The International Monetary Fund (IMF) blog is usually worth reading. I subscribe to its email feed, as a result of which I saw its forecast on interest rates, made over the weekend.

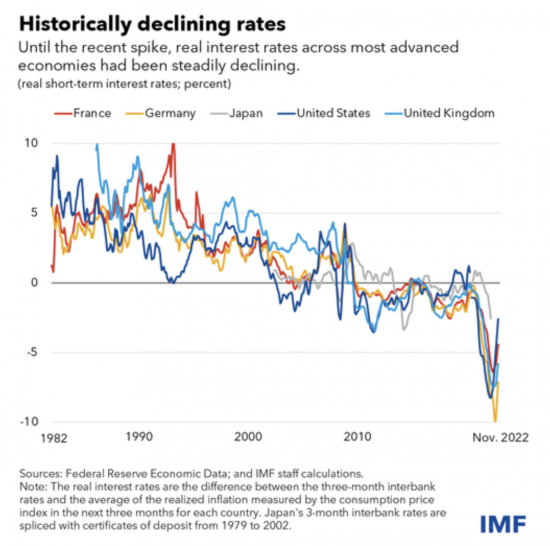

As the authors of the IMF blog note, historic real (net of inflation) interest rates have fallen heavily over the last few decades:

The uptick of late is notable. The authors speculate on whether this can be sustained. They conclude it will not be. They suggested that the overall pressure in rates is downward:

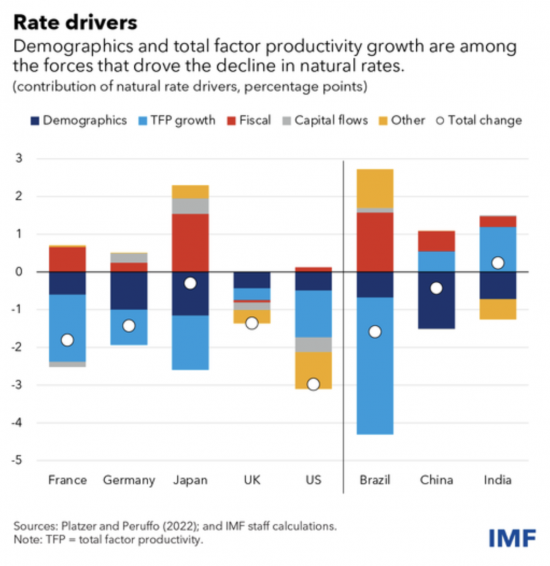

The primary reasons are twofold, in their view. One is the impact of demographics, which I will discuss in a moment. The other is what they define as total factor productivity growth (the total amount of output produced with all factor inputs in the economy), which is declining in most countries surveyed.

I have three thoughts. First, of course total factor productivity is declining. The capitalist economy has run out of ideas as to what to do: innovation is fast disappearing and what there is will require little factor input (including labour in the case of AI). The measure shows an economic system that is not providing answers to meet needs. That is especially true when most needs that are unmet will have to be addressed by the state in future since markets are incapable of delivering what is required.

Second, the term 'demographics' is, I think, likely to be misleading. The required term is 'inequality'. It could be 'intergenerational stress'. The fact is that financial wealth is growing in the world. Most of that growth is going to those who are older. Like almost all those with wealth, the greatest concern of those with that new wealth will be preserving it. They will as a result be intensely risk-averse. The consequence is that they will save in cash, fuelling what is already a glut in worldwide savings. Of course real interest rates will fall as a result, whatever central banks like the Bank of England want to think.

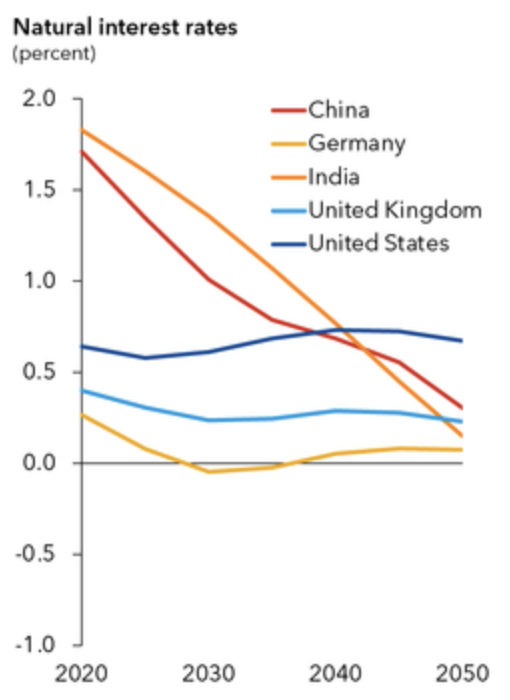

The IMF forecasts are interesting as a result. They suggest this:

In other words, interest rates will track inflation in the UK. Inflation is going to tumble. So too will rates, whatever the Bank of England says.

Unless, of course, they want to create an epic financial crisis.

I don't rule that out.

