The headline economic news this morning is that CPI inflation has, according to the Office for National Statistics, fallen to 6.8 per cent in the year to July, down from 7.9 per cent in June and 8.7 per cent in May.

This decline was widely expected, including by me. The prices of domestic energy and food created most of the decline. However, in the wider CPIH index news was not so good: some housing costs are rising.

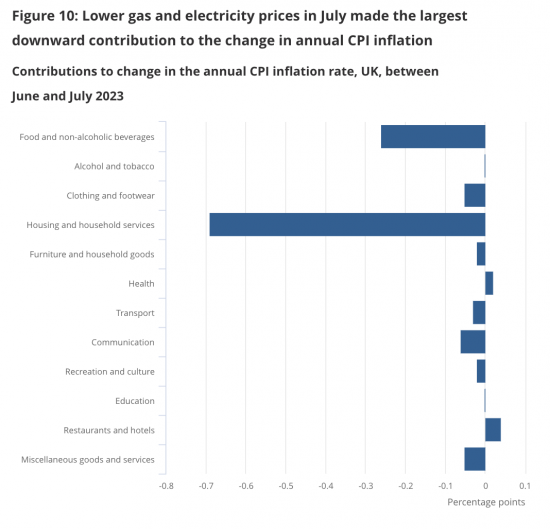

Overall the breakdown in contribution to the change was:

As usual, noting reactions has been interesting.

Almost without exception those commenting this morning are saying this is a blip due to changes in the energy price cap and that because wages are now rising above the inflation rate the Bank of England must react by increasing interest rates, yet again.

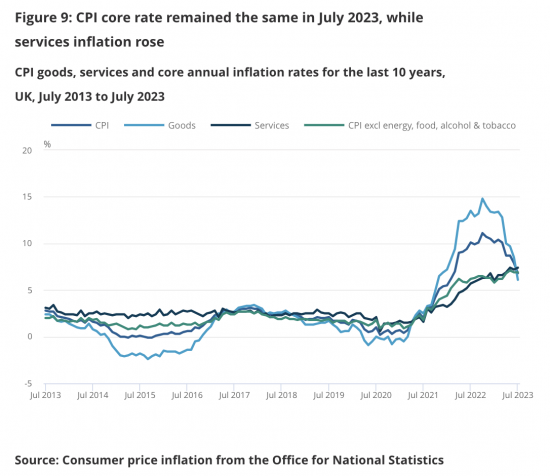

It would seem that although the trend in inflation is now markedly downward and we know that increasing interest rates has little impact on inflation for up to eighteen months after the rate increase occurs, those who think that there is a direct relationship and that the Bank of England really has control of this issue believe that more must be done. The argument is based on core CPI being unchanged in the month:

My argument is, of course, that this is the moment to cut rates. Unless action to do so is taken now the downward trend in rates now seen could very rapidly lead to deflation - which is likely to lead to recession. There is no advantage in that right now - not least because the actual cost of repaying debts rather than just meeting the interest cost upon them - rises when there is deflation.

But what do I expect to happen? I am sure the Bank of England will be flattered by the opinion of all those calling for more rises who have such quaint belief in the power of the Bank to address this issue, and that the Bank will respond by duly delivering the demanded rate rises that can only do harm to the economy and increase inequality within it. The fools are in charge, after all.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Have I understood right: there’s a risk of deflation, a falling absolute price level, and this can be mitigated by cutting interest rates. In other words cutting interest rates is inflationary by a small amount, and reduces deflation risk.

We need to stimulate demand. That is infaltionary – and we will need that to prevent defaltion. That is my argument.

Inflation is a first derivative of prices, and changes in inflation is a second derivative. Like distance, velocity and acceleration. The rate of inflation may have fallen, but inflation is still large and positive (that is, there has been some braking so acceleration is negative, but velocity remains positive and distance keeps increasing).

That means prices are still rising, just at a rate that is a bit lower than in the recent past, and the large price rises over the last two years are now baked in. Along with the negative impact on standards of living for many as their incomes have not increased as fast as prices. Incomes always lag inflation (there is no wage-price spiral) and we should expect to wages to increase faster than prices for several years to catch up.

Agreed

I was talking about inflation over 12 months by the way.

