As I have already mentioned this morning, I spent last evening reading speeches by members of the Bank of England Monetary Policy Committee whilst watching coverage of Trump. I have already commented on Trump. Let me now turn to the Bank of England.

There were two speeches. One was by chief economist Huw Pill. It was the usual bilge that Pill always has to offer. As the Bank said of the speech:

In this speech Huw Pill discusses the outlook for the economy, including how lower energy prices might push down on inflation in the short term, but could also boost demand and therefore impact inflation in the medium term. He stresses that the MPC must continue to monitor how these external shocks to inflation might become embedded in the economy, and therefore risk persistently high domestically driven inflation.

If I decode that Pill is saying that he knows price increases are going to slow and rapidly. But, for a high interest-rate fetishist like Pill this is no good reason to think that the war on inflation is over. Instead, he says that a reduction in the rate of price increases will release all our animal spirits (even though wage rates are lagging far behind price rises) and we will all go on a spending spree (although with what money, since people are running short of it, he does not say) and as a result, inflation will boom again.

All I can presume that Pill is describing is the potential behaviour of his own equally very well-heeled mates, because in the real world this is not going to happen. But then Pill knows he has a duty to those mates to keep rates up. After all, they will be earning positive rates on interest on their savings very soon if he manages to do so, and that is as they would like it. Blow the rest of us. Pill believes people are driven by self-interest, and he brings that belief to his job.

Politely, Pill is talking total nonsense.

The speech by Professor Silvana Tenreyro, an independent member of the committee whose time on it is very nearly up, was very much more interesting. She has opposed interest rate rises for many months now. I will ignore her comments on QE for the moment, fascinating and equally maybe a little disingenuous as they are because I think she knows that there is much more to that issue than she mentions in the speech. Instead, I will concentrate on her comments on what the Committee needs to do right now, which came at the end of the speech. She said:

With Bank Rate moving further into restrictive territory, I think a looser stance is needed to meet the inflation target in the medium term. In general, a looser stance can be achieved either through lower Bank Rate today, or through lower Bank Rate in future... So I expect that the high current level of Bank Rate will require an earlier and faster reversal [of interest rate policy], to avoid a significant inflation undershoot.

Her opinion is, in that case, diametrically opposed to that of Pill. She wants bigger and faster cust in bank base rate, as Danny Blancflower and I have called for. Her reason is simple: she thinks it likely that the inflation rate will not only get to 2% much faster than the MPC suggests at present, but has a very real chance of turning negative, as was forecast by the MPC in February. Keeping rates high now would, in her view, make the likelihood of this very much stronger. And since the Bank is meant to deliver a rate of 2% an immediate cut in rate is, in Pro Tenreryo's view, essential.

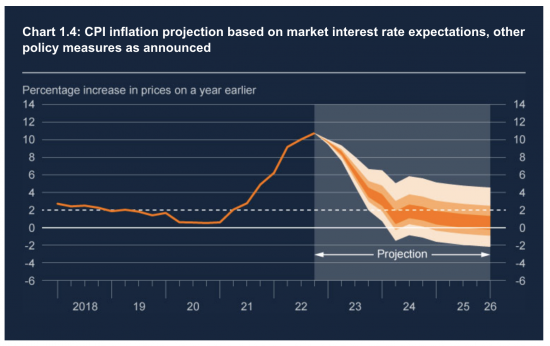

I could not agree with her more. The evidence all stacks in her favour, and none of it does in favour of Pill. Here is the critical chart from Februray:

This is an MPC forecast showing deflation is likely. She is simply confirming that likelihood. Pill is in fantasy land off the upward scale of the projection.

The question is, who will win this argument? I have no doubt Pill will. Leave misogyny and the fact that Prof Tenreyro is leaving out of it. I think that the Bank of England is set on a course of destruction, of which Governor Andrew Bailey and Huw Pill are the architects and the rest of the employed apparatchiks at the Bank will not dare challenge them, and so they will get their way.