What I do know is that eventually, the Bank of England will have to give in. Rates are going to fall. We cannot live in a world where there is growing inequality and a glut of savings and have any other outcome.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I do think the long term decline in real rates is driven largely by an aging population. The savings glut is driven by folk about my age who need something to live off in old age…. so will save regardless of what interest rates are. So, pressure on real rates will be relentlessly lower.

But then what? Over the next 2 decades or so I will be buying real things… produced by a diminishing pool of workers able to deliver those things. Whilst the long term trend of real rates is down and the short term path of inflation is down, the longer term outlook for inflation is not good and those with “pension pots” they think are good enough to keep them comfortable might be disappointed as they jostle with other elderly folk bidding up the price for the few carers available.

Nice of you to blame the elderly again. That’s exactly what the government wants, to set off generation against generation.

I expect it on other sites, but not this one.

But if we stop being generic, some of the elderly do have a lot to answer for.

Some of the elderly, yes, but you could say the same of all other age groups. What about the 2.1 million pensioners living in poverty?

Agreed

That is why being more specific helps

Not all older folk are wealthy, I agree… but there is an increasingly large number of elderly people and a larger number of them are wealthy; a sufficiently large number that it is (and will continue) driving economic trends for decades to come – just look at Japan.

I am certainly not trying to stoke intergenerational tension – on the contrary; without recognising these trends, problems are stored up and become explosive when eventually they are released (which they inevitably will be if left unchecked).

All the policy prescriptions that I would propose which would involve higher taxation for unearned income would not hurt poorer pensions as they do not pay tax. Indeed, higher taxes on unearned income might make it more palatable, politically, to pay a better basic state pension.

So, apologies for stereotyping but my point still stands.

Well, if the aim of the bank is to act as a handmaiden for vulture markets to pick up cheap assets by causing chaos, that will reveal itself over time for sure.

Look at the forty plus year trend line of interest rates. Now extend the line. Where is that going? What changes the direction? Where does it end? What is the correlation between the long term downward trend line and the upward march of Neoliberalism from 1980 (Reagan and Thatcher)?

It is remarkable that the Neoliberals do not believe money is fundamental to economics; but have financialised the economy; nd are now working to replace money with credit: because – you can privatise credit, but you can’t privatise money.

Money (and the right alone to issue money) defines sovereignty in the modern world.

Unfortunately I tend to think that the ones who think interest rates will not go down very much may well be right here, simply because of neoliberalism and the banks and markets.

On a side note, what are your thoughts on this?

https://www.theguardian.com/world/2023/apr/10/super-rich-abandoning-norway-at-record-rate-as-wealth-tax-rises-slightly

I call that a success

So 30 super-rich Norwegians have moved away so they don’t pay more tax? Hardly a flood, as said in the report. The article shows that the Guardian has moved from its socialist roots, too, framing it like that.

It’s no worse than people like Richard Branson making the BVI his home. I wonder what will happen if the Swiss government puts up its rates for the super-wealthy. All countries should do it. Then they will have to pay their dues.

That’s not envy speaking, by the way. That’s because I just can’t understand why these super-rich people don’t want to pay to help their countries of birth.

There is no way they will need the amount of money they save in not paying taxes.

There is a solution to this

Make wealth taxes payable on a ‘pssport basis’ i.e. liability is due on a citizenship and not a resident ce basis

And those wishing to give up the passport pay a one off ten year charge

How would that affect my daughters in law, one Spanish and one Danish?

Neither of them want to become British citizens. There was an article in the i on Tuesday, with questions on the citizenship question paper.

1. Catherine Howard was the 6th wife of Henry 8th. True or false?

2. What are two buildings designed by Inigo Jones in 17th Century?

3. In which country of the British Empire was the Boer War fought?

Most people born here wouldn’t know those answers.

Until recently my Danish daughter in law would have had to give up her Danish citizenship to become British.

Admittedly, neither of them would be paying wealth taxes, both being teachers.

The BOE made one of the worst possible decisions by increasing Interest rates, the inflation figures this time rounded are not down to spending, they are down to commodity presures caused by Putin, hence we are seeing money not being used on manufacturing but on energy costs, as a result disposable incomes have nose dived which required Lower Interest rates to free up an economy where all the money is disappearing into One place, that being Energy companies, this is a very different form of inflation and hiking Interest rates at this time will put Too strong a handbrake on our economy, I assumed that the BOE had members that spotted the differences, but alas they have made things worse..!!!

Pretty much agreed

The BOE can do whatever they want to the interest rates it’s gonna make absolutely no difference to inflation. Inflation is due to external pressures I e energy and COVID supply backlog . Nothing else , like you say people’s money is only going into one place and that’s energy or in my case childcare but that’s another issue. It’s quite embarrassing that the so called experts can’t see this on the BOE board . They are without a doubt killing off the economy which makes me wonder what is the real motive for all these unnecessary rate increases.

‘ you can privatise credit, but you can’t privatise money’.

As incisive as a scalpel John and agreed. That I believe is the direction of travel we seem to be on.