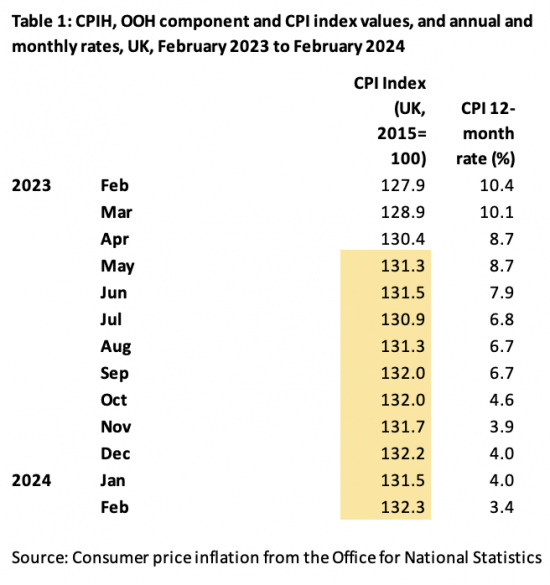

This is data on the consumer price index for the last year or so published this week by the Office for National Statistics:

Why show it here? That's because this lunchtime, the Bank of England will almost certainly refuse to cut interest rates, saying that they cannot be sure that the supposed battle against inflation has been won as yet.

Why show it here? That's because this lunchtime, the Bank of England will almost certainly refuse to cut interest rates, saying that they cannot be sure that the supposed battle against inflation has been won as yet.

However, look at the figures highlighted in yellow in the above table, and you will see that, since May last year, there has been almost no change in the overall consumer price index. In other words, with minor variations from month to month apart, the so-called battle on inflation has been won, and the evidence that this is the case is overwhelming.

If high interest rates were meant to beat inflation, then there is no remaining case for keeping them high. If, as I suspect, there will be no change in rates, what then will be the reason for keeping them at the extraordinary levels that they are now at? Could it be pure politics, with the aim of making the rich richer?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I predict a bit of pre election rate cutting from the supposedly independent Bank of England.

So do I

You think politics trumps economics? From neoliberal Conservatives (or Labour for that matter) in a political hole? Surely not! You mean the high-minded Sunak, Hunt and their brilliant Government? You can’t be serious……? Deceive the public? Fool voters? Basically cheat to stay in office or win an election? Never!

“Never” does of course include cheating the public, while denying you are doing it. Blaming somebody else when it all goes wrong after the event. And then deny it ever happened. And if someone proves they lied; say it was all a long time ago, and everything has changed, nobody now at the top knew anything about; there has been a complete overhaul, and it could never happen again.

Until they are re-elected. Then you can guarantee they will do it all again……….

I saw a headline today: “Pension triple lock will be in the Tory Manifesto”.

It was in the last one.

Promises are made to be broken.

Indeed…..

Timed so as to precipitate us into deflation just after Labour get in? I can see the headlines now, “Markets react to Labour Victory!”

Maybe…

“what then will be the reason for keeping them at the extraordinary levels”…

Those playing in the gov bond markets need time to adjust their positions to take advantage of when interest rates fall (and thus bond prices rise). These things need to be carefully managed otherwise profits will be missed. Gentle falls are better than precipitate falls, and obvs, the BoE needs to send subtle signals to all involved. Signals that only the priestly banking caste can recognise. In these matters, obviously the needs of the country as a whole don’t count (& never have).

(for the avoidance of doubt – there is some irony in the above as well as truth).

🙂

Spoken like someone that has zero knowledge of how bond markets work – if you had a basic knowledge of markets you’d already be able to calculate how and when the bond market predicts that interest rates will come down.

Which is totally at odds with what you’ve claimed above. It’s almost as if you are speaking from a position of ignorance?

Oh dear….

You really think the bond markets work as the textbooks say?

How sweet

Guys, am I right in thinking this is how things worked back in the days when our currency was commodity-backed, ie., before Bretton Woods broke up? I have an acquaintance who rigidly insists bonds have the same function now as they did then and who perhaps as a consequence point-blank refuses to accept govt. money creation. I suspect Natalie’s another, similar, flat-earther.

I think you are right

Back in 1982/83 I played the gov bond markets. I had around £2000. Howe had cranked rates to 16% & the only way was down.

