According to a Sunday Times article published last night and now covered by others, including The Observer, Rishi Sunak is considering cutting inheritance tax. Whether this will be before the next election is unclear; more likely, it will be an election pledge. Whenever, or however, delivery is promised, this is a terrible idea.

I should be specific. I am not suggesting that inheritance tax need be retained in its existing form. There are good reasons to make changes to it, which I will get to in the Taxing Wealth Report 2024 series in due course. There are even one or two things that I think should now fall outside the scope of this tax. I hope to propose one of those changes during the course of the coming week. So, if Rishi Sunak said that he was reviewing the way in which inheritance tax worked, I could not argue with his intention to do so.

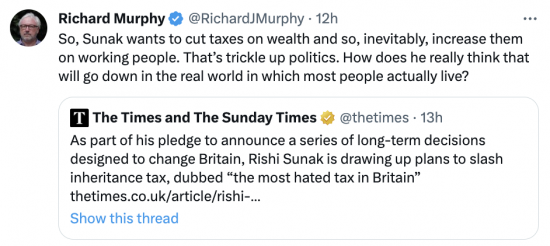

That, however, is not what he is saying. If the Sunday Times article can be relied upon, and I think it's safe to presume that it is based upon a well-placed leak, then Sunak's intention is not to reform or enhance inheritance tax. It is, instead, to cut it in the first instance, with a view to abolition thereafter.

Let me just put that in context. Firstly, we have had inheritance tax or one of its predecessors since 1694. It is, in fact, of exactly the same age as the national debt, precisely because the existence of both makes sense.

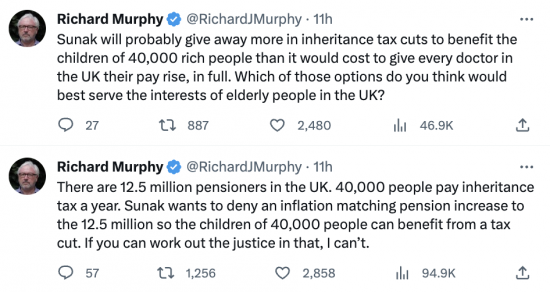

Secondly, and more importantly, it raises a little over £7 billion a year, with that sum being on a rising trend at present. I did a couple of tweets on the consequences of losing this revenue, assuming that the control of inflation required its replacement, last night:

You will note that they got quite good reach given that they went out on Saturday evening.

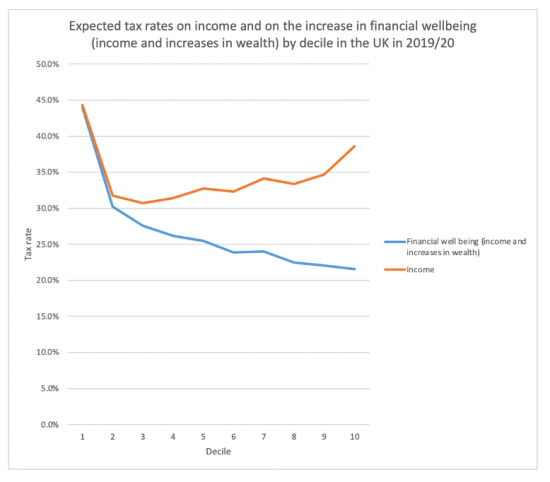

Third, as I noted recently as part of the Taxing Wealth Report 2024, those with wealth in the UK are seriously undertaxed. Those in the lowest decile of income earners in the UK pay tax at around 44% on their combined income and gains in financial well-being each year, whilst those in the top decile pay at 21.5%, or less than half that rate. That is why there is capacity to raise more tax from wealth in the UK.

There is considerable capacity to raise more tax from those with wealth in the UK right now. The last thing we need is a tax cut for those who can afford to pay more.