The CPIH index for July 2023 actually fell slightly compared to June. But it wobbles around on a monthly basis – the index fell by a small amount in January 2023 too, compared to December 2022, for example, but increased in the previous eleven and the next five months. There is often a slight drop in January, and (last year excepted) June and July are usually pretty flat. Let’s see what happens in the autumn.

We have seen the CPIH index increase by nearly 16% in the last two years (111.4 in July 2021 to 129.0 in July 2023). That percentage change is more that the previous eight years combined (95.7 in July 2012).

The Chief Secretary to theTreasury, John Glen, was on Radio 4’s Today.

He was claiming the inflation rate was coming down due to their ‘plan.’ For once his view was challenged. The fall is largely due to the fall in energy prices , said Nick Robinson, and that was international.

Glen’s next argument was that their restraint in spending helped keep down interest rates as they had to borrow less.

We then heard he has argued with a BBC correspondent that the UK had grown faster than Germany or Japan since 2016 and services exports were up , plus we had joined the 12 trillion Pacific trading organisation. Nick Robinson quoted a trade organisation which said most members were finding exporting more difficult.

The response was “the nation took a decision” (no mention of polls for the past four years saying most people think it was a mistake) and they were ‘working hard’ to maximise the benefits.

The govt do seem to live in a different world but I take some comfort in that their version is being challenged.

John Glen is a liar first and foremost – a dullard, as brown as brown could be (and by that I mean a boring ‘yes’ man as well as dishonest).

I heard some idiot on R4 (where else – duh!!?) saying that the the new figures show that Government had got public sector pay restraint right.

That’s totally testicular in my opinion.

When Glen talks about growth, it’s obvious where the growth is – its the stored money that is growing, the stored money of the rich and the banks thanks to interest on the CRBA.

And how does it grow? By putting up interest rates of course – do you need to be Einstein to work that out? I don’t think so.

So to then say that growth is happening because of wage restraint is a lie that is part of the bigger lie about why interest rates are ‘working’.

Wages are just being used to justify a get rich quick escapade for the rich and the banks.

And it’s working for the rich but of course no-one else.

Yes indeed

A number of people I know have given up listening to Today. I just took a crumb of comfort in what he said be challenged instead of waved through as so often.

The interest payments to boost the banks’ profits is such an obvious target for any party wanting to help ordinary people. And working people paying mortgages (and rent in many cases ) are paying for the ‘policy’.

Oh for a real opposition.

I listen to it intermittently at best

My wife sometimes tells me to listen when something comes on – but she finds much of it pretty hard going

Why does no one demand they explain exactly how rate rises will have desired effect?

Richard, over the course of many posts you have done an excellent job of exposing the many arbitrary assumptions, inaccuracies and straight forward errors involved in the UK government’s presentation of the UK’s finances. Vitally important work because as we all know, bad data leads to bad decisions.

Is it not time that somebody did the same for inflation?

On the one hand we now have at least four measures of inflation bandied about as if everybody had an intimate understanding of the subject, while on the other hand according to the BBC, a recent survey revealed that most people believed that when inflation went down it meant that prices were falling.

Other problems related to the meaning and calculation of Inflation are never discussed.

To take a couple of examples.

Why are some items like housing partially or almost completely excluded and how do we define the difference between rising prices due to changes in supply/demand and rising prices due to too much money chasing too few goods, services and assets?

Maybe a clue as to why this mess exists can be gained from looking at core inflation, the current rising favourite of City Analysts.

A measurement that excludes fuel, food, alcohol and tobacco. i.e. a measure that disregards everything that does not much affect those on very high salaries, like City Analysts.

This is a very large reduction in CPI in one month! By my calculation it means prices in the month of July 2023 we’re 5.3 less than in the month of July 2022.

CPI is falling very fast.

Of course the BoE will raise interest rates.

Prices in July 2023 are higher than in July 2022. The rate of inflation is falling. Prices are still rising.

Hmmm. I think I phrased that very poorly. My apologies. Yes, prices in July this year are higher than in July last year. That’s what the CPI figures say.

CPI in July 23 was 6.8% compared to 7.9% June. These two rises are both averaged over a year, so they have 11 months of price rises in common. The only thing that has changed is prices in July of each year. For CPI to have decreased overall in the year by 1.1% over the year as a whole it must have decreased much faster in July this year, because the effect was “diluted” by the 11 months that were constant in the calculation for June and July.

