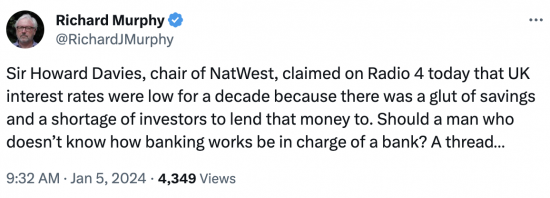

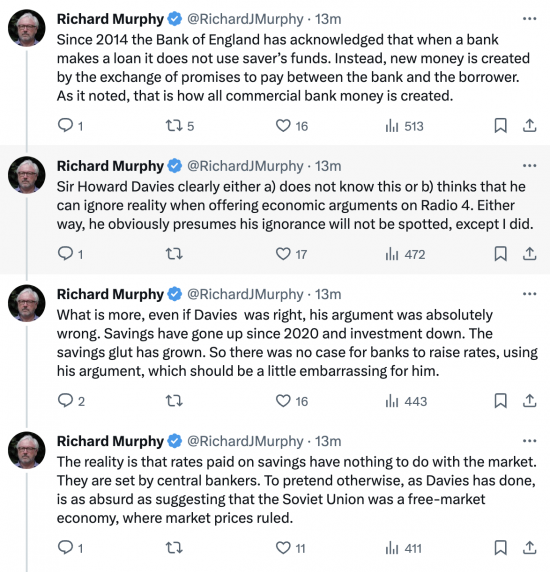

I have already noted one absurd comment by Sir Howard Davies, the Cahri of NatWest Bank on Radio 4 this morning. But, it was not the only one. He also revealed that he has no understanding of how banks, markets and central banking work in the UK, or else he was disguising that he actually does so but would rather not refer to reality. I explained this in a Twitter thread:

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

True.

And…

Buying a house is not that difficult, says NatWest chairman – latest updates

https://www.telegraph.co.uk/business/2024/01/05/ftse-100-markets-news-halifax-house-prices-us-jobs-latest/

Holy Crap.

The same goes especially for Chancellors.

Scary article, Richard.

How many other buffoons are in senior positions in the boardrooms throughout the country?

Richard,

You have managed to get everything wrong here. Foolishly so.

Banks don’t create money out of thin air.

When a bank lends, about 10% of the money must come from tier 1 or other regulatory capital internally. Normally deposits. The rest is borrowed from money markets.

This is well understood. Banks are in the business of credit creation and maturity transformation, but they do not create new money in the sense you are claiming.

The savings glut you refer to in 2020 was caused by lockdown and QE. There were huge amounts of cash in the financial system because of this.

As we know, when there is too much of something it’s price will go down.

Which leads nicely to your next false claim. You say markets don’t set the price of interest rates/savings. Banks are paying such low rates on savings exactly because of the excess amount of them. If there was a need to capture deposits (as they still need them) they would increase rates. Thanks to the savings glut and QE cash is the system is in excess, so savings rates have not kept up with the mode in the BOE base rate.

Only the BOE base rate is set by central bankers. All other rates relate determined by the market via supply and demand.

You say that people in positions of authority should have economic competence. Yet you regularly and clearly display little or none of the same yourself. Your recent post regarding the national debt is also riddled with errors and outright falsehood.

Isn’t it a bit hypocritical to present yourself as an expert in economics and finance when not only have you no training or practical experience in either, but your own post show how little understanding you have, then attack others who do have decades of training and experience?

Might I suggest you stop making a complete fool of yourself and read this? https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy

The Bank of England completely agrees with me (and I stress, not the other way round).

I look forward to your humble apology.

That bank of England piece is overly simplistic in itself and was written as a teaching aid for students.

What it describes is not the creation of money in the sense you suggest. It is the creation of M4, broad money, more commonly known as credit.

Your lack of understanding has led you to believe that banks can create money out of thin air. Which is totally false.

What they can do is create credit out of thin air, assuming they have sufficient regulatory capital (notably deposits) AND can borrow the money from the money markets.

In your world, banks would never have liquidity concerns because they could simply create more money. Clearly not the case.

I notice you don’t deal with any of my other points.

I’d also be interested to hear what makes you think you are an expert in banking and finance, or even an economist at all?

Let me ignore your snide comments – most especially when you tell neither me or my readers what your credentials are.

Second, you deliberately misread the BoE article – which refers to exactly the situation I describe.

