Yesterday was a debacle for the Tories.

Education Secretary Gillian Keegan sought to blame everyone but herself for the mess in the management of RAACs. In the process, as Sophy Ridge on Sky pointed out to her in a surprisingly forthright comment, she same across as both arrogant and indifferent.

It became clear that Sunak is the villain in the piece, having cut the school refurbishment rate to 50 a year whilst Chancellor, suggesting that each of the country's 22,000 schools might be refurbished once every 440 years.

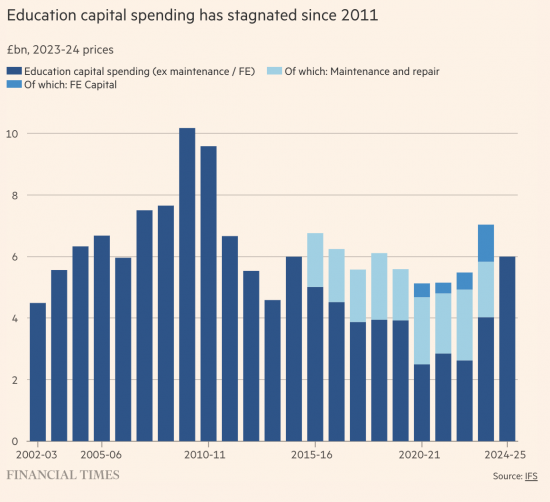

And the Institute for Fiscal Studies threw in a chart which the FT printed, which might suggest Labour got this right before 2010 in a way that the Tories never have:

Note that it is in current prices. It is also damning.

And yet, none of this should be surprising. The Tories manage as they think the private sector works. And the part of the private sector that they seem to admire the most is private equity.

The term 'private equity' gave respectability to something that was in its day called asset stripping. Pioneered by the likes of Slater Walker and Hanson, this sector has always specialised in buying cheap, selling off the assets of a business, loading an entity with debt, and then flogging off the denuded remaining business to whoever might take it on, with the buyer's chances of prospering greatly diminished by all resilience within the business they have acquired having been removed from it by the asset stripper, which has gained considerably by doing so. A little opacity around the accounting always helped the process, of course.

The asset strippers quite quickly permeated the Tories: Peter Walker was the first. And they have never left.

The result is the type of failed government we have, laden with debt, the assets sold and resilience gone with under-investment the consequence. Opacity remains a feature. This is the Tory model of business. They have governed in this style.

Britain has been asset-stripped. No wonder it does not work.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Very fine blog, my only comment, 1997 Labour continued the vile-tory programme with PFI (what a brilliant piece of work by that moron Brown) . Gillian is a nonentity, wrong place, wrong time, something for the meeja to take a pop at (key phrase “pop at” attention only lasting hours), whilst ignoring the underlying malaises (so many!) which have been identified by you & lots of posters on this blog.

This blog shows that the malaise has been going on for a long time – John “pretty thing” Bentley – I recall him – one of the early asset strippers, all doing their bit to pauperise the UK, knowing the price of everything, the value of nothing.

I couldn’t agree more but there is also the contribution made by the authoritarian hierarchical management systems that now dominate public and private organisations, where if you wish to keep your job loyalty and sucking-up to the Supreme Leader is everything and honesty and competence count for nothing.

Most people will have experienced the usual result.

A new scheme is introduced by the Supreme leader.

The workforce reports that it is a complete disaster.

The workforce’s junior managers report that there are severe problems but to protect themselves highlight the very rare occasions when something worked.

Middle management reports that there have been significant successes but there are some problems that need working on.

The Senior management tell the Supreme Leader that the scheme has been a big success with a few teething problems that need sorting out.

The Supreme Leader basks in the glory of another problem successfully dealt with and the magnificence of their own intelligence and judgement.

Never Learning anything.

A post that sums the Tories up magnificently.

And to think:- when we needed someone to look after our children’s schools, this bunch of idiots gave us………..BREXIT?!!!!

I enjoyed the Tory meltdown yesterday (although the consequences are horrific).

Then I saw Laboured’s reshuffle. Liz Kendall…………….are you serious?

This as a business model has obvious limits – once all the successful companies have been stripped, there are no targets left.

Combine this with the Amazon-style parasitic practice of destroying any company that sells successfully through their market place by duplicating their products at lower prices until they go out of business, and the way other big tech firms buy up competitors rather than risk them growing & you have a recipe for the end of the neoliberal dream.

Coming to all of us, as I write.

Now we are talking! Love it. I spent my working life in business, but when you start treating financialisation as the end, and not merely the means, you have lost the plot. It is the road to economic perdition.

I agree with the piece and all the comments so far.

In his defence Peter Walker was a wonderful Welsh Sec. We had interlinked digital communications between all public bodies under his control, so NHS and LAs could share data and work together. Regrettably, that was almost all destroyed when the Vulcan replaced him.

So much about the UK seems threadbare. So much inequality and unfairness.

Water companies break the law by dumping sewage into rivers during dry periods and yet we, the most surveilled, recorded and tracked population in the world seem incapable of enforcing the law.

Infrastucture is ignored until it fails or is outstripped by demand. Whilst we support Ukraine with millions (billions?), which I am not objecting to, not a single Royal Navy attack submarine is at sea. (There will be a single ballistic sub, the deterent sub, somewhere). These are the countries most valuable assets. This is well worth a read;

https://www.navylookout.com/why-are-no-royal-navy-attack-submarines-at-sea/

Goodness knows how many old nuclear submarines are tied up waiting for disposal.

There are parts of the UK that I going to run out of water a certain times of the year, where is the preventative action?

The list is a long one.

Re Gillian Keegan: Byline Times carried a report yesterday, that she said in February on a visit to the DfE in Manchester, “we just need to keep the lid on this {RAAC} for two years, then it’s someone else’s problem. ” Possibly said as a black joke (more probably serious), but it suggests that the Tories know well that they’re on the way out, and are cynically seeking to leave as much chaos to the next govt as possible (while lining their friends’ pockets). Leaving a massive set of problems for their successors, who can then be attacked for their failure to remedy huge problems. Add to that the revelation of £38m spent on DfE offices re-furb, then Keegan is left trying to defend the indefensible.

https://eastangliabylines.co.uk/keegan-keeps-the-lid-on-raac/

Also, several MSM outlets reported yesterday, straight-faced, that the Treasury had ruled against any new money for the RAAC crisis. None of them commented on this represents either the Treasury openly making public policy, or the Govt spinning an unpopular refusal to spend onto the Treasury. Both outrageous.

Finally, Building magazine reported yesterday that the Building Industry, unlike the Govt, are actually meeting to discuss the magnitude of the problem, and make plans to tackle it.

https://www.building.co.uk/news/clc-to-hold-crisis-talks-on-raac-schools-today/5124963.article?utm_medium=email&utm_campaign=Daily+Building++Daily+news&utm_content=Daily+Building++Daily+news+CID_86208c1495a221e9606de3532af5835e&utm_source=Campaign+Monitor+emails&utm_term=CLC+to+hold+crisis+talks+on+RAAC+schools+tomorrow

Asset-stripped carcass UK sold out by traiTory Govt – who is there to hold OLIGARCHY OF MISRULE to account?