The economic outlook appears to be even poorer this morning.

Those renting are having a torrid time. Rents are up at least 10% in the past year.

Those who can get a property are accessing some of the poorest housing stock in Europe.

The government is going to make things worse. They plan to solve the refugee processing backlog by releasing 50,000 into the community without support, many of whom will then become homeless.

And things are little better for homeowners. MetroBank is in financial crisis (although that's being talked down). The bank has a loan book that few think of the highest quality. That is why its value has fallen to £100 million. The problem for it is it needs to refinance £350 million of its own loans in the next year, and raise £250 million in extra capital. There is, I suggest, no way that it can survive that dual demand in its existing form. A white knight will have to be found, and that is always a sure sign of an impending financial crisis. Just think back to 2008.

That is not the only problem for banks. As the FT has noted, bank third quarter earnings look like they will be hit hard by the fall in the value of their bond holdings as markets take the impact of long-term high-interest rates into account. Since interest rates and bond values are pretty much the inverse of each other, those rates are now hitting the value of bank balance sheets hard, just when their mortgage and loan portfolios are severely threatened by bad debt risks, also created by high-interest rates.

Those bad debt risks are, of course, the consequence of personal and business debt crises as high interest rates hit. So, there are further threats of homelessness whilst unemployment is bound to rise.

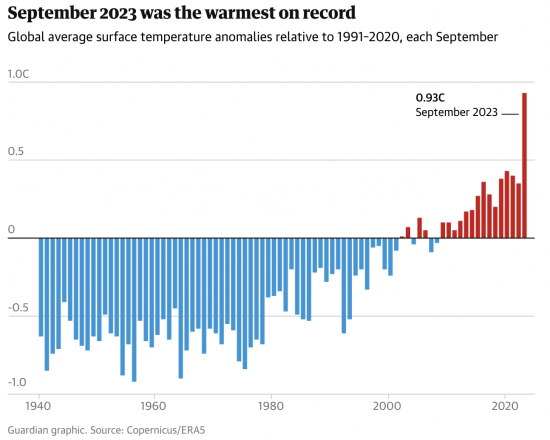

And let me add some more misery into the mix. September was totally abnormally hot:

That's not just aberrational: it is staggeringly abnormal, and that is continuing. I am writing this in the open air and just shirt-sleeved at 8.20 in the morning in October, with 25 degrees forecast for the south at the weekend. The scale of investment required to manage this is also off the scale.

So what does all this mean?

First, it means that the Bank of England policy of high-interest rates is working as I predicted it would, to crash the economy. That did not require me to be an exceptional seer: the Bank of England wanted this to happen to crush demand in the economy and is getting what it wanted. I just had the honesty to call it out. The crisis we face is not necessary: it is being manufactured in Threadneedle Street.

Second, the cost of this is not going to be some little blip in the economy. This moment now feels like 2007 - when everything began to go wrong but few said it (again, I was one of the exceptions). It feels like everything could totter over soon, with calamitous (I do not use the word lightly) consequences.

Third, no one is getting ready for this. The Bank of England is talking about selling £100 billion of its bond portfolio in the next year as part of its quantitative tightening programme as part of its programme to maintain high interest rates when the reality is that it should be planning for the emergency support that the economy is going to need, soon.

The Tories are playing games. The whole focus of their conference was putting spanners in Labour's works: HS2 abandonment apart, nothing they announced will have the slightest consequence before they are out of office.

And then there is Labour. This weekend will be interesting only for the sentiments on display. If they win today's by-election in Scotland they will be buoyant. If not (and you can guess where I stand on that) they will be hunkering down before even reaching office.

My suspicion is that they will win because there is always a backlash against a sitting MP who has failed. In that case, expect talk of them saving public services without spending a penny on them because fiscal rules will be referred to time and again, whilst nothing of substance will be said because (as Pat MacFadden has tediously said, yet again, this morning) they 'need to see the books' before deciding on anything. It is as if imagining what might be revealed is a task way beyond their ability.

Fourth, then, there is the real need. That is for an economic redesign. I mentioned the need for innovation around what is possible yesterday. Nowhere is that more apparent than in the economy itself.