Third, of course banks need regulataory capital – they are not a bank without it (to state the bleeding obvious)

But they do not need that to create money – they need it because the customer might not repay. That’s totally different.

But as the BoE banks never need deposits – and despoits are created by lending and not the other way round.

If you call here again you wioll need to provide your full CV and a link to prive its credibility. But you’d still be wrong.

Shah,

“That bank of England piece is overly simplistic in itself and was written as a teaching aid for students”.

I am late to this, and now trying to wrap my head round this statement; I gave up because it is so obtuse. Are you saying the Bank of England is writing and communicating rubbish to professionals? That it teaches students guff? That it treats professionals as students? That it treats students badly? That there are two or more levels of truth: the ‘true’, and the ‘really, really true, that only a special banking priesthood understands?

I am afraid you seem to be stuck with the ideas of 1950s textbooks (long exploded, I’m afraid – your chums are trying to rationalise their way out of that hole by explaining it all away; they always knew it was a muddle, and then stick with the guff anyway). May I suggest, in a spirit of helpfulness, that you read Mehrling, ‘The Hierarchy of Money’?

Max Planck stated the concept: “An important scientific innovation rarely makes its way by gradually winning over and converting its opponents: it rarely happens that Saul becomes Paul. What does happen is that its opponents gradually die out, and that the growing generation is familiarized with the ideas from the beginning: another instance of the fact that the future lies with the youth.”

You choose.

Thanks John

Oh dear.

First, banks DO create money “out of thin air” – but that does not mean they can do it without limit…. and nobody is claiming they can. They must have capital commensurate with the risk of the loan in line with the Basel regulations…. but this is a CAPITAL issue – nothing to do having to “have money in the till” before a loan is made.

When a bank lends £1 to a client where does that £1 go? It becomes a deposit at said bank – loans are “auto-financing”. Only when the client wants to pay someone that banks elsewhere does the lending bank need to raise a deposit in the market.

How the bank raises those deposits is regulated, too. (You must not rely excessively on interbank borrowing).

You are correct that the BoE sets the Base rate…. but, one way or another, all rates across the curve are linked to that rate and expectations of how that rate might evolve over time. Furthermore, the BoE through QE has shown it CAN set rates across all maturities if it chooses to do so. This is what drove rates so low during COVID…. policy.

Now, there are issues about savings and how they are invested/deployed… but that is another question (and one that Richard has said a lot on already).

Spot on – loans create deposits – a point I have just also made

Re: Banks creation of credit and/or money

“.. bank deposits are defined by central banks as being part of the official money supply (as measured in such official ‘money supply’ aggregates as M1, M2, M3 or M4). This confirms that banks create money when they grant a loan: they invent a fictitious customer deposit, which the central bank and all users of our monetary system, consider to be ‘money’, indistinguishable from ‘real’ deposits not newly invented by the banks. Thus banks do not just grant credit, they credit, and simultaneously they money.” (emphasis in the original)

Source: How do banks create money, and why can other firms not do the same? An explanation for the coexistence of lending and deposit-taking, International Review of Financial Analysis, Richard A. Werner, Volume 36, December 2014, Pages 71-77, https://doi.org/10.1016/j.irfa.2014.10.013

Thanks

Shah might do well to read this more detailed description of how ordinary banks create new money from, er, the BofE (this one was new to me too, incidentally) https://www.bankofengland.co.uk/explainers/how-is-money-created

Incredibly enough, it’s not just British banks which can create money. Here, the Bundesbank expands ” “In terms of volume, the majority of the money supply is made up of book money, which is created through transactions between banks and domestic customers. Sight deposits are an example of book money: sight deposits are created when a bank settles transactions with a customer, ie it grants a credit, say, or purchases an asset and credits the corresponding amount to the customer’s bank account in return. This means that banks can create book money just by making an accounting entry: according to the Bundesbank’s economists, “this refutes a popular misconception that banks act simply as intermediaries at the time of lending – ie that banks can only grant credit using funds placed with them previously as deposits by other customers”.” https://www.bundesbank.de/en/tasks/topics/how-money-is-created-667392

That should have a few commentators here spinning.

The Canadian central bank has also said such things.