Conveniently there was a class of gov bonds on which no tax was levied if you were outside the Uk (which I was). The trick was to take the bi-yearly interest payment, bond price falls, then after circa a few weeks Howe reduced interest rates, bond price went up – (sometimes going up in anticipation) and sell (with no loss of capital) – & move on to the next. From memory my return on capital over the year was 100%. I even charted out (on paper – no spreadsheets then) how bond prices and interest rates evolved.

Of course the interest rate then was massive & totally unsustainable – thus predicting its fall was faily easy (timing less so). The current rate of 5% is small but, equally needs to come down for the reasons given in the blog. How/when it comes down? well I doubt if things have changed very much. I am certain that the banking priests get subtle signals from the BoE as to when things are going to happen. Not needed in 1982 cos the fall was so very large.

I don’t think I contradicted myself – happy to be corrected.

If we live in a world where all algorithms are lossless, then you would be correct. Prices are a product of algorithms. The exact algorithm and the data inputs are unknown to us. Also we can’t backwards engineer prices to reveal data from them with out making assumptions about how that data was created. If we can change the calculated data inputs by changing our assumptions, then it would seem that all we are doing is making excuses.

I figure the annualised rate over the past 9 months is about 1% per annum. Well below the, arbitrary, BoE target, which is anyway too low (IMO).

The only reason why CPI isn’t lower is because CPI calculated over a year has a lag of six months; it’s telling us what CPI was 6 months ago (with smoothing).

So, 6 months ago inflation was 3.4% and falling. Now it is 1% and stable. In order to even reach the BoE target inflation would have to be 5% (annualised) over the next 3 months. It is irrational to assume this.

The BoE should be cutting the rate fast. They will do so eventually, but it will be too late.

Agreed

Well if you consider the main drivers of the inflation spike have been largely sorted.

Russian piped gas has been replaced with LNG, much greater storage capacity, a large increase in renewables, a reduction in overall energy usage and (probably) some rebadged cheap Russki gas coming in from India.

Post COVID global supply chain issues have been largely fixed barring the odd Houthi missile.

As a result inflation has come down all on its own.

The other drivers were caused by vastly increased mortgage and rental costs and the rising cost of flyaway holidays, expensive restaurants, new cars and other luxury goods – all driven by the relentless shovelling of risk free cash into rich people’s bank accounts.

All in my opinion of course.

It does seem that the ‘sovereign’ UK is largely following US …the MPC minutes dont say so directly but there seems to be an underlying concern about the xchange rate.

But why doesnt BBC query the logic ? The Governor mentioned the Red sea – the Houhties must be worried about BoE base rate – much more than USS Dwight D Eisenhower bombing raids.

Its all ritual – leeches, blood letting etc etc – no logic – BBC ediitorial guidelines say this should be pointed out

Inflation not yet on their (made-up out-of-thin-air) 2% target [current rate, 3.4; target, 2%].

https://www.bankofengland.co.uk/monetary-policy/inflation

Here’s hoping for a few reductions this and next year as my rather generous (looking at it from a 2024 prospective) 1.64% mortgage will rise between 5-7%.

Not sure how many people this and next year are going to manage with mortgage repayments. Would have been nice to paid a little higher rate over a fixed 30 years like our friends is the USA.

I see the Guvnor of the BOE wants to see that inflation is under control before starting to lower interest rates. With respect what is he waiting to see? The CPI figures are only in the rear view mirror. Try to get out of your tower and see how much of the economy is suffering, and maybe talk to people outside of your social and business circles in The City.

Did he wait to see if the inflation increases were sustained before you chose to raise interest rates during the current cycle? The base rate started to increase from 0.1% in Dec 2021, and got to the current 5.25% in August 2023.

But it is what to expect from these high priests of neo-liberal thinking.

But thankfully they are dovish compared to their comrades in Turkey who raised their base rate from 45% to 50% today, and are tring to deal with a CPI of 65%. Clearly high interest rates are not working there to reduce inflation. But when you have a sledgehammer, everything looks like a nail.

The arrangement has changed now but earlier the BBC News website had the “rates held” story next to the “absolute poverty increase” news story, which I thought was a pretty striking juxtaposition.

Yes

Would love to know the response from a reincarnation of Maynard Keynes I only attended introductory lectures on his economics, but was captivated by his destruction of the “free” market BS. Reckon concepts like pump primers, would excite a new generation of enthusiasts to economics.