amount of equity the private sector risked, but good grief, not the heavy debt the private sector loaded the industry with); a fact you believe the Courts will uphold (on what grounds, I am not clear). There is an implicit reasoning here (which I detect – but may be wrong), unstated in your argument; that Government must accept this principle of public obligation for private failure; or the ‘market’, or international markets will take fright.

What are the bonds worth?

Your thoughts cloely align with mine John – but I have not had time to write them down

The problem here is obvious, to everyone except Conservative or Labour politicians. Don’t privatise fixed public monopoly utilities in the first place. But we knew that in 1980. It is a disaster, and the ideology is so atrophied, the regulation so useless, the Government management so inadeuate, we cannot even fix it, by relying on either Conservative or Labour. It really doesn’t sink much lower into an incompetent stew than this mess. We can’t even extricate ourselves from the shambles, without giving a bunch of scroungers even more money; having already blown Billions; for nothing but sewage ravaged rivers and compulsory water bills for a deplorable service.

Would it were atypical ……..

Waspi women? Beyond us. Can’t handle it.

Blood scandal? Beyond us. Can’t handle it.

Postmasters/mistresses? Beyond us. Can’t handle it.

English Leasehold scandal? Beyond us. Can’t handle it.

Fire-risk building cladding? Beyond us. Can’t handle it.

Not a single one is less than ten years in the making; in none of these cases is any end – or even hope – in sight. In decades, nothing achieved, nothing done; but PR, waffle, and utter, despicable failure.

Every single one was self-inflicted. I could go on. And on. And on. And on…….

You could

Now the DWP is suing carers for recovery of paymnents it made in error

Thames Water management interview on Sky, seemed to suggest their five year plan is to spend £20Bn; and raise customer bills by 40%, presumably now.

Factor that into the discussion.

We are living in a madhouse. And day and daily BBC Scotland and the Press media assault the SNP Government for everything and anything they can lay hand on; relevant or not; whether spurious, trite or blown up out of nothing. When the dust settles, I turn round, turn on my taps, and albeit not flawless, am relieved to find that Scottish Water has survived, somehow, yes bruised and imperfect, but functioning, safely (more or less?) in public hands. No thanks to the Conservative Party, and I do not see Labour on the nationalisation front foot over the water crisis in England. Is Labour going to throw the private sector Water Industry a public gift of ever more money to help its bonus culture back on its feet? Who knows. Labour does not want power to do anything. They just want to be in office; and talk.

You are right: this is a madhouse

What are the bonds worth? We don’t know.

However, we know the company borrowed £14bn; we know they paid out £7bn in dividends; so we can presume they spent the other £7bn on infrastructure. However angry we are it does seem a bit unfair if the government gets all that infrastructure that was built for (say) £2bn

We all agree that the company owners should lose everything. We all agree that the lenders should not have permitted such large debt to have been accumulated but their level of culpability is an order of magnitude lower and I think the absolute minimum payout should be £7bn (50p in the pound).

I fear that in the desire to “teach a lesson” the opportunity for an orderly transfer of assets to the State will be lost.

But that is not how valuation works, Clive, imo. The discounted future value of the net income stream from those assets may be very small, and that is the basis for valuation here.

“so we can presume they spent the other £7bn on infrastructure”.

That is a big presumption. Even if all of it was spent on infrastructure assets (?), we know nothing about the quality or effectiveness of the investment decisions, or if spent in the best way.

The order of magnitude of the culpability here of overloading the level of debt, I would argue is the root of the problem. The sliver of equity, mountain of debt is now mainstream. I would not judge the level of culpability as a function of whether it is debt or equity; it is the fundamental business model failure, and bad management that matters.

Here we are, bailing out institutions that made bad decisions about large amounts of debt, yet again. I would draw the conclusion that they never learn; except that they will be saved. They know the State will bail them out, at a probable cost to public services, while the miscreants are saved, so they can have another pop again, in a few years; when the dust settles and the politics and noise has moved on to something new and trite.

