A depressing poll release from YouGov suggested this yesterday:

Which do you think the government should prioritise?

Bringing down inflation: 51%

Preventing the economy going into recession: 33%https://t.co/Dl1ItXXsfmBringing down inflation: 62%

Bringing interest rates down: 22%https://t.co/h9BRBQEbOJ pic.twitter.com/eZdhkOo04u— YouGov (@YouGov) May 26, 2023

Apparently, people are quite convinced that bringing down inflation is more important than avoiding recession, whilst beating inflation is even more important than cutting interest rates.

Years of propaganda from the government and the Bank of England has convinced people that economic sadism on those who have to borrow is the price worth paying for the supposed advantage of reducing inflation. It would seem that very few ask the obvious question, which is how increasing the price of money can prevent the value of money from deteriorating.

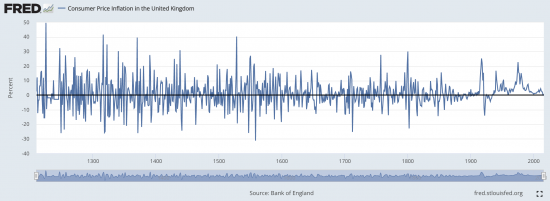

The reality is that inflation always goes away anyway. Take, for example, this St Louis Fed chart which summarises data from the Bank of England on inflation trends in first England and then the Uk over a period of more than 800 years:

After a period of inflation there has, historically, always been deflation, and even if the latter has been rare of late, there is always a return to more normal rates. The simple fact is that despite what politicians and the Bank of England claim, inflation does not persist. The policy measures put in place to supposedly tackle it only make things worse. But people have been persuaded otherwise.

Economics, it seems, has not yet got out of the age of mythology.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Yougov is iowned by Nadhim Zahawi a renowed tax dodger.

It’s like climate change thinking you can control the weather or say an illness from spreading you can control pollution and you can try and make people more healthy but the rest is fantasy. Reality eventually bites that yes they can not control inflation but they can make it difficult to borrow which in turn means somone can not pay as their debt relies on ever more debt. This then, when somone can not pay has a deflationary effect which ever end you chose to impose it at the top or the bottom of the pyramid.

I don’t think it is owned by him any more

Didn’t he give his founder shares to his dad in an offshore trust fund?

https://www.taxpolicy.org.uk/2022/09/21/zahawi_hide/

But I think they have been disposed of now

We’ve been indoctrinated into a world of exploitation through the morning news and daytime TV – we’ve been sort of machine learning some really crap stuff.

Persuaded? Do they ever ‘persuade us’? I think you give them too much credit. Persuading people is very hard work. No. They prefer to lie and force the lies down our throat using the ever-compliant media.

It’s more like they just present the lies they want to present, over and over again until we just get used to it. The only real debate about these issues is in places like this thank goodness.

‘Persuaded’? To be persuaded surely needs the presence of alternatives etc. That’s where the likes of you come in Richard.

“Inflation or recession” or “inflation or interest rates” are false dichotomies implying inteterest artes will fix inflation.. Inflation affects everyone immediately unlike the others, so maybe not too surprising people respond to the poll. Maybe “should we demolish the house to fix the roof slates” – may elicit a different response.

“Years of propaganda from the government and the Bank of England”

Surely – “grooming”?……….. people are groomed to accept and indeed welcome the absue inflicted on them by their abusers (possibly seen as “betters”).

Some might call it the Stockholm syndrome: you come to love your captor/abuser.

However, ultimately, this is all about power relationships: those that are doing the grooming know what they are about, & enjoy it.

Readers can reflect on the long history of those that groomed, knew what they were doing, knew the damage they were doing, still did it and……….enjoyed doing it.

The imbecilic grin is still affixed to Gidiots imbecilc visage.

The sad thing is that UK serfs have been groomed to the point where ……………they are incapable of understanding what is going on.

Your last line is spot on.

It’s like the line from that Grant Lee Buffalo Song from the 1990’s – ‘We’ve been lied to, now we’re fuzzy’

“Economics, it seems, has not yet got out of the age of mythology.” This is absolutely true and so is Mike Parr’s comment that right-wing politicians groom voters by generating myths. This is why Starmer wants no truck with his party’s desire to move to PR he knows he won’t be able to get away with foisting right-wing policies onto the electorate so easily with FPTP gone.

Uplifted by nature. Pity that GDP only really values which can be extracted from nature. Economic falls woefully short when it comes to capturing non-market benefits. These values are manifest in nature – recreational, aesthetic, spiritual.

The UK is a country that’s high in the list of Mythlands. It’s full of Neomythics who fail to recognise that money is a balance sheet phenomenon for the purposes of transaction and not magically grown on money trees! Not merely that, however, there’s also a widespread failure to realise that those transactions urgently require a balance sheet with nature as global warming is now revealing.

Very slowly the Neomythics are starting to understand that with the use of money not only do you need a lender of last resort because market capitalism is unstable but also an employer of last resort to help ameliorate the environmental damage. Both of these functions can only be delivered by the state and that is why to stop being a Mythland and a Neomythic you have ditch being a Market Fundamentalism (a Thatcherite or Neoliberal if you like) and recognise the only way forward is a Public/Private partnership.

“Pity that GDP only really values that which can be extracted from nature.”