They seem to be quite open about this in Canada where the Library of Parliament has helpfully pointed out that this is how the central bank works too, ie when it purchases an asset (like, say, a bond from the treasury) it creates the money to do it “”Both the Bank of Canada and private commercial banks create money by making asset purchases or making loans. However, money creation by the Bank of Canada through purchases of Government of Canada securities is essentially an internal government process; this means that external factors, such as financial market dysfunction, cannot cause the federal government to run out of money.”” that last being very useful to know as a reference also https://lop.parl.ca/sites/PublicWebsite/default/en_CA/ResearchPublications/201551E

Thankis

That was what I was actually looking for

I keep a list of useful links 🙂

https://www.economania.co.uk/various-authors/where-money-comes-from.htm

Bill

Can I share all those quotes here – with credit given?

Richard

Oh sure, I always expected other people to use them 🙂

Thank you

Shah would presumably recognize Keynes as an economist.

Keynes in his 1930 ‘Treatise on Money’ had this to say on bank money creation:

“If we suppose a closed banking system, which has no relations with the outside world, in a country where all payments are made by cheque and no cash is used, and if we assume further that the banks do not find it necessary in such circumstance to hold any cash reserves but settle inter-bank indebtedness by the transfer of other assets, it is evident that there is no limit to the amount of bank money which banks can safely create provided that they move forward in step… Every movement forward by an individual bank weakens it, but every such movement by one of its neighbour banks strengthens it; so that if all move forward together, no one is weakened on balance. Thus the behaviour of each bank, though it cannot afford to move more than a step in advance of the others, will be governed by the average behaviour of the banks as a whole – to which average, however, it is able to contribute its quota small or large. Each bank chairman sitting in his parlour may regard himself as the passive instrument of outside forces over which he has no control; yet the ‘outside forces’ may be nothing but himself and his fellow-chairmen, and certainly not his depositors.

“A monetary system of this kind would possess an inherent instability; for any event which tended to influence the behaviour of the majority of the banks in the same direction whether backwards or forwards, would meet with no resistance and would be capable of setting up a violent movement of the whole system….” J.M. Keynes, The Pure Theory of Money (1930) pp 23.

Thank you

Add in Minsky’s Financial Instability and thats pretty much all you need to know about why the financial lemmings head over a cliff on a regular basis, leaving the rest of us to clear up the mess.

Hi Mr Shah – how is Tufton street these days? Busy?

As most people readers of this blog will know, bank savings are not used to lend out for mortgages.

The Bank of England gives banks a license to create a mortgage loan “out of thin air” buy just creating it on a computer, knowing that the money will be paid back, and the loan extinguished.

This is similar to the myth that taxes pay for government spending.

Anyone who does not know this should read about Modern Money Theory.

Is he the same Howard Davies who was the chairman of the FSA. He is there to smooth out potential problems with regulatory authorities. The revolving doors are real.

The same….

Davies is a child of the London ruling classes dinner party circuit. I knew it well until I broke their unwritten rules of possessing a strong social moral backbone and intense emotional driving need to have social Justice being done and seen to be done. He a useful fool, as so many now in high places in the corrupted UK state are, but here I suggest that here is trying to fool uninformed voters into accepting high interest rates as being a ‘fair’ result of Thatcher’s ruse, that state or bank finances are simply like your common household budget.

I agree about what he is doing.

I just want to get this straight.

Are you, as an accounting professor, saying that banks don’t need to balance their books when they create a loan?

In other words are you saying that their asset/liability on a loan is not zero?

By definition they balance their books

The loan is created by double entry – which is all banks exist to do given there is no tangible existence to commercial bank money

So of course the books balance

How do you think that they cannot?

With logic like this it’s amazing that no bank is desperately trying to employ you?

What do you think a bank Treasury department actually does?

Arbitrage with a view to being a profit centre

Are you another yet another banker who refuses to understand banking?

So when a bank creates a loan, and that money gets withdrawn and used for some other purpose, where does the bank get the money to make it’s balance sheets balance?

Let’s be clear, if a bank loans me money and I use that money to pay someone else then I still owe my bank money.

But, now I have none one of the loan funds left in. My current account. The bank no longer owes me that money. It woes it to someone else instead. But of course the books still balance.

Maybe you should a) learn dou7ble entry b) learn how banks work c) learn some very basic economics before commenting critically again.

You borrow money from bank A. Then you pay it to someone else.

You do indeed owe bank A the money. But bank A does not have a claim on where that money has gone. It has a claim on that money from you.

What you are basically saying is that money is tracked round the financial system and wherever it ends up bank A is owed it. Which is nonsense.

Anyone with any basic understanding of banking and accounting should know this.

