I was working on a wide range of data on the cost of pension tax reliefs yesterday as part of the project I am working on that is considering potential tax reforms that might empower politicians to answer the question, “How are you going to pay for it?” when they persist in maintaining the household analogy. Some of the figures that fell out from that were quite surprising, and even shocking, but they are for another day.

What I noticed this morning was an article in the FT on this issue that looked at it from a quite different perspective. As they noted:

This week, a freedom of information (FOI) request revealed some eye-opening facts about the UK's biggest pension savers — including one who has amassed a retirement fund worth £11mn.

The identity of this person and how they built up such a colossal pension is unknown. However, they are not alone in having a supersized fund. Estimates of private pension wealth compiled by the Office for National Statistics suggest that some 929,000 savers are sitting on a pot worth between £1mn-£2mn. A further 128,000 people have pension savings worth £2mn-£3mn and an estimated 46,000 investors have more than £3mn.

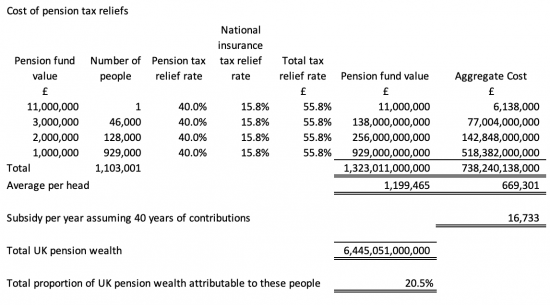

I have done a little analysis of this data. I made some simplifying assumptions, the biggest of which, by far, is that all funds have a value at the bottom of the stated range. I have understated every figure that follows as a result.

I also assumed:

- A consistent 40% tax rate for those making contributions. Some may, however, have been at higher rates. I am aware that relief might technically only have been at corporation tax rates as salary was never paid, but given that the pension is an alternative to salary (a salary sacrifice), I think this is fair.

- I have allowed for national insurance contribution relief assuming just the employer's rate and 2% contribution rate that applied to higher earnings until recently.

- A forty-year contribution history to accumulate these sums.

The resulting data is as follows:

These 1.1 million people own 20.5% of UK pension assets, the total figure coming from the ONS 2020 wealth data. Of course, most people own very little of this wealth: 48% is owned by the top decile of wealth owners based on ONS data.

These funds have a total value of £1,323 billion, or £1.323 trillion.

Assuming that tax relief has been provided, as I note, the majority of this value is funded by tax reliefs. Those tax reliefs will have contributed £738 billion to these funds at an average cost of subsidy of £669,301 per person. Assuming that it took forty years to accumulate these pots, that is a subsidy of £16,733 per person a year.

The current state old aged pension is £10,600 power annum.

If anyone can find any justice in that, please explain it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

We have a pension tax system that accrues wealth to wealth but seems to make it harder to accrue wealth lower down the pecking order.

You are right.

There is no justice in this at all, the state pension is hopelessly unfit for purpose.

To me this whole thing is nothing more than a policy to create a cabal of rich people to cement into society who will become political donors to those who perpetuate this sort of policy making.

I think that this is what happened in the U.S. to be honest.

Wealthy people save anyway. No tax break is needed to encourage that.

Best solution is a decent “living pension” – then no pension tax breaks are required… although I am not set against the current system of auto enrolment (with opt out) for all employees…. as long as the amounts are capped.

I am wondering, does not the life time allowance (now abolished) suggest that much of that accumulated pension wealth in your table would have been taxed? I believe that this has been one of the issues preventing doctors working more hours. Or are there other rules for the truly wealthy??!!

Finally, I am not even sure it makes sense for the moderately wealthy (ie owners of property with a mortgage) to even save into a pension. If they are paying 6% on the mortgage versus saving at 4.5% in gilts; if they are claiming 40% tax relief now versus paying 20% later then it is not such a great trade. Perhaps better to pay down the mortgage? Sure, most will not be invested in gilts and will hope for better returns but it is a pretty levered position betting on rising asset prices (house and pension fund). Indeed, with an aging population it might even look Ponzi-ish.