Had prices in July, relative to June, increased by (approximately) 7.9% divided by 12, i.e. 0.66%, then inflation would have remained at 7.9% per year. Had prices not risen in July relative to June then inflation would have decreased to (about) 7.25% per year ( that is, eleven twelfths of 7.9%). But, in fact, CPI decreased much more quickly. So prices in July, relative to June, must actually have decreased. And the approximate calculation suggests they decreased at an annualised rate of 5.3% per year.

This annualised rate of deflation in July seems extraordinarily fast. Of course one might say, “it is only one month’s figures and they vary month to month”, (though I’d add that decreasing annual CPI has been a consistent trend over the past few months). Or one might say “ahh, but core inflation remains high”. Nevertheless, prices in July are lower than in June (even if they are higher than a year ago). When prices are falling quickly, as they are at the moment, then one might wonder whether a contractionary monetary policy, particularly one with a time lag of 12 to 18 months, is an appropriate policy response. Some might say it is madness.

So, as I said, that is probably what the BoE will do.

You are right about the eleven months in common so that change is all dependent on comparison of two months a year apart, whatever the ONS say

It is a very simple calculation, comparing the prices index in each month with the same figure a year earlier.

In June and July 2022 the CPI index was 121.8 and 122.5. That is a rise of 0.6% from June to July 2022.

In June and July 2023 it was 131.1 and 130.9. That is a fall of 0.4% from June to July 2023.

The shifting 12 month window replaced a month with a rise of 0.6% last year with a month with a fall of 0.4% this year. The net result is a fall of around 1%.

There were big monthly rises last April and May (1.1% and 2.5%) and October 2022 (2.0%).

The change was masked this year because the index continued to rise, but watch out for claims of success in November 2023, when October 2022 falls out of the calculation.

Thanks and agreed

Tim Kent

In working out that prices in July must be lower than in June, are you forgetting the effect of prices in June 2022? The inflation rate in June 2023 was affected by the prices in June 2022, so you cannot just say that, because inflation has reduced this month by a certain amount, prices in July must be lower than in June. Because they, very clearly, are not.

Show me prices in July that are lower than they were in June. Some energy prices have reduced, food keeps on going up at well above the rate of inflation.

Falling inflation does not mean falling prices. It means the rate of increase is falling.

Cyndy Hodgson,

I think Andrew (above) has given some accurate figures and shed some light on the issue. My calculations were approximate (for simplicity) but, I think, illustrated the point that I was trying to make.

On average, prices fell from June to July this year. There were falls in energy prices and, I think, food which outweighed other price rises. Over the period of a month prices fell, whereas over the period of a year they rose.

The annualised fall in prices from June to July, that is if prices were to continue to fall at the same rate for awhile year, is about 5% per annum (using either Andrew or my calculations.

In the short term prices are falling (even though they have risen year on year). Short term we are in deflation (although that is unlikely to continue for many months).

And my key point is: if you are in, severe, short term deflation, it really doesn’t make sense to raise interest rates. Perhaps the Monetary Policy Committee thinks this is a short term blip (though it has happened for a couple of months). If so perhaps they should pause interest rate rises, especially since they take a long time to take effect. Raising rates in September is crazy.

I’m entirely with Richard on this; the BoE should really be aggressively lowering rates. But I don’t expect that to happen.

Second paragraph, third line, is there not a not missing? It jarred on me when I wasn’t there. Regards.

Edited, thanks

If the Chinese government controls inflationary pressure by forcing all foreign exchange to take place through state owned banks and then sucks out the inflationary pressure by using a certain amount of value to buy foreign government treasury bonds then the UK government can do a similar thing simply by imposing an oligopolistic tax (windfall tax) on those businesses seen to be price gouging. Of course this would never do since free market capitalism is regarded as a sacred cow which must never be sacrificed for the greater good of the many because the few must have their comfort!

“The comfort of the rich depends on an abundant supply of the poor.” Voltaire

Where is Keir Starmer demanding this? He may have a Napoleonic complex but his horse always faces in the wrong direction!

Simon Wren Lewis refers to research showing that low interest rates increase the disparity of wealth between rich and poor.

https://twitter.com/sjwrenlewis/status/1691413491213565952

https://www.imperial.ac.uk/business-school/ib-knowledge/finance/how-central-banks-interest-rate-rises-affect-the-richest-and-poorest-families

He seems to buy some of MMT but not all.

Presumably Richard would argue for fiscal or other ways of limiting the inflation in asset prices when interest rates are low?

