I have reviewed the Bank of England's latest survey of opinion on inflation, which has just been published. The results are, to be kind, quite bizarre.

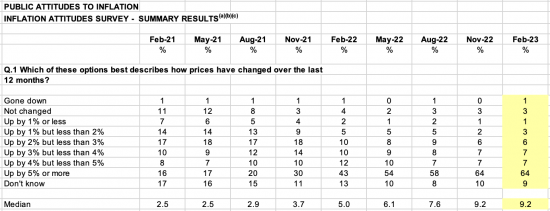

Most people rightly know inflation is more than 5%, but quite bizarrely a third think it has been less than that:

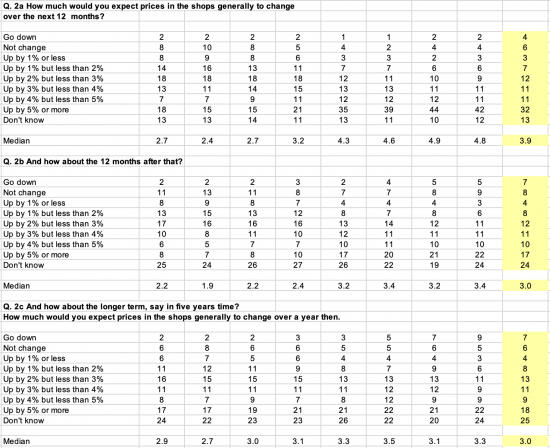

When asked how inflation will change people are hopelessly wrong in the short and medium terms:

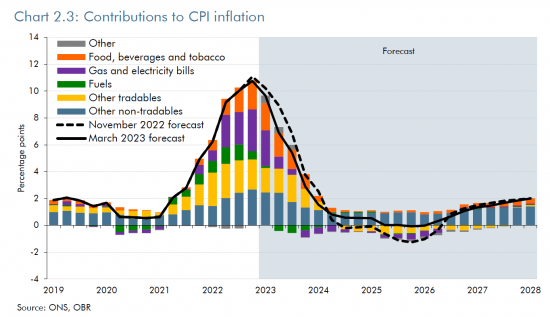

Almost without exception, they think high price increases (which are what inflation is) are here to stay. This totally contradicts data from the Office for Budget Responsibility report on the economy this week:

They are sure inflation is tumbling. And in 2024 they think it could be heading for zero.

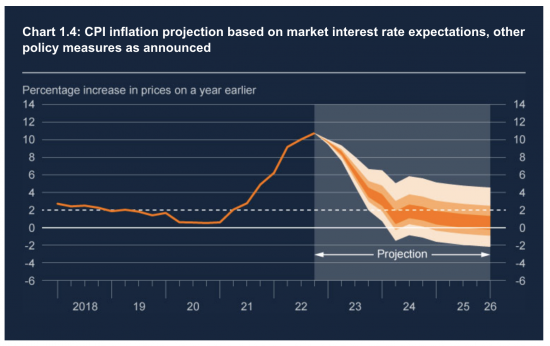

So do the Bank of England. This is from the last Monetary Policy Committee report:

Very low inflation is likely - less than 1% in 2024 with deflation quite possible too. Which does not mean prices will fall. But it does mean they will stop rising.

What the Bank of England needs to ask is why people's inflation expectations are so wildly out in that case, because they so obviously are.

So, a quick poll:

Why do people think the risk of inflation is much higher than it actually is?

- Because the government has hyped the risk? (31%, 89 Votes)

- Because the media has hyped the risk? (25%, 71 Votes)

- Because they just don't know - and maybe no-one does (15%, 44 Votes)

- I don't know, but show me the answers anyway (14%, 39 Votes)

- Because the Bank of England has hyped the risk? (10%, 29 Votes)

- Because people know much more about inflation than the Treasury or Bank of England and the actual risk of inflation is much higher than either of them think? (5%, 15 Votes)

Total Voters: 287

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

There’s a reason I voted that people know more about inflation than the BofE or the Treasury, even if my tongue was in my cheek.

From the petrol bowser, my mortgage payments (increasing every single month) to my online shopping app I can track how inflation has affected our purchasing power in the last 12-18 months. The actual increases are a lot more than the official inflation rates.

So for you, a usually rational and reasonable voice on fiscal matters, to turn around and say “Durr, people are dumb because they don’t understand how benign inflation is” is, quite frankly, insulting.

You admit that even if we achieve negative inflation prices are unlikely to fall. So we are stuck with these higher prices for the long term. Don’t tell me I’m an idiot if I think inflation is responsible.

That is quite a weird comment

Petrol prices are falling

Mortgage costs do not for 99% of poeoiplle change very month

But I agree food prices do: the last shop was a bit shocking

Bit inflation is not about absolute prices. It is about relative prices. Prices will not fall. I quite explicitly said so. But the rate of change will. That is what this is about

Did you miss the point of this?

Or are you, like increasing petrol prices, just making stuff up?

“That is quite a weird comment”.

Actually, no it isn’t. It is how people subjectively experience effects in every day life that matters to them, politically.

