As the Bank of England noted in a blog yesterday:

Higher interest rates are putting pressure on indebted corporates through higher debt servicing costs. Such pressure increases the likelihood of defaults on corporates' debt and may lead some firms to reduce investment and employment sharply. Defaults can increase risks to financial stability directly through reducing lender resilience, while sharp reductions in investment and employment can indirectly affect financial stability by amplifying macroeconomic downturns.

This risk is, of course, what the Bank of England has chosen for the UK economy without it ever being able to justify that decision with any identifiable impact on inflation.

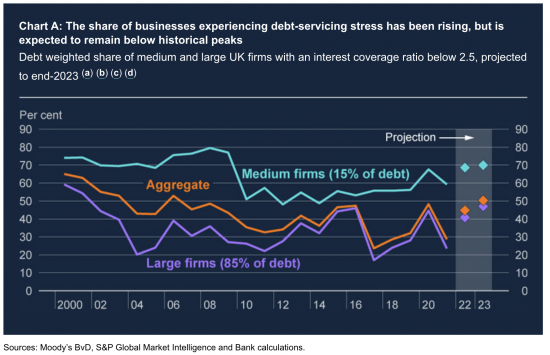

The result is the risk identified on the following chart:

After the risks of Covid, corporate debt risk fell in 2021. And since then, as is app[arent from the dotted lines, which are described as projections, they have increased considerably.

This is, of course, the consequence of interest rates rising from 0.1% to 5.25% at the behest of the Bank of England, with the forecast being that they will now peak at 6.1%.

The consequence is that 50% of larger companies and 70% of medium-sized firms face real debt difficulties.

I stress that this does not mean that all these businesses will fail, but it is likely that they will, as the Bank suggests:

- Reduce investment

- Cut employment

- Face banking difficulty and reduced profitability for some time since many loans are negotiated over periods of several years.

And some will fail, leading to banking-related issues when that sector is already facing an ever-rising risk of mortgage defaults.

None of this is surprising, of course. This is exactly what the Bank of England chose for us to have. The outcome is what they want. The risk of destruction is their chosen method of economic management. This is what the supposed 'economic grown-ups' at the Bank think we need.

In 2016 the UK chose to place sanctions on itself by opting for Brexit.

Since 2021 we have opted for a wholly unnecessary economic Armageddon as a result of outsourcing the management of the economy to the Bank of England.

I hope that one day we might do better than this.

Labour is not offering us this prospect. It is committed to Brexit and Bank of England control of the economy. But I have to live in hope.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The more you analyse what has been going on for decades in the UK the more you realise there is a deeply corrupt establishment pulling the strings and the Labour Party is part of this having been infiltrated at the least by right-wing dogma if not selfish ambition by individuals for power and/or money. In parallel to corporate indebtedness there has been a much longer growth in householder indebtedness where a house price to income ratio is out of control with an accompanying housing crisis.

“At its peak in June 2022, the cost of a typical UK home was £293,586, while the average annual earnings of a full-time worker were £40,196. According to Halifax, this put the house price to income ratio at 7.3, the highest – or least affordable – level ever recorded.”

https://www.theguardian.com/money/2023/aug/23/inverclyde-scotland-halifax-affordable-great-britain-buy-home-house-price-income-property

Where are you hearing Keir Starmer talking about reigning in the licenced and shadow banks and tackling the need for more affordable homes? All you get is a lot of dogma bleating about the need for fiscal discipline that will severely limit the government’s ability to do this despite the large house building programme after the Second World War. A programme which has still left the country with many energy inefficient homes than other countries. This should be a poverty indicator as well as a Net Zero failure indicator!

https://labourlist.org/2022/10/labour-must-maintain-its-fiscal-discipline-in-the-face-of-tory-economic-recklessness

Perhaps Richard you could at some stage do a forensic analysis of this Labour fiscal discipline dogma.

When the currtent work on tax is done, maybe

That is still progressing – but will be of book length when done by the look of it

I have been hoping you will actually publish it as a book….

It may be an ebook.

Books take a long time to come out.

Print on Demand self-published on Amazon, on Kindle and Audible (if you have the support to create it from the ebook) is quick and you can then charge for it. And you should…. but you need to make it easy to consume – it is going to be a monster!

I would want it on audible to listen to at fast speed and as paperback to refer back to and annotate.

Let’s see….

Mr Schofield, you noted that:

“there is a deeply corrupt establishment pulling the strings and the Labour Party is part of this” – all depends what you mean by “corrupt”.

One of Richard’s blogs covered the NHS (Don’t Rock the Boat in NHS Trusts). The central thrust was that such Trusts only select people to sit on them that have the same mind-set as those already sitting on them. Substitute any UK institution (BoE, Treasury etc etc) for NHS Trusts and you will see identical behaviours. I know a Spanish economist (some of my best friends are economists 🙂 ) who was offered a job at the Treasury – he turned them down, on the basis of a) not very interesting, b)intellectually as dull as dishwater, c) tediously orthodox (some other words were used one beginning with w. & ending with ..ers – I think you get the dirft).

Key point: most UK institutions are in stasis because they only select for same-type mind sets – & this extends to Kid Starver/Reeves and the kow-towing to economic orthdoxy (or as this blog shows – the on-going economic destruction of the UK).

Which leaves the open question: where does this end?

