It is a morning of very mixed messages on the economy.

Chancellor Jeremy Hunt will on Monday set out a series of “Mansion House reforms” intended to channel tens of billions of pounds of Britain's pensions savings into high-growth companies.

Hunt will use the chancellor's set-piece annual speech in the City of London to set out reforms he claims will seize “benefits of Brexit” and make UK capital markets more attractive.

The second of these paragraphs shows how fanciful is Hunt's thinking. The only way to address Brexit now is by asking to go back.

As for the first, the idea that pension fund money might actually be used to fund investment is something I have long advocated. I am glad that he has noticed that pension money is not being used in this way.

But the simple fact is that if pension wealth is at least 42% of total UK wealth (as ONS data shows) and represents at least 77% of all UK financial wealth, with ISAs making up another 8% of total financial wealth, meaning 85% of that financial wealth is now tax incentivised, then if money is not moving from tax incentivised saving into actual investment there are two possible explanations.

One is that the tax incentive to save is wrongly structured because it does not require that the saving be linked to investment, meaning the return to the state on the funds used to subsidise that savings activity goes to waste.

Or, alternatively, the incentive is being abused by those who use the saved funds to provide fund managers with a return that is unrelated to any actual investment activity because the funds are actually used for speculation.

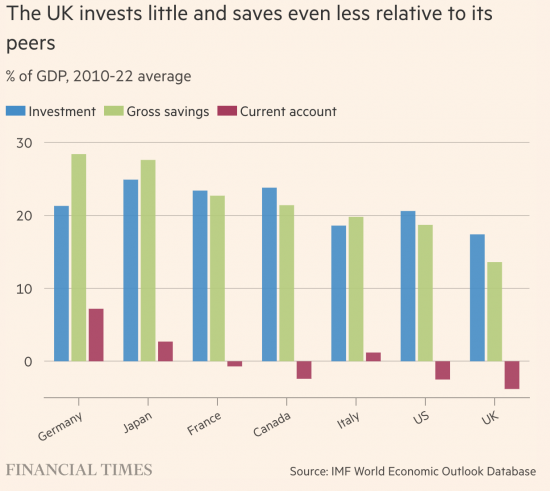

I would actually suggest both these things are happening. So, I think does Martin Wolf, also in the FT yesterday. He has this chart:

Wolf bemoans our lack of saving, which he links to our lack of investment. He does not, however, make any of the necessary links.

If almost all our saving is tax incentivised and we do not save enough he does not ask why are the incentives wrong? Nor does he ask why can't we afford to save more, if that is what we need? And, again, he fails to ask why is there such a marked disconnect in the UK between savings and investment?

The answers are actually, I suggest, the same in each case. It is that we do not think savings need to be invested in this country. They only, it is thought, need to be speculated. That means that money saved does not reach the productive economy in the UK but instead actually leaves it altogether to float in a financial ether where it does nothing but support City bonuses. Productivity remains low as a result, meaning we do not have the income to save more, and so a vicious cycle ensues.

Meanwhile, as Larry Elliott notes in the Guardian:

There are other suggestions for how the government might speed up the green transition, all of which meet with the same riposte: that the plans are unaffordable, irresponsible and the stuff of fantasy.

In truth, the real fantasists are those who cling to the belief that we can continue to exploit the natural world to satisfy our desires. If that's what economics is about, we badly need a new economics.

What Larry is noting that the actual response to real economic need for investment is that we cannot afford it, which makes no sense at all. If the UK savings rate is 13% then that supposedly means we save £325 billion a year. But apparently we cannot find the money needed for climate change to be addressed because, presumably, that would stop the flows into the City required to keep the stock exchange Ponzi afloat.

We do indeed need a new economics. And it has to reconnect savings and investment, which is the most massive disconnect in the whole world economy, where most wealth is just a chimaera, built on myths supported by accounting that reports everything but the fact that most profit is made by exploiting the future of life on earth.

Larry is right then about a new economics. But who will listen?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The difficulty I have with all the people who say “We *do* have the money for this . . ” is that they don’t go on to say what they would spend it on, what resources they would move around, what resources they could create, and then compare that to the alternatives.

If new economics means that there are no opportunity costs in deploying people to do one thing when they would otherwise do something else, then I’ll stick with the old one thanks.