The price of this folly will be paid by us all. The days of having an independent central bank have to be numbered.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

You know who will win – the BoE staffers will vote in a block to follow the boss. (If Danny learnt anything from his time on the MPC it surely is that!). Nevertheless, good to see that independent MPC members are following his tradition of challenging the consensus.

Just to reiterate – real rates are high. The measure we need to look at is current rates versus expected inflation….. and that suggests that 2 year real rates are over 3%. (2 year swap rates are 4.40% and inflation forecasts from the OBR for the next 2 years are, Q1 2024 – 2.5%, Q1 2025 0.0%… on average 1.25% over the period that the 2 year swap rate covers).

Combine that with “Austerity” and we are in real trouble.

What makes me really cross (well, one of the things!) is that the inevitable decline in inflation that will occur over the next year will be used as a justification for the current policy. Which TV journo will challenge this?

Answer to your last: none

I too am worried

Since energy prices have contributed much towards high inflation, a Bank of England target of 2% still indicates rising prices.

Decreasing energy prices may turn inflation negative, which is surely something we all want. But is deflation a good thing?

Or does this show that a single inflation figure is not a good economic indicator?

The last is undoubtedly correct

So……………let me get this right – what Pill(ock) is saying is that high prices are good because they stop us being greedy and taking heating and hot water for granted.

And, if prices come down, our consumption will go up, and so the supplier will increase costs to make more money or claim scarcity of supply. So we need to have high prices.

Have I got it right? What a surprise!

So, this is what ‘pure economics’ looks like then?

If so, what a load of bollocks.

He is blaming the people who need heating!! The ill! The elderly!! Families with young children! I saw a tenant of ours the other day who was very frail telling me that she had not had her heating on because of fears of being cut off. I mean she was SO frail.

And what did the Neo-liberal Witch from Grantham (Thatcher) say in the 1980’s – ‘more choice, more competition, lower prices’.

Hah!

So the obvious thing to do – not obvious to Mr Pure Economics himself Pill(ock) of course – it to control the failed market as it has obviously made huge profits. No let’s say that again – EXCESS profits.

They’ll create any excuse to keep the gravy train moving won’t they? This is not market failure to ‘pure economists’ like Pill(ock) – this is SUCCESS as far as they are concerned.

All Pill(ock) has done above is create a wonderfully beneficial circular argument for over charging for energy.

It society’s fault for being cold!!

One word: Despicable.

Agreed

“And, if prices come down, our consumption will go up, and so the supplier will increase costs to make more money or claim scarcity of supply. So we need to have high prices.”

Oddly, I had a conversation with a senior Commission person last September when we were pushing hard for elec market reform. “Yes but if prices come down won’t people use more elec?” was her response. Myself and colleagues were sufficiently stunned to be unable to answer for a minute or so.

If energy prices go back to “normal” (2019/2020) then consumption will go back to normal. Why would people consume more?

Staggering, isn’t it?

Some years ago I was doing some work with the Bank which took me to Washington, accompanied by a senior Bank economist. At the time, house prices were yet again rocketing upwards and on the flight over it was a topic of conversation. It’s alright my Bank companion said, as prices go up there will come a point when people sell their houses. Then when prices fall, they will buy in again. And where do they live in the meantime I asked? Bit of a silence…

Yes I was a bit stunned. Purist economics in action. Homo economics in perfect markets. The whole experience taught me a lot about the strange world of central banking. A little known fact is that the Bank has agents around the country whose job it is to talk to people about their actual experiences. Businesses, local government and the rest. The agents then feed into the MPC along with the economists. Either the agents aren’t doing their job or are not being listened to.

How Pill thinks demand is about to surge when wages have fallen so far behind suggests that he is utterly detached from the real world.

Bizarre……

It’s pure fascism Mike – blame the victim.

