I have this morning published the next in my series of proposals that will make up the Taxing Wealth Report 2024.

In this latest note, I consider the need to reform the rate at which inheritance tax is charged. I suggest that one of the biggest reasons for the unpopularity of this tax is that the 40% flat rate used once an estate falls within the scope of the charge to this tax appears to be a very blunt instrument.

What I suggest is required are progressive rates of tax, rising as the size of the states increases, with the overall aim of making this tax considerably more progressive rather than to necessarily raise additional revenue. The latter objective may, however, be achieved if the other recommendations made with regard to inheritance tax in the Taxing Wealth Report 2024 were adopted.

As the summary of the note says:

Brief Summary

This note proposes that:

- The rates at which inheritance tax is charged should be subject to review.

- The existing flat charge rate of this tax is inappropriate and might be one reason for its lack of political acceptability.

- The current charge structure of this tax also fails to deliver sufficient vertical tax equity within this tax.

- At the same time, that flat rate also results in insufficient wealth being redistributed by this tax when that is one of the objectives for using it.

- If new tax rates from 10 per cent to 60 per cent of the value of chargeable estates were introduced on cumulatively increasingly wide bands of chargeable estate, then whilst no additional tax might necessarily be collected the distribution of that charge would change considerably, with much more being paid by higher value estates.

- The suggested revised structure would reduce the inheritance tax due on almost all chargeable estates of less than £1 million, often by significant amounts.

- When this issue has been addressed, and when other recommendations in the Taxing Wealth Report 2024 relating to this tax have been considered, it may be appropriate to reconsider the size of the nil rate band for this tax.

Discussion

As I suggest in the note:

It has long been the case that the structure of inheritance tax has been overdue for reform.

The nil rate band for this tax, which takes the vast majority of UK estates out of a charge to inheritance tax, has been set at £325,000 since 2009, although this sum can be increased in the case of the passing of former domestic residences. This sum is not expected to change until at least 2027.

The rate of tax has been subject to even less change. A few exceptions apart, once inheritance tax is charged it has been due at 40% for decades. It is stressed, that this rate only applies to the chargeable estate above the nil rate band, and not to the estate in its entirety.

For a tax that is so unpopular, according to public reports, the fact that there has been no serious review of its structure or rates for more than a decade is surprising. The changes that have been made have all tinkered at the edges of the tax, but not addressed issues of principle.

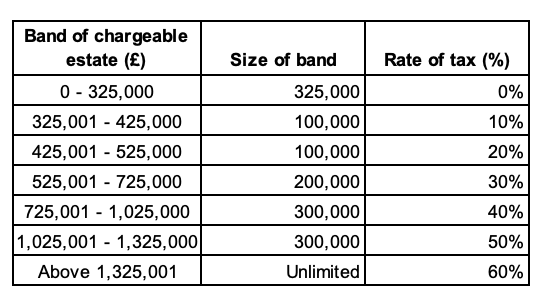

There are almost countless ways in which changes to the rates of inheritance tax could be made. I have not sought to model them all. I have, instead, opted for a relatively simple reform, which is to keep the nil rate band as it is at present, but to then introduce progressive tax rates thereafter, as follows:

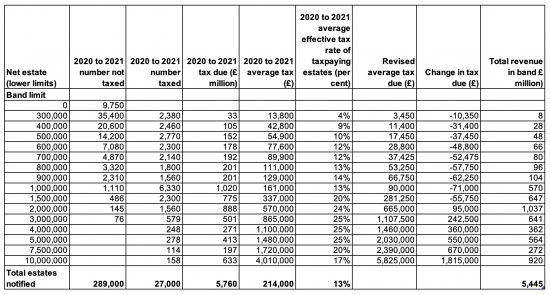

This would change liabilities by band as follows:

As I suggest in the note:

As will be noted, for many smaller estates, where the imposition of this tax is most keenly felt, liabilities would fall if these bands were adopted.

This would also be true for all estates where the overall net estate is less than £1.5 million.