Bank A still has to make it’s balance sheet whole though. Which it does by borrowing, as various people above have tried to explain to you but you have steadfastly ignored, and they do it by borrowing in money markets.

Always, and I mean always

Loans = retail deposits + wholesale deposits.

If you don’t understand this basic stuff how on earth do you have the arrogance to claim that you, who have never worked in banking or economics understand more than literally thousands of people who have and are genuinely experts in the field?

I have to be honest and say that you know nothing about the Dunning Kruger effect.

However, I am a patient man, so let me explain what happens when a bank creates money out of thin air.

First of all, the bank creates a loan account for the person who borrows the money. That person then owes the money back to the bank. It is a banking asset and a liability of the borrower.

Secondly, and simultaneously, the bank will either create a current account for the borrower, or add the sum borrowed to their current account. It makes no difference which is done. The point is that this current account balance is a liability of the bank, owing to the customer, to whom it is an asset.

Please note that, at this point, the liability owing to the customer, and the liability owing by the customer, are identical. Double entry guarantees this. Double entry in fact created the money. No one else’s cash was involved. All bank money only exists as entry in double entry bookkeeping systems. The books always balance.

Then the customer uses the entire sum that they have borrowed, which is in their current account, to pay someone for something to person who banks with another bank. Their current account is reduced by the amount that they borrowed. Their bank, on the customer’s instruction, then pays to the bank that holds the account of the person being paid the balance on the borrower’s current account. The recipient bank then credits that sum to the account of the person to whom payment was made.

So, instead of the bank that made the loan now owing the borrower the balance on their current account, they now owe it to another bank instead. Their books still balance.

The bank that received the money is now owed it by the bank that created the original loan. That asset in their books is matched by their liability to the person to whom payment was made. Their books also balance. That is the miracle of double entry.

And, contrary to your claim, this is exactly how the banking system does work. Every single payment made is traced through the entire network of bank accounts, day in, day out, and all of them are cleared through the central bank reserve accounts, the balances on which were gifted to the banks by the Bank of England to ensure that they were solvent after the 2008 and 2020 crises, which is also why bank Treasury departments never have a problem in finding loan funds, because the Bank of England guarantees that they will always have them available to them.

So, does the original bank have to borrow to make the payment to the new bank it has transferred the current account balance of the person who borrowed funds from it to? No, of course it does not. Or rather, it does, but the funding is guaranteed to be supplied through the central bank reserve account balances for each of these banks will hold with the Bank of England. In effect, the recipient bank lends the original bank the money to make the payment to it. That is why it becomes a creditor of the original bank.

And that is how banking works.

And, for the record, am I an expert in this? I guess simply because I am able to explain this to you in a way that very few people could and you do not know it, compared to you I most definitely am.

Fox, when the client spends the money they have borrowed the lending bank (A) DOES then have to borrow. But where has the money gone? Answer, to another bank (B) who, for want of anything better to do with it lends it straight back to Bank A.

If a bank is “short” of funds there is always another that has excess.

So, making the loan creates the deposit; after that it is just shuffling it around the banks (in their CBRAs) as the loaned money is spent (and spent again and again).

And to ensure that thsi systyem works we have the central bank reserve accounts – which Fox needs to search in here for an explanatioin – or see the glossary

Richard

You have described the back payment system. Which is not the same thing as balance sheet management.

Sure, banks can create new loans and deposits, otherwise know as credit, but this isn’t the same as new money. The bank’s net assets don’t increase by doing this. And when the money leaves the bank to be used they have to borrow it interbank, which Clive also says.

But tell me, if a bank doesn’t need deposits how could bank runs and liquidity crisis ever happen?

Moreover, if banks don’t need deposits, wht bother with them at all? Just lend unlimited amounts?

I would love to see you actually debate a real expert one day, without you hiding behind your blog and it’s comments policy. I could arrange such a thing if you’d like?

Your inability to follow an argument is staggering. For the record, I have already answered all the points you gave raised, most in my reply to you.

It gives me no confidence you could know an actual expert.

As for my comments policy, how about thanking me for posting your nonsense?

@Fox “Sure, banks can create new loans and deposits, otherwise know as credit, but this isn’t the same as new money”

I’m genuinely interested in (a) what is new money (b) how a bank creates it.

I look forward to the reply, too

It would seem that it is “Whack-a-mole” day – or in this case, “Whack-a-tuftonite” – goodness me arn’t they poping out of the wood work with their hair splitting specious arguments.