But I am uncomfortable with the proposition that, if in a real market place the debt is worthless, that doesn’t count, when you are important enough (nor does a PV of future income), because what alone matters is that the “opportunity for an orderly transfer of assets to the State will be lost” (there is an elegant circularity about the – the orderliness and the transfer I suspect are co-terminus); but without spelling out why that should be. It hovers, darkly in the shadows. The “markets” (should I speculate?) don’t like real markets, when they produce the wrong answer in big numbers. That is the problem. When there is a crisis, private capital runs for its life. All you have left – is the State*, and the National Debt, aka The National Dump. If you are big enough, the State will even pay you for your rubbish. Tease that proposition out, make it stand up to open examination in detail; and perhaps we will find if it withstands the test; or can be addressed and disarmed. The Water companies are big, and critical for people; but they are not the banking system. Is there no end to this bail-out addiction version of neoliberalism?

*3% War Loan, 1914 proved that definitively.

Looking at the accounts of all water companies on a consolidated basis I noted that over more than 20 years:

How water companies’ investment was funded

The funding for the total apparent investment in fixed assets over the period of £91.5 billion that the above, albeit brief, analysis suggests took place in the English water industry as a whole between 2003 and 2022 would appear to have been supplied in the following ways:

a. £1.7 billion relates to assets being revalued rather than acquired. This is an accounting entry with no cash being involved.

b. £50.9 billion was funded by borrowing.

c. £38.9 billion was covered by operating cash flows that effectively offset the depreciation charge and was generated from income over the period.

These sums together come to £91.5 billion. Looking for further explanation on sources of funding appears unnecessary. The share capital raised did not appear to fund investment. Instead, it appeared to almost exactly compensate for the over-payment of dividends made during this period.

Let us suppose TW bills rise 40%; and only after that the State buys out TW by purchasing the Bonds for £12Bn. It seems to me that while the bondholders are being protected, the customers are paying, again for the failures (crudely for simplicity a comparison from Richard’s £39Bn receipts v. £50Bn borrowing). But that is alright; the customers do not have the political levereage of bondholders and banks; they have to find a way to influence politicians. Guess who wins that struggle?

No contest

That was your 4,000th comment John

Crivens, jings, if I may borrow from the expressive vocabulary of DC Thomson. I suspect the world may patiently be waiting for a period of silence from me.

Now I understand why other things I am writing are progressing at a snail’s pace, and one of the tardier snails…………… jings, crivens.

🙂

Keep going…

Congratulations John Warren.

Don’t always agree… but you do make me think!

The reason the lenders kept lending and rolling the debt over, and the reason it’s still trading @80p is simple. There was never a normal corporate cash flow or asset basis for the lending. It was always simply assumed that if the WC’s got into difficulty OFWAT would bail them out by making us consumers pay more. There was concern that things might get stinky for a while (no pun intended), but that ultimately lenders would be made whole by the Government. How sad that us lenders (I was one back in the day) were correct, albeit not quite for the reasons we thought. Turns out that even if OFWAT doesn’t bail them out (again no pun intended), it’s political masters from Con and Lab seem hellbent on doing so directly. Long after my time, but I bet the new generation of bankers were crapping themselves when Corbyn came so close to power. How happy they must be to now be sharing canopes with Starmer and Reeves.

The BBC is appalling on this issue, as I imagine most media are. This article reeks of bias by omission, no mention of the total dividends paid over this historic fiasco, a figure that is readily available. Just comparing the total dividends against debt is absolutely telling. This is the only place where genuine understanding and fact-based explanation can be found. I want to thank you for the work that you do, and the light you shine on the dire state of economic journalism in the UK (and across the world), which is disjointed, unintegrated and framed entirely in favour of the very people and organisations that journalists should be holding to account, not apologising or making excuses for.

https://www.bbc.co.uk/news/business-66051555

Thank you

Is it not the case that Australian asset management bank’s strategy in acquiring Thames Water was to load it with debt, use that debt to pay dividends and interest payments to itself, its shareholders and lenders, milk the company for every penny that could be squeezed out of it, and then sell it on before the sh*t really hit the fan, to anyone aiming to plunder whatever pickings were left on the carcass, with a strategy of then being bailed as too big to fail followed by massive price increases for customers, all adds to up one massive fraud? And should be treated as such?

That may be a little harsh

And maybe not

[…] Thames Water is bust: our politicians need to deal with it Richard Murphy […]