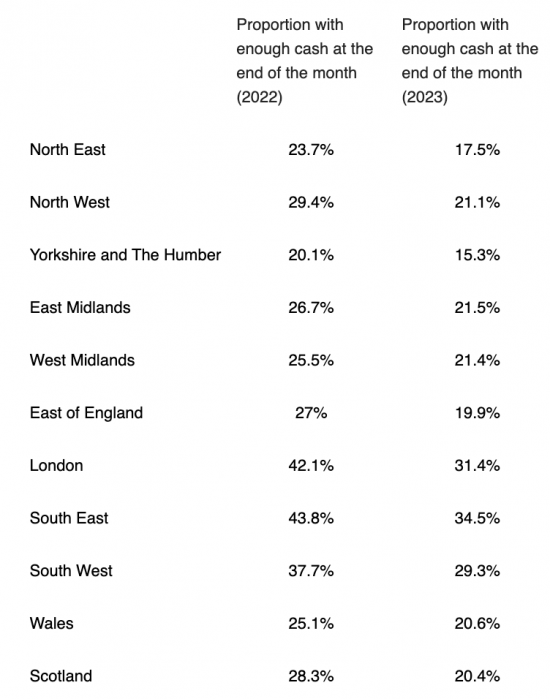

Investment advisers Hargreaves Lansdown have a pretty slick media operation these days. This sent me this comment and table this morning:

Runaway inflation has ravaged the amount of money people have left at the end of the month. In Yorkshire and The Humber only around one in five have enough cash at the end of the month to be resilient, and in the North East, and West Midlands only around one in four do. By the end of 2023, inflation will have taken a horrible toll. The proportion with enough surplus cash to be resilient will drop in every region. It will be around or below one in five in eight out of eleven regions, but will fall furthest in London the South East, the South West and Scotland.

All such measures are, of course, estimates. But what this research shows is a persistent loss of financial resilience right across the UK impacting large parts of the population. The consequences cannot be good: if the aim of politics is to relieve people from fear the exact opposite is happening right now.

A quick poll:

What will people with less money at the end of each month do?

- Despair, leading to serious increases in ill health (29%, 277 Votes)

- Spend less (22%, 206 Votes)

- Default on critical payments like rent and utilities (19%, 180 Votes)

- Borrow, even if the cost is high (12%, 117 Votes)

- I don't know, but show me the results anyway (12%, 114 Votes)

- Get very angry (5%, 46 Votes)

- Think this is all worthwhile to beat inflation (1%, 7 Votes)

Total Voters: 947

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Maybe I need to get out more… but I am surprised by this data. Even in better times in more prosperous areas even before rate hikes/real wage cuts fewer than half had money at the end of the month. One might quibble about the quality/accuracy of this data but the overall picture and the direction of travel is clear.

But it’s just comparing 2022 with 2023. Were there better times in 2022 for any areas?

What I noticed is that even though they said that London, the South East and the South West will lose the most, they are still higher than most other areas were in 2022.

Mr Parry this is in response to your comments on the reliability of the data.

I’m going to work on the basis that the commentators on this group are fairly self-selecting – the impression gained is of sober people who are careful with money & try to have some in reserve. The reality at many levels in society ain’t like that.

Few years back – our elec mater was kaput (disc not rotating) – so new one installed. Got talking to the meter man, many broken meters? – nope – so what do you mostly do? – disconnect people or install pre-payment meters – lot of poor people? – nope, mostly quite well off who go to the restaurant a couple if times a week and live on credit, – blimey, is this common? – far more than you think. We looked at each other and shook our heads at human recklessness.

This is the reality in Belgium – a well off country – I can imagine it is far worse in the UK & would hazard a guess that many people are living on the edge.

I wish I head read this comment before I voted, as I completely re-thought my approach. I selected “Spend less” because I *can*. Far too many people are already in a position where they have nothing more to cut back on and so their only option is to take on credit (while also getting desperate and angry).

The figures refer to the percentage of people who have what they call ‘financial resilience’. I may be wrong but on the company’s website re financial resilience there is mention of enough money to survive for three months. If this is the sum of money referred to, I am surprised the percentage of people who have that is so high.

I took my son who is studying A Level music to see Beethoven’s wonderful Emperor Concerto at the Bridgewater Hall in Manchester a number of weeks ago. Normally we’d all go as a family but decided to cut costs a bit (it’s a piece he has chosen to write about for his studies). Schubert’s ‘Unfinished’ Symphony was also played. ‘Great concert.

It’s the first time I’ve seen Bridgewater Hall half full though? A symptom of the CoLC? Bridgewater is great because you get lots of families going (young and old) usually but now it just seemed like The Barbican or the South Bank in London – lots of older people, usually full – but loads of empty seats in a Northern concert venue is a testament to something very negative.

I ask you. What the hell is going on? How the hell is anything supposed to happen or keep happening without money?

Everybody’s wages is someone else’s wages? That’s basic economics isn’t it?