This whole thread neatly encapsulates the simple ignorance that is not only is in the banking sector but the wider country.

It seems that even the bankers here have never heard of ‘fiat money’ as a concept and in operation.

And there seems to be no intellectual curiosity either as to where money in this country actually comes from and who owns the currency, printing rights and permissions and gives it legitimacy.

I suggest that Shah, James and Fox read Christine Desan’s ‘Making Money: Coin, Currency, and the Coming of Capitalism’. Oxford, U.K.: Oxford University Press. ISBN 9780198709589. OCLC 914353437.

And if not that then at least then Perry Merhling’s ‘The New Lombard Street: How the Fed Became the Dealer of Last Resort’ (2010) as John Warren would not forgive me for not mentioning .

And of course, there are others if you interested in facts and not fiction.

Thanks PSR

Amazing, isn’t it Richard, how the trolls seem to come out of the woodwork when you point out that a high-profile banker or politician has uttered something which is demonstrably idiotic in support of the prevailing neo-classical/neo-liberal shtick?

If I was a fan of conspiracy theories, I might say that these folk are perhaps paid to muddy the waters as much as possible! However, it’s probably more likely that they are simply ignorant unless they work in finance/property and therefore benefit greatly from the current status quo.

Well spotted…

Economists won’t admit it because it was what they were taught and if they want to get on in that world, they have to stick to that belief system. And a ‘belief system’ is just what it is. A reasonably educated person reading more widely about economics is soon baffled about just how many bizarre assumptions neo-classical economics makes. The Cowboy Economist has been mentioned before – his book is an excellent intro for non-economists, to the various economics sects. Contending Perspectives in Economics. by John T Harvey.

As for bankers, their ability to create money is one of the keys to their ability to make vast profits and pay themselves handsomely. No wonder they don’t want us to know how it works. Meanwhile the BofE has as one of its key roles, the protection of the interests of the City, not the interests of the wider population and business.

I must post some of his videos.

Highly recommended. Short and to the point. And the only economist who can make you laugh – with him rather than at him!

Judging from some contributions today, it seems to me that a lot more folk – mostly with one-syllable “names” – are afraid that you are increasingly getting your message across to a wider public.

🙂

Why is it that, if your judgement is correct, no bank or finance institution or asset manager or hedge fund or anyone has ever employed you for consultancy advice? Or is it so deep that ABSOLUTELY EVERYONE in financial markets are wrong and only you right??

Maybe because I have always sought to work in the productive economy?

I have never had any desire to work for wealth extractors. Why would anyone want to do that?

Productive economy? Begging for donations from charities and universities to regurgitate previous material you’ve written to justify the outcome that you wanted, regardless of the actual evidence.

Perhaps you have a different definition of ‘productive’ than the rest of the world?

It’s interesting that you challenge other people for their banking credentials yet your banking ‘credentials’ are the fact you’ve (mis-) read a BOE document?

I guess by the same token, I’m an expert pilot as I once flew in an aeroplane.

This is quite amusing

This commentator is also the one called James Green

And he (excuse the assumption) is also our so called ‘Banking Expert’ and has another comment waiting moderation in another name that will never see the light of day, where he claims to be a woman.

The astroturfers are making their money today.

O

It’s good for the rest of us to occasionally get a sense of who these characters are, and their trolling behaviour. And we’re all very grateful for the work you do filtering most of them out.

Do you identify commenters from their IP addresses?

Yes

It is how I work out who the mutliple identity trolls are

Upton Sinclair explained it many years ago:

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

go on Jake (I can call you Jake?) where do you work in Tufton Street? Tell us – don’t be shy, it’s nothing to be ashmed of (much).

It’s amazing how many banking ‘experts’ there are in here, all of whom have never worked in banking in their lives…

And yet if you dared to criticise their own roles, they’d claimed you don’t understand what they do because they are experts and you don’t have the knowledge.

It’s a strange world.

Go on, expert

Give us your name and your qualifications

And tell us why all the central bankers who agree with me?

And since I am quite sure you are not an expert try answering this from investopedia that you should understand

https://www.investopedia.com/ask/answers/100115/who-decides-print-money-canada.asp#:~:text=The%20Bank%20of%20Canada%20creates,and%20government%20bonds%20or%20securities.&text=The%20Bank%20of%20Canada%20can,need%20to%20hold%20as%20reserves.

