I noticed part of an old post of mine being cited on Twitter yesterday. It was as follows:

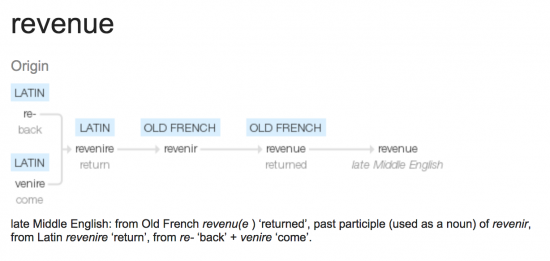

This is fascinating. What it shows is the etymology of the word revenue:

As a commentator, using the name Calgacus, said in a comment on the blog yesterday:

As a commentator, using the name Calgacus, said in a comment on the blog yesterday:

Revenue is a pretty good word to use for taxation. What is bad is the idea that it provides income for the state. Revenue comes from re + venir; means to come BACK. It encapsulates the idea that taxation returns unto Caesar what originally came from Caesar, the correct spend first, tax later order.

This is, of course, the idea implicit in modern monetary theory, but that theory is simply a description of reality in this regard. As a matter of fact government spending has to precede taxation or there is no money available with which tax might be paid.

I always wonder why this is so hard to understand.

What I can, however, relate is a story told to me by a director of one of the UK's tax justice organisations before we parted company. Discussing this issue he told me that if he admitted that tax did not fund public services, as I argued, then his whole business model was going to fail. As a result he said that he was not going to admit that truth, even if he knew I was right.

Are politicians in the same boat as that person? Do they think their livelihoods rely on denying economic reality and so they won't go near it? If so, what state are we in?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“What did the government do with the tax revenue? Spend it? No. They burned it. All of it. They carefully kept records to show they burned all their revenue! Taxes are for redemption, not for revenue. Colonial governments did not need the revenue. They spent the currency into the economy, and taxed it back so they could burn it. The true purpose of the tax was to create a demand for the notes. Collecting taxes then ensured that both the government and those owing taxes “redeemed” themselves: taxpayers were “redeemed” as they no longer owed taxes, and the government was “redeemed” because its own debts – represented by the notes – were burned. The redemption was mutual and simultaneous.”

— Making Money Work for Us, by L. Randall Wray (2022) https://amzn.eu/d/3HlFjyv

Pugin’s Parliament was built after a great fire burned down Parliament, in 1834; where Fawkes had failed to destroy the building in 1605. How did it happen?

It had been decided to burn the huge mass of redundant tally-sticks that had represented the debts of Government in past centuries, as modernity in the shape of Government bonds had taken over. In the archives in Parliament all the returned tally-sticks, matched and cancelled were piled up. They tried to burn the vast collection, in the furnace. The process ran out of control, the tally-stick pile ignited, and the conflagration destroyed everything, including the House of Commons. Only Westminster Hall survived.

Cancelled debts still had a bite…..

Apparently, Andrew Bailey studied Economic History some time ago-did he go back as far as this? I only ask out of a shared interest-nearly 50 years ago I tried an A level Economics exam, in which 50% of the marks were for Economic History.. my father ( who had obtained a double first in History and Economics before the War) was our teacher. I believe all our A level class got good grades because we were taught to think about the long scale of economic events and that just regurgitating the graphs, ad nauaseum would not prove that we had a grasp of ‘economic’ reality. I find it profoundly dispiriting that even today economics students are peddled the same story-what was it now-all things being equal? ..bla, bla. . ps I got an A!!! I will let you know when I retire in 3 years time whether I am still solvent¬!

I’m sure it’s the case that some deny reality because it suits them, be that neoliberal, populists or tax justice organisations. I suspect though that many people including many leading politicians really believe it, because it’s the received wisdom they’ve lived with all their lives and it’s common sense’.

Persuading people that reality is different, that there is another way, is really hard. That’s because it is emotional task, rather than rational. Getting people to accept long held beliefs are wrong strikes at the very heart of their self esteem. It’s akin to religious conversion, switching allegiance from United to City or, in my personal experience, voting Green in 2015 after a lifetime supporting Labour including party membership.

‘Conversion’, for that’s what it is, is possible but needs patience, multiple strategies and individual tactics. Cognitive Dissonance can’t be overcome b telling people they’re wrong or stupid* but patient (patient!) reasoning, empathy and above all persistence can pay off. Keep plugging away and we can shift the dial.