To think: is this what the angry voters voted for in 2010? Talk about chickens coming home to roost.

It’s ugly and totally unnecessary.

Looking through a newsfeed today on the UK cost of living crisis, I see the following headlines.

People Are Shoplifting Their Way Out of the Cost of Living Crisis.

Cost of living crisis leading to some families cutting off internet.

Rise in personal insolvencies in Ashfield.

Cost of living fears outweigh mental health and climate change as biggest concern for parents.

Low income households face £200+ energy bill shortfall.

Cost of living crisis delivers ‘sharp shock’ to retail as UK footfall falls in March.

More people entertaining at home as cost of living bites.

‘Worse than the pandemic’: Pub bodies warn of closures as energy bills relief scheme ends ‘

…and a lot more.

Oh, but a bit of good news – for some.

What crisis? Footsie fat cats pocket 12% pay rise – despite the cost-of-living pressures battering workers.

So, I think the answer to this poll is that people are spending less, getting very angry, leading to despair and a serious increase in ill health (6.8 million on England’s NHS waiting list). Given the Tories battle to keep pay down with well below inflation settlements, stealth taxes in the budget (equal to 4p on income tax), continued rampant inflation in everything we need (mortgage payments, rent, gas, electricity, water, travel costs and food), I would expect things to get worse and spending tighter. Given Tory policy, how can it be any other way? Unless you are a fat cat of course.

What is surprising is that we have got through the winter without any major protests and the poll, at the time of writing 12.30 , no one had ticked get very angry.

It occurs that maybe many think the ravages of inflation were unavoidable . But we had profiteering and stupid action by the Bank of England. Do they not realise? Is that due to the Tory press/ cautious BBC? Or failure of the Opposition parties to take a strong stand?

I am sure the anger is out there. We might yet be surprised.

I didn’t tick get very angry. I have been very angry for some months. I am now in despair. I know many on this blog live in circumstances different to mine, so this may help some people to understand my perspective.

I am a pensioner. My main income is state pension, in addition a small occ pension and a tiny 2nd occ pension. I have been struggling all winter to make ends meet. My fuel is on a pre-payment meter. I cannot get any form of credit.

Inflation is at around 10%. That means for months I have been trying to pay increased costs without increased income. That has been hard.

My state pension is going up 10.1% from April. The reality of that is that the state pension I received on 3 April was all at the old rate. My next payment on 1 May (actually 28 April because of the bank holiday) will be 1 week at old rate, 3 weeks at new rate. I will not receive the new rate in full until 29 May (actually 26 May because of the bank holiday). My other 2 payments will not be received at the full rate until 15 May and 31 May. However, on 1 April I had to pay an increased council tax. In addition I did not receive, on 1 April the £67 government contribution to my fuel costs that I have received for the last 6 months.

So on the same income that I was struggling to cope with in March, I have to pay out at least an additional £100 at the beginning of April.

I don’t have the energy to be more angry that I already am. I despair.

Thanks for sharing Cyndy

And this is unnecessary, as we all know

Expressed another way: in better off regions 60% of people don’t have enough money left at the end of the month, in the worst off region it is close to 85%. In both case, if people have reserves (“if”) they will dig into them. If they don’t what then? begging? – oh hang on, that’s banned.

Overall well North of 50% of people throughout the UK have no money left at the end of the month. More than half the population have no money @ month end.

What the hell is going on? Will social unrest kick-off? What will happen is there is a very long, very hot and very dry summer?

Good questions

I think fear is the plan. Crush people’s resilience and moral the better to con & exploit them.

More to the point, rather than a long hot summer, we didnt have a particularly cold winter – yes, December was very cold but the rest of it was quite mild, so what if we were to have a colder than average 23/4 winter with what that means for food and fuel bills?

An interesting zoom tonight that some of you might want to watch.

https://yorkshirebylines.co.uk/politics/how-do-we-get-better-mps-find-out-on-11th-april/

Starts at 6.00pm.

I think the voters in the poll above have got it just about right with nearly a third judging despair to be the most likely response.

The fact that in almost every way imaginable this country is falling to pieces, like Brexit, has been totally excluded from the national conversation.

The Tories and the Liz Truss fan-club that passes for our national mainstream media is now engaged in a massive exercise to induce the public to forget the disastrous mess they have made of running this country.

“The fact that in almost every way imaginable this country is falling to pieces”

So true

Are there any readers of this blog in the likes of Australia, New Zealand, Canada etc…?

How is inflation affecting people over there, how are public services and their health service going on?

Not many

I think I have said it before on this blog, but I remember an estate local to me (private, mortgaged or mortgage free houses) in the 80’s, very little in the way of improvements to the properties, 99% were as they were built in the 50’s, also, cars in the driveway that were over 10 years old and with different coloured wings (remember that?)

Fast forward to now and the same estate is almost unrecognisable, extensions, double glazing, relaid driveways with a car that is renewed every few years.

The local pub is busy and people regularly have lunch there to this day.