However, on higher value estates the overall liability increases, as it would also do if other recommendations in the Taxing Wealth Report 2024, e.g. with regard to agricultural and business property relief are also taken into account, given that most of the estates claiming those relief will fall into this category.

It is suggested that this overall redistribution of liabilities is just and equitable whilst also achieving the goal of redistributing wealth within the UK without imposing tax charges at rates that are uncommon within the rest of the economy.

It will be noted that this change is broadly tax neutral. Bands could be altered to achieve an increase in revenue raised. Those chosen here were instead picked to increase the degree of redistribution that the tax might achieve.

Sometimes taxing wealth better is about achieving social goals and not raising revenue. This suggestion is a case in point.

Cumulative value of recommendations made

The recommendations now made as part of the Taxing Wealth Report 2024 would, taking this latest proposal into account, raise total additional tax revenues of approximately £105.2 billion per annum.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Would it not be more appropriate for IHT to be paid by beneficiaries who receive property? Also link it to income levels. More progressive.

Yes

But the Taxing Wealth Report is about what is possible without major tax redesign.

I was thinking a major overhaul of the system is required, but see your point.

I like the idea..but Richard’s suggestion is implementable “at the flick of a switch”.

So, start with that…. and work up to your idea in time?

Precisely

That is my logic

I am not saying we stop with the Taxing Wealth Report 2024. I say we start with it.

I have been wondering what you would suggest for IHT given it is (I think) the only tax on wealth itself currently. As opposed to tax on income or capital gains resulting from wealth.

Introducing progressive tax rates seems totally sensible. The only thing is that suggesting a top rate above 50% might deter politicians from taking your proposal seriously. It isn’t logical, but it is nevertheless a psychological barrier in many people’s minds.

And you don’t mention the principal residence allowance here; I know you have a separate proposal covering it in relation to capital gains, but as you have said it is more likely that any political consideration of adopting your proposals would be individually rather than as a package. For some reason people have been conditioned to think that their parents’ paper wealth as an accident of living through a period of high property inflation should be especially privileged.

I also think that however great the logic for inheritance tax falling on the recipient, there are much too high barriers for heading in that direction. The principle of removing tax at source, mainly through PAYE, makes tax administration very much easier. The majority of the population nowadays can go through their lives never having to fill in a tax form and it would introduce a huge amount of anxiety to ask them to do so after a bereavement. It would also raise a question of whether it is appropriate for a lump sum inheritance received once in a whole lifetime to be taxed on the same basis as a recurrent income received annually.

Thanks

I do muse on these comments

A lot of the ideas you have proposed seem to be fair to me but there seems to still be an addiction to ‘trickle down’ rather than genuine re-distribution through tax. It’s an appalling situation to be in even after so may years of evidence that trickle down does not work.

@PSR

Quite right. The problem with trickle down theory (which somebody once told me doesn’t even exist) is it assumes that only the wealthy spend money. In reality everyone spends money, but only if they’ve got some to spend. Those with least spend relatively far more and will willingly beg, steal or borrow to contribute to the process of driving the economy.

Spot on

I very much doubt this would make IHT more popular, because I think the complaints about it come from people who would be well into your 60% band (plus people who like to think they might be, or are deferential to the wealthy).

I like your approach, in other proposals, for abolishing many of the unjustifiable existing exemptions from IHT. This makes the tax more equitable, so it’s easier to defend. What seems to me to be missing (so far) is anything to raise IHT from people who are so wealthy that they can easily arrange to be domiciled in a no-IHT jurisdiction. Why can’t their UK-located assets be brought within the scope of UK IHT? Without this step, the problem remains that IHT applies to wealthy people up to a certain level of wealth, but not to even wealthier people; which undermines the equity of the tax.

And that makes it harder to justify raising the top rate of IHT to 60%. And if the tax base of IHT could be broadened in the way I suggest, would there even be a need to raise the rate?

U.K. located assets of resident on-doms are subject to IHT niw.

Why not extend it to UK-located assets of non-resident non-doms?

Because we do not have the right to tax them under international treaties