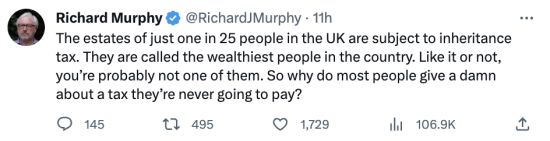

Inheritance tax is, however, the tax that the right-wing media loves to hate, making it what has been described as the most hated tax in the UK when the reality is that less than 4% of estates in this country pay it. As I tweeted last night:

As I also said in response to the original article:

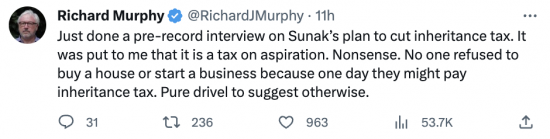

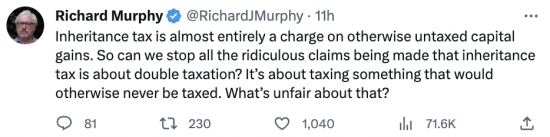

All the usual right-wing tropes on this issue are now coming out. I did an interview for Times Radio on it last night and noted on Twitter:

I then added this in response to comments:

It is an unfortunate fact that the wealthy have been successful in persuading people to believe this nonsense.

But at least it tells us where the Tories are.

They are on the side of the most wealthy and not of pensioners.

They are on the side of untaxed wealth and not of workers.

And they are on the side of shrinking the state as climate change threatens our well-being forever.

The debate on taxing wealth is not going away. At least the Taxing Wealth Report 2024 is timely. But it is not top of the agenda as yet. I was asked to be on LBC Radio this morning, and the section on inheritance tax was dropped in favour of a discussion on HS2 (now running from a remote part of West London to a field somewhere south of Birmingham). I suspect that the chance to talk about it will happen, however. The subject of taxing wealth is not going away.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I suspect that a lot of the hoo-haa over inheritance tax comes from the massive over valuation we now have in the UK property market.

When average UK House Prices were about 3x earnings firstly all most people might expect to inherit was – assuming a sibling, just over a years worth of earnings, a handy sum no doubt but not earth shattering.

Now they are nearer 10-12 times and with smaller families inheritance suddenly becomes much more relevant to peoples life chances, in particular the ability of the grandchildren to get onto the property ladder.

If house prices reflected the cost of building – about £1000 per square meter plus say 10% for land then that might take the wind out of the Anti Inheritance Tax lobby

Almost all journalism is based on a well placed leak. It is wholly game for insiders, manipulating politics. We, ‘the mugs’ are supposed to lap it up.

I have just listened to Trevor Philips on Sky News, and the ‘three stooges’ supposed commentators, pretending they are “cynical” and effectively reading out the neoliberal mantra. There is apparently no money left; just like 2010. We are going to have responsible government; it seems because ‘business’ has given up on the Tories. But business likes projects, ‘other people pay for’, and the Labour Party they will back because Labour will be responsible. You make sense out of all that guff. And while we are at it; will all the professional stooges in politics and news media please explain how we started in 2010 with <£1Trn in debt and no money at all to do anything; ended up with thirteen years of grinding austerity because we had no money, but have ended up £2.5Trn in debt (£1.5Trn we don't have, never had – but there it is, it just appeared out of thin air); and nothing whatsoever to show for it (especially outside London); and now we have no money at all, again. We have an additional £1.5Trn of debt from money that was never there. Funny that. So we had thirteen years of Conservative government, austerity and economic policy and ended up not just with no Money at all yet again, nothing to show for it but decaying infrastructure, White elephants, complete chaos in almost everything; but £1.5Trn worse off. This is the Britain we are supposed to vote – for more of the same; austerity, no money, drowning in insoluble problems; and what is the sole answer to all that? Keir Starmer, a lawyer and Rachel Reeves, a central banker. God help us.

And the Unionists in Scotland actually think this is the best Scotland can do.

For those who think the LibDems may offer an answer; Cole-Hamilton has been interviewed on BBC Radio Scotland News. He was challenged on Brexit and claimed to be pro-European; every LibDem wants to be back in Europe but it isn’t possible, just a “statement of reality”; all we can do now is “baby steps” and have a route map (what route map, where, how long?). The best we can do.

When it was pointed out that Scotland was clearly pro-Europe and the SNP offered the only way back into the EU, where Cole-Hamilton wants to be; Cole-Hamilton’s response was, this “is for the birds”; his heart, however is European. We have to take his word for it, because it is not expressed in action. On an independence referendum for Scotland, whatever the level of support in Scotland: “nobody is talking about this anymore”.

