Time and again, commentators on this blog get angry with me for suggesting it is rational to avoid investment in shares.

This morning the bFT agrees with me, via its Alphaville column.

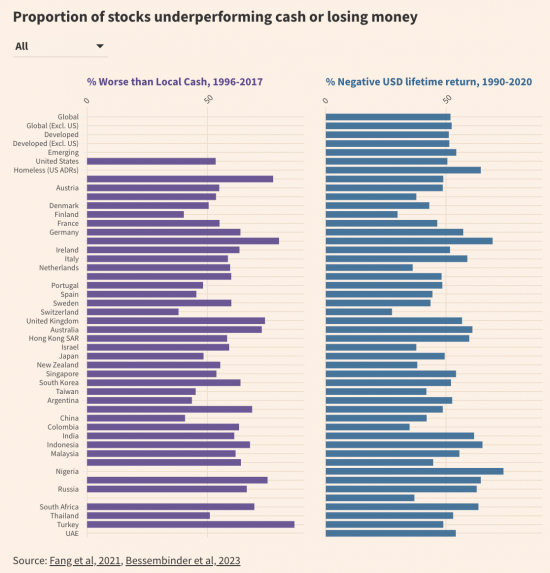

It turns out that over the long-run a rising tide has lifted far from all stocks. Like not actually lifted them at all.

The median global stock as an investment has been worse than local cash instruments or dollars in a cookie jar.

That's a finding based on the work of Arizona State professor Hendrik Bessembinder.

So, three questions.

First, why all the nonsense claimed about saving in shares when most destroy value?

Second, why the myth that capitalism works when very clearly it does not? The only companies that break the noted trend enjoy actual or quasi monopoly power.

Third, why do we waste so much money on the financial services sector when they deal almost excessively very in failed commodities?

It's time for different thinking,

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

A brief look through my share portfolio confirms his findings (or worse!!)…. unfortunately.

As my late father, a Trust Officer with The Midland Bank used to say, take your money to the bookies you will know in a few minutes if you have made a profit or not.

As you have pointed out the value of shares no longer bears any resemblance to the value of the Company issuing them or provides any new investment. Its little more than betting.

The most popular Equity Fund in the UK is Fundsmith..from inception to today it is up 532%..over the same time UK Bonds made 17% and cash 10.4%..

So, there are exceptions

Few find them

And by and large they invest in companies abusing society

“So, there are exceptions, Few find them”

Fundsmith is accessible to all and is now £24bn in size, pretty much all owned by UK retail investors so a large proportion of the UK savers will own it. Of course equities are volatile but over the long term a diversified portfolio from any decent manager has outperformed bonds. Of course you can pluck time frames to counteract this to suit your argument.

Except Pam (which I am quite sure is not your name) that is clearly not true

You are trolling

To Pam, Academics know the truth that on average funds do not beat their benchmark. You are comparing equity funds to bonds, you need to look at risk adjusted returns of equity funds and compare them to the equity index they are selecting from. You are muddling the active passive debate with the equity bond debate. Most Equity indices (Spain and Italy have not fared so well) and Bond indices have beaten cash in the last 40 years but that is not the long term, we have many generations left on this planet (at least I hope)

Every week someone wins the lottery…. does not necessarily make lottery tickets a great investment.

For every Terry Smith (Fundsmith) there is a Neil Woodford. Even Fundsmith lost 14% in 2022.

Yes, sounds right. So is the “answer” long-term government infrastructure bonds? Pensions invested in green renewal, “localist” as far as possible? We are a lot of people to keep well.

It probably is, is what I am hinting at

The short answer is that markets are only efficient at passing on information.

What markets lack is the ability to discriminate between bullshit and the truth within that information.

That is fundamentally why markets don’t work. And – allied with the herding mentality and optimism driven by greed is the makings of a continuous disaster – which is what has been happening for years anyway.

And even then, passing on selective information to selected recipients…

Ar Merrill Lynch it was known as ‘pump and dump’.

This graph shows (I think) that 50% or more of individual stocks will loose money vs cash. That’s fine. But if the other half increase in value by more than the loss, you are still ahead.

From the above graph you can conclude it is rational to avoid investing in individual shares, but investment in a larger number of stocks (index tracker ?) still makes sense.

Or are all those graphs that show up when searching “ world stock returns after inflation” wrong?

They reveal that there are aberations.