Having worked with and for banks off and on for much of my career, including with central banks, it amazes me how little bankers seem to know about how their systems really work. And most economists know even less about banking, with a few honourable exceptions.

“It’s a strange world.”

It is indeed. We are presumably supposed to take your authority at face value, because? Because you have self-titled yourself, “banking expert”? That is it? A social media sneer, breezing in from nowhere, waving an anonymous pseudonym as your introduction. That is quite a pitch. If you are a banker, I have to let you know, you are not helping your corner much, I’m afraid; it is a little ….. how may I put this delicately; dubious.

Bankers (need I remind you), after all have ‘form’. the last time they were left on their own, adrift in self-regulation; we had the trifling matter of the 2007-8 financial crash (well, it ended remarkably smooth and trifling for a lot of banks that deserved stiffer retribution for the total failure of the set). I hate to tell you; it wasn’t much of a recommendation. for your – what is your word – ah, yes expertise. Do you really think the reputation of bankers is much recovered from the crash? The damage is still to be seen. It isn’t helped by little masquerades like this; if you are a banker.

A strange world indeed.

It’s interesting that you dismiss Investopedia when it doesn’t give you the answer you want, but at other times is a source of facts?

Regardless, in relation to banks making loans, the article says:

“However, the amount of money a bank can lend is limited since it must have enough deposits to make the loans….”

This is what Treasury departments are paid to do on a daily basis – to ensure that deposits match up with loans.

You can pretend they don’t as much as you like but you’re lying, presumably because your actual practical experience of banking is zero.

We know what your banking credentials are: zero.

Oh dear – you really are very silly

So, my bank pays my money to another bank because I pay soemone who banks with that other bank

Is my bank now short of assets? No, bevause I still owe it on my loan account: that is its asset.

All it now has is a liability to another bank and not me on my current account. So, of course it’s books still balance.

And the Treasury depaertment only has to reconcile its central bank reserve accounts – which is inter-banki funding using government created moeny.

You really do need to undertsand banking and clearly do not.

Suppose the government makes a major policy announcement tomorrow to liberalise planning. One third of the green belt within 15 minutes cycling of train stations abolished, height limits for new and existing housing to 25 metres no questions, stamp duty abolished, housing benefit capped at the level of the 30th percentile nationally, and that the opposition said they would support the changes.

Let’s say that house prices drop 10% on the news.

The Tufton street mob are saying that the banks will have a problem. You seem to be saying that they’re right but it can be dealt with by creating more money out of thin air.

In reality the government will not do soemthign as stupid as you suggest – parrtly because it knwos the iumapct in banking

But what hapens when banks are at risk of failing? As we know from 2008 and 2020, the government will always create new money out of thin air.

That’s why the economy did not crash in 2008 and 2020.

So, what are you trying to say? It’s really not clear.

A bank expert and Mark Carney’s dog. The wit of the neoliberal. Says it all, really. Way bak in the early days of music hall it was a bit rough and ready, apparently. They had a long stick with a big, wide hook on the end, to drag off really bad acts.

You need a long stick with a big, wide hook on the end, Richard.

🙂

Well I certainly won’t be using investopedia ever again. They don’t seem to know the difference between a traditional building society, where deposits do indeed have to match or rather exceed loans, and a bank where loans are not dependent on just deposits.

For a number of years in my early career I developed financial models for building societies as they really did have to manage their funds very tightly. When I then started to work with banks I learnt just how sloppily they were run in comparison to those dour Yorkshire folk (!) running building societies. Whilst paying themselves a fortune by comparison.

But then some got re-registered as banks as it was so much more fun….until most went bust because they stopped appraising the quality of the promises to pay of those they lent to. That’s the real limit on the ability of a bank to create money.

Precisely. And we lost some good organisations as a result. Northern Rock I knew very well and they were a really well run building society until they were hijacked by a bunch of shyster carpet baggers, and run into the ground.

Which rather proves the point – they were better run as building societies than as banks with all the vices of that sector.

Correct

It can be useful sometimes IMO but Investopedia seems overwhelmed by orthodoxy, and should probably be viewed from arm’s length.

I tend to agree

I used it precisely for that reason in this case

Yes, but there is literally no limit to the recklessness and stupidity of bankers; which is why I have seen so little reason to trust them with anything (least of all money!), since 1986. The individual’s trust in commercial banking and bankers should be measured rigidly by the exact limit of the Government guarantee given to domestic depositors; which is the only thing you can trust, no matter what.