The Jews had to be blamed for the hate that was heaped upon them, so that the Nazis could cast their cruelty aside as justifiable and normal.

It codifies indifference.

To me, this is exactly how we are being treated right now by the markets who should be meeting our needs but are meeting theirs first instead.

A “spending spree” on heating in winter. Is Pill actually saying the BoE is managing demand to reduce the population’s use of energy in winter to heat their families, and cook in winter? Credit to PSR for his response, I still cannot quite grasp any body would actually propose such a policy, deliberately.

At the same time major oil companies are going on investment strike because of the windfall tax, for outrageous profits they made completely unrelated to their business acumen; profits incidentally, I remain doubtful will ever be taxed, because the windfall tax was implemented so late (I suspect deliberately by Government foot-dragging) it will prove too late to catch the peak profits, given the timing differences between profits earned, and income taxed (which they believe, nobody will notice, because most voters do not read corporate accounts, probably eighteen months later; with the real effects probably buried in complex footnotes only forensic accountants ever read).

This should also remind us of the dilatory nature of regulation in Britain; the energy regulator seems to me a great deal more interested in saving the energy suppliers, and making them profitable, and shore up the complete disaster that is the British energy market, than any interest or responsibility they think they have to consumers; but I am sure Mike Parr is better able to deconstruct the facts than any analysis I may offer.

This way of governing, where business is protected from disaster (TBTF), Government protects itself from irresponsibility and unforgivable financial waste of resources through incompetence or ideological stupidity; where phony markets are created ex-nihilo by government, and grotesque monopoly or windfall profits are made by corporate business, but the pain from economic setbacks or crises is passed directly to the public, and the poorest suffer most; just has to stop. It is intolerable.

Agreed

Ah-ha “regulators” let me number the ways in which I despise thee.

Over the years I have spoken to a wide number of (energy) regulators in different countries on various energy problems. They are for the most part passive & only react when prodded by politicos. At a technical level they usually lack knowledge (Ofgem employed one engineer in the period 2000 to 2014 – I used to feel sorry for him) and see most matters through an econometric lens – to the exclusion of other considerations. The on going Ofwat saga (in a regulated monopolistic system) being only the most egregious example of regulatory failure. At a European level (& mirrored at a Uk level) there is normally a closed coterie of advisers/trusted hands which ensure that “the regulatory boat is not rocked” and difficult questions not asked (perish the thought that they are ever answered). Reports commissioned by regulators (and the penumbra that surrounds them) are carefully calibrated to stick with the status quo.

Two important features of regulators have become apparent to me over the years:

1. a total lack of detailed knowledge – how does a given XYZ actually function – technically and in market terms .

2. system malfunction is greeted with congnitive dissonance usually in the form of “nope the market is still working ok”

The impact of this can be seen in mainstream commentary on regulatory failure.

https://www.theguardian.com/commentisfree/2023/apr/05/reduce-average-uk-electricity-bill-public-ownership-clean-energy.

I am certain Mr Hayes means well (& I support the establishment of a gov-owned energy company). But he rather misses the point that the problem is the need for elec market reform. The BTL is instructive since it is clear that most commentators fail to understand how renewables are remunerated. This leads on to my final point.

Most commentators to this blog will have read Orwells 1984. However, by far the most terrifying part of 1984 is not the story but the Appendix covering Newspeak. Marketisation (of everything) is becoming so deeply embedded in thinking processes that the ability to think (& express) in terms other than “markets” becomes a struggle. This is less a problem for me (& colleagues) but regulators are so far down the markets/Newspeak route that even root & branch reform would be ineffective – extirpation (+ nationalisation of what they “regulate” ha!) is the solution.

On a lighter and final regulatory note, years ago I attended an Ofgem organised “renewable developers meet the DNOs”, at the end I remarked to Ofgem that I would willingly pay to attend future events given the high quality of the entertainment (a sort of Circus maximus without the blood as the RES mob ripped lumps out of the DNOs it was wonderful). I helped matters along by pointing out to the DNOs that they had to hire more staff to handle applications from RES developers who, for the most part were private equity operations representing high-net worth individuals (Ofgem looking on in dismay) as the DNOs pulled faces and the RES mob went into denial (or De Nile).

