Much fuss is being made this morning about the fact that the UK energy price cap is being reduced by approximately 12% to £1,690 per annum for a typical dual-fuel household. This will save approximately £200 a year for those households. The trouble is that the remaining price is totally exorbitant.

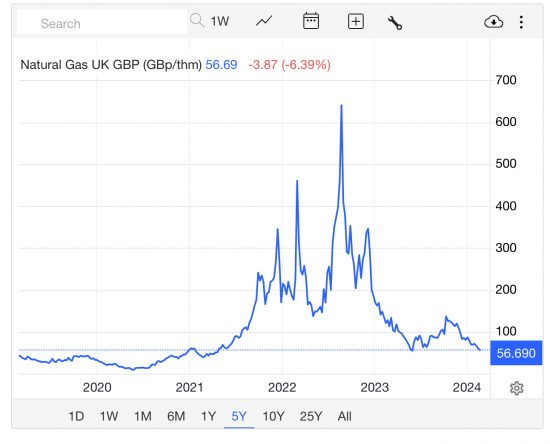

UK gas prices have moved as follows over the last five years:

You will note that the price is now back to levels last seen in 2021. You will also note the trend in those prices, which is that they are still moving downward.

This table indicates movements in the UK household energy price cap over the last five years:

What is very clear is that when UK gas prices were last at their current levels, the energy price cap was around £1200 per annum.

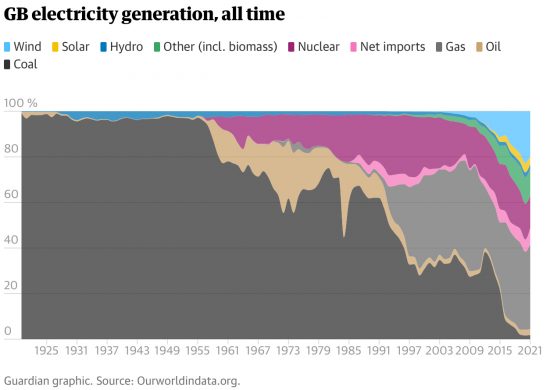

This chart from the Guardian shows the make-up of the energy used to generate UK electricity. The prices of solar, wind, nuclear and coal have not changed in any significant way since 2021, excepting the need to pay higher wages. Gas is back to where it was.

What this evidence makes clear is that excepting the impact of inflation on wages, which is an inevitable catch-up consequence of general price rises, there is no other reason for a change in the UK energy price cap between 2021 and the present moment.

The Bank of England suggests that £11.79 now is worth what £10 was in 2021. Let's assume that this would be a fair rate of price inflation for energy as a result (ignoring the fact that the sector's raw material costs do not justify any price increase). Applying this to the energy price cap that existed during 2021 would suggest that an energy price camp of about £1,400, or thereabouts, at present. That is all that inflation could possibly demand. We are, however, going to get an energy price cap of £1,690 per annum.

So, the question is, who gets the extra £290 a year, or thereabouts?

There is, of course, only one answer: it is the energy companies, who will take it straight to their bottom line profits.

If you want to know why the UK economy remains a mess and why we are still suffering inflation, it is precisely because we are being exploited by large companies who are exploiting the uncertain economic environment that the Bank of England has deliberately created to extract profit from us all, and wholly unnecessarily. Despite that, the Bank of England is still claiming that it is wage rises that are troubling them.

They really should stop talking nonsense and turn their fire on the true agents of inflation in the UK economy, which are our large companies who are imposing price increases of way above the current rate of inflation. Then we might see some economic justice for a change.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I won’t repeat my comment that I made on your “Green Deal” piece – you have said what I think much better.

Why are journalists not picking up on this? It appears that they just re-hash the Power Company press releases without critical thought. Why no question to Andrew Bailey about this?

Critical thinking is in critically short supply

I noticed that Owen Jones uses the term “client journalism”, which I think most journalism has now become; it is a grubby sub-set of the public relations business. On the point of the energy price cap, it is all based on a corporate profit-siphoning scam created by the Conservative phoney-market charlatans in Government. I mentioned it on another thread, just before you blogged on the cap. It is all just a racket. There is almost nothing left in Britain that isn’t a racket.

Owen has, I feel, recovered his purpose of late

Rehashing those press releases is what they’re paid to do. It provides cheap copy and that’s all that’s needed to get eyes on the adverts, originally and still largely the most important part of the newspapers, far more so than the actual news. That was added later as an inducement to look over the lists of adverts which formed the original papers.