If you are Mark Carney’s dog how come you can write? & should I contact Mr Carney – I’ve always wanted a dog that could write.

It occurs to me that you might even be called – Henry – aka “Chunckie” as in the dog food advert “Henry – time for chunckies”.

Can you also do gzinters? I ask because this is perhaps rare in a writing dog? (gzinter? 2 gzinter 4 2x) etc.

All for now Henry – or will you also answer to “Chuncky”?

“We know what your banking credentials are: zero”

WE???

There was me thinking you were an individual poster.

‘We’ as in the readers of this blog.

The whole world knows he has no bank expertise – he’s not even denied it himself.

Is this news to you?

So, Jason, tell me how not long ago you claimed to be bboth Mark Carney ans his dog?

Can I suggest that the only thing you know anything about is false internet identities?

Wow, not only was Jason Cundy a pretty average footballer, it seems he doesn’t really understand double-entry book-keeping.

I can imagine that this/these disinformation merchants can be found using various accounts on twitter, all with that paid for blue check mark for ‘authenticity’, of course.

The easiest way to understand it is to consider a credit card.

You buy something and the bank pays for it.

The bank records your debt to the bank.

You have to pay off the debt to the bank.

Richard, I`ve been following your blog for some months. It is most illuminating for a financial illiterate like me, for its clear and forthright exposition of UK government`s dishonesty. It seems plain to me that they have mastered the conversion of notional money into cash. Is that criminal fraud?

Also, this reply frame has been interfered with crudely, I had to re-type it.

Anyway, many thanks.

Richard, Thanks for persevering in explaining money creation and banking, and remaining civil in replying to many comments.

I would be interested to understand a little about how the “Islamic banking” system works and if it is significant in a UK and world context.

I know I can google it myself but hope you and some of the (self proclaimed) experts who follow your blog may be able to give a concise summary, and/or provide some reliable links to follow up.

I have no expertise in that area. Anyone else?

Of course long ago many great economists made the same point as the Bank of England. But so have Central Banks. In Canada in 1939 the Governor of the Bank of Canada responded this way to questions:

Q. And they issue that form of medium of exchange when they purchase securities or make loans?

A. Mr. Towers: That is right. That is what they are for… That is the Banking business, just in the same way that a steel plant makes steel. (p. 287)

https://parl.canadiana.ca/view/oop.com_HOC_1804_1_1/363

Asked about the 1931 MacMillan Report

Q. I draw your attention to section 74, which is at page 34 of the report:—

“ It is not unnatural to think of the deposits of a bank as being created by the public through the deposit of cash representing either savings or amounts which are not for the time being required to meet expenditure. But the bulk of the deposits arise out of the action of the banks themselves, for by granting loans, allowing money to be drawn on an overdraft or purchasing securities a bank creates a credit in its books, which is the equivalent of a deposit.”

you find any fault with that statement?

—A. None whatever.

https://parl.canadiana.ca/view/oop.com_HOC_1804_1_1/165

https://en.wikipedia.org/wiki/Macmillan_Committee — Keynes et al

Thank you

Looking at how persistent the detractors here are, I’m moved to ask where they actually come from?

The fact that a number have come here and called you ‘left-wing’ when to me at least you are demonstrably ‘progressive’ rather than trad’., left wing I find interesting.

So, where does this (un)healthy supply of detractors come from?

Tufton Street?

MI5?

The Tory Party?

Labour? (I’m serious).

The MSM?

I’ve got to say that I am curious. And in this world of dirty tricks these days, I’d strongly recommend it.

I can’t tell you PSR.

All I can say is that some of them are very good at using multiple identities.

To put it a little crudely, I’ve always thought that the ability of banks to create money, and then make money on that money, was like a business with an endless supply of free raw materials.

No wonder they are so profitable. Except when they screw up or break the law and get fined. Which they do on a regular basis.

Aristotle had things to say about this…

But you are also right

In an unregulated system, yes, this can go on and on and on. The problems only come when bankers run out of decent prospects to lend too and/or the pricing of that lending becomes to tight against the risk of default. At that point a banking crisis ensues.

In a regulated system capital and liquidity rules but limits on this activity…. but the track record on this (bankers and regulators) is not good.

Yiu are precisely right – and this is exactly what those claimning expertise here do not, very obviously, comprehend.

If knowing how banking works became a requirement for being a banker, an awful lot of them would be out of a job.