I noticed a report in the FT yesterday that said:

That is an astonishing fall.

That is an astonishing fall.

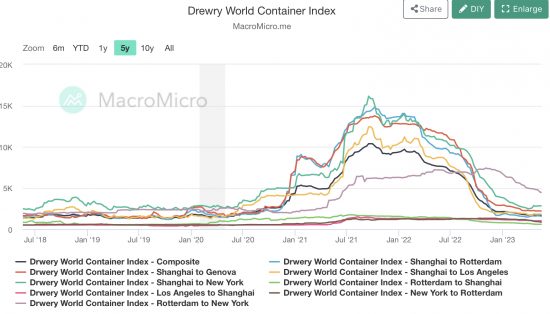

So, I then looked at the Drewry WCI index that monitors the cost of transporting a freight container on key routes around the world. It looks like this over the last five years:

As is apparent, one or two routes excepted, freight rates are back to pre-Covid rates. So world trade is back to normal.

As is apparent, one or two routes excepted, freight rates are back to pre-Covid rates. So world trade is back to normal.

So if trade is back to normal and there are now no apparent supply shortages, with the capacity to meet demand clearly existing, the question has to be, why is inflation continuing?

We know there is no wage / price spiral, because wages are very obviously lagging prices just about everywhere, so that cannot be the answer.

The only obvious answer in that case is that profits have risen and are being maintained. Greedflation is keeping prices high.

The question is then, when will we get price controls if business refuses to bring them down by itself?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I guess this is where they deploy the ‘markets and competition ‘ incantations. Though maybe that links exposing oligopoly…

There could be a major monetary event still working through the system. Overlaid on that government does seem to find unproductive ways of getting supply to increase in important areas like housing, Help To Buy really?

We’re doomed I tell ya.

But I’m curious as to why you ever believed that inflation would be below 2% by December 2024 by monetary policy even looser than pre-pandemic.

Loose monetary policy has nithing to do with it

That’s just a great question.

Gas prices too, are 90% of last summers peak.

Its astonishing how much we are being bent over. Sunak needs to more than ‘have a chat’ with industry bosses.

Richard,

As shown by the energy cap the Tories favour suppliers and are not interested in mere members of the public.

I am afraid that the Labour leadership is too scared to take action. They might scare the Murdochs’ of this world.

I fear that you are right, but it won’t stop me saying it

‘When hell freezes over’ I would say.

I do not see where price controls would come from at the moment – politically at least.

The FT also reviews Andrew Bailey and the BoE’s Monetary Policy Committee’s extraordinary statements to the Commons Select Committee yesterday. He confessed that the bank’s forecasting model was not accurate and the committee had reduced its participation in setting interest rates, explaining that: “The reason we are not following ‘the model’ is because there are asymmetric effects [in the BoE’s view of the path of inflation] . . . We have taken a conscious decision to aim off [the model’s predictions]”(Quote from ft.com/content/b972f5e3-4f03-4986-890d-5443878424ac).

Failure in our world has become ‘aiming off’. I am a little puzzled; bereft of a usable model, what they are doing. Putting their finger in the air? I ask, because it would be a better answer than the one he gave the Committee. I cannot think of a more hopeless confession of profound inadequacy than this (again quoting from the FT’s reporting for the wording): “Instead of using the model’s results, Bailey said the BoE’s work was now to think hard about ‘how we operate monetary policy in the face of very big shocks’. He added: ‘We’ve got to get on top of it and get inflation down’.

This is the Central Bank which determines our monetary policy; has been doing so since the Financial Crash; has been insistently telling us the decisions it makes have been in our best interests; and has claimed it can justify increasing interest rates by following its authoritative analysis. Now, suddenly – in mid-crisis – the BoE has to ‘aim off’ their model, that they have suddenly realised doesn’t work, and they now need to “think hard” how to handle monetary policy to cope with Big Shocks. Buried in that waffle is an oxymoron. The BoE has been telling us they had fixed the core problem after the 2007-8 Crash. Clearly, not only does this imply they haven’t; but they are now confessing that they do not really understand the nature of the problem.

This is a resignation statement, but without the resignation.

The whole thing was an admission that they are clueless, have spent a great deal of effort on creating models thatr do not work, and are carrying on as they were anyway

Hopeless, in other words

That is very much the impression I got from Huw Pill’s cagey replies to the carefully selected questions presented at the online Q&A session he did for the BoE’s “outreach” panel ten days ago.

He did have to deal with his little faux-pas (where he said in public “People just have to get used to being poor”), but much of the rest of it was just the usual flapdoodle about how wages (rising or not, apparently) cause inflation.

This forum has been transformed from a moderated discussion platform to a top down “We’re going to tell you how things work” setup, with no space for reader comments. And that happened pretty quickly once people started using it to question the BoE strategy on inflation.

Odd, isn’t it?

I have given up on it

Mind you, I did the whole of Rachel Reeve”s speech today and think I deserve a medal

Some of the stickiness in energy prices – that in turn lead to high food inflation through costs in the agricultural sector – is due to energy suppliers hedging their fuel and renewable contracts when prices were higher and other firms then getting locked into new long-term energy contracts with them as their old contracts expire.

Maybe the same issues are happening in shipping – the spot market or future contracts price is what is usually charted. If the spot market is only a small part of the total market then prices in it will also tend to overshoot on the downside in thin markets, also seen in the fall in investment in new containers.

Of course this still means the oil, gas and biomass companies, renewable energy producers and shipping companies are now making the profits from the business customers locked into those contracts.

The energy price is working through

So will food prices

I will do a blog on those, in fact

[…] had a quick check of some key food prices on international markets as a result of comments left on another piece I wrote this morning with regard […]

Years of mergers, buyouts and failing monopoly control? How many sectors are controlled by just a few mega corporations?