We need to cut interest rates because that is possible and would cut inflation. It is economically counter-cultural, but when convention is very obviously not working what is wrong with that?

We also need to raise taxes on the wealthy for three reasons. The first is that the government needs to spend more as a proportion of GDP in both the short and long term and that will require that the inflationary impact of that spending be removed from the economy by making extra demand on those best able to meet it.

The second reason is that income has to be redistributed into the hands of those who need it if they are to survive the stresses to come.

And third, when markets are failing to direct savings towards real investment - which they are so obviously not doing - the state will have to intervene to achieve that goal.

What we then need is a plan for the required spending. It will not be possible to cut our way out of the crisis to come - at least not if the lives of the people of this country matter - so there have to be such spending plans.

My great fear is that Labour is doing none of this thinking. It is not even aware, I suspect, that it is required even though this crisis is going to emerge on their watch unless something very unexpected happens to save them.

We are already in the proverbial creek. My fear is that no one in charge knows where the paddle is. And that is really scary.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I agree that a cut in interest rates will lead to a fall in inflation but I would like to know why you think that especially as it goes against mainstream thinking.

Orthodoxy says raising interest rates reduces demand, and also says it is excess demand that supposedly causes inflation .

However this inflation was caused by market failure (supply chain breakdown post Covid), excessive speculation ((in commodities post war starting in Ukraine) and by market exploitation (profiteering by energy companies, retailers and now banks).

Raising rates facilitates these failings. It did seem nothing to address them, so orthodoxy is wrong – but his a convenient cover for market failure of multiple sorts.

It strikes me that the level of imagination and vision required has a slight feel of what the Attlee government did in 1945

Spending plans need to be based on what the economy could become rather than on its current enfeebled state.

The Keynes’ quote I’ve just seen seems apposite here:

“We do nothing because we have not the money. But it is precisely because we do not do anything that we have not the money.”

I feel the same to be honest – the country is dominated by the orthodoxy of TINA but which should really be called ‘You Will Not Get An Alternative’ because certain people won’t allow it.

And it is the same people who are maybe flocking to the Labour party now offering to fund it – ensuring the crippling continuity we suffer under.

What I see as a result of this is squashing/suppression of hope. This is further leading to mental health issues in society increasing at a huge rate and that maybe where any backlash will originate from. These mental health symptoms are redolent of those coping with war.

There has been a war against this country fought by its own government against the people based on the belief that we ‘had it easy’ during the brief respite we had from from the Tories between 1997 – 2010 and it has been a long and dirty war.

We need to otherthrow the Tories, their funders and even the Labour party (collaborative or not with the Tories) if necessary if we are to live free from fear and embrace the future.

Sorry, Richard. Easily decoded typo, but – hmm?

“My suspicion is that they [Labour] will win” […] saving pubic services […]”

Oops…..

This year the government will give the UK’s banks £45 billion they have done nothing to earn. That’s because of QE and interest rate rises.

The banks should therefore be okay?

Only if they have significant reserve account balances

But industry-wide in the UK, the banks will have an extra 45 billion, effectively as a bonus. That should surely cushion any upcoming bad news

Banks fail individually

Yes they will fail individually, but given the additional revenue from interest rate increases, can you explain why that would occur now?

Because this bank is believed to face exceptional risk in its loan books, meaning they are exposed to the risk of capital losses.

Does the increased risk matter though? As banks create loan money from thin air, does it truly matter if a loan goes bad? And meanwhile they, as an industry, have the extra 45 billion as cover

Yes

Money might be created out of thin air

But it is debt

And if the bank cannot honour its debt its debt

The idea that debt does not matter is wrong

The health of the many outweighs the needs of the one.

In my view of course.

The sector as a whole should be ok.

That’s what was said in 2007

There really are times when understanding micro helps

“That’s what was said in 2007”

by whom?

Could you share a link perhaps to show that – that while the banking sector as a whole might benefit to £45bn or so as you recently said, the micro model undermines that because an individual player is struggling and this undermines your macro assessment.

Your question and the assumptions on which it is based are naive.

