I have this morning published the next in my series of proposals that will make up the Taxing Wealth Report 2024.

In this latest note, I suggest that the rate of small company tax in the UK should be aligned with the basic rate of income tax, increasing it from 19 per cent to 20 per cent as a result.

More significantly, I also propose that the differential of ten per cent between the corporation tax rate paid by smaller and larger companies should be restored, increasing the rate on those larger companies from 25 per cent at present to 30 per cent.

The total tax raised might be £7 billion a year with the incidence falling almost entirely on the shareholders of those larger companies, who will be amongst the wealthier people in the UK.

The summary of this note says:

Brief Summary

This note suggests that:

- The rate of corporation tax payable by smaller companies in the UK should be aligned with the basic rate of income tax, which is 20 per cent at present. This would increase their current tax rate by 1 per cent.

- That larger companies in the UK should pay corporation tax at a rate 10 per cent higher than smaller companies because:

- They have higher rates of profitability than their smaller rivals, usually because of their ability to extract monopoly profits from consumers because of their market strength.

- They have lower costs of capital than smaller companies because they tend to be able to borrow more at lower cost than smaller companies, which ability also allows them to invest more than their smaller rivals which in turn tends to reduce the tax rates that they might otherwise pay.

- The cost of proper tax compliance is proportionately higher for smaller companies than larger ones, meaning that they should enjoy at least one lower tax rate as a result to compensate them for this.

- Smaller companies need to retain more of their profits than their larger rivals if they are to invest, and the rate of return on investment by smaller companies tends to be high for the benefit of the UK economy as a whole.

- Larger companies are larger polluters and pose a greater threat to biodiversity than smaller companies and so should pay more corporation tax as a result when there is at present no other tax to reflect this fact.

- There would be only limited behavioural responses to this proposal because it only applies to UK-generated profits and it is increasingly difficult to relocate profits to other countries or tax havens for taxation purposes.

- As a consequence, it is likely that this proposal might raise an additional £6 billion per annum from large companies and more than £1 billion from smaller companies, providing total additional revenues of £7 billion per annum as a result.

Discussion

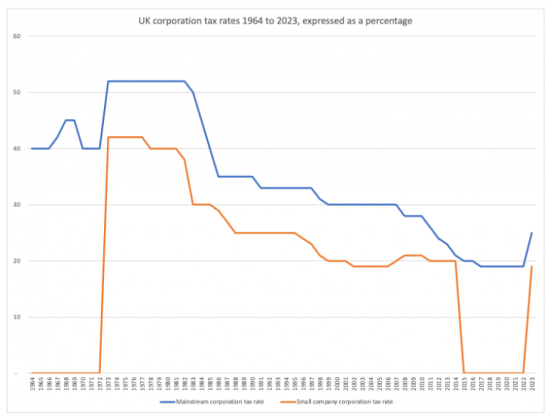

The tax rates paid by large and small companies in the UK have varied significantly over time, as this chart notes:

What is apparent is that the tax rates used for these two classes of company varied by a differential of around 10 per cent in all years except those before 1973 and between 2015 and 2022, when the tax rates paid by all companies were the same.

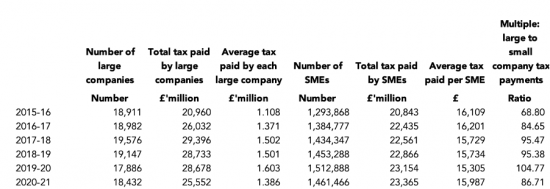

The actual sums paid by company in each class has always varied widely, as this table shows:

For the reasons noted in the summary above, it is suggested that there is good reason for the differential in the tax rates between large and smaller companies to be restored.

Cumulative value of recommendations made

The recommendations now made as part of the Taxing Wealth Report 2024 would, taking this latest proposal into account, raise total additional tax revenues of approximately £83.3 billion per annum.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I sometimes wonder why companies are taxed on profits rather than turnover.

I mean, I don’t get taxed on how much money I’ve got left at the end of the month!

You are taxed on your income.

Profit is the income of a company.

Think about a supermarket. It buys a tin of beans for 50p and sells it for 70p. It makes 20p, at most. Tax it at 30% on turnover and its tax bill is bigger than the money it makes. Why is that appropriate?