As the Office for National Statistics has reported this morning:

- The Consumer Prices Index (CPI) rose by 4.0% in the 12 months to December 2023, up from 3.9% in November, and the first time the rate has increased since February 2023.

- On a monthly basis, CPI rose by 0.4% in December 2023, the same rate as in December 2022.

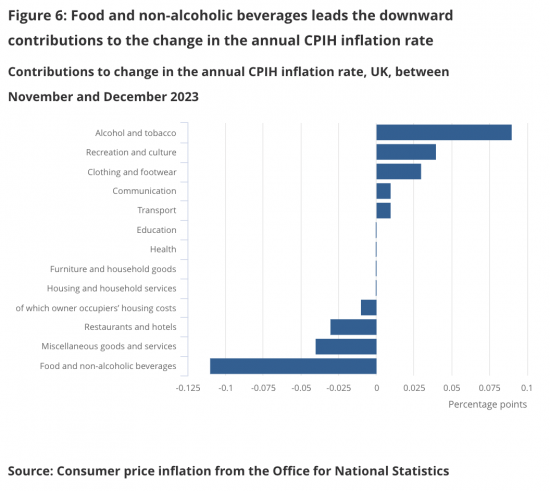

- The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from alcohol and tobacco while the largest downward contribution came from food and non-alcoholic beverages.

- Core CPI (excluding energy, food, alcohol and tobacco) rose by 5.1% in the 12 months to December 2023, the same rate as in November; the CPI goods annual rate slowed from 2.0% to 1.9%, while the CPI services annual rate increased from 6.3% to 6.4%.

Let's put this in context. The main contributors to inflation in the month were:

The rise in tobacco prices is still related to a change in the law deliberately pushing prices up. Everything else nets out to zero. And no one expected another significant fall in inflation until the energy price cap falls in a couple of months' time.

The media will be all over this saying the battle on inflation has not been won as yet and that catch up wage rises are threatening a wagwe price spiral. All of that is nonsense. By mid-year inflation will be near 2%. That will be hard to avoid now. Eberything else in the media omn this issue is just fodder to let the Bank of England keep interest rates high.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Whilst 12 month inflation figures are justified to smooth volatile monthly variations, when inflation is changing rapidly it is useful to look at the monthly figures.

The monthly CPI index actually fell, by 0.6%, in January.

The stable 12 month figure masks the real picture that inflation continues to decrease.

The 12-month inflation figures which form the target in the Government’s remit to the BoE don’t smooth out monthly variations. The formula is CPI now less CPI 12-months ago, with the difference being divided by that old CPI to get a percentage. That old CPI could go up and down quite dramatically. A good example was its rise in Oct 22 of just under 2% (in one month!) following the Truss affair. Then, surprise surpise, that silly annual headline rate dropped in Oct 23 by over 2% (in one month).

Of course, both the PM and the Governor of the Bank claimed credit, but the real reason for the drop in Oct 23 was because the difference betwen the two CPIs (Oct 23 minus Oct 22) was less.

Precisely

As Danny Blanchflower and I have been pointing out for a long time.

OK , meeting with our contractors the other day in the development trade, they told us that prices in the supply chain were still increasing, but output was dropping as sites were reducing staffing because of a slow down in house sales.

The cost of bricks has stabilised but at a high rate due no doubt to the energy needed to fire them. Topsoil and its transport costs have gone up really high even though oil prices seem to be dropping.

To me this means that inflation is not really a simple monetary issue – it is brought about by supplier behaviours as much as anything else – maybe price gouging as much as they can before recession bites?

It’s a fascinating area but also one that is abused by the BoE for sure.

Gilts are up on this data (after a fall yesterday based on US inflation data).

I think PSR’s comments on price gouging are pertinent and should be very troubling for the BoE. Why? Because it is a key source of inflation and not controllable by interest rates without incurring massive collateral damage.

On energy. Before the war in Ukraine the Price Cap was never a typical price paid by households it was there to prevent extreme abuse of customers that did not shop around. Now, we all pay the Price Cap as the standard rate (roughly speaking). This Cap is based on a wholesale energy price so if they could “beat the cap” before, why not now? And what about the leap in Standing Charges? Mine has doubled since coming off an old fixed rate deal – have wages or other fixed costs doubled?

Well, we all know why…… because they can get away with it!

What is needed in may areas is a State owned provider that can lead market pricing and keep other providers “honest”… be in energy, water, basic banking etc..