There are I think two other aspects of regulation that we have not touched on.

Firstly the political environment in which they operate and that shapes the thinking of those who are their masters. In today’s neoliberal world where markets are believed to know best and the state should avoid interfering, regulators reflect that. They are seen up to be essentially passive with their powers and resources minimised. They intervene only when it is too late and then do too little as that is all that they can do. The opposite would be if it was seen that markets need active management, in their own and society’s interests.

Secondly, there is an implicit assumption that those being regulated want to play by the rules. That is plainly not the case with the City and water being blindingly obvious current examples. It’s called gaming the system where those being regulated actively ignore or evade the rules, lobbying to change those rules and at times colluding with regulators. What punishments there are can be dismissed as a minor cost of doing business with no accountability for those at the top who determine the patterns of behaviour.

Changing a culture is always difficult, especially when it is set from the top. Until those at the top suffer severe personal penalties including both jail and fines commensurate with their incomes, nothing will change. It’s has to be clear that succeeding by ignoring the rules at the expense of society, the environment and the wider economy will end in tears. Only then will the message filter down those organisations to those tasked with doing the actual dirty work.

Im not holding my breath…

From the MPC graph: The probability of deflation can be determined and it is less than half. Are you sure that you’ve read it right?

Yes

And the probability is understated is the whole point the Prof is making

Well one Professor is stating, as opposed to all the other MPC members and pretty much everyone else in the UK economics world.

Just because you agree with her doesn’t make either of you right. As John points out the chance of deflation is a lot less than 50%.

Perhaps you would like to give us your predictions for CPI headline and core for Dec 23 and Dec 24? We could even have a little wager on it.

My position is clear

You are trolling

Ok.

If your position is clear, what are your forecasts for Dec 23 and Dec 24 CPI.

You do have these don’t you?

And if I am trolling, and you are so obviously correct, I’d be happy to put my money where my mouth is.

But I doubt you will somehow. It’s easy to spout rhetoric and nonsense from the safety of a blog, it’s a lot harder to do it in real life when something is actually on the line.

I doubt you would be though.

I don’t gamble

I don’t trust those who do

And you nhave already changed your identity

What a surprise

Mr Tring,

“The probability of deflation can be determined”.

It depends what you mean by ‘determined’.

Determining the probability is not determning the result. The clue is in the word “probablity”.This is not a scientific prediction, but a forecast; a quite different level of precision is involved. The probabliity will have a standard deviation (variation in dispersion); and this is economics, so the SD is likely be high, given the stabs at a forecast by bankers and economists are so often badly wrong, and their models necessarily over-simplify the nature of economic phenomena. Furthermore, when the SD is ‘determined’ (not a helpful word here), it still does not determine the result. Economic statistics, eh?

“The days of having an independent central bank have to be numbered.” Indeed, given its history the BoE (and many others) need direct political control. Although to be honest, the myth of independence is just that – a myth – central bankers are like fan dancers of old – you are never quite sure if they have no kit on (= are independent) or not – with the politicos happy to maintain the illusion (….darling raise your up fan a bit to stop the punters seeing the reality etc).

However, you might be interested to know that “independent central bank” fetishists (for that is what they are), in this case the IMF are saying the following to Ukraine:

“and further strengthening the independence of the central bank. “Independent and effective anti-corruption institutions will help reduce corruption risks during martial law and build public and donor confidence in future reconstruction,” the Fund adds”.

Pathetic stuff but what would one expect from the IMF? The usual “conventional wisdom”, promoting a “model” that was broken more than two decades ago. Once the war is over, the troops will come home – circa 300,000 battle hardened men (& women) who might not take kindly to the bullshit spouted by besuited imbeciles.

