Investment adviser Hargreaves Lansdown sent me a press release this morning, which despite my best efforts I cannot find on the web. In it, they said:

Teenagers are set to get an F for finance. Because while schools have done everything possible to prepare them for their GCSEs and A-Levels, there's a reasonable chance they're horribly unprepared for looking after their money.

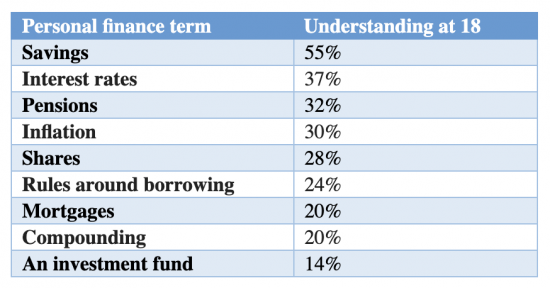

By the age of 18, the vast majority of us had massive gaps in our knowledge. Despite the fact that an awful lot of people take on student debt at this age, and even more will qualify for credit cards, three quarters of people don't understand the rules around borrowing at the age of 18. Today's 18-year-olds will also be emerging into a world where inflation and interest rates will play a key role, and yet at 18, only 37% understand interest rates and 30% have got to grips with inflation.

Aside from everyday finances, we also tend to know very little about putting money aside for the future at 18. While a healthy 55% have grasped savings by this age, only 32% know what a pension is, and our investment knowledge is even more sparse – only 28% know what a share is.

They then included this chart indicating the state of awareness 18-year-olds have on some key financial issues:

I think we could all agree that on some of those issues the level of understanding is particularly worrying. That rules around borrowing and the impact of compounding are not understood is most especially concerning.

If evidence was needed that education of the sort that I proposed in the report that I published on Sunday is required, then this is it.

I will be contacting Hargreaves Lansdown about this.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I do agree with your general statement about teenagers in particular, though two of my grandchildren are in their mid- to late- teens and the other two are approaching their teenage years. None of them are acquisitive, a position suggested by your list of nine terms.

I would add to the list “financial crisis management”, essential for those approaching adulthood. Yes, it’s a broad set of skills and would benefit all of us, providing a context for your list!

Knowing the term ‘pension’ at 18 is very different from knowing what your pension does for you at age 65 or 70. Not quite sure how knowing the word at age 18 helps.

When you think how many waspis were fleeced by the government shows how little it helps, too.

Perhaps it helps with an understanding of the bank of Grandma and Granddad!

That might have worked until food and energy prices more than doubled.

A gentle push back…

It’s a common assertion that people, and young people in particular, need ‘educating’ in financial matters. However, I can’t help thinking that this is a bit of a cop out by the financial world, reflecting the over complexity of their products, their untrustworthiness and the lack of skilled advice that they now provide. We can joke about the Captain Mainwarings but there was a time when bank managers and their equivalents in other financial businesses could be trusted and were equipped to provide honest advice. I also wonder where in a crowded school curriculum this is going to fit. Along with Rishi’s extra maths!

After all, we are not expected to know the details of how our cars work to drive them and get from A to B…

Robin – the banks used to advise to by with profits funds.. the most opaque product imaginable.

Absolutely true – as did the building societies. Being one of those people in the 70’s

Nonetheless, I still feel that financial institutions themselves are being allowed to get away with a caveat emptor approach, blaming consumer problems on the consumer. That includes small businesses as well as individuals

I agree with you Robin

But awareness of compounding is pretty basic maths people need to know for real life

I couldn’t agree more.

The idea that it is perfectly normal to live in a society ruled by money where every service provider is a swindler and the government will do every thing possible to help them should never be accepted.

Instead the Financial Services sector needs to be put back in its box so that they become like the old nationalised Water companies. Behaving responsibly and quietly providing an essential resource.

Robin Stafford said:

After all, we are not expected to know the details of how our cars work to drive them and get from A to B…

In 1973, I was aged 17, my father agreed to give me my first driving lesson. We went outside and he opened the bonnet. He pointed out the things that mattered and explained how they worked and how they were affected by the driver. He taught me basic maintenance and how to change a wheel. The only thing he would not trust me to do on my car was the brakes – he insisted my slightly elder brother oversaw that.

The result was that I knew not just how to control the car, but what mattered and what to do about it. I believe it made me a very much better driver than I would have been without it.

I got my first car in 1980, I think

It was a minivan and very basic

But I could do a lot on it

Now? I can change a wheel and a lightbulb, at best. The rest? Not a clue…

Funnily enough I did the same with my daughter. Spent as much time in the garage with her as my son and she is a better mechanic than him – or her husband! And taught her to drive.

But my point still stands. We should not have to know all the ins and outs of financial products to avoid being scammed. It is a cop out by the sector to say it’s the consumers fault. That said I’m all for some basic financial skills being taught. A bit like basic car knowledge.

I’ve long believed that even a basic financial grounding for children would wipe out most of the personal finance industry.

I mean what do you actually need? An ISA and perhaps a stakeholder pension* for future house purchase etc and for retirement in a basic global tracker.

A basic knowledge of borrowing/mortgages and how interest works.

And some family protection for when you have liabilities

And that’s about it really.

* A parent can start a stakeholder pension for a child to a max of £300pm gross. If the child keeps it going until they are 60, back of fag packet calcs show they’ll have about £2.4 million to retire on @ 7% compound. That’s in an ideal world. Unfortunately, iphones, PCP car purchases, takeaways and eye wateringly expensive sandwiches and coffees always seem to take priority these days….oh well.