Really? He really thinks that? The passionate democratic zeal of the LibDems does not extend to providing any democratic way for Scots to extract themselves from this chaos. The LibDems have no red lines at all. They never had; they never will. They are followers, not leaders: sheep. They are selling not pragmatism, but weakness, disguised as conviction and expressed in meaningless waffle.

Cole-Hamilton is classic LibDem. The soft, weak, pliable follower; in the school of Steele or Clegg: cushion politics – he bears the imprint of the orthodox leadership, and conventional opinion, however daft (even from another Party): of whatever last sat on him.

The Tories should explain who this benefits, and why this is advantageous to the rest of us.

As you say, this looks as if it benefits only those with an extraordinary amount of money. They can’t argue that trickle-down economic spreads the wealth, because if that worked, the wealthy would have done so, and they would not need to be subjected to an inheritance tax.

Call me cynical because to me this is yet another way the Tories can reward themselves because I’m sure it will help with their donations for general election campaigns.

The Tories should these days be rebranded as the ‘Self-Interest Party’ – although I concede to Mr Warren that this is a product of the party system, the Tories take it further by doing stuff like this which is really is just another form of culture war for which they masters at.

You tweeted that the estates of just one in 25 people in the UK are subject to inheritance tax. I don’t doubt this. But in your tweet you also said that they are the wealthiest people in the country. This I don’t believe. It’s not the top 4% of wealthiest estates that pay inheritance tax but 4% that are spread further down the wealth distribution.

So for example, the 6th Duke of Westminster floated around the top of the Sunday Times Rich List since its inception. Yet when he died in 2016, instead of the whole UK inheritance tax take nearly doubling that year, as it should have done, reportedly his estate paid little or no inheritance tax.

This is unfair. I look forward to hearing your suggestions for reform of inheritance tax. But I would suggest that one of the reasons why the tax is so disliked is that it does actually impact people, especially in London and the South East, who are in nothing like the top 4% and do not consider themselves particularly wealthy. There are many very ordinary suburban areas now where a modest 3 or 4 bedroom semi-detached house will be valued near or even over £1m. Combined with minimal other assets in an estate, then even taking into account the Residence Nil-Rate Band and the ability to transfer allowances between married couples, a inheritance tax liability may arise. Should such estates pay something in inheritance tax? I would say yes, but only if a way is found to make the seriously wealthy pay too and that is not what we currently have.

Michael

You always comment in the same way.

You appear to agree with me. But then you offer an obstacle. It is always that unless we can have perfection we can pot have the good. So you actually argue for the status quo.

It’s better than average trolling, but it is still trolling and it is tedious, not least because most of your claims are wrong. Most people will clearly not pay IHT, whatever you claim.

Up your game or don’t bother please.

Richard

I am not arguing for the status quo. I would like to see reform of inheritance tax. Perhaps when I read your reform plans I may agree with them. For me it is important that the tax doesn’t focus solely on the well-to-do as it currently does, leaving the seriously wealthy untouched.

Which of my claims are wrong? I never claimed that most people will pay inheritance tax. Rather I claimed that inheritance tax impacts more than the wealthiest 4% of estates, and that it is important to recognise this even if fewer than 4% of estates are impacted. This is part of the explanation as to why the tax exercises a lot of people. For they can imagine owning a suburban semi and their estate being taxed, but can’t imagine inheriting something like the Grosvenor Estate.

I don’t recognise your accusation of trolling, unless you attribute that to anyone who doesn’t 100% agree with you. I mostly agree with you but think some of your solutions are over simplistic.

Your tone has implied otherwise, to me.

Fior example the claim you make that a person in 3 bedroom semi will pay IHT mey be true in some cases in London, but not much elsewhere. It was an overly simplistic generalism.

And to claim we should not reform a tax unless it is perfect is an argument for inaction – and that is what your claims feel like to me.

Why will I suggest nothing that will really tax the super-rich under IHT? Because I am a pragmatist and whe n we get close to the royals tax is not going to be reformed.

But that does not mean that IHT cannot be seriously improved.

What is wrong with that? Remember, perfection is the enemy of the good.

