The Office for National Statistics (ONS) has published its first estimate for growth in the UK in the quarter to 30 September 2023. I thought that this was rather graphic:

The big round zero has made an appearance.

As they had to say

- UK gross domestic product (GDP) is estimated to have shown no growth in Quarter 3 (July to Sept) 2023, following an increase of 0.2% in the previous quarter.

- GDP is estimated to have increased by 0.6% in Quarter 3 2023 compared with the same quarter a year ago.

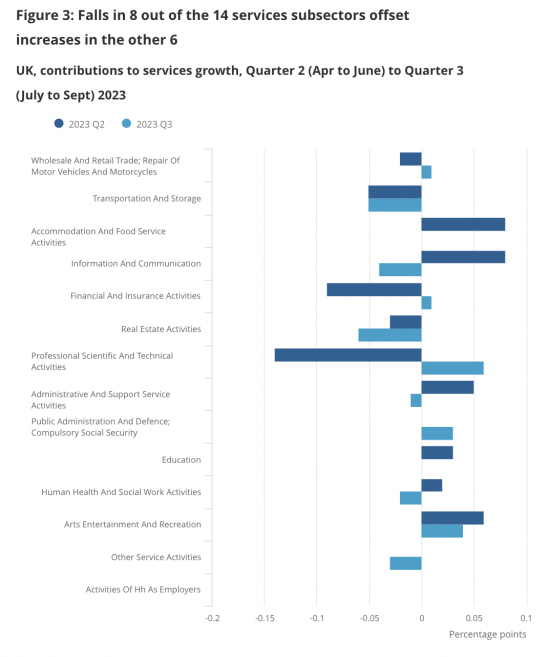

- In output terms there was a 0.1% fall in the services sector, which offset a 0.1% increase in construction output and broadly flat output in the production sector.

- In expenditure terms, an increase in the volume of net trade was offset by falls in business investment, household spending and government consumption.

- Compared with the same quarter a year ago, the implied GDP deflator rose by 7.9%, largely reflecting a fall in the implied price of imports, which contributes positively to the implied GDP deflator.

There are a number of things to note.

First, if this is the case, then very obviously what is being disguised is that some parts of the economy are having a really tough time, whilst others are still growing, a little. The same will be true of regions and households. If the economy as a whole is standing still, some are not doing so. That is one of the reasons why all politicians aim for growth. Their hope is that if there is some growth, no one is left completely behind. Right now, they will be.

Second, this is apparent in some of the data by sector:

A majority of sectors are falling behind. More than that, though, the major ones that are doing so have been some of the big drivers of inflation. They include professional services and financial services. If they are declining - and other data suggests that they are - then the likelihood that inflation will fall soon is high. In that case there is good reason for interest rate cuts.

Most of all though, I read this data in combination with an article I read yesterday from the FT that noted that:

Thirteen years of Tory rule has, on the basis of their own chosen criterion for success, been a disaster. There has been growth, but at best this can be put down to rising population, almost all of which is due to immigration.

The focus of the Tories on austerity has crushed the economy.

Their belief that being a world-leading financial services centre matters has been utterly misplaced: that activity has delivered no productive investment to the UK economy at all, and has simply led to vast quantities of resources being wasted on speculation that has added nothing to human well-being.

And the very obvious need for a new direction in the economy, which the 2008 crash always indicated was required, has not been seen. Worse, no investment in it has been made.

In summary, the Tories have been a disaster for the UK.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Hi Richard,

Absolutely agree.

Going back further, the Conservatives have been the party of failed economic experiments:

Monetarism

Privatisation

Austerity (aka “expansionary fiscal consolidation”)

Trade barriers (Brexit)

“Supply-side reforms” I.e. poverty wages.

Trickle-down economics

All had small to zero evidential basis and have proven themselves to be utter failures.

AND

going back on the gold standard ay 1914 rates

cuts in the 1930s

keeping the pound over valued in 1960s and high interest rates to draw in foreign deposits. It also reduced investment.

Monetarism

Big Bang de-regulation of the City

Lawson boom -and bust

ERM

and as Richard has shown more borrowing and spending than Labour

Your last sentence perfectly sums up the problem that has faced this country for the last 100 years.

In terms of the economy, social progress and Britain’s place in the world community the Tories have been an ever developing disaster, but throughout that period they have repeatedly been re-elected.

In no particular order I would suggest that the three biggest problems are:

1 The centralisation of power into a system of profoundly undemocratic National Government making it all too easy for this country to be run entirely for the benefit of a tiny minority of the population.

2 A media owned overwhelmingly by the extremely rich and greedy.

3 The British class system that has made such a powerful comeback in the last forty years.

The Tory party has blighted the lives of my me and my family, my career, hopes for the future and my mental health since 2010. And that of many others too who are worse off than me. I’ve worked all my life – and for what?

The Tories are beyond understanding, empathy – anything. I detest them.

The Tories are the enemy within in this country.

