As the Office for National Statistics has noted this morning:

- The Consumer Prices Index (CPI) rose by 10.1% in the 12 months to March 2023, down from 10.4% in February.

- On a monthly basis, CPI rose by 0.8% in March 2023, compared with a rise of 1.1% in March 2022.

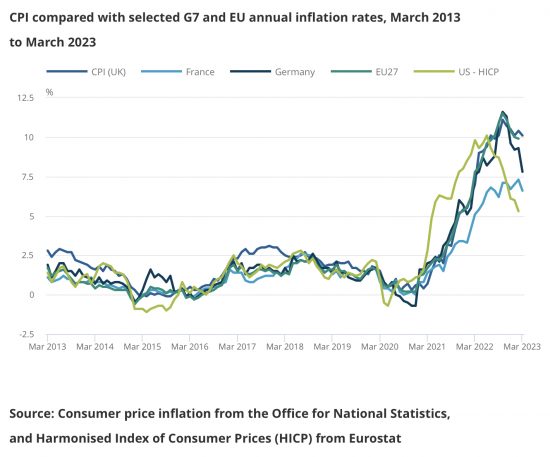

That is disappointing. This small decline contrasts markedly with experience in Europe:

Rates are tumbling in the way I would expect in France (a bit) and Germany, especially. Why aren't they here? The answer appears to be in the rigidity of our energy pricing, and Brexit (of course).

Rates are tumbling in the way I would expect in France (a bit) and Germany, especially. Why aren't they here? The answer appears to be in the rigidity of our energy pricing, and Brexit (of course).

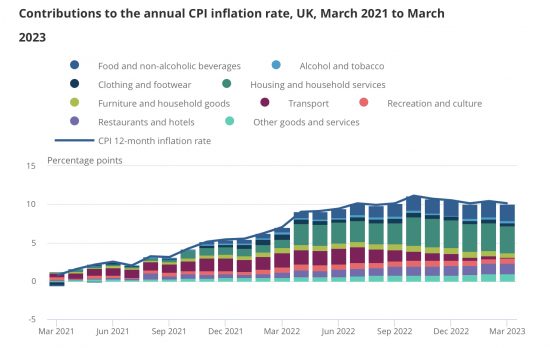

Dealing with energy pricing first, this chart gives some indication of its significance:

The large green band is household costs and by far the largest increase in that is energy costs. Since the rigidity is our rigged markets will not let these fall yet we will suffer higher inflation for much longer than Europe. The message is very clear: we need to change energy price regulation.

The large green band is household costs and by far the largest increase in that is energy costs. Since the rigidity is our rigged markets will not let these fall yet we will suffer higher inflation for much longer than Europe. The message is very clear: we need to change energy price regulation.

The other large component, in blue, at the top, is food. This is not entirely down to Brexit, but if we are looking for differences with the European experience, it most definitely is.

None of this changes my argument that inflation will tumble this year. Energy price caps are going to be much lower in the second half of the year. Inflation will fall then.

Nothing also in this data does anything to change the argument that this inflation is all about some companies exploiting inflation for gain. It is not wages driving inflation: they are lagging far behind it. Profits are what are keeping us worse off. Profit taking and the dogmatic refusal of our politicians to address the disaster that is Brexit are what are keeping UK inflation higher than it should be.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It would be interesting to see how the US is doing. They went faster and earlier with interest rate rises than the UK did, but the graph doesn’t show the trend there.

It is on one of those charts: they are doing better

Given their abundance of Natural Gas (from fracking), I don’t think the US has had such a surge in energy prices as Europe which was reliant on the Russian gas pipelines. That would make a difference as well, I’d have thought.

A bit, certainly

But gas has not been a big issue in reality: prices have fallen again

Brexit and Energy. No surprise there. I have seen nothing – absolutely nothing – to suggest the British Government is doing anything substantive (i.e., not ‘Blah’) to abolish the failed, phoney ‘market’ for domestic energy they created to scam the British consumer, and enrich the major energy producers and network providers; who are ripping-off the British domestic consumer because domestic energy is inevitably a monopoly; the supply is determined by a monopoly infrastructure.

This is a scandal.

And who do the BBC R4 Today programme get to argue for even more wage restraint and yet higher interest rates than Karen Ward -JP Morgan (who she?) one of Hunt’s economic advisors apparently.

They feebly asked her whether the paltry public sector wage increases would add to inflation – which she more or less dodged.

For all they were mentioned you would have thought we were in an economy where profits don’t exist.

No one thinks pay rises are fuelling inflation right now

Even Stephanie Flanders mocked the idea at the weekend

I think I caught part of that this morning – the speaker trotted out the usual line that increasing public sector pay would cause demand-side inflation, based on just-so stories about the 1970s. She should show us the evidence.

You are right that overall inflation will fall in time and that the UK is slower than others in seeing this because of our energy market and Brexit. I do think though that food prices might be a bit different or at least slower to see inflation dropping. Brexit and Energy are big factors here too of course but climate change is increasingly affecting production – and that impact is only going to go in one direction. The UK, I suspect, imports a higher proportion of its food than many other European countries at 50% so we are likely to be particularly vulnerable to this. Short term there may well be food inflation figures improving as UK production picks up over the next few months. My hunch (I’m not a professional in this area) is climate change pressure on food prices will increase again later in the year particularly if we switch to an El Ninio warming period.

Mr Wiggins,

Sure, sure, sure. Meanwhile what nobody wants to discuss is that when business opportunitically puts up prices to make a windfall profit out of a passing monopolistic advantage; the price will invariably go up very fast, and come down veryl slowly; the advantage is exploitable not just by the price movement, but the time lag in political action. Windfall profits are never fully taxed; windfall taxes lag in implmentation, and there are never penalties for business cutting its prices as fast as its prices go down; but it always reacts fast to prices going up; unless it is in business in a sector that makes it a taker of prices, rather than a setter of prices; i.e., the business is in he smae predicament of the poor final consumer. We live in Britain; the rip-off capital of the ‘free’ world.

You can than the Conservative Party every single day for how lucky you are to live in a country in which FPTP guarantees that the rip-off Party can rely on an 80 seat majority, and overwhelming power, with the votes of less than 25% of the registered electorate; and can then brin in new ID rules on voters to ensure nothing changes. I suspect the Conservatives are working toward being able to ensure they will have a mjority with no more than about 15% of the registered electorate; through achieving an electoral gerontocracy; eventually relying exclusievly on the over-80s+. Neoliberalism eh? Always cutting edge with someon else’s throat.

Hi Richard,

I note you have stated that Brexit is causing inflation to some degree.

Are there any articles you have written and can suggest that i read that explains this? I wouldnt want to be caught on the hop with my brexit voting friends if i suggestbthis but dont have anything tomback it up with.

Thanks

I have not written such articles as I recall. However, the simple fact is that very large quantities of goods are having problems getting through the ports, and that is especially true for foodstuffs. With regard to them, many European companies will not now deliver to the UK because the costs of doing so are too high, because of both paperwork and delays. The result is, inevitably, inflation in UK food prices.

I just listened to the IoD’s economist on C4 News preaching the conventional neoliberal wisdom on the need to squeeze wage inflation; but when asked about corporate profiteering, an outpouring of anecdotalist waffle, retelling second-hand subjective stories about the need of businesses to put up prices ,suddenly descended in a cascade of windy fluff and puff around my ears. I am now floating on cotton wool. I haven’t the slightest idea what it was supposed to mean; but after all, they would say that, wouldn’t they ….?

The IoD and rigorous economic thinking, eh?

I tweeted, rather angrily about that performance from former Labour minister Kitty Ussher and got a lot of support.