No one makes the straw man claims you are making

So I will continue to delete you by default

Dear son of Milton his ideas died with him!

Mr Frilton,

Rather than looking down your nose whilst millions of people struggle, why don’t you jump in, do the modelling for your point yourself and make a positive contribution? You won’t impress anyone by standing on the sidelines being sniffy.

Richard,

My obvious question might be why do we have private pensions?

If we were to increase the value of the New State Pension and add on something like SERPS – an earnings related element with perhaps the opportunity to buy some extra pension as in most public sector schemes then there would be much less money flowing into basically speculation?

I would further suggest that before you paid into a private pension you would have to have bought the full amount of ‘extra pension’ in the state scheme.

This is a question I will be musing on

Here’s your Sado-Monetarist answer why it’s not a good idea to rely solely on state pensions:-

“Well, obviously, the financial circumstances have changed quite a lot since ….. became leader and things that might have been possible are just not possible now.”

Looking at Wolf’s chart served to remind me that the issue may be cultural; and deep. Britain and the US look a little like outliers; marching to a different drum. I write this because I feel I have seen that same comparative outlier position before, in different econmic-financial contexts. Frankly I no longer think mere political practice can fix this.

I’m inclined to agree, being just back from 3 weeks travel in the USA where my son and family have lived for a number of years. I’ve been there many times and have worked for a couple of US organisations. At the risk of over-generalising, in both countries there is an instinctive libertarian, even selfish mindset amongst much of the population. I’d contrast this with a more communitarian mindset in for example much of Europe (and I have extended family in France).

As an aside, my son has decided to stay on in the US for at least a few more years. He works in automotive and marketing and as a result of Brexit, those sectors are dead on their feet.

Politicians these days are simply the air traffic controllers of policy – ensuring that everything is in a holding pattern up in the air and preventing us from coming down to earth and doing what needs to be done.

We need a new economics – agreed. Many good think pieces have been written on the structure of a new economic order (and an effective transition). But we are stuck with massive economic illiteracy at all levels. At academic level, Gregory Mankiw’s textbook is the recommended text in many academic departments of economics. Same old stuff as I had myself as an undergraduate – just nicer diagrams!

Then we have politicians and journalists who talk endlessly about the need for more economic growth, and haven’t the faintest idea about how money and banking works.

Finally, there is the ordinary citizen, who believes that economics has laws (like physics) and that one needs a brain like Einstein to understand it. So, policy is what is inflicted on us – by the graduates of Oxford PPE.

The authors of Econocracy tried to demystify economics at neighbourhood level (in Manchester). But the task is much bigger than that. I have my own experiences of demystifing economics – some modest success – but the participants are told by their elected representatives that TINA rules.

Thankfullly, economists do not build bridges – or other complex structures

Politicians in the UK don’t design bridges but they all conspire to progressive collapse of the country through their economic and monetary illiteracy much of which hinges around the centuries old but shallow Quantity Theory of Money. Some of them even make it onto the Oxford PPE course which seems largely to consist of hanging around reading comics named TINA!

Seeing the big picture. Are we there yet?

In the summer, my grandad used to drive us to the seashore, 3 miles along the coast from where the Sellafield nuclear plant discharged water from its cooling towers into the sea, where we would collect sea-snails and limpets to cook and eat. As we approached the last hill before first sight of the sea, we would ask excitedly, ‘Are we there yet?’ and he would reply, ‘Nearly’.

Just as inevitably, the effects of global warming are becoming increasingly apparent, but a concerted global response is not.

There is a consensus across scientific research that our Earth is undergoing a convergence of catastrophic ecosystem tipping points, whose conclusion will be the extinction of all forms of Life.

Nonetheless, amidst all that research, there is also some good news.

The good news: https://www.joboneforhumanity.org/

The biggest investment the Uk has made is in housing, not better housing but in pumping up the price of housing in a huge ramp that suits house owners and landlords but prices out the young, and those on low incomes.

While money continues to flow in this direction, funds are being misallocated and misery increases.

Time for land and property taxes to level the playing field.

That is not investment

That is speculation

Nobody ever mentions the relationship between debt and saving. The UK has pushed housing values up with extra debt for decades. People cannot save if they borrow, and now far too many cannot even service their debts. A housing crisis lies ahead, and thus increased saving is unlikely.