The intelligent members of our species knows that in our “entanglement with things” we haven’t been producing accurate balance sheets that price in our negative effects on the planet. But then what would you expect of neomythics who still believe in the Adam Smith myth that market fundamentalism of necessity generates equilibrium?

High inflation is easy to understand. We’ve all seen how much the price of our shopping has rocketed upwards over the past year or so. The idea that it could continue at similar rates for another 18 months is unconscionable.

Recession, on the other hand? A nebulous term, if your job is pretty secure.

I’ve personally felt the impact of the inflation over the past couple of years much more than I felt the impact of the global financial crisis back in 2008.

Not claiming that the extreme media focus on inflation doesn’t help the government/BoE narrative, just noting that it’s understandable why the layman might not be quite so concerned about recession as he should.

I’ve just seen your tweet about the relationship between interest rate hikes and inflation because private businesses in the economy’s supply chains are themselves saddled with debt!? Which would increase the cost of money borrowed.

You and others (Hudson) have pointed company debt out time and time again as a fault line in modern capitalism – it sounds compelling and worthy of a post in itself (when you have the time).

If this link is strong, then the only people benefitting from this are the banks. But its wider affects on inflation would be little known in society at large which is a concern.

For myself, fighting inflation with inflation is plainly stupid. But if what you say does indeed cause inflation, then interest rate hikes are even more stupid that even I thought.

Unless of course, you are banker who owns those the loans.

But also, it proves that nothing has been learnt. Thatcher put up interest rates in the early 80’s and destroyed British industry because their bridging loans become too expensive with huge social consequences (and blamed British businesses) . And here we are again, with the knowledge there is debt in businesses that means their wares will become more expensive and make things worse for society again.

Good lord – why does it seem to me that only worst ideas manage to persist these days?

But then again the answer’s there isn’t it – its just plain power of the greed of capital at work – helped by their chief lobbyist – Andrew Bailey.

Love your phrase “fighting inflation with inflation” so reminiscent of trying to douse a fire with petrol. The mainstream economics profession is clearly a joke imposed by the Gods!

“ After a period of inflation there has, historically, always been deflation, and even if the latter has been rare of late, there is always a return to more normal rates.”

You ignore the measures put in place to deal with those bouts of inflation, suggesting instead that nothing was done to address the issue. This is massively disingenuous.

Try overlaying the history of interest rates in the same graph and publishing that. Then try and justify that using interest rates to manage inflation (as promoted by the vast majority of economists) doesn’t work.

At present you’re dishonestly trying to show one picture and deliberately ignoring the causes behind it.

What measures were taken over the hundreds of years I have referred to

Go on, tell me precisely what you are referring to

I know you can’t because you are trolling, but I will give you the chance

I already explained, Richard.

Overlay the interest rate data on your graph.

The interests rates that most economists understand are a useful monetary tool for managing inflation.

Go on then

Do it

And you know base rate was not an issue fir most of this period, don’t you?

Richard Werner’s good overview in Fortune Magazine explaining inflation, particulary our current bout induced by central bank mismanagement. It should help Nigel smithson understand why the majority of mainstream ideological neoliberal economists dont understand economics.

https://fortune.com/2023/03/20/is-federal-reserve-too-powerful-inflation-quantitative-easing-richard-werner/

Mr Smithson,

Overlaying inflation (RPI for example) against interest rates doesn’t demonstrate “causes”. If you mean by inspection, taking say 1979-2023 doesn’t really show a convincing uniformity of trends. The problem here is sudden events. Crises that tend to show the flaws in theories (because economics isn’t a rigorous science). You could, of course show the statistical correlation (your obligation here, you are making the claim), but you must know that statistical correlation doesn’t actually show causes. Indeed it is very difficult to make any such claim, and “overlaying”, and pontificating about results certainly doesn’t do it. Your overlay suggests very loose comparative trend patterns, within quite narrow dates but not over time, and certainly not since 2008. You need to do a lot more work to make any kind of fist of your extravagant claim. In other words, prove it.

Your problem is economics is an extraordinarliy weak discipline for something that claims so much power for so little evidence for its authority.

Oh dear the Guardian and Observer management and its writers stuffed out with clueless Neomythics! See today’s Observer editorial the headline of which states the following:-

“Austerity, Brexit and catastrophic fiscal decisions have inflicted long-term damage to Britain’s productive capacity. Labour is offering the renewal it so badly needs”

https://www.theguardian.com/commentisfree/2023/may/28/observer-view-on-tories-disastrous-economic-legacy

I agree with them

Labour will be better than the Tories

But because of their own massive economic misunderstandings, not by nearly enough

William Keegan arguing there’s not even “enough” under Labour as far as Brexit goes:-

https://www.theguardian.com/business/2023/may/28/even-farage-says-brexit-has-failed-why-wont-starmer

Excellent question

Just tweeted on it

Is your approach to grow out of inflation, so avoiding a recession is essential?

No

As I said, it just goes away

Reversion to the mean is normal

I’m finding it easier to identify which groups are disadvantaged by putting interest rates up and possibly/probably accelerating the progression to recession but which groups are advantaged by these measures.

If a kid in the playground found a way of rigging the game of marbles, he might win a lot of marbles but soon there’d be no one to play with.

I suppose on option at this point might be to then loan out his marbles. – giving the illusion that those taking the loaned marbles still have a stake in the game.