I was reading the article on enshittification, from the FT, yesterday. It highlighted the lack of competition. I fully agree that we need a state run energy provider to provide competition. We need this in other sectors too.

The neoliberal mantra is that private business is more efficient than public business, even after profit extraction. If that is true (I’m far from convinced), then private businesses have nothing to fear. Indeed they should welcome state competition to demonstrate their virtuous efficiency and justify large salaries and bonuses. But I don’t hear anybody calling for state competition.

My word, you are “on a roll” Clive. The current political uncertainty in the world (including the weakness of Western democratic leadership), war in the Middle East (Palestine and Red Sea) and Ukraine, not only creates an environment that feeds the fear of inflation but enhances the opportunism to key suppliers in a global economy to raise prices independent of costs and increase margins. Once the fear that shipping rates rise (for example) raises the prospect of price rises for goods, whether or not the suppliers goods were obliged to take the Cape of Good Hope rote. The technical term for this technique is capitalism.

The solution is regulation, but we don’t have any. Britain is so open to abuse, a man can board a plane to New York, without a passport. The Americans, unsurprisingly sent him back.

Britain is not a country capable of coping with exploitative profiteering, or managing its borders. Indeed we are here by Conservative design. This is their legacy: what you can see is what you get (that phrase defines the Conservatives.) Don’t think this hopelessness comes cheap. The Conservatives splurge Billions with wanton irresponsibility to achieve this level failure. They began fourteen years ago with < £1Trn of debt; and now we have £2.5Trn of debt; iand nothing to show for it. Nothing works, and the infrastructure is 'shot'.

Robert Reich has been banging the corporate price gouging drum for several years now.

Stateside.

He came up with a figure (from memory) that only about 40% of price rises were from materials and labour costs inflation, and the rest was price gouging.

Like many of this blog’s posters, he argued for stronger regulation, some two years ago now, and also commented that price gouging indicated an absence of competition in consumer markets.

For me, this all goes back to JK Galbraith’s analysis almost 60 years ago now, that the corporate sector could fix prices through its market power, and monopsony still seems to dominate British farmers contracts with the big 6 supermarkets, and of the 7500 of dairy famers left, 350 a year are still going out of business. There were almost 24,000 dairy farms in 2000.

One of the unforeseen consequences of this monopsony is the further industrialisation of agriculture, with all the impacts that has on environmental quality, soil fertility and consequently net zero targets, across both arable and livestock sectors. This is one of the numerous reasons why carefully considered regulation is so important.

“Shrinkflation” requires a massive and highly unlikely change of mindset, of porcine aeronautics scale. Such is plutocratic power.

Now that Labour is fully on board with business (aka corporate) friendly policies, the prospects of any regulation at all in any sector, let alone effective regulation, seem bleak.

I work in the Consumer Packaged Goods space in what is termed ‘Revenue Management’ ie what are the right prices to meet volume and £/$ goals. In the industry, post Covid this has all been about not just recovering increased manufacturing costs but finding a new higher price point to have an improved margin rate. The consequence of this is that volumes are now falling off a cliff across the board as shoppers look to trade down into cheaper alternatives as they simply aren’t prepared to pay on-shelf prices. Retailers don’t like to lower prices unless they really have to so promotions are the name of the game to make shoppers ‘feel’ they are getting bargains whilst maintaining decent margins.

I saw Biden complaining to retailers this week about ‘shrinkflation’. Good luck with that. Without any price control mechanism you will get whatever the retailers and manufacturers give you to hit profit targets

Thanks

This still refers to December inflation?

Incidentally, last year’s February through to May inflation (inclusive) was close to 4% so prices have to be going some this year to not drop rapidly (as of course you have been saying for a while). For example, I reckon CPI would drop to around 1% if the next four monthly increases were 0.2% each.

It’s interesting that the BBC (and most outlets) are putting first the that food prices have fallen instead of (as you said) that it’s the “first time the rate has increased since February 2023”.

Foo prices have fallen

Booze and fag prices have risen more

And Sunak will be claiming all the credit for “taming inflation” when it does fall. Unfortunately, there are a lot of people gullible enough to believe him.

Politics.

Don’t shoot until you see the whites of there eyes etc

Come Spring/Summer, wait until you see the wave of tax and interest rate cuts as the government leans on BOE.

Tories claim ‘we are the party to look after the economy blah blah blah’

Public forgets all the previous failures and votes them in. Again.

Maybe we’ll get lucky and get a hung parliament with the Greens holding the balance of power.

That is optimistic

My wish too but – optimistic? Yes, agreed. But once we’ve got PR … what then?