You have I think made exactly the same observation, when you have changed you perspective and insisted, rightly that Sunak and Hunt can take no comfort from a fall in inflation, because even if inflation is 0% people are going to continue experiencing the high prices they have already been experiencing; all that happens is, prices stop rising at the rate they were rising. But subjectively people feel they are still paying high prices, especially if their income has not kept pace with inflation. Indeed, even though the rate of rising prices fall, prices still rise, albeit at a lower rate. By that point, most people are not feeling any of the analysis is helping them; they are worse off, and it isn’t stopping. That turns into politics, and their view of economics.

I was referring to the aggression rather than the point, which as you note, I get

I absolutely must have missed the point of this.

To accuse me of aggression, and of fictionalising fuel prices, is particularly odd, verging on disingenuous.

I think it perfectly explains your original point. You have absolutely no idea how inflation practically affects ‘ordinary’ people. Oh to be in such a position as that.

I usually defer to you on matters of fiscal policy, but I’m afraid this exchange has me questioning all of that. In fact I can’t help but feel more than just a little bit betrayed.

Fuel prices are falling

Sorry, you fictionalised your claim about them

I pointed that out, entirely fairly

And let me be clear, I smelt trolling in the first post and so even more strongly now

And given I argued the whole point you tried to make on Radio 2 during my budget commentary this week the suggestion that I do not understand the issue is absurd

So, most of the organisations who claim authority on financial matters said inflation wouldnt go up (except Dr doom and he’s always gloomy) so having got badly wrong in the first place why should we believe them now. They aren’t suffering a 10% drop in living standards, we are.

Fair point

Except arithmetic guarantees it will, another war or global financial meltdown excepted

And because that is what always happens

TLDR – averages are bad.

In some cases, people might still experience inflation, as CPI/RPI/any measure is just an average which can be (is) mis-applied.

Inflation of 10% on energy will hit those on lower incomes harder.

And commentators say things like “your savings are losing value” if you’re getting 4%

But if your savings are for house purchase and property is only going up 1%, you’re actually gaining.

Inflation measures are averages but how they land at different income levels can be dramatically different.

The recent c10% could easily be 25% for some and 3% for others.

Richard’s analysis of inflation is correct with the information that is available now. However, I think it is wrong to get too complacent about prices remaining stable into the middle and longer term. Food supplies could easily be disrupted by drought and extreme weather, more wars (Taiwan, Iran……?) can cause oil prices to rise again. Gnina may not continue to be a cheap producer of consumer goods if they run short of computer chips or other essential minerals etc

I don’t know where they find a few percent of people who think overall prices have stayed the same or fallen. Perhaps those people are placing too much emphasis on the fall in the price of petrol or diesel in the last few months.

There is a fair chunk of people who don’t know or haven’t noticed, but most people know that prices have risen significantly in the last year.

As for the future, there may be a combination of views. Some might mistake continued high prices for high inflation, and know that they are going to continue to struggle for some time. Some might expect the current inflationary conditions to continue for some time. Fuel prices had fallen away from the peaks last year but they are still higher than before the pandemic for example.

I think the message is clear

High prices are confused Witt inflation except when it comes to wage settlements

When we talk about perceptions and expectations, there is also psychology to take into account. I think perceptions and expectations are often a bit “sticky” and lag behind changes in circumstances. It takes a while for people to realise that inflation has been a thing for a few months, and then to realise that it has eased.

None of the above; it’s because people are so badly educated on this and any and all similar subjects. The more in the dark they are, the easier it is to rip them off, which is what this nation’s rulers (the financial sector allied with ancestral land-owners) do. There’s the problem with being educated by third parties ie the state, you only ever get taught what those third parties want you to know and they might not care to be educating you about what is and isn’t in your own best interests. Note the way all the informed commentators on here are to some degree self-educated in these matters. That’s not coincidence.

It’s also worth saying that the questions asked in this survey are a bit weird, and the population is really not anything like a random sample. – I’m signed up to take part, just because I wanted to get a look…

The people who take part fall into 2 main groups: elderly retired men who clearly vote tory, have significant savings & think young people today need to knuckle down & get back to work; and self-educated trouble-makers like me.

The questions don’t allow you to comment on whether inflation will remain at current levels – the categories offered are

More than 3%

2-3%

1-2%

etc…

Which is all pretty unrealistic at the moment.

Inflation is unlikely to come down below 3% in the next 6 months IMHO but that doesn’t mean it’s not going to drop.

So the survey of what we expect to happen next is pretty much a waste of time.

It’s quite entertaining seeing the arguments you’ve had reflected in the summary of the text comments, though, so I’ve carried on taking part!

I was originally going to put up the skewed sample

I thought that would give information overload, so thank you

Where did you find that demographic split between ERM-who vote Tory vs self-educated trouble makers?

It might be comforting to create labels for anyone not responding as you do being polar in multiple ways, but is it real?

And which way are those 2 categories voting? 32% say gov hype; is that old dudes or young rebels?

The data is about question 14 of the data in the link I supplied