One tactic we could adopt is complaints to the BBC to make sure they represent the reality accurately. I recall that had a minor effect last year, can’t recall the details though.

*PS Ridicule leading to shame can work but it can’t be planned for. One factor that contributed to the decline of the KKK between the wars was the Superman Radio show that chose the Klan as on of its main antagonists. Kids laughed at faithful renditions of Klan ceremonies, and then their fathers when they came home from the real thing.

The gang over at Positive Money have recorded an earlier Battle with the BBC over economic accuracy https://positivemoney.org/2019/05/battle-with-the-bbc/

That was it, thanks. Longer ago than I thought.

Might this be an example of « Ideological Blindness »?

Might ideological blindness be differentiated into:

1) Chosen ideological blindness, as used by some economists, politicians, reporters, « experts » etc. with significant power/income associated with this manipulation/distortion?

2) Induced ideological blindness, mainly found in the general public who are actively enabled and encouraged in their deluded certainty?

You raise an important point. The idea that it is the voter as “taxpayer” that actually funds everything is reassuring about who is in charge. The idea that Government is in complete charge is terrifying; because nobody can, or should ever fully trust Government, for obvious reasons; the Trumps and Johnsons are everywhere; but do not necessarily wear their heart on their sleeve. Politicians are always happy to feed the illusion, because they re happy to feed the voter with any illusion that both works and secures them in office and in power, to pursue the purposes of the vested interests (and entryists) they serve, out of the sight of voters. An electorate that believes the myth is esier to manage.

True

“Are politicians in the same boat as that person? Do they think their livelihoods rely on denying economic reality and so they won’t go near it?”

You hit the nail on the head and the problem is not just with “how do we look at tax, gov revenue, gov spending” ? The problem extends to other spheres including energy. Fix modes of thinking, unwillingness to be curious, vested interests, all combine to generate stasis in a given area.

& indeed, if somethings changed, some people would………..need to find something else to do (e.g. gov owned energy system? no need for a regulator employing thousands of people). The classic real example in recent times was a large office in Euston that reconciled ticket revenues between various operators. On the day of rail nationalisation in the 1940s, it was abolished.

The Railway Clearing House

It was a staggering operation as you say rendered completely irrelevant by nationalisation but back now.

Hum, looks like The Bible got there first

Give unto Ceasar tha that is Ceasars

I don’t think that it is hard to understand the idea of spend before taxation. It is getting the message out in a noisy world that is the problem.

But for those in this long battle to control the money supply, I can see why they would find it hard to accept.

This is the problem. It is not a problem of cognition; it is a problem of denial due to ideology and greed. It is refutation.

It is hard for these ‘hyper-individuals’ to accept the sovereignty and therefor the supremacy of State owned money because quite simply it interfere’s with their desire to control the money supply, insist on (for example) a nice fat juicy CBRA for their activities but pauperising austerity for everyone else. This is also why modern economists – most of whom are neo-liberals – don’t really think about money – it interferes with their faith based thinking.

Because that is how you acquire money-power – the ability to fund political parties, acquire state assets at knock-down prices, get on exclusive procurement lists etc.

We all know what the answer should be – it should lie in a political opposition who offers a different way based on what we really know about money. That is what Attlee achieved because every historical documentary will tell you that WWII bankrupted Britain – a sovereign money printing state – bankrupt apparently!!

But the party political funding system and the continuing growth of undertaxed wealth and its tumescent bank accounts has conspired to withdraw that option from us.

It is the negation of how money and tax works – not the understanding thereof. Because understanding the truth of this matter undermines the malignant power of wealth. And that in itself gives me a moral reason to tax wealth more. That is what I have learnt in these discussions, and that is the role of the State IMHO.

Otherwise we are going back to the dark ages………………….

… as I’ve long been predicting.

I frequently wonder about a young Margaret Roberts sitting in the congregation listening to her father preaching on that text…

What went “wrong”?

she identified with Caesar.

Money as a “reciprocator” or “returner” for strengthening promises and stabilising value. Obviously also for facilitating choice which barter struggles with.

Yes, but this only works for national governments at the currency issuing level. A more personal concern for me is how it works for lower tiers of government that have to take tax in the national government’s money to fund their own spending. The generally broke state of local and regional councils in the UK suggests that it is not currently working well, and as I live in a Dependency where a very large amount of national government function is devolved to what is effectively the municipal council, it worries me that there is little robust economic theory for our situation that our politicians and their advisors could draw upon.

Accepted

eg Scotland?

A glorified council, nonetheless in fiscal terms