Interesting point, Bill. May 3rd 1966 apparently was the first time The Times had news rather than advertising on its front page.

It was alleged when I worked on a local newspaper that it was the classified ads that ensured continuity of reader/buyer-ship. So-called news etc was a vehicle for carrying display ads.

The ‘journalists’ are paid not to pick up on it – or even to be a little curious or inquisitive – especially by the oligarch owners of the press and the govt-controlled BBC.

In the last sentence, perhaps “The new” should be “Then we” ?

Corrected

Thanks

This is my understanding

There is a price at which a company is predicted to make a fair profit.

Statistically, some companies will do better than that, and some companies will do worse.

The Regulator does not want the inconvenience of energy suppliers going bust.

So that fewer suppliers fail, the Regulator deliberately sets the cap above the predicted fair price.

This means that the majority of suppliers make more than a fair profit.

The inconvenience of more customers freezing is the responsibility of another department.

The margin is way, way to high for that, though

And we should avoid talking about margin in percentage terms. If prices are 50% higher and margins unchanged in percentage terms then profits are 50% higher.

We should always talk about margins in pence per kWh or BTU

There will be plenty of deals available under the price cap.

But it’s worth recalling how many energy retailers collapsed in 2021. Neoliberal commentators blamed the price cap for existing at all, while social democratic commentators blamed the energy retailers themselves for not hedging, forecasting or advance purchasing correctly. Either way the market is a lot less competitive than it was before Theresa May was Prime Minister.

Mr G, : “This is my understanding”

This is the reality:

There are elec generators that sell to elec retailers.

The two are usualy owned by the same company – but with ahem, “chinese walls” between the two operations.

(excuse me for a moment – I need to laugh hysterically).

At the time of privatisation, the nuke mob were floated off with no retail operation.

This led to them being driven out of business by “integrated” players (including EdF) & then picked up at a “discounted” price.

Renewable generators (RES gen) are +/- on contracts for diff – which is a synthetic way of integrating fixed cost generation into a wholesale market based on marginal pricing, which is supposed to sort out the least cost generation from the most cost. Feel free to speculate what happens when RES gen is most generation and has a fixed price..

Elec pricing is based on a system that has long passed its sell by date. The only reason it has not been reformed is that assorted neo-liberal imbeciles (economists) still think it works, & of course the elec generators and retailers have a nice little thing going & doubtless provide bungs to the assorted politicos that are too stupid to know what is going on – or too corrupt to be bothered.

You as a citizen with no ability to change things can thus only sit back & “enjoy” the current situation.

Mr G, has your understanding changed? Or do you require the difference between fixed cost versus marginal pricing to be further explained? If you don’t, then you may rest assured the “market” for domestic energy was designed by the Government, especially for you.

“if you don’t understand”

Worth pointing out that roughly £350 of that £1400 or roughly 25% is made up of the energy poll tax aka standing charge.

The standing charge is a clear example of market failure, the charge being so high to cover the costs of the middle men supply companies that went bust. So much for the joys of market competition

They are also profiteering on consumers ‘Standing Charge.’ Two years ago I tried to obtain information from Ofgen concerning the addition of £68 levy to my energy ‘Standing Order’ implemented as a ‘one off’ levy on all consumers for recent energy company failures. I assumed Ofgen would have a record of the failed energy companies which they had calculated a charge and asked whether the amount of £68 added to the ‘Standing Charge’ would be removed the next year. Despite repeated questions Ofgen refused to provide a straight answer. Therefore I concluded the ‘One off charges’ Ofgen calculated for failed Energy companies has been carried forward and hidden so we continually pay a additional £68 each year on our energy standing charge for the ‘one off’ energy company failures. The market is well and truly rigged.

Others have commented on the perversity of the whole system and the standing charges, with their embedded “pass through” of market failures, busted suppliers, and (as I understand today’s announcement) the shared burden of increasing late and nob payment of bills by more and more customers.

Reducing the unit costs and increasing the standing charges is a disincentive to frugality and energy saving measures; and regressively penalises low users.

Living in a well insulated modern house (and being abstemious) my standing charges are half of the total bill; so their increase (of a similar % to the unit cost changes but in the opposite direction) cancels out the ‘reduction in fuel bills’ reported so sloppily.

Typo: NON payment of bills, not ‘nob’ payment!