Do you think that justifies the whole indiustry dedicated to stock picking?

Right now it is, choose tech, and that does.

Everything else, forget it.

Now I’ve solved the oroblem do you want to revsie your answer?

If 51% of your stock picks go from 100 to zero, and 49% go from 100 to 250 you are still ahead. This is a contrived example but the dats show that this is what happens in aggregate (see those graphs of total return after inflation).

I agree that picking one individual stock is a stupid idea but I feel like the data are being used to suggest that investing in stocks is a bad idea in general.

I’m not arguing about the morality of this just the facts.

The data is based in aggregates.

It is also based in reality.

You are just making stuff up.

So truly neoliberal of you.

Gareth is right. This is what Bessembinder has said “Four out of every seven common stocks that have appeared in the CRSP database since 1926 have lifetime buy-and-hold returns less than one-month Treasuries.”

So the median stock will lose you money, but on average you’ll still be all right because the stocks that do well do so by more than the losses from the greater number of stocks that do badly.

There are many examples of such effects in wider society – the majority of what first time gardeners plant blind will fail, but a small number of plants will thrive and even take over if you’re not careful.

I note you did not quote himn saying that

In fact, what you conclude is not what the data necessarily says, as the FT notes.

I was trying to discuss reality based on data. If our data show different things either one of us is wrong or one of the data sources is wrong, or one of us is trying to argue something that the data don’t show.

I’d be happy to be proved wrong so can update my model and understand the world better. But I don’t think that is what the data show.

Throwing around “neoliberal” insults doesn’t help advance the debate alas.

But you weren’t using data

You used assumptions

And that is neoliberal trolling

Don’t bother again

Richard you are like a kid who runs off home with the ball under his arm when you start getting beat. You really sound like a spoilt brat. Gareth was civil and polite and looks to want to enter a genuine discussion. Which you didn’t want to do so you throw ad hominem insults instead.

Ah, Pam Barton reappears in a new guise. Whatever next?

I agree with the overall thrust.

My own vile habit of stock picking has made me signinficant amounts of money (could still lose me the same). But is not for everybody & as Richard notes, ul;timately it is completely unproductive for the economy. To offset my vile habit, I have also invested directly in companies where such investments will make a difference. Sadly, the current stuructures for financing early-stage/medium stage companies in the Uk are…. pathetic. One UK company (bio-tech) which I directly invested was unable to raise a piss-ant £1m loan & was snaffled up by a US outfit. This seems to happen on a regular basis.

Last comment: stock markets are not bad at pricing shares in the short term but laughably bad at pricing shares in multi-year time frames. I am very happy with this situation, reflecting as it does a refutation of efficient markets (ha!) and the idea of share price random walks (eh?).

Mike – you highlight one of the less understood failings of the City. Much noise is made about the high rate of innovation and start-ups in the UK, which may well be true. However very few make it to be medium-sized let alone large, and a big factor is the unwillingness of the City to lend and invest to meet the needs of growing SMEs. They are more interested in speculating in start-ups that they can exit ASAP and flog off at vast profit, all too often to larger companies based outside the UK. The world of vulture capitalists. The Dot-Com boom was a case study. It also shows in the shortage of mid-sized companies and the poor levels of productivity of SMEs generally. Its very hard for them to get the longer term investment that they need, be it in people, technology or whatever.

I was a CFO during the dot com boom. That was my experience, although the company did reach sale and that helped fund my first years as a campaigner….

I suppose the obvious point is to what extent are the financial ‘markets’ genuine markets?

As a ‘for example’ the amount of foreign currency needed to finance a years world trade is about 3 days worth of trading on the global FOREX markets so the traders could take the other 362 days off and go down the allotment which would be much better for everyone.

Unfortunately, this seems to be the case.

I have a hybrid mortgage here in the Netherlands which is 50% interest-only and 50% investment in a few share portfolios managed by the bank.

I’m now 16 years into the mortgage and the target investment valuw for 30 years is €88,000

So now I should have amassed €46,933 – the current built-up value is €33,113

I’ll make a big profit when I sell so I’m not worried, but it does rather prove the point, unfortunately.

That was the endowment nightmare that hit the UK hard in the 90s.

The endowment market fiasco could easily be repeated in pensions.

Endowment mortgages assumed that Equities would always perform well in the long run. But, outrageous fees dragged on modest performance so this was just not true in many cases.