Just what they need to focus on….

No mention from anyone about how the BofE plans to deal with inflation when it’s caused, as I gather lately much of it is, by profiteering supermarkets. How are they going to factor that in, I wonder?

What I don’t understand is about what Sam says above is what is supposedly ‘on the line’?

Millions of people’s lives are already on the line as a result of these policies.

What sort of ‘line’ is he talking about?

I also note that – typically – your detractors have to look at the graph. Because it looks like math!! It has lots of numbers! Ooooooh!! Scary!!!

Oh the graph – of course! No – not the revealing biased nonsense that comes for Pill(ocks) own lips – John and Sam have nothing to say about that. Well of course!

… and you don’t even need to take Richard’s word for it – the OBR (hardly a hotbed or radical thinkers) agree with him!

They forecast inflation in Q1 2025 to be zero – meaning that prices in March 2025 will be the same as they were in March 2024.

Richard’s view on where inflation is heading is fairly “mainstream” – what is radical… and it is the BoE being radical… is to think that real rates in excess of 3% are a good idea. Well, not radical – just plain stupid!

Agreed

Thanks

David Byrne says:

In the words of Robert B Reich (U Cal. Berkeley) in his interesting book ‘The System’, he states that the global free-market is dead and that wealth and power have spawned an oligarchy that is driven by insatiable greed and the destruction of democracy. He confidently asserts that we are being “shafted”.

In the UK, the media tell us that energy prices are “coming down”. Not true. Natural gas and oil prices have come down by (approx.) 80% and 70% respectively, globally from peak levels. Fuel prices are down, but where is Ofgem hiding?

What we see are massive windfall profits to the producers followed by dividends and share buy-back benefits to the wealthy and powerful.

Similarly, in the case of UK food price inflation, supermarket profits will undoubtedly soar.

Ask our farmers who wins and who loses!

Reich is correct. The system is rigged against us and we are being well and truly shafted by those that we elected to protect our best interests. Who do they really serve?

Profit

Canadian Blair Fix has recently published an astute analysis of how high interest rates are part of the war between the interests of Creditors against Wage-earners, in times of high inflation. Which may be the key to Huw Pill’s stance.

https://economicsfromthetopdown.com/2023/03/23/inflation-the-battle-between-creditors-and-workers/

Good article

Worth reading

In drafting a comment above I made reference to standard deviation; that remark returned me to the graph supplied in Richard’s blog (Chart 1.4 CPI Projection), and noticed, purely by inspection (I do not have the data), that it doesn’t look like a bell curve. I am not sure how to turn that back into an interpretation of he statistical methodology, and perhaps it is of no significance; but I always like to look behind the curtain. Anybody with some thoughts on this, or am I bottling smoke?

Incidentally, I discover the BoE Independent Evaluation Office reported in 2015 (I can’t find a later report, unfortunately), provided a paper entitled ‘Evaluating Forecast Performance’, which it carried out by comparison of forecasting accuracy with “private forecasters”. It showed no notable signal of bias (dispersion from the norm) for 2002-2014 for GDP and other measures, but on longer term >1 year forecast for wage growth, the conclusion was this: “For the UK unemployment rate and wage growth, we found statistically significant evidence of bias( Bank forecasts typically too high) and strong inefficiency”.

Like you,I do not have the data

It is not a bell curve (Normal Distribution)…. but a lognormal distribution.

In short, prices can’t go negative but they can go go very high (hyper inflation) so we see a skewed distribution.

We also see this distribution when looking at stock prices but not (interestingly) for interest rates.

Yes, of course; thanks! However, YoY inflation can be negative. Aren’t lognormal distributions with low volatility YoY below 1% not lognormal, but closer to normal? I am not sure why it doesn’t hold above 1%, or is it a matter of volatility? Maybe this is nit-picking, or maybe I have just lost the thread on this.