David Byrne says:

Well done Richard. The blog is getting close to unravelling the scandal of domestic energy prices for gas and electricity consumption. We all have opinions on the subject, but these are irrelevant and detract from understanding the true nature of the problem.

Your graphical representation, if considered qualitatively, provides the trend. And this means that energy prices should be back to pre-covid levels.

The FACTS should be understood.

1 Natural gas prices globally are based upon the Henry Hub market level (USA) and the TTF level (Netherlands/Europe)

2 She’ll, BP and Centrica, for example, buy at global market prices and sell at prices that ‘the market will stand’. Such a lack of a competitive market means that a cartel is in operation-a private monopoly

3 Centrica sells gas to British Gas (Centrica owned) at a price which results in £600 millions profit from domestic customers. This profit is then ‘returned’ to Centrica

4 Electricity retail prices are based upon the cost of natural gas powered generation, not an average of wind, solar, nuclear etc lower costs

4 Standing charges. Why?

5 OFGEM, the ‘independent’ regulator, which should be defending the domestic customer is muted. It is therefore not fit for purpose

6 Energy company profits are currently at their highest and share prices are surging.

The system is rigged. The government, the news media and OFGEM , the opinion formers, they ignore the facts, preferring to be economical with the truth.

Any more facts, fellow readers?

Yes. Domestic energy is a monopoly; if it wasn’t you would have multiple electricity cables and gas pipes feeding your home. The regulator is not there to protect the consumer; the regulator is there to protect the illusion that there is a market, when there is indisputably, a monopoly.

The cost of the new Hinkley Point nuclear power station is now estimated at £31Bn-£35Bn. Only Government support and a monopoly supply could conceivably justify that cost (which is build costs, not even the decommissioning cost – which is unquantifiable, literally). Private capital would not, on its own and in a competitive context, touch it with a barge-pole.

There is no domestic energy market. It is fake.

Mr Byrne:

“1 Natural gas prices globally are based upon the Henry Hub market level (USA) and the TTF level (Netherlands/Europe)”

erm no. The HH price is very roughly 2x TTF. Which is why, last year, the EC/EU decided to start buying NatGas collectively cos they were being “taken to the cleaners” (a technical term for being over charged). My contacts in the Euro gas industry tell me that in early 2023 they asked about collective buying & were told (by the EC) that this would be (& I quote) “anti-competitive” – anyway summat must have changed cos now they do (buy collectively).

There is no “global CH4 price” just prices based on what assorted hooligans sitting on gas reserves think they can extort from assorted supplicants.

On a positive note – the French think they have found 250MegaTonnes of “white” hydrogen. If this is the case, then I will relax back into my sofa, open a couple of beers & pop corn and watch the undoubtedly amusing “negotiatations” between France & Germany.

If cheap enough, could this be used to repower Germany’s moribund industrial sector, currently dying a slow death due to the (contrived) absence of fuel from Russia and the crippling costs of buying America’s shale alternative?

The standing charge is ridiculous. As a single person household who is very green, I pay more in standing charge than usage for electricity all year round and for gas half of the year. The standing charges are rising again, so effectively my bills are going up not down. I’m with Octopus who I can’t fault and on smart tariffs.

If we are to encourage reduced usage for environmental reasons the unit price should be staggered so it is cheap for the lowest amount of usage and rises the more you use, effectively the reverse of how interest rates work on some savings accounts. We should also be rewarding those companies using energy from renewable sources and penalising those using the most polluting sources. It feels the only energy policy we have at the moment is ensuring energy companies make a profit and their shareholders get good dividends!

I’ve mused on this and all I can see is a party political funding process at work.

By backing off the market and encouraging price gouging, the Tories are filling their election fund account – quite simply some of this profit is likely to come their way.

Nationalise party political funding the UK NOW!

Another scam that runs alongside price gouging:-

https://www.theguardian.com/politics/2024/feb/18/hmrc-investigations-of-wealthy-tax-dodgers-halve-in-five-years

Agreed

It was notable that for teh last few months, commentators such as Martin Lewis were estimating price reductions for April around 15-16% based an analysis by Cornwall Insight. My impression is that their estimates have been pretty reasonable particularly in the short term. And yet we end up with only 12%. Your analysis here gives a pretty good idea what’s going on.

And my supplier has asked me for the same direct debt for th rest of the year – and I am already in credit

So I changed it, downwards