As the FT notes this morning:

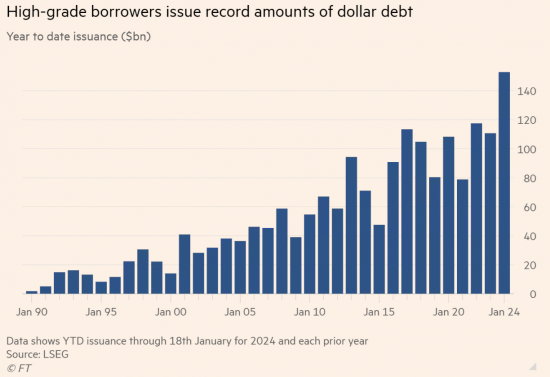

US corporate bond markets are “on fire” as companies have sold a record $150bn of debt since the start of this month, the busiest opening to the year for more than three decades.

This chart tells the story:

Literally, money is pouring into debt as people wishing to deposit funds seek their last chance to fix good rates and corporations take the opportunity to secure money while it is available.

Three thoughts.

First, whoever says debt is unattractive is wrong.

Second, there is no hint here of unsustainability, so why is that question raised of government when its offerings are of higher grade than those being snapped up in the market?

Third, why are politicians so frightened of debt when that is so obviously what markets want?

I have no answers to those questions: the politics of anti-debt sentiment make no sense.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

You have convinced me that the Bond market, both government and corporate, is now most realistically seen as a savings scheme, but what worries me is that it is largely a savings scheme for the rich paid for by fleecing everybody except the rich.

To make it even worse the richer the rich get, the more they use that money to maintain themselves in political power, so as to keep on inventing new ways to fleece us.

That’s the next issue…

This problem has always struck me as largely one of language. Bonds, corporate and government, are not debt on the sense that you or I might be in debt. But it’s because that word is used that in the public perception, as well as that of perhaps less than bright politicians, it’s perceived as “bad”, even with an undercurrent of “immoral”. We are socially urged not to get into debt, so immediately buy the idea that any debt should be reduced.

I wonder how many premium bond holders realise that the government is in debt to them – would they want their bonds cancelled and be given their money back?

What other language could be used to avoid the word debt, even the word borrowing, to more clearly represent what it actually is?

As I have noted before – Premium Bonds play a key part in the narrative of this…

Another untruth comes unstuck.

Our politicians have either been bought – which is highly likely – or just got all this wrapped around their necks which is also quite possible.

I just saw a repost of this Guardian article from a week ago: https://www.theguardian.com/business/2024/jan/13/watch-out-rachel-reeves-the-old-guard-is-ganging-up-on-your-borrowing-ambitions

I’m not sure how much is gobbledygook, but it does make the point that whatever a government wants to do, they are at the mercy of the financial markets. Just how much does the government have to adhere to what the market makers want, regardless of their own ideals?

It was discussed here a week ago

It is the usual banker warning to a supposed left of centre politician to remind them that the bankers think they are really in charge even though QE should have shattered that myth

The bankers message is even simpler “market makers like bankers good/state bad” when clearly anybody who bothers to think knows the state is a market maker too!

Sorry, looks like I missed that one!

“….whoever says debt is unattractive is wrong”. Correct

“…no hint here of unsustainability”. Hmmm, I am not so sure.

Government debt IS sustainable because government is sovereign; Corporate borrowers are not and the ever greater leverage that all this issuance implies is risky – Thames Water is the obvious example of over leverage… but there are many others.

“…why are politicians so frightened of debt”. It suits the Tory small state agenda and Labour are too timid to challenge it… so we must.

“Government debt IS sustainable because government is sovereign; Corporate borrowers are not”.

Government operates in a timescale quite distinct even from that of corporations, still less individuals that is far, far longer. Redemption is postponed, and that works for debt. The rollover has replaced the perpetual, but it operates with similar effects. Government debt is around long enough for inflation to work in its favour; the implicit power of the time value of money (for government) is made explicit, by endless postponement. Inflation cycles tend to follow a very rough bell-curve over quite short time spans. This, over time discounts the debt held by Government when rolled over. When the Government finally paid off the last of the colossal bonds issued to fund slavery emancipation (1833); in 2015, the constantly rolled over sums were finally reduced to amounts that were completely inconsequential in debt terms.

But they were not repaid in reality; they were rolled over.

No, Richard I assure you; I have the conclusive evidence that, according to the Treasury itself they were “redeemed (matured)” on 1 February, 2015 (from research I am carrying out on slavery emancipation funding). It was originally to be redeemed in 1957 or later; and rolled over until 2015.

But new debt was issued to pay for the redemption so in reality they were rolled over.

On the wider point of government debt; while it is suggested that debt is costly; not just to service, but because it matures and requires to be redeemed: although the Treasury does not issue perpetuals any longer, I believe we can consider the rollover function to provide Government with quasi-perpetuals, de facto. i believe we need to reconsider the debt problem. It is not quite what it seems, and certainly little like the guff politicians chatter about.

Agreed

I still believe in perpetuals

I am not disputing the role of rollovers in the management and renewal of Treasury debt; that is a given. But the Treasury itself is making a precise distinction between the many, may rollovers of the emancipation debt (which was transformed over 180 years, from 3% Annuities, to 3.5% bonds to 4% bonds in numerous iterations – in fact I have not been able to identify them, they are effectively lost); and the final redemption in 2015. I am not making the distinction; it is the Treasury that makes the point; so it must have distinct meaning for the Treasury. What do you propose is the substance of the distinction?

The distinction is semantic.

Those debts ceased to be and a new one was issued in their place. The substance is cancellation. The form is rollover.

For clarification, my original point was that Government was capable of using inflation beneficially over time, and manage rollover and redemption over the long term, to let time erode the final maturity cost from its original materiality and reduce the penalty of redemption to a materially insignificant level. The consequent ‘rollover’ to fund the redemption is therefore itself less material.

Sorry to persist, but we agree; save that redemption is a real event, and not merely semantic. The debt context is continuity of the underlying debt level. My final observation on the matter.

(ref Clive Parry’s comment on (un)sustainability):

What’s this debt issuance actually funding?

M&A activity and buy-backs (that benefit executives with options) – ie artificially pumping share prices and the Dow Jones, which will end in tears, with a share price ‘correction’ and defaults, hurting the little guys and pension funds, again – or is it going into real productive investment and entrepreneurial innovation?

Mainly, it is refinancing existing debt that is maturing. This is true whether you are looking at the corporate sector or Government bonds.

So, it is the change versus previous years that should give us a clue about the extra leverage you rightly fear. Although, even here it could just be a switch from bank loans to bonds prompted by capital/regulations that lead to disintermediation. We just don’t know.

Finally, you absolutely correct – whatever is going on is certainly not financing real useful activity.

Thanks, Clive Parry.

Indeed it’s changes rather than a single metric that will give a clearer picture. One reason why I like SFC (Stock Flow Consistent) models – which of course line up with Richard’s emphasis on double-entry.

And the debt rollovers in an environment of (unnecessarily) increasing interest rates simply loads both government and corporate (and small-business) accounts with an increased proportion of revenues going to ‘extraction’ as interest rather than profit that could be reinvested.

To what extent do politicians actually want debt too?

Longitudinal evidence in terms of the extent they issue debt might suggest that they do in fact want debt.

In that case, anti debt narratives are not just false but part of a deliberate a propaganda mix that justifies austerity.

Perhaps politicians are simply averse to spending the peoples’ money on the people?