Strangely enough I also go by the name Michael, but I don’t know who the previous poster was, although I do tend to ask about the technical details of proposals! No doubt this could become rather confusing.

Anyway the issue I would have with reference to the Duke of Westminster is that the assets are held in discretionary trusts, consequently they are subject to a 6% tax every 10 years rather than 40% when somebody dies, but it is the Business Property Relief rules that allow that particular estate to escape tax. Even if BPR wasn’t available that particular estate wouldn’t generate a single huge payment in one year on death.

My own issue with IHT would be that I don’t see why a house should receive special treatment in the form of an increase in IHT allowance vs any other kind of asset. In essence it amounts to special additional tax relief for people that just happen to live in the south.

I address your concern in the morning, if I feel ok.

@Michael ” the issue I would have with reference to the Duke of Westminster is that the assets are held in discretionary trusts, consequently they are subject to a 6% tax every 10 years rather than 40% when somebody dies”

So does the Duke of Westminster “own” the property, or does the trust own the property? What influence does he have, and does he benefit financially?

I look forward to your comment on IHT and the additional allowance for property. With Principal Private Residence Relief, the additional allowance for IHT purposes and the lack of an additional tax equivalent to the benefit derived through ownership of property when compared to taxes paid on rent, it has to be said that housing ownership is subject to an incredibly light taxation regime compared to almost any other asset.

“So does the Duke of Westminster “own” the property, or does the trust own the property? What influence does he have, and does he benefit financially?”

It isn’t really material because he is under a different tax regime for inheritance tax for two reasons:

1) Because the trusts are subject to taxation every 10 years, not upon death

2) Because the assets that are held in the trust get business property relief because they form a part of a business, the same would be true of assets not held in a trust

The original poster claimed he expected to see billions in inheritance tax as soon as the previous Duke died. I am sure some inheritance tax will have been paid on assets held personally, but the bulk of the business isn’t treated that way.

Don’t get me wrong business property relief is a strange thing. It appears to be aimed at avoiding situations where family businesses are broken up and sold off upon death and consequently it should create some stability for everybody including employees, but it does mean that the wealthy can avoid inheritance tax as long as their assets are employed in a business. Classic examples would include turning a family estate into a theme park or owning a farm.

Agreed

It is @n issue I will get to

But today I have done just about nothing

There’s an increasing amount of chatter about the possibility of a snap election in November this year, could this (cut in inheritence tax) be Sunak floating the idea with this in mind? Interview with Barry Gardiner a few days ago came right out with that and there have been a few other videos with people dicussing this possibility.

On a different note, I’ve just watched a Politics Joe video from seven months ago talking with Torsten Bell. Its the first time that I’ve sat through one of his interviews and even as an economics layman I found Bell’s statements to be severely lacking mostly due to his several glaring omissions (he was discussing inequality but never once mentioned the prospect of increasing the tax burden on the wealthiest) which seemed rather telling: he appears to be a neoliberal to the core satisfied with claiming the veneer of progressiveness while suggesting policies that are reminiscent of the tall 90s.

Bell was Ed Miliband’s head of operations.

Yes – and it showed. Milliband was surrounded by many of the right-wing New Labour dregs; I’m sure that Bell found such company very much to his taste. The whole video was just one bad faith statement after another while the very policy changes that could help were notable by their absence. I find listening to people like Bell deeply frustrating and consider them to be worse than the Tories (in some ways) as they are able to peddle the same neoliberal tripe as the Tories but under the undeserved and incorrect label of being ‘left’.

My goodness, if the Tories win the next election we all might as well book ourselves a one way ticket to Dignitas. The vast, 99.9999 recurring majority won’t be worrying about inheritance tax.

“You will note that they got quite could reach given that they went out on Saturday evening.”

Richard, this sentence doesn’t make sense. I am uncertain what you are saying here.

It does not make sense.

Reach is the number of times they were viewed by this morning

Larry – for “could” read “good”; then it makes sense!

“All for ourselves, and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind.”