The motorways are busier than ever with more HGV’s, motorhomes and cars than I have ever seen.

Old railway lines that have been turned into walkways are busy with cyclists and my local national park has more ramblers than ever.

It seems that this cost of living thing only affects certain sections of society.

What disgusts me is that only 15% of people in Yorkshire have money left to spend at the end of the month. The whole of North Yorkshire is tory. Sunak can afford to heat his swimming pool, and have power diverted to do it, and people in his constituency don’t have money to live on.

I feel as if I am living on quicksand. Nothing can be planned for. Systems/rules change constantly.

Family events still being upset by Covid. Train travel upset by strikes. Pension plans upturned by government decisions. Disabled parking stopped in a city centre. Costs for planned events hiked at the last minute. Favourite products delisted or out of production. Ordering gifts online for delivery to Northern Ireland “not available at this time”. No real understanding of energy costs for the rest of 2023. Prescriptions now taking 5 working days, not 3. Dentist giving emergency treatment but then 6 weeks wait for follow up treatment. “No one available” to give respite home care to allow a short break.

And none of the changes are improvements. Everything, drip by drip, disappointment by upset, getting worse. AND – I am lucky. Very lucky. I have “plenty”. Today.

But 10% less then 15% off that then x per cent then………. How much, in real terms, will be left in 2033?

I have to say it feels as though we are being subjected to some sort of shock doctrine as has been practiced in south east asia, Russia etc.

Seems to me that all main political parties are banking on ‘despair’ being the common response to the cost of greed scandal, rather than ‘anger’. None of them are offering the prospect of systemic change that addresses causes but only weak and one-off palliatives that merely reduce the severity of the symptoms. Tranquillisers rather than cures.

The government seems content to demoralise large swathes of the population. At times it feels as if they are doing it (and/or allowing it to happen) deliberately.

An interesting table of figures.

I think people will spend less. Some will have no choice in the matter because (inflation adjusted) they will have less and not have credit to be able to borrow. But of course some spending is not discretionary – housing costs, energy, council tax, essential travel, telecoms tend to be on inflexible long contracts – so many outgoings that can’t be stopped or reduced. So defaults, despair and anger must follow. Not necessarily in that order.

If the governments of recent years have not already done so they are in grave danger of creating a the sort of underclass that Dickens railed against. Perhaps not quite so squalid and dirty, but just as nasty.

‘Perhaps not quite so squalid and dirty, but just as nasty.’

Andy – just go out there and look. Having done the rounds with my son who intends to go to University in September, most English cities have urban zones that can only be described as ‘dumps’ with unkempt green borders, a lack of street cleaning and the appalling condition of the pavements and roads.

The only exception was Keele University – but we mistakenly drove through Stoke on Trent on the way there. I know Stoke well, and it has manifestly got worse – the pot hole capital of the UK never mind the Potteries (and its not even that anymore is it?). No wonder 4×4 sales are up – a saloon car just does not cut it on the mean roads of post BREXIT/Tory Britain.

We drove North to see my elderly and frail father in law at the weekend and the M1 is just one long rubbish bin.

I’ve just been reading this poem on a Facebook page. It made me think of this poll.

So!

So much disappointment!

Such bad news to bear!

So much pessimism

Sit down and dont despair

Yes the Country’s buggered

The options are absurd

The chance of something better

A choice between two turds

So thats not where I’m heading

I’ve seen this plot before

Disciples of the devil

I’m going to ignore!

The Devil reincarnate

Thatcher at her worst

Blair and Brown recycled

Our Nation sadly cursed!

So, I’m thinking different

I hope that you will too!

Together make an effort

Lets see what we can do!

Our horizon can be brighter

If we ignore all their rules

We can overhaul the system

And employ some sharper tools!

So! You may be wondering,

You’ve heard this all before!

So, break out of your comfort zone

And this time dont ignore!

Written by Peter Jenkins on Growing Resilient and Sustainable Communities.

Here in Denmark we anxiously follow events in the UK. Here we have inflation too, public health services stretched, and high(er) interest rates. But fortunately DK has been prospering since the 60’s, so we have well-insulated houses, mortgages that most can afford, and well-functioning government and business. Wages cannot quite keep up with inflation (especially heating) but most can manage to tighten their belts a little. Plans are already well-advanced to ease out oil-fired boilers and replace them with central heating.

The stability we have here is due in no small part to our (inevitable) coalition governments – it keeps the loons in check. Our labour market is also underpinned by sensible benefits – losing your job is not a catastrophe, and there are plenty of new opportunities.

Looking at the UK, its demise on so many fronts and its lack of will for change, we despair. We are all Europeans, after all, and losing you to Brexit is still incredulous to most of us this side of the water.

Arthur has just given us one of the best arguments for replacing FPTP with PR in Westminster elections: “The stability we have here is due in no small part to our (inevitable) coalition governments – it keeps the loons in check.”

Unfortunately the loons in Westminster are more interested in perpetuating their access to the gravy train and their stranglehold on the UK’s citizens.