I would

I saw the Wren Lewis exchange yesterday.

I am puzzled by two of his statements about interest rates:

“Apart from the fact that high rates reduce the value of wealth.”

It’s inflation that’s doing that, isn’t it? And high interest rates are adding to inflation with increasing cost of mortgages, rents and business loans?

But not for the rentiers who are getting better returns on their investments?

“one of the problems of keeping interest rates low is that lower rates increase the value of wealth and therefore increases wealth disparities between rich and poor”

Baffled…

Is the explanation in the word ‘value’?

Can anyone clarify what he’s talking about for me?

P.S I’ve read the linked article, but it still looks a bit of a muddle.

High interest rates do reduce the value of bonds – they work inversely to each other, so he is right

BUT you will notre house prices have only just started to fall

The world is messy is the reality

I also read the article, and see it as a cover to keep interest rates high, rather than a serious effort at equality. When rates drop, everyone gets richer, but the rich benefit more? ok, but do the poor benefit? Yes because overall, costs to business reduce, meaning prices CAN fall. The prices of everyday things matter much more to the poor than the rich, in some cases heating or eating, so whatever effect it has on the rich, doesn’t matter if it makes life better for the poor.

Wealth inequality can be dealt with other ways.

I think the article is intentionally misleading.

Gerd

When we hear, usually from our mass media such as BBC’s Radio 4 Today, that ‘The Markets are Expecting…..’ or, ‘The Markets have priced in…..’, who actually are these ‘markets’?

I am assuming that there are not millions of individual buyers and sellers that make up these markets, buying and selling interest rates according to their own buying and selling preferences out of which comes ‘the invisible hand’ and, who we are told, influence the Bank of England.

I am assuming that really ‘the markets’ (in the context of interest rates) are a very few senior managers that decide what their firm’s trading strategy is, who then instruct their traders to carry out and implement this strategy.

So, is the market really a very limited number of people – literally a handful; and if so who are they?

@ Steven Boxall

& what are they after ?

Any index that doesn’t include housing costs is a sham. The RPI is considerably higher than the CPI. Rents are causing huge distress. Mortgage payments are the same. It seems to me an index that includes everything should be implemented. Any thing else is useless.

I fully agree that the current range of inflation rate measurements are not fit for purpose. But including ‘everything’ would not be fit for purpose either. I don’t care if a luxury yacht price has increased or decreased and I doubt if most people would care either, so including that in the measurement is pretty pointless.

What needs sorting out is the ‘purpose’ for which inflation rate measurements are not fit. As an example, social security benefits are uprated in line with ‘inflation’. But the expenditure of a single person subsisting (or not) solely on social security benefits differs hugely from the expenditure of a family with 2 children and an income of £150,000 per year but the measurements used are most closely aligned with the expenditure of the second group.

Is it time someone pointed this out more clearly than I can?

The difficulty is that multiple measures are needed

Richard, that may be a difficulty, but it is also a fact. But no-one seems to be worrying about it.

I read oil prices are falling. Why then are all the filling stations in Buckinghamshire where I live have increased prices by around 7p a litre in the past 7 days. More increases are forecast. Is OPEC cutting production? Or is it something else. IN my long experience when petrol prices rise so does everything else.

Oil is up right now

That is OPEC pressure, I think

The Labour MP Richard Burgon on Twitter said this.

Our inflation rate is 6.8%. In Spain, it’s 2.3%.

Here’s some of how Spain did that:

– Proper caps on energy prices

– Lowered public transport costs

– Taxed excess profits

– Rent caps

We don’t need more interest rate hikes.

We need to take on corporate power like Spain has.

None of which the Tories will do (and I doubt Starmer’s Labour would do either, except perhaps tax excess profits).

Spain’s unemployment rate is 12%. Double the rest of the EU27.

The Guardian slowly crawling towards reality on inflation although it’s still mono-obsessive it’s nasty wage growth in the finance sector held up for condemnation but no sign of focus on nasty profit gouging in oligopolistic businesses:-

https://www.theguardian.com/commentisfree/2023/aug/16/the-guardian-view-on-inflation-stop-hitting-homebuyers-and-squeeze-the-super-rich#comments

The UK is so corrupt housing costs not accurately in price indexes. Mustn’t upset the bankers blowing house price bubbles or their largesse to party funding and MP benefits will disappear!