Chris Giles, the FT's main economic commentator has said this morning has said this morning:

There is a fair chance that by the time the trees come into leaf in Washington, Frankfurt and London, this decade's inflation crisis will definitively be over.

He added:

In the six months between May and November last year, for example, the annualised rate of consumer price inflation was only 0.6 per cent in the UK and 2.7 per cent in the eurozone. Excluding volatile energy and food prices, annualised core rates of inflation were 2.4 per cent in both economic areas over the same period.

And then he said this:

It goes without saying that the rapid demise of inflation on both sides of the Atlantic in the second half of 2023 was as surprising as its prior increase. Last summer, the Fed, European Central Bank and Bank of England all expected inflation to remain above target until 2025 at the earliest.

At which lint, I groaned with dismay that someone in such a position can have been s9 unfamiliar with the evidence. As I wrote in August 2022:

Danny Blanchflower had a longish discussion yesterday in which we agreed that the inflation that is dominating economic discussion about our economy at present is a passing phase. That does not mean it is not important. Far from it, in fact. But what it does mean is that when discussing inflation we have to remember that this is a temporary phenomenon, and what is just as important is to discuss what happens after it.

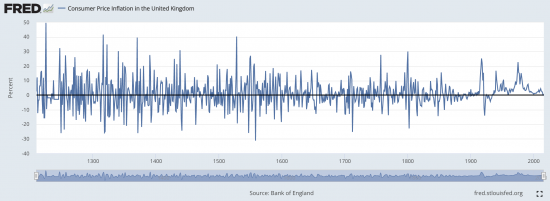

There is a lot of evidence to support this opinion. First, take this St Louis Fed chart which summarises data from the Bank of England on inflation trends in first England and then the Uk over a period of more than 800 years:

After a period of inflation there has, historically, always been been deflation, and even if the latter has been rare of late, there is always a return to more normal rates. Inflation does not persist.

The evidence is unambiguous. There never was going to be a struggle to bring inflation under control. Its return to mean, low, rates was always inevitable, and it is happening.

In that case the question is, what has been the cost of the mistaken belief of the likes of Chris Giles and the world's cohort of central bankers who believed otherwise, contrary to all available evidence, and who have demanded and then unleashed economic mayhem on the world via totally unnecessary and utterly destructive interest rate rises in the meantime?

Rarely in the field of human endeavour has one rather small profession caused so much harm to humankind as neoclassical economists do now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Good point.

Facts have never been allowed to jade the views of Neo-classical economists as they continuously create their own reality.

All I see BTW is that our response to inflation is driven by the opportunity to profit and nothing more. This is treated as something natural – even dare I say it – as a right of markets to do so.

Isn’t all of mainstream politics (I won’t dffeentiate Labour and the Tories on the issue) now driven by the opprtunity to profit?

Oh indeed – crises are there to be exploited these days – not solved. It’s called Fascism I believe.

I see it at work – I call it ‘Cavalry Management’ – it’s where a situation is left to deteriorate to such an extent and then – at the opportune moment – in rides the manager like the cavalry to the rescue to save the day and boost their status. But it should never have been allowed to get that bad in the first place.

I wonder if economic groupthink is reflecting political naivety, which in turn is reflecting public understanding.

Thatcher’s ‘household accounts’ analogy has permeated the public’s understanding of economics. And no political party is trying to undo that understanding.

And, in turn, the BoE and the Treasury and others are reflecting the political status quo.

Like the ‘Scottish currency’ question, all understanding of economics is whittled down to a couple of simple, erroneous sentences which are easy to understand but which are just plain wrong.

I too despair. Time and again we heard so called experts give subjective non evidence based assessments of the inflation bubble completely ignored the root causes. The BBC were and remain major culprits and repeatedly failed to challenge statements that were and remain false. Heading towards the election Sunak and Hunt will continue to claim that they have successfully tackled inflation and will go largely unchallenged or will Labour finally summon up some courage and the present the facts to call them out ?

I think the reason the economy is of no concern to those running the country, is that it does not appear to do harm to the well-off, and of course, they are of the belief that those with money are the wealth creators.

Not surprisingly, this is reinforced by the billionaire-owned media. See for example: “Multi-billionaire owner of luxury jewellers Cartier says the thought of the poor rising up and overthrowing the rich keeps him awake at night” (Daily Mail, 9 June 2015).

Funny how the thought of millions of people having to use foodbank, and “Soaring malnutrition” (Guardian, 28 Dec 2023) doesn’t keep the well-off awake at night.

This is predatory capitalism at work.

Sources

https://www.dailymail.co.uk/news/article-3117048/Multi-billionaire-owner-luxury-jewellers-Cartier-says-thought-poor-rising-overthrowing-rich-keeps-awake-night.html

https://www.theguardian.com/global-development/2023/dec/28/soaring-malnutrition-is-a-stain-on-british-society

Meanwhile the Bank of England has asked Ben Bernanke, ex-chair of the Fed, to review their work. Given that he comes from just the same cabal of economists, we can expect nothing to change.

https://www.theguardian.com/business/2023/jul/28/ben-bernanke-lead-review-bank-england-economic-forecasting-errors

[…] By Richard Murphy, part-time Professor of Accounting Practice at Sheffield University Management School, director of the Corporate Accountability Network, member of Finance for the Future LLP, and director of Tax Research LLP. Originally published at Tax Research […]

“Don’t sweat the details” (an American expression I think) appears to be very much the mantra of the British including its politicians (You quickly realise this from reading the ill-educated comments in the Guardian). As Christine Desan points out in a recent paper how after the 2008 GFC and the onset of Covid in 2020 can you intellectually evade the questions of how money creation works? She certainly “sweats the details” and surprises us with the implications for the lack of monetary literacy, in particular for the course of human history.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4585801

“The Monetary Structure of Economic Activity: A Constitutional Analysis” Christine Desan, December 1st 2023.

It’s a good paper

Thank God for Christine Desan is all I can say……………………………

………………….this paper means that the true nature of money can be exploited by anyone – including the institutions that created it, by the people who are empowered to manage it – which includes democratically elected politicians who don’t want to use it for the majority and are all to often bribed to look after their funders – the rich.

It seems to me all they are doing is trying to shore up Sterling. Since we aren’t trading very much now there’s less demand for it. Rich folks don’t need to pay their taxes since they don’t have to pay any any more.