Sorry, but do you know anyone who can afford £300 pcm for their own pensions, let alone those of their children? That’s ridiculous.

Hi Jen

It was just an example. They key factor when it comes to investing is time. Even if its fifty pounds a month, the numbers can be huge after 50 or 60 years of compounding.

Davidn, you are also extremely clever if you can work that out on the back of a fag packet!

Sorry, but saying that awareness of compounding is pretty basic maths is what puts lots of people off maths.

https://hansard.parliament.uk/Commons/2022-07-20/debates/3548E215-AB0B-4DBB-8D02-4AACA94105F2/Pensions(ExtensionOfAutomaticEnrolment)

This is my MP, bringing in a new bill for automatic enrolment to pensions to be brought down to 18. I don’t know any 18 year olds who are capable of saving in a pension scheme, because they have only just left education and don’t have jobs yet. Apprentices don’t earn enough to have pensions. 21 year olds leave university owing enough to have a small mortgage. I know it doesn’t have to be paid off straight away, and only if they earn ‘enough’ money, but if they don’t earn enough to pay something towards their education loan, they don’t earn enough to pay towards a pension.

It is as bad as demanding that someone who earns £10,000 a year ( £833 per month) must save towards a pension unless they go through a fairly complicated process to opt out, a process that many of them would be unable to follow.

No one can live on £833 per month. Taking money from them to put towards some mythical pension, so the state will not have to support them as much, should they ever reach old age, is robbery.

Compound interest is (according to Einstein) the eighth Wonder of the World; those that understand it earn it, those that don’t pay it.

Now, understanding does not prevent indebtedness….. but it is a start.

🙂

Three experiences formed my views on personal finance (these may well be at variance with Richard’s).

1. Poseidon Nickel : I watched awestruck as it climbed from $0.8 to $382 per share (I still fantasize of having bought at $0.8 via a Swiss bank 🙂 as a school boy ).

2. Lecturer in “General studies” at Liverpool Poly in the 1970s – in one class he had us do some stock picking and we “bought” a stack of shares at the start of the year & tracked them (he also taught us about the diff types of money). Interesting exercise since it showed how money could be “made”. As trainee engineers – the numbers were “interesting”.

3. 1980, Howe, interest rates hitting 16% (ish) and me knowing for sure the only way was down. Me buying and selling gilts (I won’t go into the details – but I was getting a circa 100% return on my money/year 1981 and 1982 – basically shorting). I used an early form of spreadsheet to track which gilts to buy and when to sell.

Mother speculated in shares from 1956 until the last years of her life (reasoning that what was good enough for vile-tories was good enough for her).

Thus for me, stock picking has been the way I have made money – working has been the way I have paid the rent & put food on the table. This path is not for everybody & you can question the ethics, stock markets do close to nothing for an economy. That said, I guess I have an advantage – I’m highly numerate

Final suggestion (apart from the need to teach people useful stuff about money): don’t touch Exchange Traded Funds (ETFs) with a barge pole – very dangerous instruments

Let’s agree on the last

Apparently there is $10Trn invested in ETFs (2021).

I know

And many have massive liquidity risk inherent in them

Totally agree – and especially about compound interest – the Rule of 72 (page 64, Killing the Host, Michael Hudson, 2015).

When I left teaching I was persuaded by an ex-teacher turned financial adviser to put my pension pot into a private pension, and obviously add to it, monthly. I assumed as he was an ex maths teacher he knew what he was doing. After a few years I had a letter from the DWP to say that I was not making enough profit in my cafe to pay into a private pension and would have to stop it.

The pension company took their cut of my pot, the adviser took his, HMRC took some and I was left with less than I had paid into it originally. That was after 15 years of paying in.

I don’t trust teachers on pensions.

In fairness, HMRC don’t tax pension funds

Pensions funds pay taxes on dividends, as famously introduced by Gordon Brown in 1997.

No they don’t

Wrong

There is no tax credit that they can reclaim.

I know that, but it wasn’t fair of them to close the account and give me it all back, taxed, including the ten years of saving in the teacher’s superannuation scheme. If that had been kept in, I would have a much better pension now.

£20 a month for a couple of years meant I had to close the pension altogether.

At the time we didn’t think about that as my husband had had a bad accident, and never worked again. We had other problems on our minds.

A couple of days ago it was gender pensions gap day, where the gap between women’s and men’s pensions was detailed by the TUC. The figures for women are quite frightening.

https://www.tuc.org.uk/news/tuc-women-more-twice-likely-men-miss-out-pensions-auto-enrolment

Surely, the article is about improving financial education which means not telling them or doing it for them but ensuring they have a good understanding – enough to be able to keep abreast of future changes. Changes in financial packages, and in their personal circumstances. This might well be a valuable extension to Maths education until age 18.

“iphones, PCP car purchases, takeaways and eye wateringly expensive sandwiches and coffees always seem to take priority these days…” –

And perhaps they don’t. Perhaps most young people are rather good at prioritising their needs, especially when they have an understanding of the larger picture.

One of the problems that concerns me is the idea of going to a cashless society. We spend years teaching children about money and value of goods, then they end up with a card to use for all payments.

Some proper financial education for adults wouldn’t go amiss either.

the goal should be to empower young individuals with the tools they need to make sound financial decisions and set themselves up for a secure financial future. By addressing the gaps in financial education and providing the necessary resources, we can work towards ensuring that teenagers are not handed an “F for finance,” but rather a solid foundation of financial knowledge that will serve them well throughout their lives.Thanks!