I have come to see them as a highly evolved English establishment version of Pol Pot, intent on taking us backward to some sort of Establishment ‘Year Zero’.

Not for them the muzzle of a Kalashnikov or a killing field – that’s too much hard work for them; their weapon of choice is economic – strangling the money supply to working people and services, their killing fields are the NHS and care homes and food banks.

The Tory party needs avulsing from our politics, along with the shady funding it attracts. That’s about the nicest way I can say it.

Today in the FT there is a headline “UK economy stagnates as high borrowing costs hit activity” (behind a paywall I haven’t coughed up to pass); which I assume means they acknowledge interest rates are a major factor in the state of the economy (0.0% growth).

I have still to see much evidence that domestic wage increases have had much material impact on the volatility of externally induced inflation, over which the BoE has no control; and the government is responsible: because it failed totally to do anything to protect Britain from energy security risks (insufficient public investment in renewables; inadequate gas storage; fake domestic energy markets; insufficient taxation/regulation of critical domestic energy producers); by relying on international markets which were and are at the heart of the disaster, and still leave us open to serious cost risks.

Just as a reminder that failure is endemic, and the BoE, FCA and Government never far away from failing the country on financial regulation; CityAM reports the following: “The UK is a ‘leading enabler’ for corrupt central Asian elites and ‘complicit in washing’ illicit narcotics profits in the Square Mile, a report by the Foreign Affairs Committee has found.”

The worst element of this is; it is no surprise. It is what we have come to expect. Regulation and enforcement let us down in 2007; we were told it was fixed. It wasn’t. It never is fixed. You really can’t trust anybody, any institution not to let us all down. I note however that in Britain’s current state, this is scarcely even worth a headline in a major news outlet.

I fully agree John, but on my bookshelf there are books by Burgis, Gray , Kendzior and Belton which attest to Russia’s contribution to the growth in criminality in our financial sector.

Who would have thought that the end of ‘communism’ and the seizure of Russia’s economic output by a small ex-communist elite enabled through Western Neo-liberal theory would have led the way to the West’s rather ropey ethics being shredded and seen for what they are: too loose.

As Belton quotes a Russian interviewee (p. 488 ‘Putin’s People’ – 2020):

‘We believed in Western values………………… But it turned out everything depended on money, and all those values were pure hypocrisy’.

In this long (and continuing?) cold war, someone somewhere is having the last laugh.

And it’s not the West.

But it isn’t just Putin or Russia. The FT yesterday had an article titled “UK is a ‘leading enabler’ of central Asian kleptocracies, say MPs” (Foreign Affairs Committee). This is a British problem. The City is associated with international kleptocracy, in the mind of the whole world. Before the GFC 2007/8 in the US Britain was associated with notably weak financial regulation. We delude ourselves, about ourselves; and our long, deeply flawed history, which does not bear inspection, not just in terms of the standards we pretend today, but measured against the decent contemporary standards of the time. We are especially adept at deflecting attention toward the sins of others; and presenting ourselves as the only dependable measuring rods of decency on which the world may rely. It is an illusion.

And Starmer proposes more of the same!

¹How much he deserves my nickname of Sir Useless Woodentop!

I despair.

Andrew – now come on, we’re meant to be beyond name calling now !!

Analysis and reflection rules from now on and ideas are paramount.

Let’s hear them!

‘…has simply led to vast quantities of resources being wasted on speculation that has added nothing to human well-being.’

Indeed. But on the other hand it has added a lot of money to the pockets of a lot of already wealthy people and organisations who routinely support (donate, or support in other ways, such as by funding right wing think tanks, much of the mainstream and social media, etc) the Tory Party.

Unfortunately – but not unsurprisingly – as Private Eye reports on a regular basis many of these individuals and entities are now shifting their focus – and money – onto Starmer’s Labour Party.

That’s hardly surprising, Ivan, given that Starmer’s Faux-Labour Party is actually the Establishment’s B Team.

Hi Andrew,

I share some frustration with the direction of travel of the Labour Party.

However, even now I would choose them 1000 times over the corrupt and incompetent rabble we have at the moment.

I hold out some hope that once they are governing rather than campaigning (in an environment that is generally hostile to radical ideas in general and Labour in particular) that they will show more courage and radicalism.

Neil

And the Brexit ‘productivity penalty’.

And the influence of the City of London in shaping an economy which has become increasingly geographically and sectorally unbalanced.

The City has led the financialisation of the UK economy channelling far too high a proportion of investment into assets such as property, infrastructure and financial asset (much of that enabling outsourcing!) and far too small a proportion into more productive investment such as new businesses, scaling business, SMEs etc.

Here’s some fascinating research on the City of London which echo the concern on this blog

https://www.qmul.ac.uk/media/news/2023/hss/london-is-a-major-reason-for-the-uks-inequality-problem-unfortunately-city-leaders-dont-want-to-talk-about-it.html

Thanks