The Institute of Chartered Accountants in England and Wales has, according to page 8 of its 2022 annual report that has just been published, 166,397 members. I am one of them and have been for 40 years now.

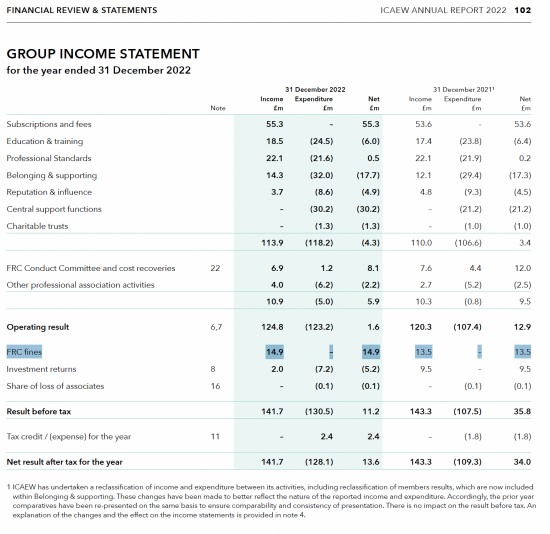

This is the income statement from the annual report:

The line I have highlighted is the one I want to discuss.

As I have mentioned before on this site, the Institute of Chartered Accountants in England and Wales receives the fines paid by its members and firms under what is called the Financial Reporting Council Accountancy Scheme, about which it says:

The FRC will commence an investigation into a Member or a Member Firm if:

- the case raises or appears to raise important issues affecting the public interest in the UK; and

- there are reasonable grounds to suspect that there may have been Misconduct.

The decision to investigate is made by the Board or its Conduct Committee. Public interest considerations as to whether to start an investigation include (but are not limited to):

In other words, the Institute of Chartered Accountants in England and Wales profits from fines on its most wayward members whose work is likely to have brought the profession into disrepute. In 2022 its entire net income came from this source. And each member benefitted by £89 as a result.

I have previously asked the Institute of Chartered Accountants in England and Wales about the ethics of this arrangement and they have never given me an adequate reply.

So, I ask again, why should chartered accountants benefit from the costs that their own failings impose upon society? I wish I could answer that. I suspect that no one can reasonably do so.

Update at 16.30 on 27 April 2023:

The Institute of Chartered Accountants in England and Wales has responded to this blog post, saying:

Until quite recently, many audit-related investigations undertaken by the FRC were funded by the mechanism set out in the Accountancy Scheme established by the regulator in 2004. Any money received by ICAEW from fines levied by the FRC in cases conducted under this arrangement has not been used to offset our operational expenditure but has been allocated to our strategic reserves and it supports our wider commitment to serve the public interest, as required by the terms of our Royal Charter.

Audit-related investigations by the FRC are now usually conducted under its Audit Enforcement Procedure, introduced in 2016, by which all fines pass to HM Treasury.

I have concerns about this statement but to explore the issues that they give rise to I need access to an archive of their accounts, which does (rather oddly) not seem to be available on their website. I have requested data and I am assured I will be supplied with it. I will withhold further comment until then.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Because income is income – no matter what it is derived from – an value free attitude brought to you courtesy of the ‘market’.

If the ICA has no independent arbiter and their main income is from fines they are bound to continue with this nice little earner especially if the big wigs in the ICA have no other moral scruples than the maximisation of income and the worship of greed. In short, they are probably mostly Tories.

Their main income is not from fines

But fines covered their entire surplus last year

Only accountants could deliver such a theatre of the absurd outcome, and deliver it with a straight face. Well spotted, incidentally. Your profession seems to me a brilliant conception; wasted on those doing it. We are back to who is attracted to join institutions, and why.

Does the ICAEW have any plans about what to do with this money?

Clearly it could (should) be used to fund something worthwhile.

Clearly if they were to do this then there would not be an issue

They have sent me a statement I will add to the post