Wind forward to today and we have a whole generation saving into equity products for a “pension top up” over/above the State Pension when retirement comes. They are encouraged by Illustrative return assumptions that are very optimistic but with fees quite high (in part due to their tax advantaged status) I fear a lot of disappointment coming.

So do I

I always these near compulsory schemes were a deliberate measure to increase rent extraction from people

Some of my modest financial reserves are in community energy initiatives. By their nature the financial capital is used for the common good; the AGM’s are a pleasure to attend – and I have a modest return. If required, some will buy back part of your holding.

WINTL?

I worked as an IFA for over 20 years starting in 1984 . I made a plan to retire with a pension pot of £100,000 at retirement in 2005. I contributed monthly premiums in personal pension plans with two different companies . I also contributed single premiums to cut my tax bills. As well as pension funds I put money into ISAs investing in Perpetual High Income funds which were doing well at . It looked as though the plan was working until in the last days of the last century . The Footsie index stood at 6990 at Xmas 1999. It took decades to pass the 7000 mark. At retirement my pension pot was £ 45,000. . I tried switching funds but to no avail. What I realised in my time in the financial sector is putting money into securities is not much better than gambling. I also realised the highly paid fund managers are mostly frauds. JK Galbraith wrote a book called ” the economics of innocent fraud”. He describes the lies told about stock markets and how the public fall for it. I have a copy on my shelves. The purveyors of investment companies stopped advertising their services for a number of years after the crash in 2000. Recently, they are active again promising the earth in the media. When members of my family ask me for advice I warn them against putting their money at risk. Richard is right as he usually is.

There was of course the Equitable Life debacle when the finance industry’s favourite went ‘wrong’ and more recently another favourite fund manager was found to have feet of clay

Well, here is the problem; even if you have worked out (from the inside or outside) that the whole financial sector is little better than a casino run by spivs; you can’t avoid them. If their neoliberal henchmen/women aren’t actually working in the finance sector; they are running the country. In the Conservative Party, the best way to the top in Government is to start in Goldman Sachs. The National Debt is just the banking system’s cashpoint. How on earth do you run up £2.5Trn of debt, with absolutely nothing to show for it, but an NHS in permanent crisis, a cost of living crisis, no money for anything, disintegrating infrastructure, decaying cities – and thirteen years of endless austerity; with no end in sight. Trust me, it will never end.

The banks and other closet monopolies, such as energy (i.e., everybody who is bleeding you dry while you are told you are not hurting enough) are the only people who are doing very, very well; thank you very much and why would they give up this endless gravy train. They know the country is full of mugs. You only need to persuade around 24% of the total electorate (mostly old) and neoliberalism can count on an 80 seat majority in Parliament. Easy money.

As long as the economy as a whole is growing, it makes sense that owning a part of that economy (through ownership of shares of companies) should earn positive returns. But I agree with Richard that a lot of the financial industry is more like a gambling industry which doesn’t contribute much. Consider the fact that the only real investment is when the shares are first issued. Once they start being traded then it is simply shares and money being swapped with no direct impact on the company that issued the shares. For the traders it is a zero sum game, both of whom are betting on expected price movements. So when a few funds achieve record profits there must be lots of losers on the other side.

It was Peter Thiel of Paypal who said competition is for losers if you want to make a profit create a monopoly.

However I have been retired for 10 years, I have a drawdown pension, and I use it, I have no additional money going in. In 2018 I moved my entire portfolio into ethical investments. I just had my annual review. The numbers take into account 2008 and 2022 crashes. I have the same amount as I started with…that is to say I am keeping pace with my spending.

I started to use an IFA when faced with the outrageous condition that having had the risk (of investment decisions) transfers to me cos that’s how the funds work, I was not allowed to move money out of a poor performing area because it had been frozen because of its poor performance. Properly catch 22. I had already encountered some sharp practice with a fund manager (high street name) investing an annual bonus in a new fund, so as to get the front loaded fees, instead of adding it to the exiting one…

The challenge is to make pensions work, to use Einsteins observation about compound interest so that they work for everyone and other peoples money is such a temptation…

There are lots of reforms needed to make pensions work that never get considered because the finance sector is a powerful lobby and a lot of the time changes go in the wrong direction. We even have the Fabian Society advocating tax breaks for the self employed – which I challenged them on.

So yes, I am privileged and in a lucky position, and you have to be very careful, but so far (touch wood) investing is working for me.