― Adam Smith 1776

Wealth perpetuates outcomes that are bad for the country. A wealthy person can afford to educate their off-spring – regardless of whether they are Einsteins or educationally sub-normal. Intelligence is distributed equally across any population. The children of bin men have, roughly speaking the same potential as those of banksters. The mean distribution curves are the same. The problem is that the wealthy spend on the educationally mediocre – to get a mediocre result. Its been going on for +/- 170 years & the outcomes are all around us. Inheritance keeps this disfunctional show on the road, allowing the mediocre (who go on to inherit wealth) to in turn educate their offspring very well. All children shopuld have access to excellent gov provided education. Only.

The end reasults of this system (privaet education and inheritance taxes not fit for purpose) are a UK economy that has been tanking since +/- 1920 and under-performing since the point that the men that drove the UK industrial revolution decided to send their children to public schools. A two pronged approach is needed, gradual strip out of inherited wealth, via serious wealth taxes (80? 90%?), and the abolition of all public shools (starting with the demoltion of the chapel at Eton). Indeed, most public schools are in the wrong place. Abolition followed by demolition.

You will upset so many saying that

Just like the right to govern, it’s all in the genes you know

Irony alert

Public schools are in the right places. They were designed to be on railway lines so the students could be put on at one end and met at the other. A bit like Hogwarts but you didn’t have to run at a solid wall to get on the train.

Today’s i front page

Labour say they are going to hit private schools with 20% VAT in first year of winning power.

Might lose a few votes but as only 7% of pupils go to them, that’s okay.

Independent schools will lobby hard against tax rules. Who would have thought it!

Would it not make more sense to lower the threshold for inheritance tax (which at present should more accurately be called estate duty) but tax the amount inherited by each individual rather than the amount of the total estate.

The current system if applied to income tax would result in somebody working for e.g. Tesco paying many times as much tax as someone else with the same gross salary employed by a small independent shop.

That would be possible. Ireland has gone that way. But that is a new tax.

Canada has no inheritance tax. Instead, all assets (except principal residences) are deemed to have been sold at market value at the date of death, and the proceeds of the deemd sale are then treated as income for the year of death. Is this worth exploring for the United Kingdom?

I will discuss such options

But, I am offering reforms, not new taxes

However, there will be some innovations on inheritance tax.

I don’t think Canada taxes estates in the way described.

I think they actually charge capital gains tax on 50% of the gain that would have arisen if all the assets had been disposed of on the day of death. As such the Canadian system can be a lot more generous than the current UK IHT system which, with the exception of the IHT allowance, taxes the whole amount rather than only applying to the gains.

There are arguments that could be made about that

Just a thought but will the Tory slogan at the next election be, “a tax cut for the few at the expense of the many” ?

I have nothing useful to say about the technicalities of the discussion here about IHT; except to point out that the IFS has also examined the issue and, as I understand it have reported that 50% of the benefit would go to those who are in the top 1% of estates. Everything in Britain ends the same way under the Conservatives; the poorest, who earn or possess least, always end up paying a far, far higher proportion of total income or of what they have or receive – in short a penal rate of tax; compared than those who earn, or possess most; for whom tax becomes a smaller proportionate burden, and has little material effect on their standard of living. And that, frankly is unforgivable in a decent society that is really intent on looking after all.

This is neither difficult to understand, nor is it unfair.

Agreed

From the perspective of someone who is one of the 4% who did pay IHT on an estate, I agree with you Richard, IHT is a way of taxing otherwise untaxed capital gains. And in fact, it really isn’t that onerous, given the allowances which if taken advantage of fully, mean that only that part of the estate worth over £1 million is taxable.

Which is what happened in my case. The total estate value was around £1.6 million due mainly to the growth in house prices in London, so that the house they bought in SE London in 1976 for £25k was worth over £800k when I sold it in 2021. A 32 fold increase in 42 years, a lot more than average salary increases or general inflation.

So the IHT was ~£230k, i.e 40% on ~£600k. Am I complaining? No, as for a start my sister and myself as the sole beneficiaries shared £1million absolutely tax free. And then got another ~£345k to share, so after other slight deductions we both got over £640k for simply having the right parents at the right time.

I am of course extemely glad to have this money, especially considering neither myself or my partner have large incomes. But let’s not pretend I have been hard done by by paying IHT or that it is an unjust tax.

Thanks

Useful lines to use there in future interviews on this