The Mail on Sunday has covered the report I have published today on the Institute of Chartered Accountants in England and Wales's hoarding of the funds it has obtained as a result of penalties and charges being imposed on its members as a consequence of them undertaking inadequate and substandard work at cost to society.

The Mail notes:

As this report makes clear by implication, there has already been a great deal of discussion between me, the ICAEW and journalists with regard to this matter. The entire report that I have written was shared with the ICAEW in advance, more than a week ago.

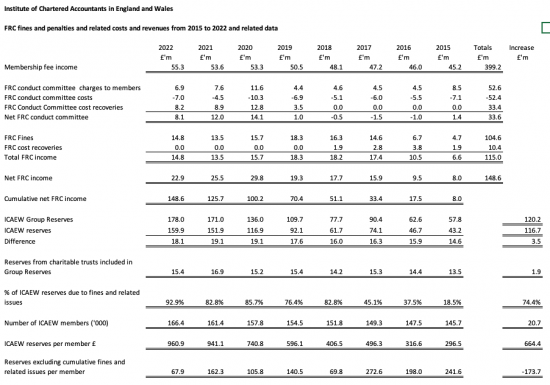

The ICAEW has challenged my work, saying that they have only profited by £127 million instead of the £148 million that I suggest. The difference between the two numbers is that they have used data from 2004, which is unavailable to me because much of the information in earlier years was not separately disclosed in their accounts, whereas I have used the period from 2015, from when the data was made explicit in their financial statements. I requested a copy of the ICAEW's workings, but they were never provided to me although I did provide them with mine:

The ICAEW described these funds as part of a strategic reserve when corresponding with me and assured me that they were unavailable for use for the purposes of offset against routine operational expenditure when corresponding with me on this issue. They had also said this to parliament in 2022.

There are a number of problems with this claim. The first is that this would imply that in an organisation that is managed for the mutual benefit of its members (which the ICAEW is, which is why much of its income is not subject to tax) this fact should, in my opinion, have been acknowledged in the accounts by the transfer of the sum in question to a separately designated strategic reserve. This should then, again in my opinion, have had a budget attached to it explaining how the funds in question were to be expended. There is, however, no mention of a strategic reserve in the accounts of the ICAEW to December 2022. Nor is there any indication given of the sums to be expended upon its strategic goals, which are mentioned in those accounts, and to which I refer in my report. As such, it is not obvious how the ICAEW can claim that this sum is to be used to make the accounting profession "resilient and [an] enduring force for good." I admit to finding it very hard to believe that an organisation has a strategic reserve for a sum as large as £127 million in its estimate, or £148 million in my estimate, when it only has £159.9 million of reserves in total without that sum being mentioned in its accounts. This is why I described those accounts as unclear.

This is also not an issue for idle speculation. If, as the ICAEW says, all its reserves are retained for strategic purposes, this does by implication suggest that none of those reserves are available for operational purposes, meaning that if it were to incur a deficit it would not be clear how that sum could be covered out of the funds retained by it without it breaching the suggestion it has made to Parliament, to me and to journalists that the funds from fines and related issues that it has been paid will not be used for operational purposes, which it says it will not do. I believe that this suggests that there are governance issues implicit in this issue that the ICAEW should have addressed, but which it has not.

I have also noted that the ICAEW says in its 2022 financial statements, and on its website, that its strategic objectives for 2020 – 2030 are to:

- Strengthen trust in ICAEW Chartered Accountants and the wider profession

- Help to achieve the Sustainable Development Goals (SDGs)

- Support the transformation of trade and the economy [after Covid]

- Master technology and data

- Strengthen the profession by attracting talent and building diversity

I have no objection to the ICAEW having any of these goals. I do, however, note that despite this programme having apparently begun in 2020, by the end of 2022 no identified spending on these issues had been noted in the accounts and that in 2022, the ICAEW was still saying to Parliament that it was working out how to expend these funds.

I also have some considerable difficulty in seeing how any of these issues might fall outside the scope of the normal operational functions of the ICAEW. This includes the help to be provided to assist the achievement of the Sustainable Development Goals, on which the only commitment which the ICAEW makes is:

We will help develop metrics and methodologies to achieve the SDGs, position our members as being in the vanguard of understanding the SDGs, and demonstrate leadership in our own conduct as a business and an employer.

In my opinion, this would appear to be a totally normal operational activity to be undertaken by an organisation like the ICAEW.

It is for precisely these reasons that my colleagues who have supported this work and I have suggested that the benefit of the accumulated funds that the ICAEW has enjoyed as a consequence of the failings of some of its members should now be transferred to third parties. The reason for doing so would be to improve the training of undergraduate students in accounting at universities, and to provide a programme of training for young people in finance and related issues to be undertaken both in schools and in broader society, with the latter being a scheme that might be modelled on the Duke of Edinburgh awards with bronze, silver and gold achievements to be accumulated between the ages of 14 and 21 that would provide employees with a clear indication of a young person's understanding of the world of finance that will have significant implications for them as they move into adulthood.

We are looking forward to discussing this with the ICAEW.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

First of all, well done for raising this.

Secondly, the whole thing to me is redolent of the sort of ethics that ‘investment ‘ banking has when it wants to ‘make a market’. The only thing that appears to matter here is making money whether by hook or crook and have loads of money at the end of it because that money in the bank now defines the organisation – not its remit. Anyone for office redecorations? Or how about commissioning a new office block? Or what about a rebrand from a brand consultant?

Thirdly – and a kinder but no less damning appraisal – would be that the ICAEW had such faith in the standards of its members that it never expected to see such an amount of fines and simply does not know what to with them.

Given the paucity of morality, ethics and management in our institutions these days, it would not surprise me if it were a mixture of the two above.

Having said that, £127 million is lot of fines and tells another story altogether.

What PSR said, Richard.

Hi Richard I was happy to partner with you in this campaign and have also written to the President of Icaew raising these matters. Relative to its annual income investment in ethical and cultured accounting education, which understands and celebrates diversity rather than patronise about it is diabolical. The same applies to public interest research and education given the huge crises in the profession. I completely agree that these funds should no longer be under Icaew control as they have shown their lack of leadership and transparency- which is paradoxical as they are supposed to uphold the highest moral standards and accountability!!!

Thanks for your support Atul

The answers delivered by the Institute above reminds one of the technique of question answering at PMQs. Plenty of waffle but little or no facts or substance.