In disaster

It ends in a new beginning, but there’ll be another Dark Age first. Prepare.

I use the words “corrupt” and “corruption” in a moral sense. Life is cybernetic in that the organisms that make it up have to steer their lives. Although the universe is governed by the laws of physics it results in a great deal of chance contingency but embedded in life is the ability to engage in choice contingent decisions to avoid being over-whelmed by chance events. Many organisms find that by cooperating both within their own organism and with different organisms this increases their ability to deal with chance events. Of course I’m saying all this against the need to obtain energy which limits cooperation, life forms including our own kill and eat other organisms. That said it seems not unreasonable to me to say that morality stems from this embedded ability to choose to cooperate with others. It should be very obvious that the UK is in a mess because a lot of people have not understood this connection between morality and cybernetics. A salutary lesson of what I’m talking can be seen in the work of the late Eshel Ben-Jacob’s work examining the behaviour of bacteria:-

https://en.wikipedia.org/wiki/Eshel_Ben-Jacob

Mike Parr: “kow-towing to economic orthodoxy”, indeed. And the general public’s ignorance is maintained by kindergarten idiocy such as this from the BBC. https://www.bbc.co.uk/news/business-50504151

Agreed

Adrian, I’m going to do a test. When the Ukrainian family that is staying with us comes back from their hols’ I will ask the charming “Wednesday” – 10 years old and as bright as a button – to spot the logical fallacies in the BBCs nonsense.

& Wednesday? – as in the Adams Family – our little refugee likes the character so much she went to school dressed up just like her, the other children in class were terrified – apparently.

Higher rates only reduce inflation because they deliver all the things they describe which reduces demand and thus upward pressure on prices. Of course this does nothing to tackle import prices or profit margin expansion but if you squeeze spending power hard enough it will work…. at great cost to many. Yet they speak in such detached terms that it makes you wonder what planet they live on.

@ Clive Parry

“Yet they speak in such detached terms that it makes you wonder what planet they live on.”

It’s this detached “I’m alright Jack” mentality which extends to why should I care what effects I have on others that’s the biggest factor killing this country. It’s been centuries in the breeding.

Might it be that the B o E really only represents and cares for the finance industry?

Britain badly needs to improve its exports after Brexit but look what the clowns Rishi Sunak and Andrew Bailey have given us with their crude Stone Age mono-dimensional thinking:-

“UK factory output tumbles to lowest level in nearly three years”

https://www.theguardian.com/business/2023/aug/22/uk-factory-output-lowest-cbi-bank-interest-rate-economy

Hope indeed!

What else is there in the face of such incompetence and self interest I ask you?

The Governor of BoE is so incompetent and has no clue.

He needs to go.

Bring back Mark Carney please before they completely ruin all our lives!

Others now view the BoE position as having moved away from Energy/Food driving increases in Inflation to Expectations are now embedded driving Nominal Wage growth in private sector hence price rises. Some orthodox economists continue to say no real evidence of profiteering eg Simon Wrenn Lewis. So it looks many economists believe interest rate increases are the weapon of choice. For once I can see monetarists and MMTers sharing the same platform and denouncing the BoE. A BoE that see its actions as fully justified regardless of the price society will pay.

I a, not sure you read SWL right……

I have no expertise in this field whatsoever, but the BoE statement did make me wonder how much extra interest the private sector has had to pay since interest rates started to rise. I also wondered about the additional costs of pay rises in the public sector. So I asked “Bard” (Google’s AI tool). Here’s what it said:

“I couldn’t find the exact figures for the interest payments on corporate debt and the value of pay rises for public sector workers in 2022-2023. However, I can give you some estimates based on the information I have found.

According to the Bank of England, the total amount of corporate debt outstanding in the UK was £1.8 trillion in December 2022. If we assume that the average interest rate on this debt was 5%, then the total interest payments would have been £90 billion in 2022-2023.

The total value of pay rises for public sector workers in 2022-2023 is not yet known, as most of the pay negotiations have not yet been concluded. However, the government has said that it is willing to offer a 2% pay rise to public sector workers, which would be worth around £1 billion.

So, based on these estimates, the private sector would have paid around £90 billion in interest payments on corporate debt in 2022-2023, while the value of pay rises for public sector workers would have been around £1 billion.

It is important to note that these are just estimates, and the actual figures could be different. The actual amount of interest payments on corporate debt will depend on the level of debt outstanding and the average interest rate. The actual value of pay rises for public sector workers will depend on the outcome of the pay negotiations.”

I appreciate that the two sets of figures are not directly comparable but the sheer contrast between the £90 billion cost to the private sector and the £1 Billion cost to the public sector made me wonder if there is any mileage in using this approach to illustrate how the BoE is driving inflation through interest rate rises, as opposed to their claim that wage rises are the cause?

I think you have underestimated public sector pay and its rise….

I am sure there is much wrong with these figures, but they were generated by the “Bard” AI; not by me. My point is that it may be worth comparing and contrasting these two sets of figures to assess the actual impact of BoE interest rate rises. Say that private sector borrowing costs are half what the Ai indicated. Then say that the public sector pay rises were ten times as much as its calculation. That still leaves us looking at £10 billion compared to £45 billion. If interest costs are 4.5 times more than pay rise costs, is that worth looking at?

You’re wasting my time

Goodbye