Let me offer you analogy. Your argument is that if Tesco is booming so must the corner shop be doing well.

That makes no sense.

Nor does your question, which assume all banks perform in the same way, face the same risk and help each other. That is not true.

I remember Robin Jackman from the 70s and 80s. England and Surrey cricketer, any relation?

I missed that

I know a fair number of cricketers who have trolled here over time

I missed this one

No, not that one, just someone trying to understand.

If the loan is created by the bank, who do they owe the debt to? That’s what I’m missing

Whoever the money was paid to – or, at least, their banker

I’m reminded of the old J K Gailbraith quote: –

“People of privilege will always risk their complete destruction rather than surrender any material part of their advantage. Intellectual myopia, often called stupidity, is no doubt a reason. But the privileged also feel that their privileges, however egregious they may seem to others, are a solemn, basic, God-given right.”

Until something breaks, which we all seem to be waiting for, nothing will change. I see, for instance, that the reopening of the Leamside Line in County Durham has been shelved 24hrs after Sunak’s speech. Nothing changes.

My MP on QT tonight, the tory .

He’s been asked about the Leamside line and has no idea. Can’t answer the question.

So the Leamside line gets binned, but Ely Junction is upgraded out of money from the Network North Plan.

Sunak had no idea on Tuesday that he was going to bin HS2, but this report miraculously appeared on Wednesday!

https://assets.publishing.service.gov.uk/media/651d64646a6955000d78b2e0/network-north-transforming-british-transport.pdf

Note where Manchester is. Getting a lot of stick for that. I wonder if it’s because it’s run by a labour mayor.

Never mind “where” it might be! I’m not convinced they have the foggiest idea WHAT a paddle is…

The storm clouds are indeed gathering. Plus absolutely we need redistributive taxation, and, in the longer term, “predistribution” through more equal ownership and control of the engines of wealth generation, so that we never again end up with such spiralling, self-reinforcing, inequalities of wealth and power.

Trouble is we won’t have a future at all unless we take the time to understand and then sensibly confront the following. To fund dealing with first the Financial Crash and then COVID governments around the world created money, which they used to buy back their own debts, sometimes as soon as the debts were issued. That was called “Quantitative Easing” (QE). Now those governments are quietly “selling those debts” back to the markets (which is a euphemism for reborrowing the money) or borrowing money to pay off those debts as they mature (meaning the “capital” of the debt becomes due for payment) and then cancelling out the money just borrowed. That’s right: these governments are borrowing vast sums to cancel it out, as that it the only way to destroy all the QE created money. This process is called “Quantitative Tightening” (QT). It means burdening the future with the massive costs of over a decade’s worth of crises.

There are alternatives to QT. In 2021 Thomas Piketty (yes, “that” Thomas Piketty), and a hundred other European economists, MEPs and campaigners, proposed either simply cancelling those debts, that governments now owe to themselves, or turning those debts into “perpetual debts with 0% interest rate”, which never therefore need to be paid off, as explained here: https://www.euractiv.com/section/economy-jobs/opinion/cancel-the-public-debt-held-by-the-ecb-and-take-back-control-of-our-destiny/

(In this specific instance the proposal was to the European Central Bank, though the same proposal could obviously be applied to any central bank that has created money to buy back its own government’s debts). This means just accepting that we created money over that decade’s worth of crises, and not loading ourselves down with massive debts.

Tragically, they were ignored, and across developed nations, including here in the UK with the Bank of England (which is borrowing £80 BILLION a year for a DECADE not to invest it but to wipe it out), central banks are quietly committing us all to permanent austerity, in their dogmatic determination to wipe out all the QE created money. This is one HUGE reason “there is no money”. That also means no money even to deal with the climate emergency! It is terrifyingly insane and has to be stopped. More here (the blog actually recommends the more cautious “perpetual debts with 0% interest rate” option. I guess you could always still cancel that out later once you can be better assured it would be safe to do so):

https://gezwinstanley.wordpress.com/2023/09/29/dont-destroy-trillions/

We need to give ourselves back a future. We need to stop QT.

I agree – and have said so here many times

Thanks