What would that figure be if it was off set by the income tax paid on withdrawals? Also those large pensions are going to be hit with a 25% charge on the amounts above the lifetime allowance when the pension holder reaches 75.

Most large funds are nit withdrawn

Hence the new charge

Am I correct that the majority of these funds will be paying a management fee to an advisor? Which is of the order of 1% per annum?

If so, that is a lot of money going into the financial services industry and those involved will want it to continue.

Anecdotally, my 40% tax-paying. pension-fund growing, friends ridicule the low growth of their pension funds, resent the management costs, and only do it because of the tax relief.

All true

Not quite true as far as charges are concerned. Some firms (usually the big insurance companies) have very low fees, especially post the introduction of “Consumer Duty” rules on 31 July. It’s entirely likely to be the case that you can hold a pension fund with fees of 0.15% – 0.35%, with the latter being an attractive ‘all-in’ cost. Things have moved on as far as the ‘raw cost’ of these products are concerned. However, there can be quite a few ‘hands in your pocket’ with defined contribution pension pots. Manufacturer fees, fund fees and exploitative ‘advice fees’ from people in my sector (IFAs). Sometimes, I see fees in excess of 2% p.a. and more – shocking.

As money put into pensions is taxable on the way out of the schemes, won’t the £16733 pa subsidy reduce substantially when the pensions are drawn down?

There is no NIC on draw down

If not drawn down the sum is IHT free

And tax on withdrawal may not be at higher rate

What are you making excuses for?

Give your reasons.

I’m not making an excuse for anything, just saying that your £16733 figure, which you compare with the state pension, is too high. It’s impossible to say by how much it is overstated, partly because of the many different rates the withdrawals will be taxed at and partly because the tax is a future event. But it’s likely to be substantial.

Separately I would expect the amount of people in these categories to increase, again substantially, now the upper limit on the tax advantages has been removed.

Hang on,mi deliberately understated the figure. I could easily be 50% higher in reality .

And it is still going to result in a massive benefit – because all these people will also get the state old aged pension (which you ignore).

So why are you defending such an inequitable system?

I suspect I am quite typical (in this regard).

I got 40% tax relief on the way in plus NI so a saving of 50+% – I now pay tax at 20%. I also got to take 25% out of the pot tax free!

So, if I “gave up” £100 in salary I gave up £50 at the time to have £100 in my pension pot. I took out £25 tax free upon retirement and will pay 20% on the remaining money (£15). HMRC is down £35 on the trade.

I have been a huge beneficiary of this scheme…. but that does not make it right.

Neatly put Clive….

I’m not defending an inequitable system, I was questioning your calculation.

The more your assumptions mean that you underestimated, the more of it it’s likely to be taxed at 40% on the way out.

On suggestions for improvement to the system is there any real downside to making your pension fund part of your estate for IHT purposes whatever age you die at?

My guess is that many of the pots much above a million are there for IHT purposes rather than income tax ones as it is difficult to get much above a million out of your pension fund while you are alive and not be charged 40% income tax on it.

That IHT exemption has to go…..

Indeed, this is an astonishing loophole. It can’t last, surely?

I am keeping quiet about it in case the kids get any ideas!!

I have it in my sights…..

If the IHT exemption was abolished then it seems to me that there is very little tax advantage to having much more than a million in a pension pot as you end up paying 40%+ on it eventually (under current tax rules).

After that it becomes much more complex. Is getting tax relief on a pension pot of £1million excessive? Significant numbers in the public services get that through their final salary schemes. In the NHS, for example, its not just consultants but many who have climbed the greasy pole a bit. For example, my other half, who is on a cancer diagnostics team in the local General Hospital, has a ‘annuity equivalent’ value on her pension fund of way over a million just because she has been there a long time and has put the effort into developing her skills. She’s not a doctor.

I am sure your ‘other half’ (what a deeply misogynistic term) wopuld love to know you think she is on a greasy pole.

Well, I have ‘Domestic Facilities Management’ And I am wise enough to realise that managing the Domestic Facilities is a skilled task.

What has happened though is that the collapse in interest rates from 2008 to date made the notional value of a ‘Defined benefit’ pension go through the roof hence the issues with Doctors pensions.

Are those values realistic? I have no idea.